-

KAS has declined by 11.80% in the last 7 days.

Despite the decline, the trend remains uptrend.

As a seasoned crypto investor with a few years under my belt, I’ve seen my fair share of market volatility and price movements. The recent 11.80% decline in KASPA over the last week has caused some concern among long-term holders like myself. However, I remain optimistic about its future potential based on several factors.

As an analyst, I’d rephrase it this way: On the 30th of June, according to AMBCrypto’s reports, there was a significant 20% increase in KAS‘s value. However, just a week later, I observed a concerning decline of 11.80% in KASPA’s value, causing unease among long-term investors holding KASPA.

In spite of a downturn, there’s still a buoyant outlook within the market, as indicated by upbeat investor attitudes. Consequently, several analysts anticipate a significant increase in market value for KAS. Over the past thirty days, the market capitalization of KAS has experienced a notable surge, surpassing that of PEPE and ICP.

A crypto analyst @Sukie shared his projections on X (formerly Twitter), noting that,

“Kaspa ($KAS) doesn’t need to be a ‘moon boy’ to reach a market capitalization (MC) of over $100 billion. In 2017, Ripple (XRP) reached a MC of around $130 billion during the bull run when there was significantly less money in the cryptocurrency market. Binance Coin (BNB) experienced an astounding growth from a MC of $3 billion to $108 billion during the last bull run. No other crypto matches Kaspa’s fundamental strengths.”

According to historical trends, KAS is anticipated to undergo significant expansion in terms of market capitalization. This increase in market cap often corresponds to rising stock prices and a surge in user engagement for an extended period.

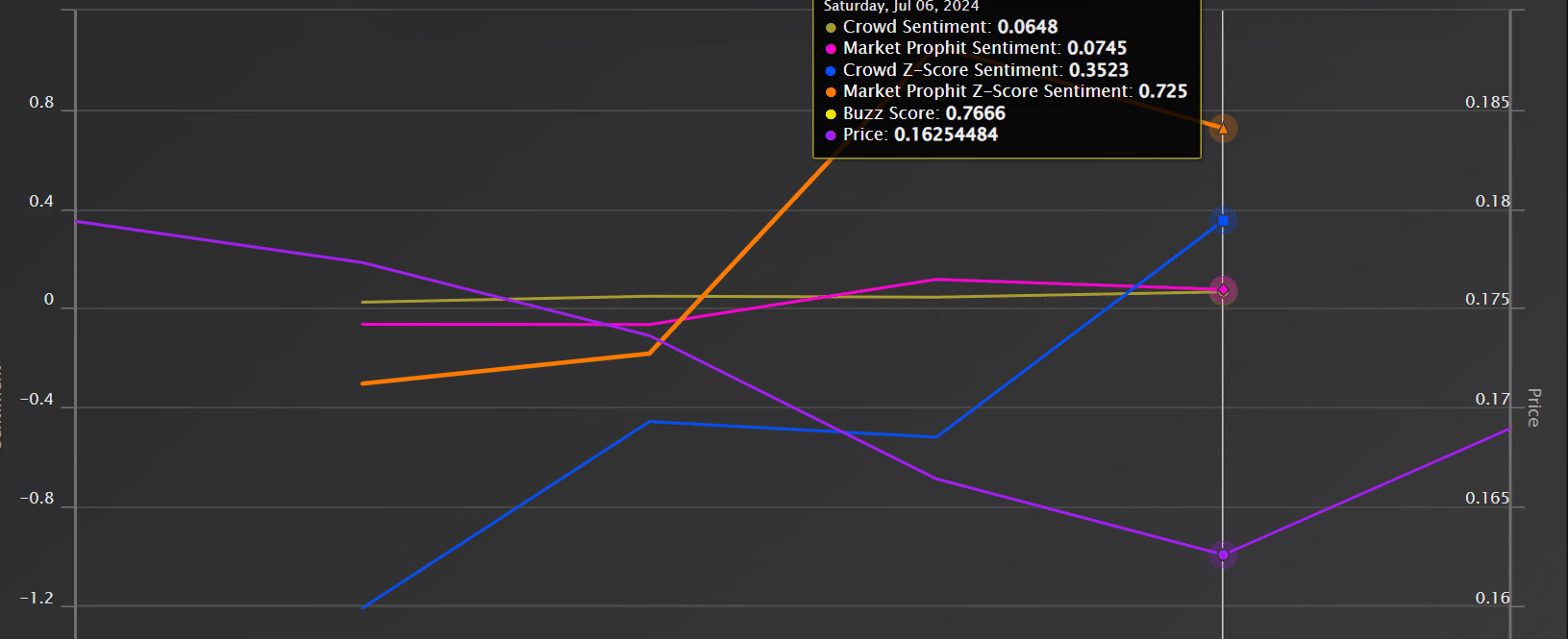

Market sentiment

According to Market Prophit, KASPA is continually enjoying a positive market sentiment.

The feeling among the crowd regarding KASPA is relatively positive, with a score of 0.06 and a Z-score of 0.35. In contrast, the general market sentiment registers at 0.07. This indicates that there’s a notable optimism towards KASPA’s future prospects among users and investors.

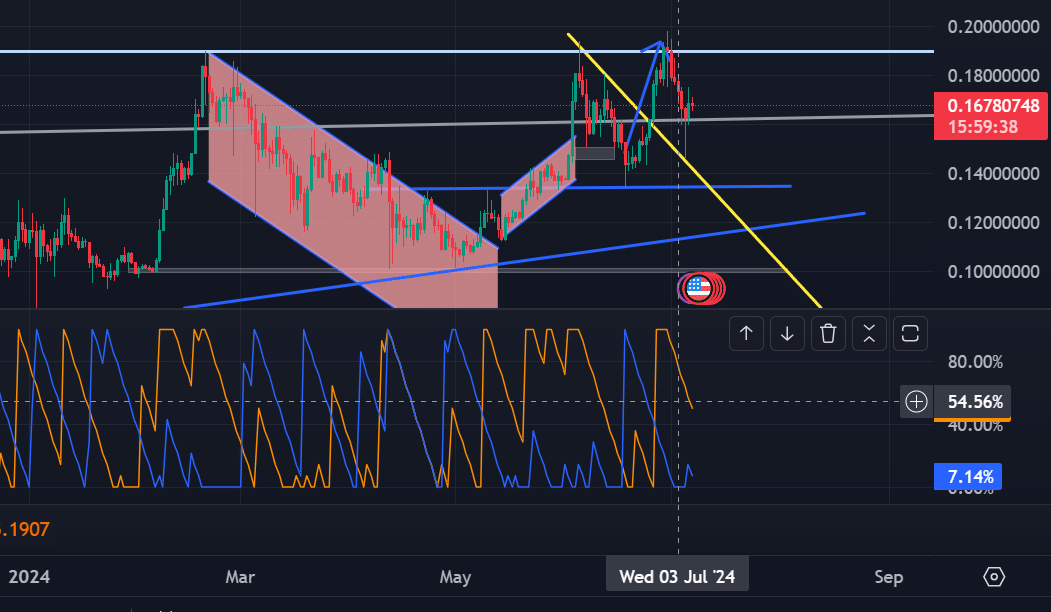

What KAS price charts indicates

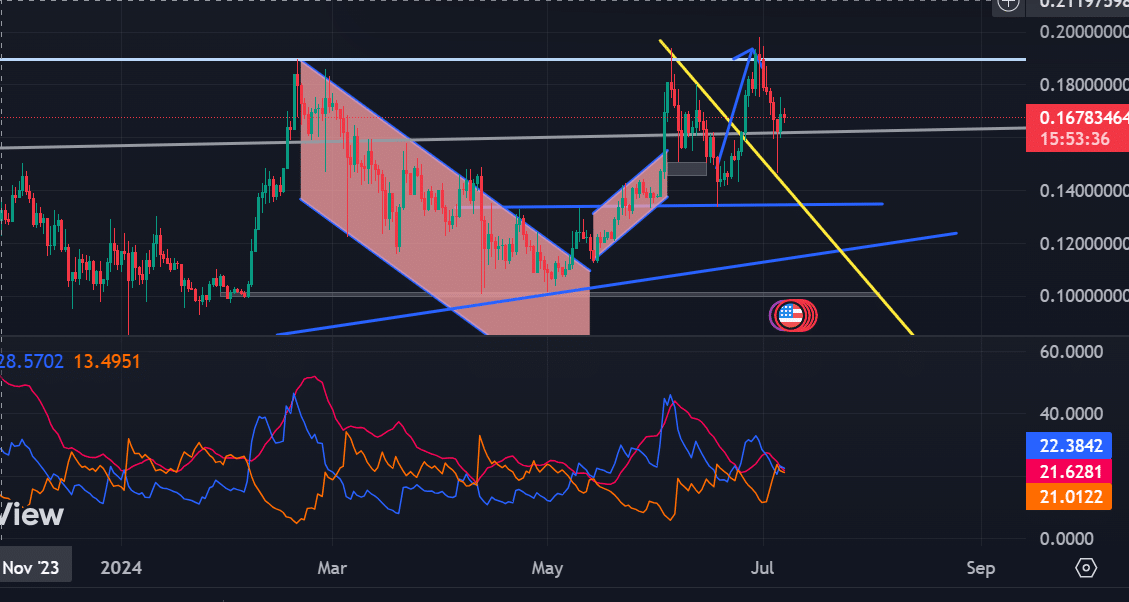

From my perspective as an analyst, the Aroon line of KAS is currently displaying a robust upward trend based on the data available to me. More precisely, the Aroon up value of 50 is situated above the Aroon down value at 7.

When the arrangement of the Aroon line is as described, it signifies a robust uptrend that is likely to persist, while also indicating that the current prices are aligned with the market’s overall trend.

As a market analyst, I can tell you that based on my analysis, the DMI (Directional Movement Index) adds credence to my observations. Specifically, the positive index, which currently stands at 22 (represented by the blue line), is superior in value to the negative index, denoted by the red line, with a value of 21 at present.

Based on the current situation, KASPA seems poised for success, with favorable market conditions potentially leading to additional growth.

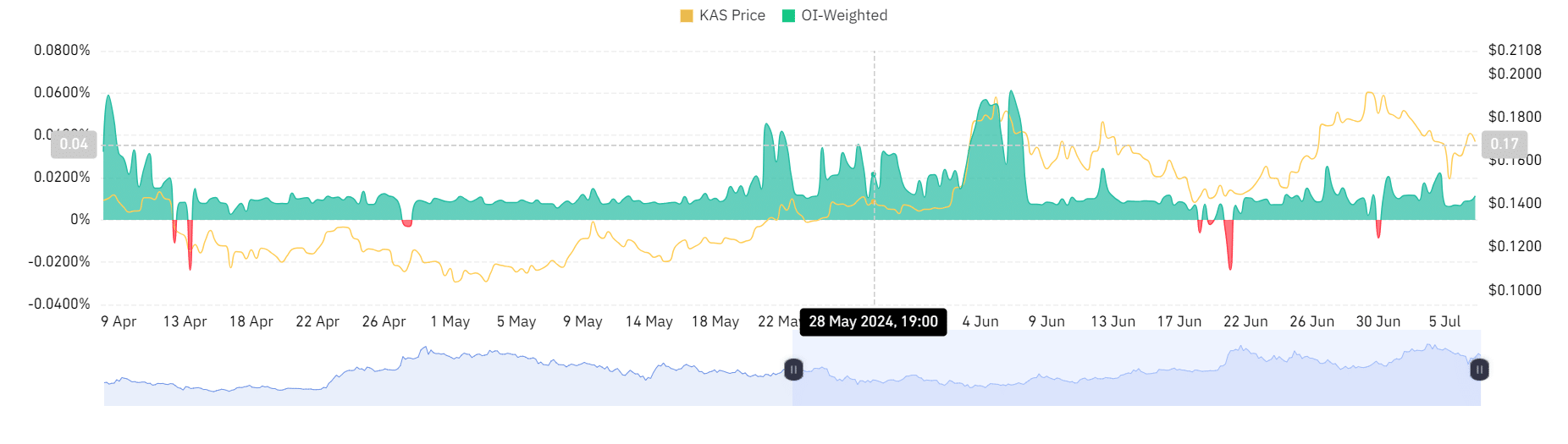

As an analyst, I’ve examined the OI-weighted funding rate’s trend over the past week, and my findings suggest a predominantly favorable development.

As a researcher studying financial markets, I’ve observed that a positive weighted funding rate indicates a stronger demand for long positions compared to short positions. This means that traders are willing to pay a premium to maintain their long positions, reflecting a bullish outlook on the market.

Can KAS maintain its uptrend?

As an analyst, I’ve observed Kaspa’s price behavior through AMBCrypto’s analysis, and I can confirm that the overall trend has been predominantly upward. Despite hitting an all-time high of $0.194, KAS underwent a brief correction in price, but the uptrend persisted undisturbed.

As of now, KAS is priced at $0.1688 following a 1.64% growth in the last 24 hours. Having encountered resistance at $0.194 earlier, a price breach beyond this level could propel the stock to a new peak of $0.23.

If the weekly chart shows continuing losses, the price is expected to drop down to the $0.15 support point.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- WCT PREDICTION. WCT cryptocurrency

2024-07-07 19:04