- Key U.S. economic releases this week, including JOLTS and ADP data, may trigger volatility in crypto markets as traders assess macro trends.

- Stablecoins show resilience with rising inflows, while Bitcoin and Ethereum react to tightening liquidity concerns.

This week brings important economic updates for the U.S., such as job figures, Federal Reserve meeting summaries, and reports on the job market.

These advancements might significantly impact investors’ attitudes towards cryptocurrencies, causing price fluctuations throughout the digital currency market. Keeping tabs on such happenings is crucial because cryptocurrencies tend to respond strongly to broader economic indicators, providing insights into possible market trends.

Major U.S. economic events to watch

On Monday, the S&P Global Services PMI was published, which indicates the condition of the service industry – an essential component fueling the U.S. economy. If this figure is robust, it may suggest economic durability, possibly supporting the Federal Reserve’s firm monetary policy stance.

The cryptocurrency market may respond unfavorably to the upcoming U.S. economic event, since increased expectations for higher interest rates can potentially decrease liquidity.

On Tuesday, the JOLTS Job Openings report will offer insights about the current demand in the job market. A surprisingly large number of job openings could spark concerns over additional interest rate increases, which might cause a drop in cryptocurrencies as investors prefer secure investments instead.

On Wednesday, the spotlight will be on the ADP Nonfarm Employment report and the Federal Reserve’s Meeting Minutes. The ADP report serves as a precursor to the formal employment report, while the Fed meeting minutes provide valuable insights into the perspectives of policymakers regarding inflation and interest rates.

An aggressive stance (hawkish) towards economic policy could potentially pressure assets considered high-risk, such as cryptocurrencies, whereas a more accommodating or patient approach (dovish) might ease concerns and foster the rebound of the market.

As a crypto investor, I’m keeping a close eye on this week’s highlights, with the December Jobs Report due out on Friday standing as the most impactful event. This comprehensive report encompasses key employment indicators such as nonfarm payroll data, unemployment rates, and wage growth statistics.

As an analyst, I find myself pondering over the potential impact of a subpar economic report. Such a report might unexpectedly fuel the cryptocurrency market, for it increases the likelihood that the Federal Reserve may moderate its pace of interest rate increases.

During the coming week, eight speakers from the Federal Reserve are scheduled to speak, offering further insights into their views on monetary policy. If these speakers express hawkish opinions, it might dampen any immediate gains in cryptocurrency.

Potential impacts on the Crypto market

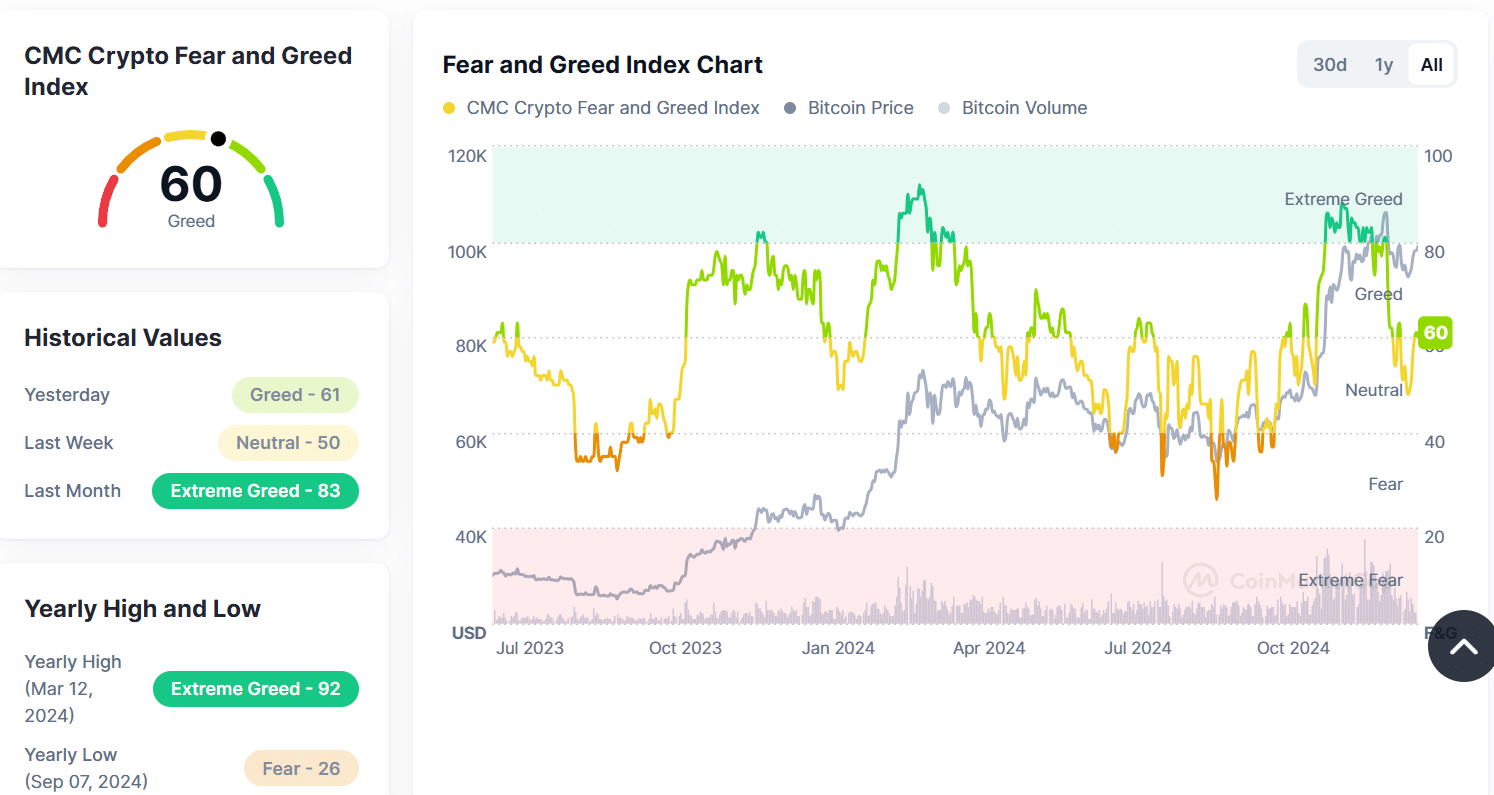

Right now, as I type this, the Crypto Fear and Greed Index stands at 60, which indicates a degree of cautious optimism – or in other words, a healthy mix of greed and fear. This is quite different from the Extreme Greed (83) we saw last month and the Neutral (50) just a week ago, hinting that traders are adopting a more balanced approach.

This week, economic happenings might sway public feelings towards optimism (greed) if soft messages are given, or pessimism (fear) if robust data suggests the Federal Reserve may tighten interest rates aggressively.

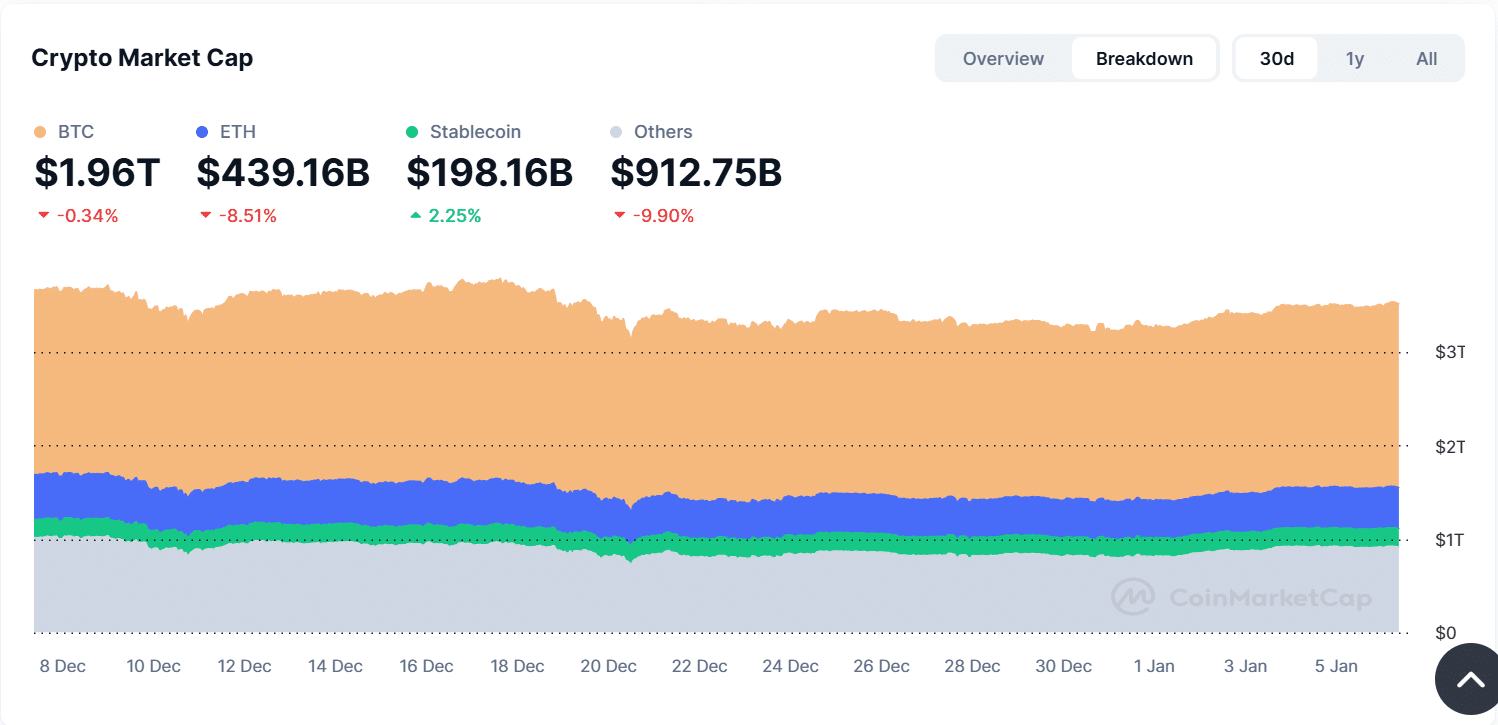

The overall value of the cryptocurrency market currently stands at approximately $3.51 trillion, showing variations among different asset types. Specifically, Bitcoin (BTC) and Ethereum (ETH) have experienced decreases of about 0.34% and 8.51%, respectively, suggesting that these assets may be influenced by broader economic trends.

Currently, stablecoins are seeing an increase of 2.25%, demonstrating a subtle shift towards safer investments. This movement suggests that crypto investors are taking proactive measures in anticipation of possible interest rate adjustments.

For about a month now, the crypto market has been stabilizing. On December 22, its total value dropped to approximately $3.28 trillion, but then it started recovering. This suggests that traders are adopting a cautious stance, weighing economic uncertainties against potential investment chances, which can be interpreted as a “let’s wait and see” attitude.

Broader implications of these U.S. economic events

The economic happenings in the United States this week might have a substantial impact on the cryptocurrency market. If the economic figures show robust growth, it could lead to more increases in interest rates, potentially decreasing liquidity and putting downward pressure on crypto values.

Soft monetary policies or less robust employment figures might boost investors’ optimism, leading them to reconsider investing in cryptocurrencies again. Meanwhile, stablecoins could attract more funds as caution remains high, but altcoins may experience additional price declines due to continued selling pressure.

The bottom line

This week, as a crypto investor, I’m closely watching the U.S. economic happenings unfold, understanding that the fluctuations in the cryptocurrency market often echo broader economic movements. These events could potentially offer vital clues to help guide my trading decisions.

As a researcher, I am examining how the current state of the labor market and the Federal Reserve’s monetary policy might shape the forthcoming mood and trading dynamics in the crypto market. These factors could significantly influence the trends in cryptocurrency prices.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Elden Ring Nightreign Recluse guide and abilities explained

2025-01-07 07:04