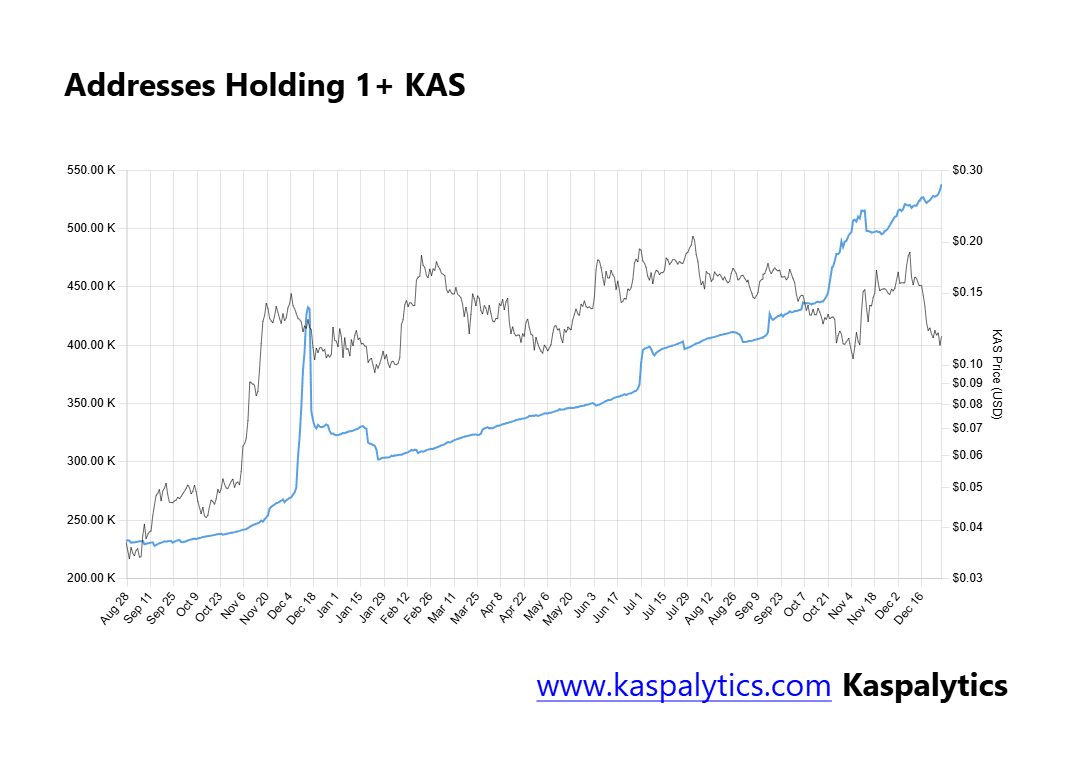

- KAS recently set a record, with over 538,000 addresses now holding the asset

- However, this milestone has had little to no impact on the crypto asset’s price performance

As a seasoned researcher with years of experience in the dynamic world of cryptocurrencies, I’ve seen my fair share of market trends and patterns. The recent surge in KAS holders is certainly noteworthy, but it seems to be dancing alone at this price party – the music just hasn’t started yet.

Despite the new record of 538,030 addresses holding KAS, the asset has shown little response, dipping minimally by 0.47% over the last 24 hours. This is a bit like inviting your whole neighborhood to a party, but forgetting to stock up on the snacks – everyone’s there, but nobody’s having a good time!

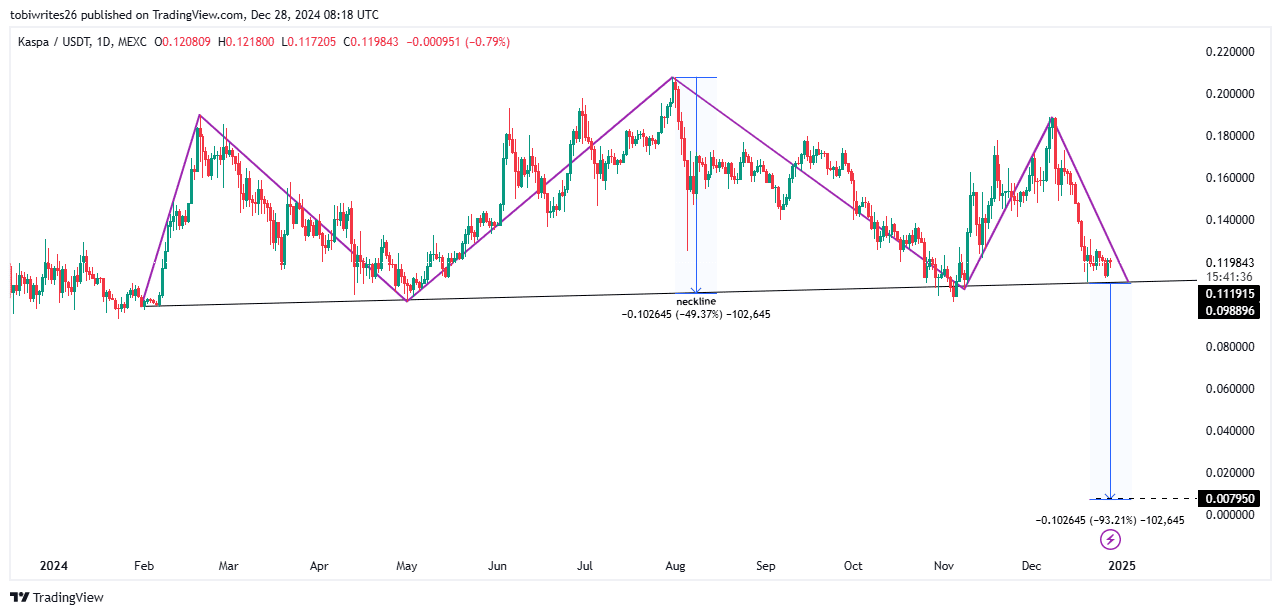

Further analysis suggests a potential 93% price crash if the critical support level is breached. That’s like inviting people to a housewarming party only to find out that your house has burned down. Not ideal.

The chart shows a classic head-and-shoulders pattern, with the price approaching the neckline – this could be the moment of truth for KAS. If the neckline is breached, well, it’s like that awkward moment when you invite someone over and they bring their own housewarming gift… a broom!

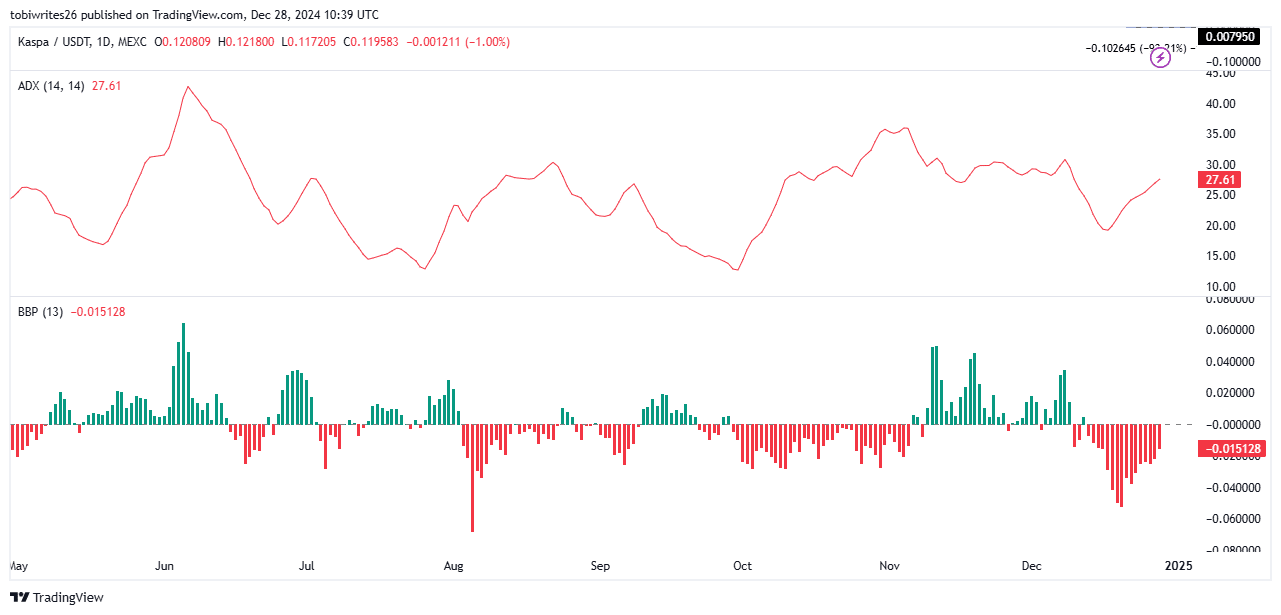

Technical indicators support this bearish outlook, with the Average Directional Index (ADI) and Bull Bear Power (BBP) both pointing to a downtrend. The ADI is like a barometer of market sentiment – if it’s raining, you don’t go outside without an umbrella! And right now, it’s pouring for KAS.

So, while the number of KAS holders may be setting records, the price performance seems to be stuck in neutral. It’s a bit like owning a Ferrari with no gas – it looks great, but it ain’t going nowhere!

And on a lighter note, I can’t help but chuckle at the irony: KAS is all about decentralization and community, yet its price action seems to be dictated by a few key players. It’s like inviting everyone to a party, but only letting a select few decide when to start the music!

Recently, Kaspa (KAS) has struggled in performance, noticeably after a broader market adjustment. In fact, within the last month, its value decreased by approximately 21.92%. Further examination seems to suggest that this downward trend might persist. At the moment, forecasts predict a potential larger drop in its chart trajectory.

In simpler terms, some estimates suggest the possibility of a dramatic 93% drop in prices, should a crucial support point be broken.

New milestone – KAS holders hit record high

Over the past 24 hours, I’ve noticed a significant increase in the number of wallets I hold KAS. These numbers have reached an all-time high, marking a new record.

As a researcher examining data from Kaspalytics, I’ve discovered an intriguing trend: now, approximately 538,030 addresses contain at least one unit of KAS. This growth pattern usually indicates that traders are amassing the asset, which can often precede price increases. However, it’s important to mention a slight contradiction in this scenario – despite reaching this significant milestone, KAS experienced a minor decrease of 0.47% over the past 24 hours.

A more detailed examination suggests that the price trend might continue to move downward, potentially leading to additional drops if the asset can’t maintain a crucial support point.

KAS to face potential 93% decline?

Currently, it seems that KAS is preparing for a substantial price decrease, given the appearance of a typical head-and-shoulders chart pattern. Notably, the price is drawing close to the neckline.

The neckline appeared to serve as a vital benchmark, halting a more dramatic drop. But once this mark is surpassed, KAS might experience a sudden plunge in its graphical representation.

Based on data from TradingView, the projected decline might reach a significant 93%, which could lower the asset’s value to around $0.00795. AMBCrypto’s examination of technical indicators suggests that the market might be tilting bearish and a downtrend may occur if this trend continues.

Bearish trend confirmed for KAS

For company KAS, the crucial market signs – the Average Directional Index (ADI) and Bull Bear Power (BBP) – pointed towards a pessimistic forecast.

The Average Directional Index (ADI) and Bull Bear Power (BBP), two important market indicators, suggest that KAS is likely to experience a downturn in the near future.

The Analysis Directional Index (ADI), which gauges the intensity of market movements, suggests that the falling trend could be intensifying. An increasing ADI signifies stronger alignment with the trend. At the moment, the ADI stands at 27.61, indicating a potential for KAS to continue losing value on the graphs if this pattern persists.

At present, it’s clear that sellers hold the majority of power in the Kaspa market, as indicated by the BBP (Buyer-Seller Power Balance Pointer). Moreover, the Bear Momentum Bars have persisted in red and are heading downwards, further strengthening the pessimistic outlook for Kaspa’s market.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Masters Toronto 2025: Everything You Need to Know

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Gold Rate Forecast

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-12-29 08:10