-

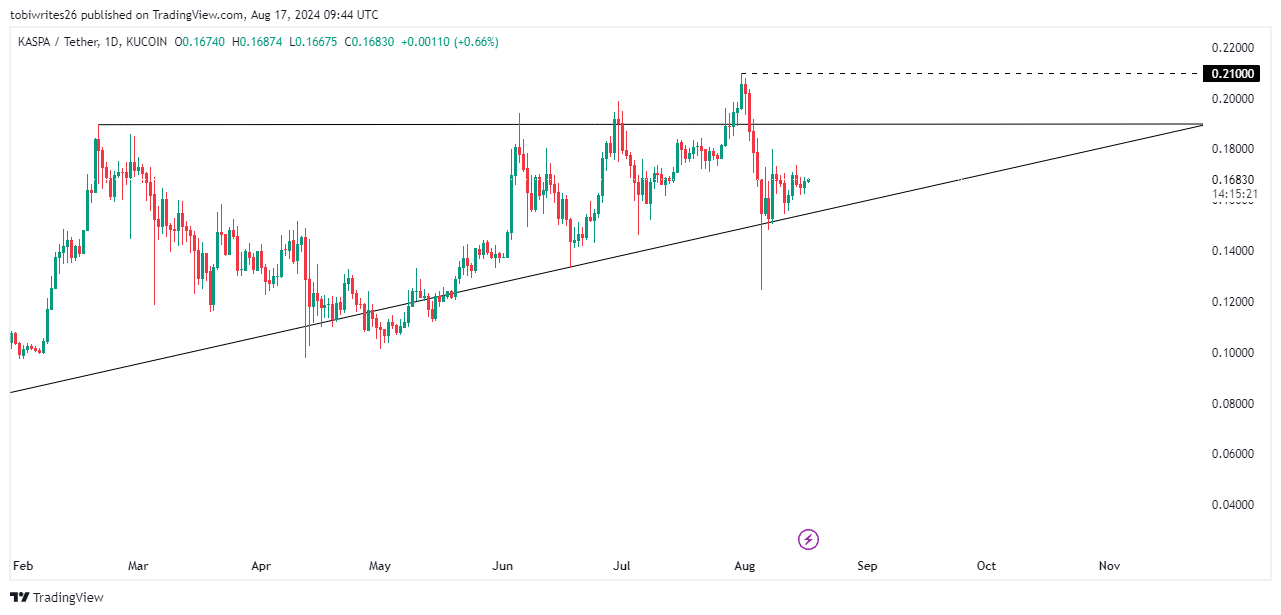

Kaspa’s emerging ascending triangle pattern at press time suggested a bullish sentiment.

KAS could surpass the previous peak of $0.201.

As a researcher with years of experience in the ever-evolving crypto market, I find myself intrigued by the current state of Kaspa [KAS]. The ascending triangle pattern at press time is indeed suggestive of a bullish sentiment, hinting that KAS might surpass its previous peak of $0.201 and potentially reach new all-time highs above $0.21.

For the past month, the value of Kaspa [KAS] has shown little change, with only a minor weekly price rise of approximately 0.95%.

At the current moment, the pattern on the price chart resembling an ascending triangle implies that Kas might experience a surge, potentially pushing its value to a record high surpassing $0.21.

A rising triangle on a chart is a bullish formation, where the upper boundary functions as resistance and the lower one acts as support, which rises gradually. Typically, this configuration signals a possible surge in price, indicating an upcoming breakthrough upwards.

KAS within the ascending triangle

As a researcher studying the price movements of KAS, I’ve noticed an interesting development. The asset had successfully surpassed the upper resistance of the triangle formation, peaking at $0.21. Regrettably, it failed to sustain this high and subsequently dipped back into the pattern, breaking the support at its baseline.

As a seasoned trader with over a decade of experience, I have encountered various strategies employed by market manipulators to gain an edge. One such tactic that I have witnessed time and again is the ‘stop hunt,’ often disguised as ‘wicking.’ This strategy, in my opinion, can be detrimental for smaller investors like myself who are trying to navigate the volatile markets. It is a practice that preys on unsuspecting traders, using their stops to artificially inflate or deflate prices and ultimately profit from the chaos. I have lost capital due to this tactic, and it has left me with a deep appreciation for the importance of understanding market manipulation and learning to identify its signs.

Here, the intention behind the stock market halt was to benefit sellers by causing the price to drop, which would trigger stop-loss orders held by optimistic traders.

As a seasoned investor with years of experience under my belt, I’ve learned that one key strategy to maximize profits is by taking advantage of market fluctuations. This technique involves accumulating shares at lower prices before the price spikes again, ensuring substantial gains. It requires patience, discipline, and a keen eye for spotting trends. Over the years, I’ve found this approach to be incredibly effective in growing my portfolio and achieving financial success.

Even though the increase has been steady so far, it’s typical to see periods of slow growth followed by a sudden spike. This pattern often indicates a possible accumulation leading to a substantial surge that might surpass the existing peak.

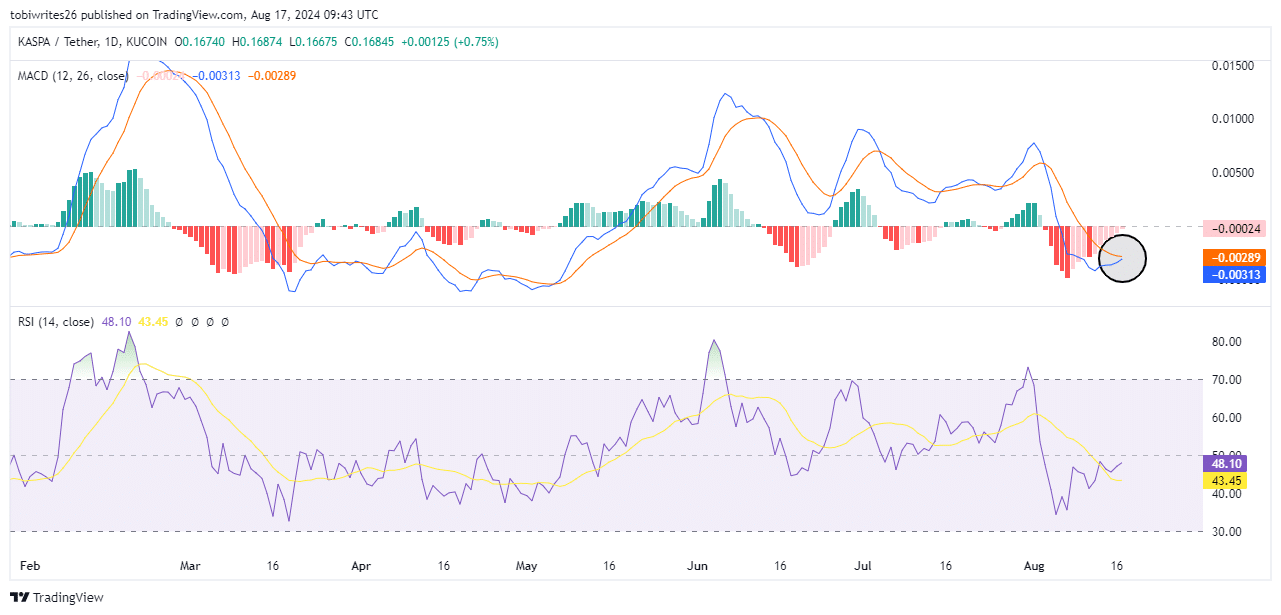

In this developing situation, analysis by AMBCrypto indicates a shift in trends as shown by technical indicators such as MACD and RSI, suggesting a buildup of positive momentum that could lead to a forthcoming increase or rally.

More bullish tendencies emerge

By analyzing the Moving Average Convergence Divergence (MACD), it appears that a potential rally within the ascending triangle might commence shortly, since the MACD is progressively exiting the negative region.

The MACD is a trend-following momentum indicator that displays the relationship between two moving averages of an asset’s price.

Looking closely at the graph shows an inclination moving towards favorable grounds, as the blue Moving Average Convergence Divergence (MACD) line is heading towards crossing above the orange signal line, suggesting a possible change to a bullish trend.

Furthermore, a swift crossing of the blue line over the orange line significantly supports the notion that the bulls are gaining more control.

Meanwhile, the Relative Strength Index (RSI) – a crucial momentum tool with values between 0 and 100 – also lent credence to the optimistic perspective.

The RSI measures overbought conditions above 70 and oversold conditions below 30.

Based on a Relative Strength Index (RSI) of 46.39, there’s a sign that bullish power is rebuilding, which could propel the price of KAS upwards. This implies that there are significant buyers poised to elevate the market in the near future.

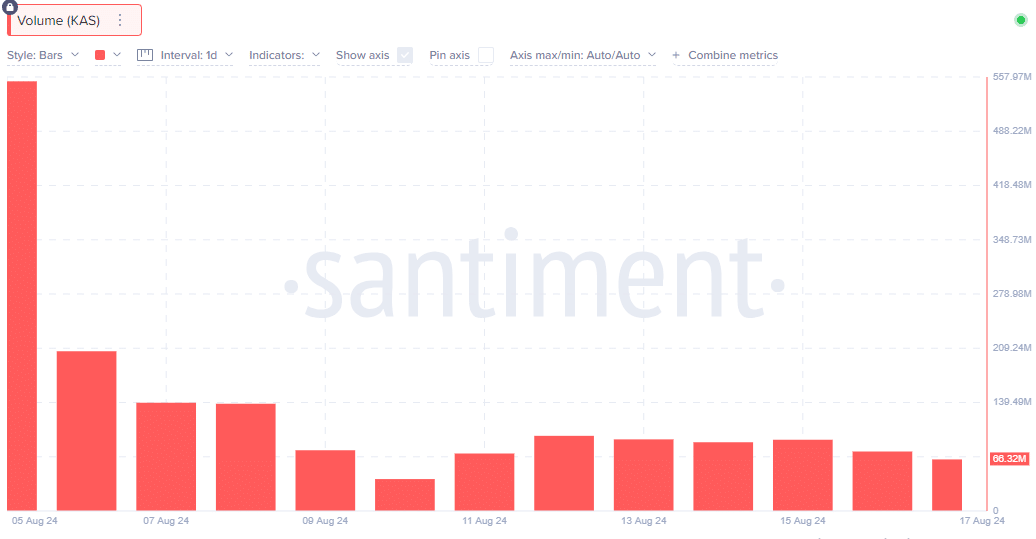

Mixed sentiment on-chain

On the 5th of August, Kaspa’s transaction volume, as observed through Santiment, stood at a high point of $552.44 million. However, by the 7th of August, this figure had dropped substantially to only $66.82 million.

Based on my years of trading experience, I find that a significant drop in demand for a product or service often indicates a dwindling interest in the market. This trend could potentially lead to further price decreases, as was the case with KAS. As someone who has seen markets rise and fall numerous times, I can attest to the importance of keeping a close eye on such signals and adapting one’s strategy accordingly.

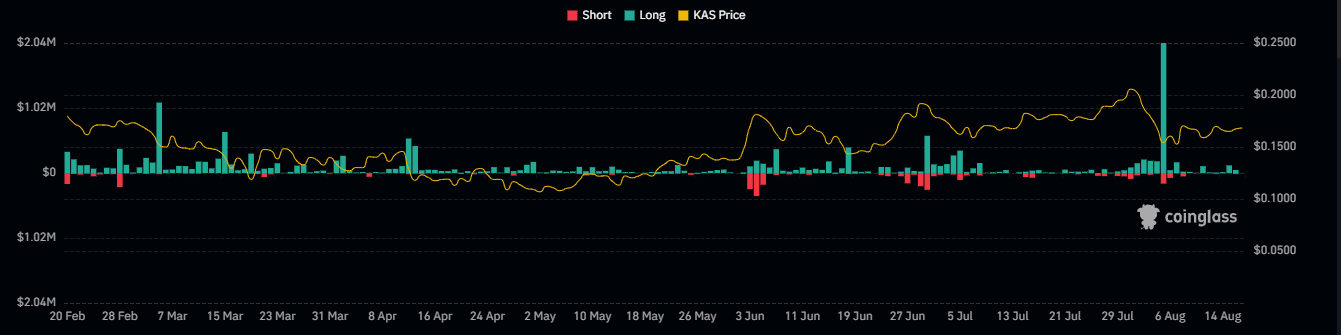

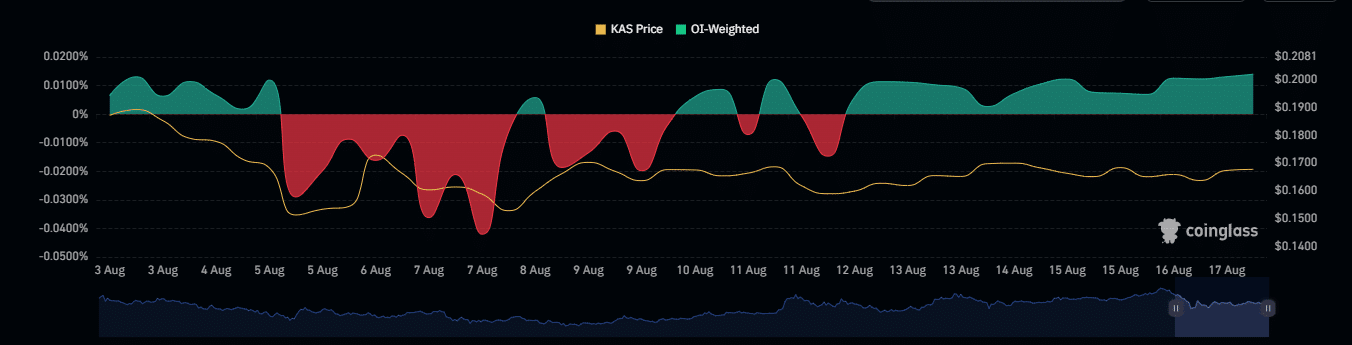

Furthermore, statistics from Coinglass show a trend of more traders holding long positions on KAS being forced to sell their holdings from August 7th to August 14th.

Typically, this situation points towards a significant decrease in price, which triggers the closing of long positions because there isn’t enough margin available to offset the losses. This is clearly an indication that the market is moving downwards, suggesting a bearish pattern.

Simultaneously decreasing quantity and cost suggested pessimistic feelings and the potential for an extended downward trend, indicating lessened trading actions.

As a researcher, I’ve noticed an optimistic outlook when considering the Open Interest (OI)-weighted Funding Rate. This rate stayed positively at 0.0140% and even showed a rise in value.

As someone who has been actively trading assets for quite some time now, I have learned that certain market dynamics can provide valuable insights into the current state of an investment. One such dynamic is the relationship between long and short positions, as reflected in the rate we observed. Seeing holders of long positions paying premiums to those with short positions indicates a strong demand for the asset, which suggests a bullish outlook. This means that investors are optimistic about the future performance of this particular asset, and I have found that such bullish sentiments can often lead to profitable opportunities in the long run. Therefore, understanding these market dynamics is crucial for making informed investment decisions based on real-world trends and patterns.

Read Kaspa’s [KAS] Price Prediction 2024-25

Using these conflicting signals, it seems the market may soon become clearer about whether it will lean towards optimism (bullish) or pessimism (bearish) in the coming days.

If the market trends positively towards growth (bullish), there’s a possibility that the price of KAS might surpass its former highest point at $0.21, establishing a brand-new peak in its history.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Quick Guide: Finding Garlic in Oblivion Remastered

- Florence Pugh’s Bold Shoulder Look Is Turning Heads Again—Are Deltoids the New Red Carpet Accessory?

- How to Get to Frostcrag Spire in Oblivion Remastered

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- Disney Quietly Removes Major DEI Initiatives from SEC Filing

- Unforgettable Deaths in Middle-earth: Lord of the Rings’ Most Memorable Kills Ranked

- Shundos in Pokemon Go Explained (And Why Players Want Them)

- BLUR PREDICTION. BLUR cryptocurrency

2024-08-18 11:04