-

TON chain’s latest stablecoin-related achievement highlighted the network’s expanding DeFi ecosystem.

A look at key metrics that underscore TON’s budding ecosystem.

As a researcher who has been closely following the cryptocurrency space for years now, I have to admit that TON‘s recent achievements are nothing short of impressive. The network’s expansion into DeFi and its success in attracting stablecoins like USDT is a testament to its growing ecosystem and user base.

💥 EUR/USD Faces Historic Test Amid Trump Tariff Turmoil!

Market chaos looms — top analysts release an urgent forecast you must see!

View Urgent ForecastThis year, Toncoin [TON] has been moving swiftly in the cryptocurrency world, largely due to its alliance with projects associated with Telegram.

Consequently, there’s been a significant increase in the need for liquidity within the network, which is clearly demonstrated by the expansion of stablecoins.

As an analyst, I’m thrilled to highlight a significant milestone in the world of stablecoins: TON has surpassed the $1 billion threshold for USDT circulating within its network. This accomplishment is a clear testament to the burgeoning ecosystem we’re witnessing on this platform.

It’s anticipated that the increase in TON/USDT will enhance the network’s appeal within the WEB3 space. The blockchain’s impressive performance this year mirrors the significant user growth it has experienced.

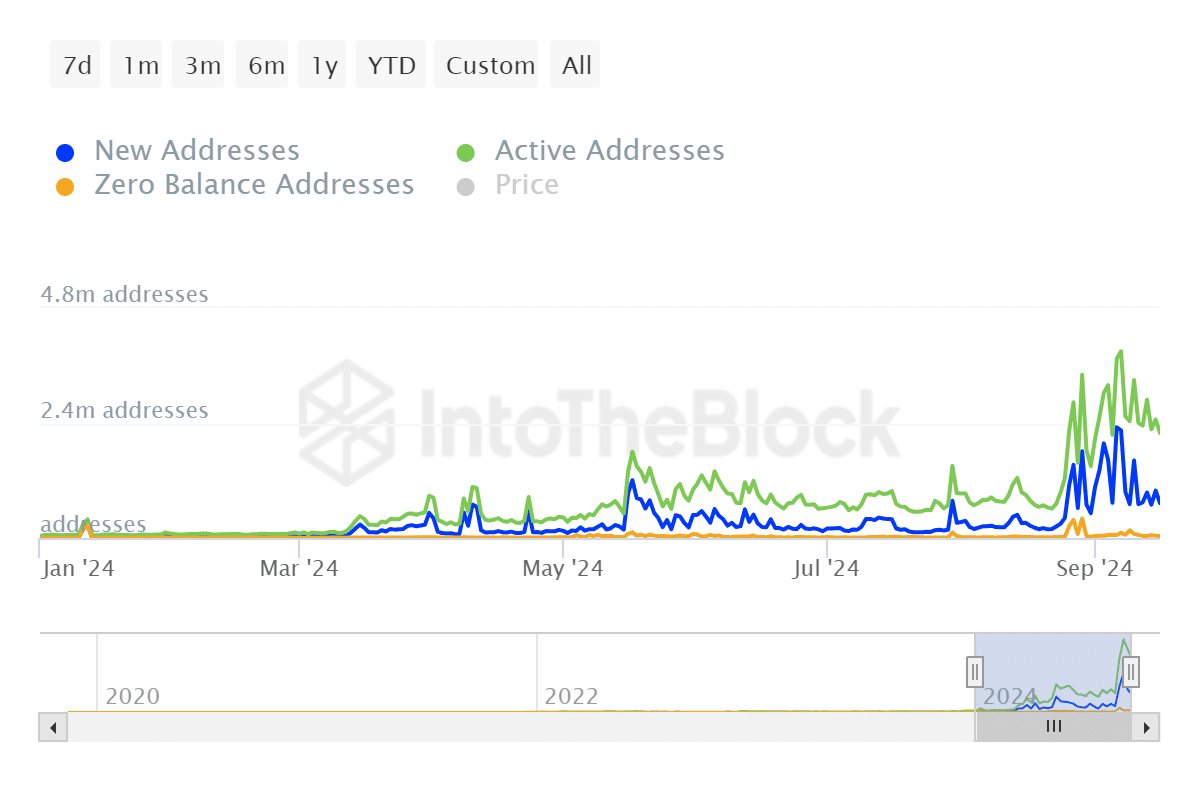

For example, new and active addresses ticked up considerably in the last two months.

On September 7th, the number of new and active addresses reached their peak, with 2.24 million and 3.9 million addresses in action respectively. This day marked the network’s highest level of daily address activity ever recorded.

Conversely, on January 1, 2024, TON counted approximately 8,170 new wallets and maintained around 34,340 active ones.

TON’s total addresses with balance recently peaked at $64.49 million addresses. The user growth also resulted in more transactions on the network.

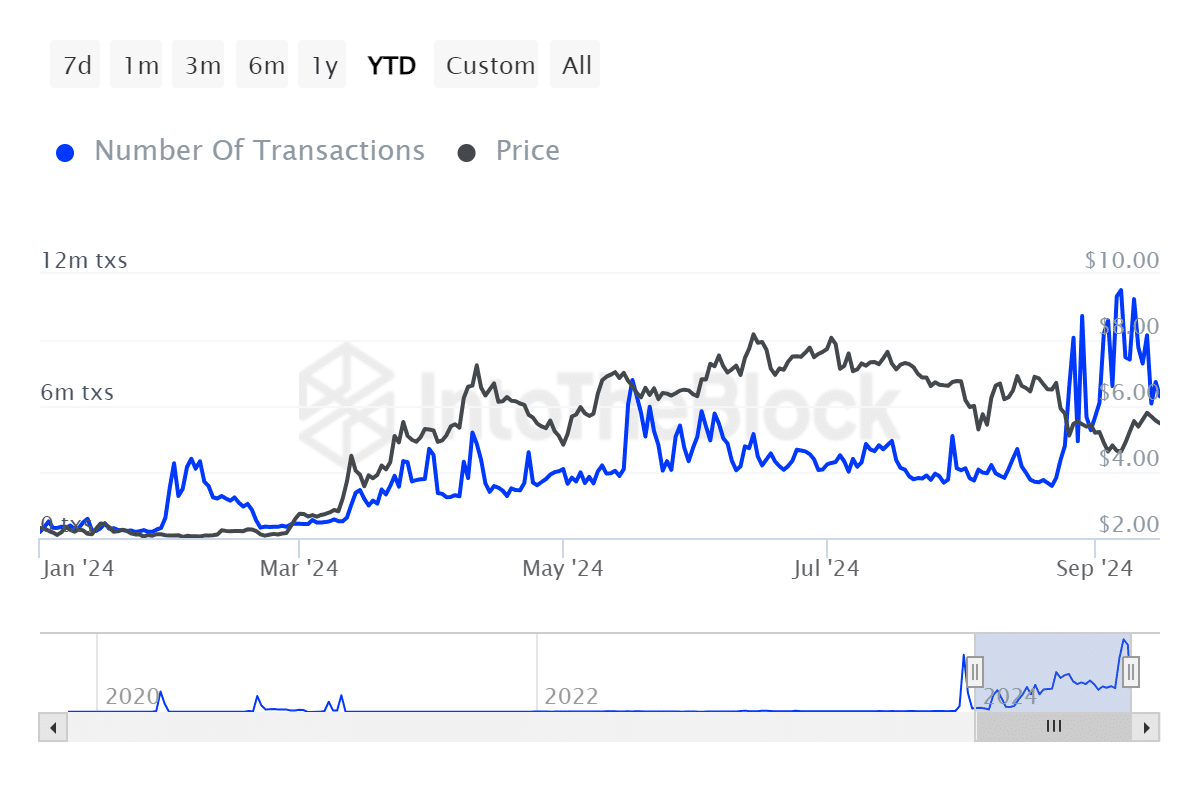

On September 7th, TON recorded its highest daily transaction count yet, reaching an impressive total of 11.27 million transactions in a single day.

Just like with other aspects, network fees have shown significant growth over the past eight months. It’s anticipated that these fees will keep rising, given the projected expansion of its Decentralized Finance (DeFi) system.

With its rapidly expanding ecosystem and increased availability of stablecoins, TON is well-positioned to be among the fastest-growing blockchains in the near future.

Can TON leverage this growth?

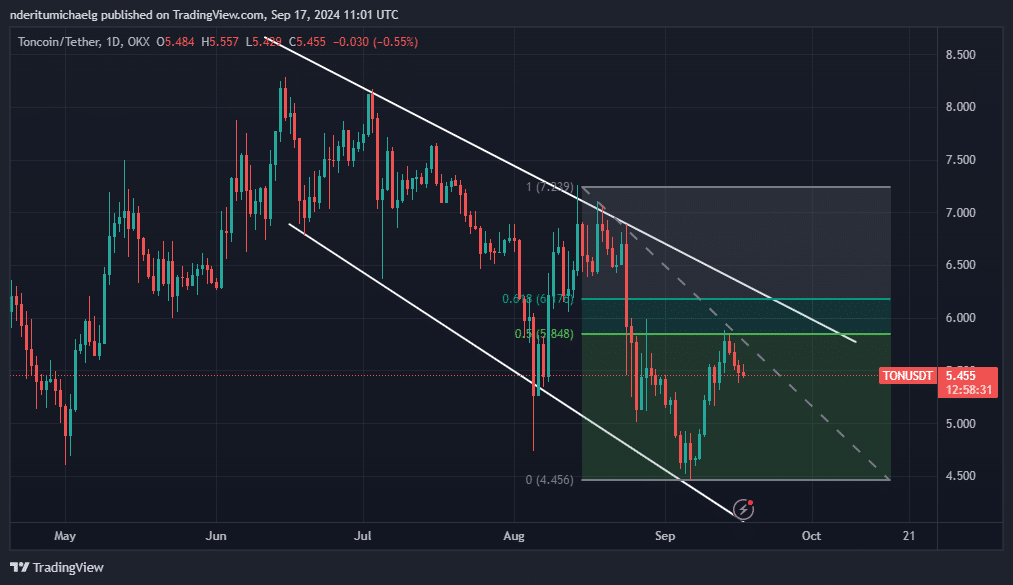

2024’s initial half saw TON making gains (bullish), but since June, it started to retreat (retracement). Lately, this digital currency has been trending downwards within a descending pathway and recently hit a support point just under the $4.6 price mark.

Its recent swing low suggests that the price may seek more upside.

In my analysis, I observed that the recent upward movement in our asset began around the second week of September. However, it seemed to face a roadblock at approximately $5.8, which coincides with the 0.5 Fibonacci retracement level. This resistance suggests potential profit-taking or selling pressure at this price point.

In simpler terms, intense selling might drive the price down to around $5.13, a level that historically functioned as a collection point for buyers.

Read Toncoin’s [TON] Price Prediction 2024–2025

TON traded at $5.44 at the time of writing, which is roughly a 33% discount from its ATH.

If the bull market resumes, the value of the cryptocurrency might surge again towards its past peaks and even reach unprecedented heights.

Read More

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

2024-09-17 23:04