- KAS has declined over the past month, dropping by 26.49%.

- Kaspa experienced a strong downward momentum risk, hitting a six-month low.

As a seasoned crypto investor with a penchant for the unpredictable, I’ve seen my fair share of market fluctuations. The recent performance of Kaspa [KAS] has been nothing short of intriguing, to say the least. While most altcoins have been dancing to the rhythm of the bull, KAS seems to be playing a different tune altogether – a melancholic waltz downwards.

Over the past month, while many alternative cryptocurrencies (altcoins) have seen gains, ranging from moderate to substantial, Kaspa [KAS] has chosen a unique course and experienced a downward trend instead.

During this stretch, KAS has been moving along a downward sloping trendline. Currently, the altcoin is nearing the lower limit of this channel.

Currently, Kaspa is being traded at $0.1265, representing a decrease of 5.21% in the last 24 hours. On a monthly basis, its value has dropped by 26.49%, and there’s been an additional 3.46% decline on weekly charts, continuing the bearish trend.

In simpler terms, the prevailing market climate indicates a significant level of pessimism towards Kaspa, as investors are consistently choosing to exit their investments.

Based on an analysis by AMBCrypto, it appears that Kaspa is currently facing a significant amount of negative sentiment. The market sentiment is measured at -0.0465, and the Crowd Z-score sentiment stands at a low point of -5.2061.

This implied that most investors lacked confidence in the altcoin’s future trajectory.

What Kaspa’s charts say

According to AMBCrypto’s analysis, Kaspa was experiencing a strong downward momentum.

In a nutshell, the market has seen more selling than buying recently, as indicated by the dropping Relative Strength Index (RSI) value of 31, which is approaching the oversold zone.

The force driving this downward movement is reinforced because the Positive Directional Indicator (DI) of the Directional Movement Index (DMI) remains lower than the Negative Directional Indicator. Thus, we can infer that the current downtrend is robust and may persist, suggesting a possible continuation of this trend.

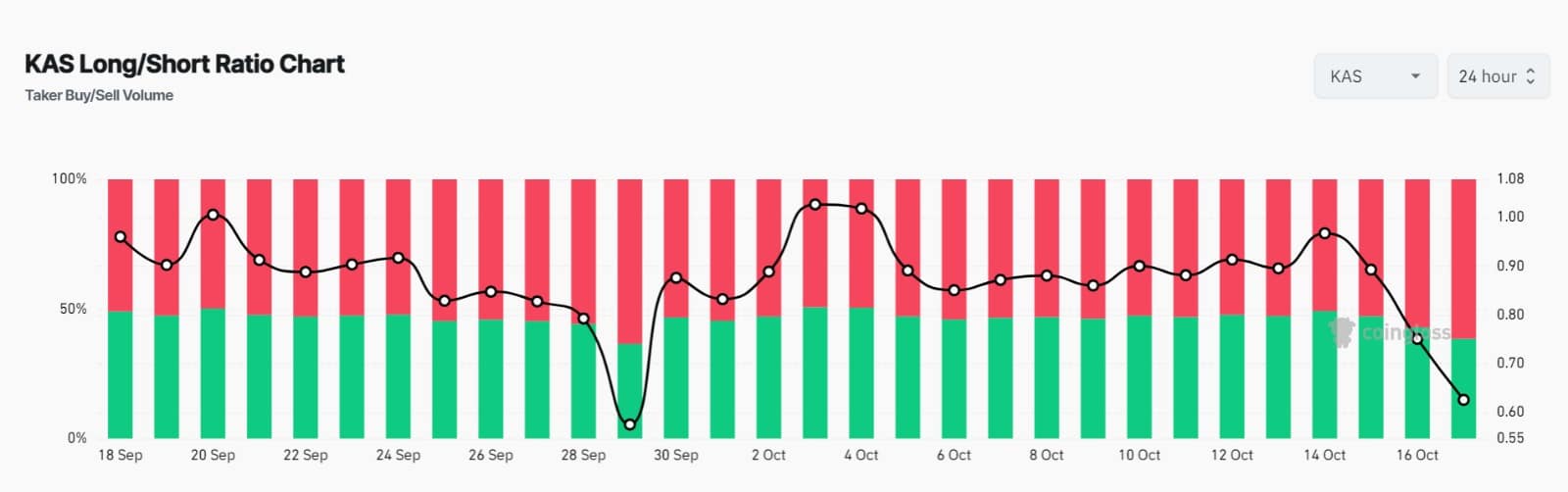

Examining the charts more closely, it appears that Kaspa’s Long/Short Ratio has dropped below 1 following a prolonged decrease. Currently, this ratio stands at 0.66, indicating that short sellers are in the majority, as many traders have adopted a bearish stance.

Read Kaspa’s [KAS] Price Prediction 2024–2025

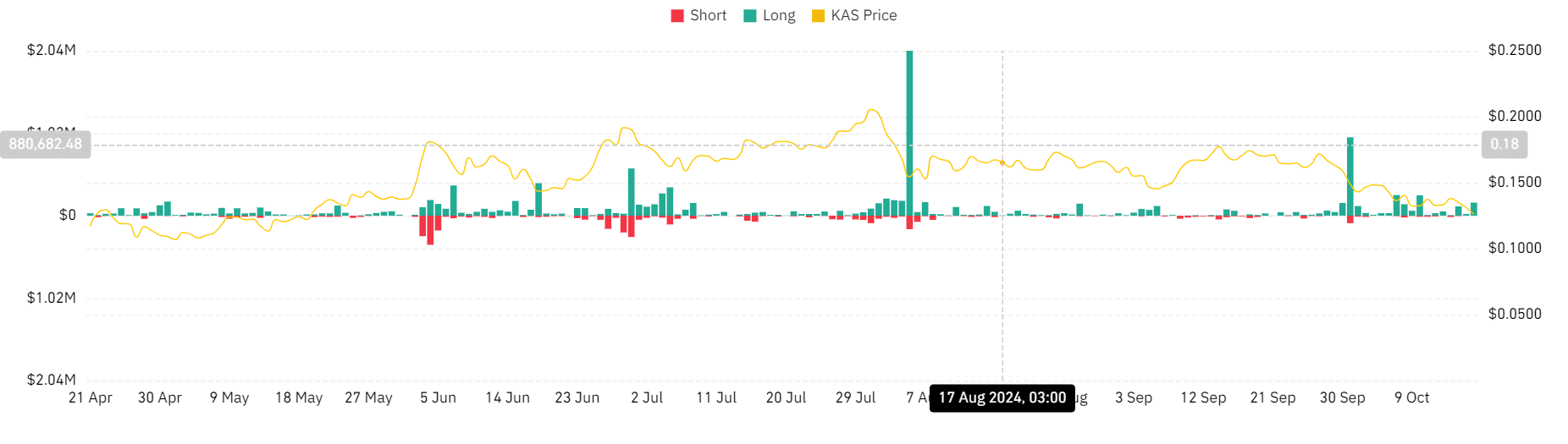

Moreover, Kaspa has predominantly faced large-scale liquidation of long positions during the last fortnight. Liquidating long positions indicates a significant drop in price.

When long positions are closed, or sold, it can intensify the overall selling activity, thereby speeding up the decline in the market trend.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-10-17 20:39