-

Justin Sun announces $1 billion for crypto industry amidst market crash

TRX, however, remains bearish despite positive developments.

As an analyst with a decade of experience in the volatile world of cryptocurrencies, I’ve seen more market swings than a trapeze artist at a circus. The recent market crash has been as predictable as a rollercoaster ride on a stormy day, but Justin Sun’s announcement of a $1 billion relief plan is like finding a lifeline amidst the chaos.

Over the past two days, there’s been a significant selling spree in the cryptocurrency markets, coinciding with a worldwide stock market plunge. This sell-off has led to more than a billion dollars worth of liquidations within the crypto industry, causing a drop of approximately $300 billion in the total crypto market value.

In the midst of market turmoil, Justin Sun, creator of the Tron Network (TRX), has emerged as a beacon of hope, unveiling a $1 billion aid package aimed at the cryptocurrency sector.

Justin Sun announces relief plan amid market crash

Amidst the market’s downturn, traders and experts were frantically searching for a means of survival. Amidst the chaos, Justin Sun unveiled a $1 billion project to aid the cryptocurrency market. Via his official platform, which was previously known as Twitter, he made this announcement.

Fear not! Our sector has seen substantial growth over the past year, so this market instability isn’t caused by unfavorable reports. Let’s discard FUD (Fear, Uncertainty, and Doubt) and continue to progress. In fact, we’re establishing a $1 billion fund to counteract FUD, invest more, and increase liquidity.

His investment serves as a reassurance for crypto traders and investors, offering them stability amidst the recent surge in market liquidations over the last two days.

Crypto market downturn and ETH liquidation

During the global stock market drop and cryptocurrency slump, Ethereum (ETH) experienced the heaviest losses. At the peak of this downturn, a significant surge in ETH liquidations was observed, amounting to over $355 million within a 24-hour period.

As a seasoned investor with over a decade of experience in the crypto market, I can empathize with Justin Sun’s predicament when faced with such market volatility. The recent liquidation of positions due to the crash in ETH is not an unfamiliar scenario for many investors, myself included. It’s always challenging to navigate the ups and downs of this dynamic market, but it’s crucial to stay informed, adapt quickly, and learn from each experience. In times like these, I remind myself that setbacks are temporary, and the key lies in maintaining a long-term perspective and staying disciplined in my investment strategy.

In contradiction to the rumors, Sun clarified during the announcement of his crypto relief plan that those claims were unfounded. He proceeded to elaborate by stating that he seldom indulges in leveraged trading and instead focuses primarily on staking and backing diverse cryptocurrency initiatives.

As a seasoned cryptocurrency investor with years of experience under my belt, I can confidently say that diversifying one’s portfolio is key to success. One strategy I have personally found effective is slowly but surely accumulating ETH holdings over time. Today, my ETH holdings stand at an impressive 377,590 ETH, distributed across multiple wallets. This approach has proven to be a solid investment decision that has served me well in the ever-volatile world of cryptocurrencies.

Potential impacts on TRX price charts?

Because Justin Sun is the creator of TRX, his comments and financial decisions could significantly influence its market movements. Despite TRX’s prolonged decline, the announcement of a $1 billion aid package has noticeably increased its value in daily trading charts.

The crypto has gained 0.56% on daily charts to trade at $0.124.

In simpler terms, according to AMBCrypto’s analysis, Tron (TRX) has been moving significantly downwards in the market. This trend is supported by the Directional Movement Index, which suggests that this bearish trend has been ongoing.

According to the DMI, the -ve index of 25.3 is higher than the +ve index of 14.6, indicating a dominant downward trend.

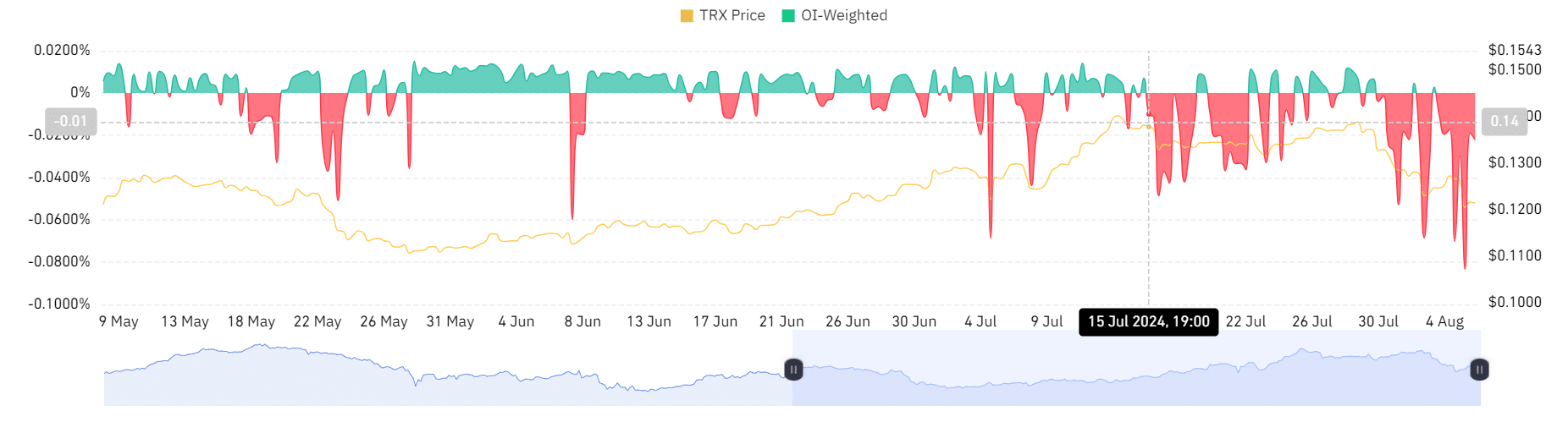

Over the past four days, as we examine more closely, the TRX OI-weighted funding rate has shown a negative value, based on data from Coinglass.

In this situation, it’s the short positions that are compensating the long positions, an occurrence that typically takes place when the cost of perpetual futures is less than the current spot price. This pattern often indicates a pessimistic outlook in the market, suggesting a bearish trend.

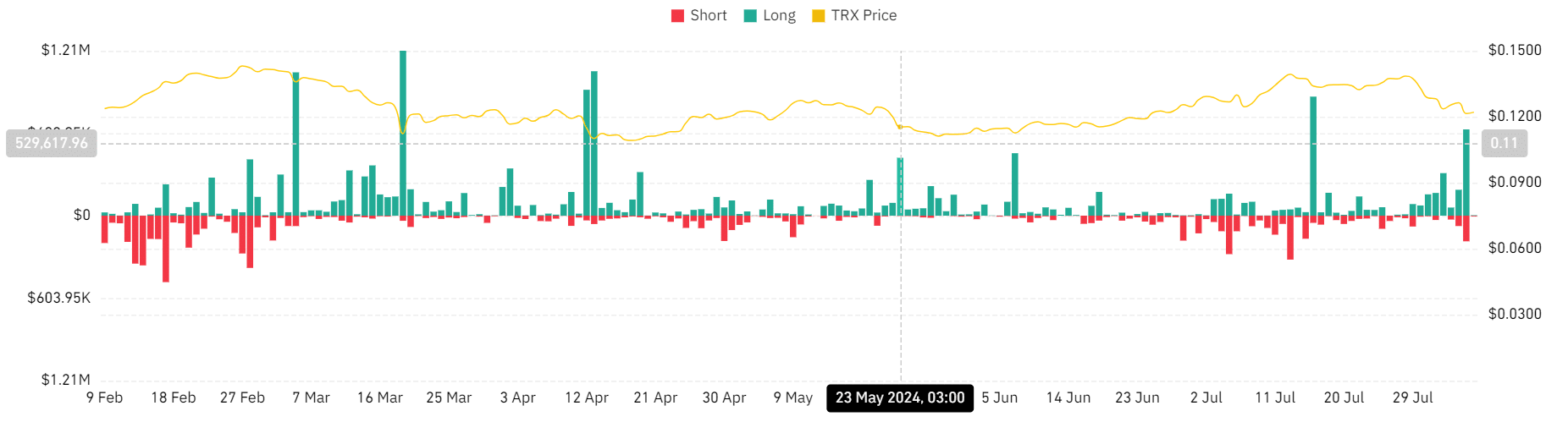

After Justin unveiled his $1 billion plan, TRX saw significant selling off of long positions over the past day as well.

Based on Coinglass data, the total liquidation of long TRX positions on July 5th amounted to approximately $631,690. This indicates that long position holders were compelled to exit their investments due to a lack of confidence in the altcoin’s current trajectory.

Consequently, despite Justin Sun declaring a $1 billion aid program for the cryptocurrency market, the Tron (TRX) market still appears bearish, as shown in the daily charts.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-08-06 15:04