- LCX breaks a descending channel, targeting $0.31732 with bullish momentum building rapidly.

- On-chain signals and rising activity support the rally, but overbought RSI demands caution.

As a seasoned researcher with years of experience in analyzing cryptocurrency markets, I have to admit that LCX has been quite the rollercoaster ride recently! The 90% rally in just seven days is not something we see every day, and it’s certainly caught my attention.

The digital currency LCX (LCX) has been making headlines recently as it skyrocketed an impressive 90% in less than a week, drawing interest from traders globally.

Currently, LCX is being traded at $0.20528, marking a significant increase of 120% in trading volume over the last 24 hours. The question arises: What’s driving this impressive growth, and will it sustain its pace?

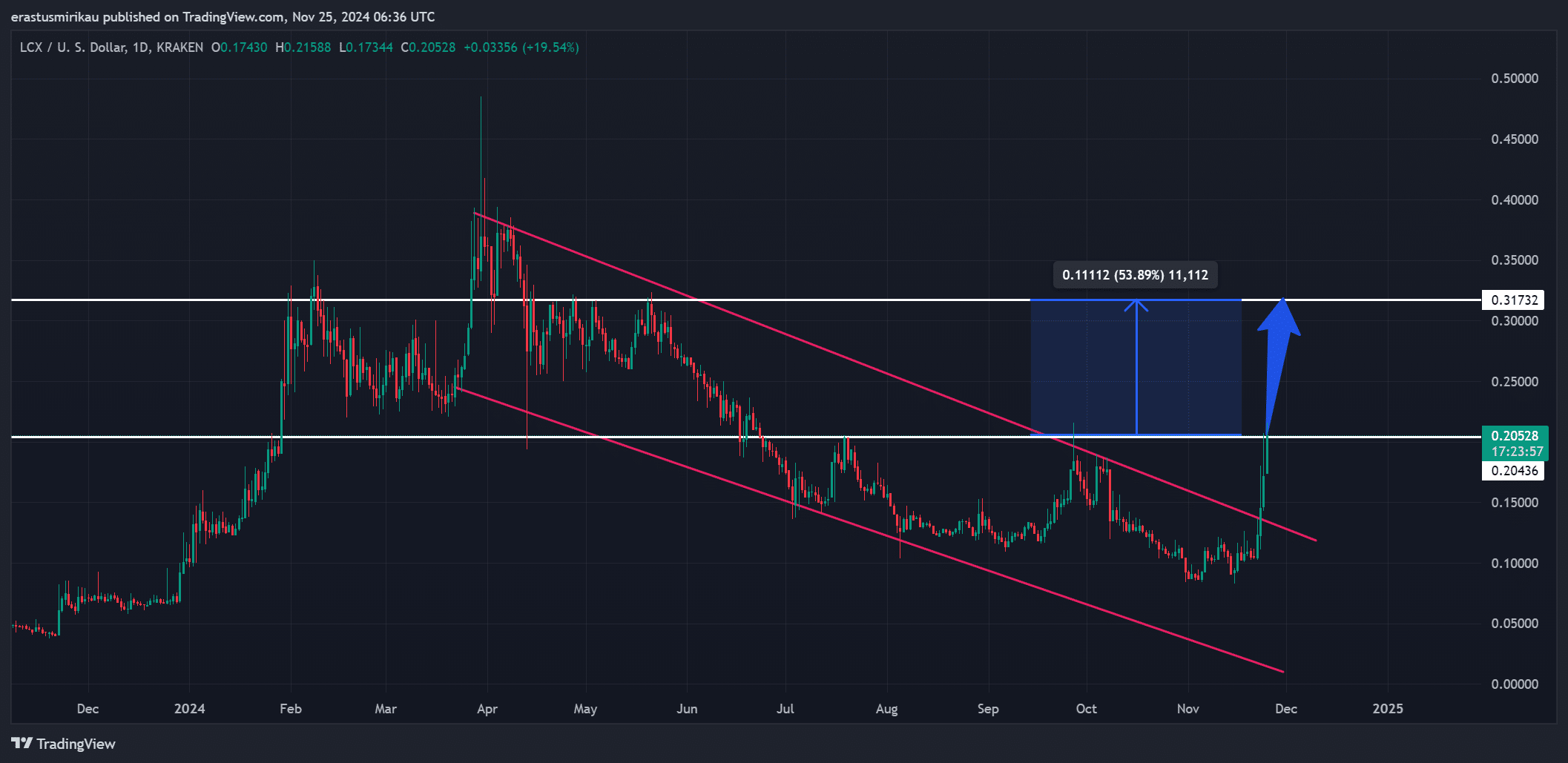

Breaking the descending channel with key resistance in sight

More recently, LCX managed to escape from a lengthy downward trending path that had been limiting its value since the beginning of 2024. This breakout indicates a significant change in direction, as buyers have propelled the price by an impressive 19.54% within a single day.

Therefore, attention is now directed towards the crucial resistance point at $0.31732, which could signify a possible increase of 53%.

Should LCX continue its upward trend, it may indicate a prolonged period of bullish momentum. On the other hand, if LCX struggles to maintain positions above the former resistance level now acting as support at $0.173, there could be an increase in bearish sentiment.

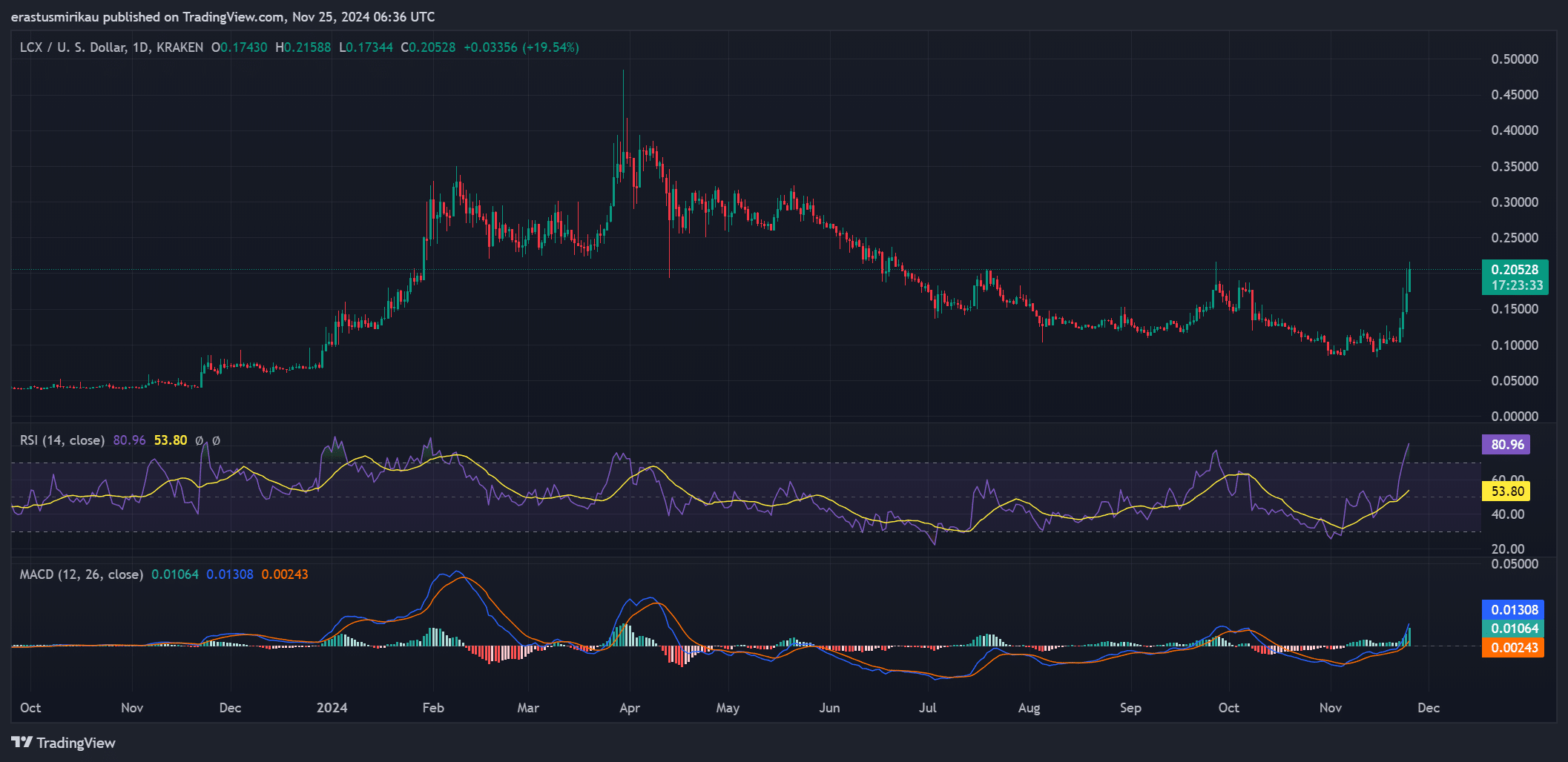

MACD and RSI paint a bullish yet cautious picture

In simpler terms, the MACD (Moving Average Convergence Divergence) is signaling a robust increase in price movement, as the MACD line has climbed above the zero mark, indicating a bullish trend. Additionally, the growing distance between the MACD and signal lines implies that buyers are currently holding more power in the market.

Furthermore, the Relative Strength Index (RSI) has surged to 80.96, signaling that the market is overbought. This high reading suggests heavy buying interest, but it also signals a possible brief reversal or pullback might occur as traders may start cashing out their profits.

Therefore, while momentum remains on the side of the bulls, caution is warranted.

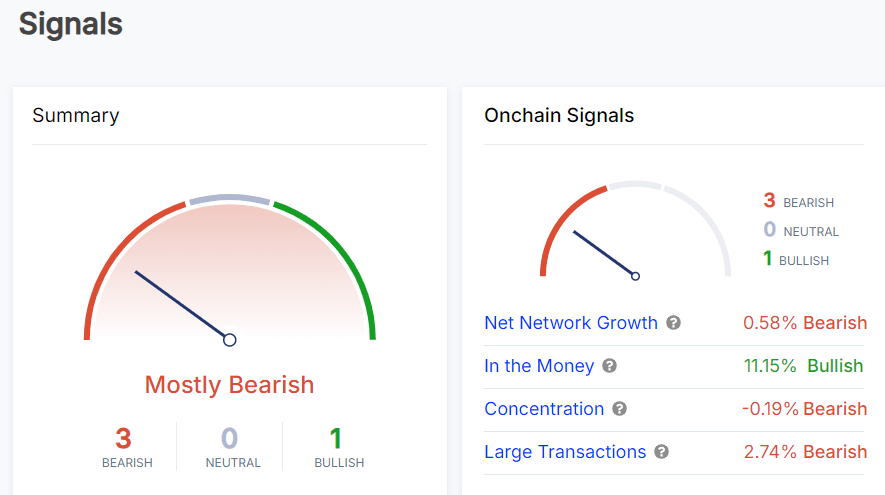

On-chain signals show mixed metrics

Information directly recorded on the blockchain offers an intricate depiction. Although 11.15% of holders are in a financially advantageous position (indicating profitability), other indicators point towards exercising prudence.

The increase in the expansion of networks is minimal at a rate of 0.58%, on the other hand, significant transactions have dropped by 2.74%. This suggests that bigger investors might be losing interest. Although retail activity seems active, institutional involvement could be restricted.

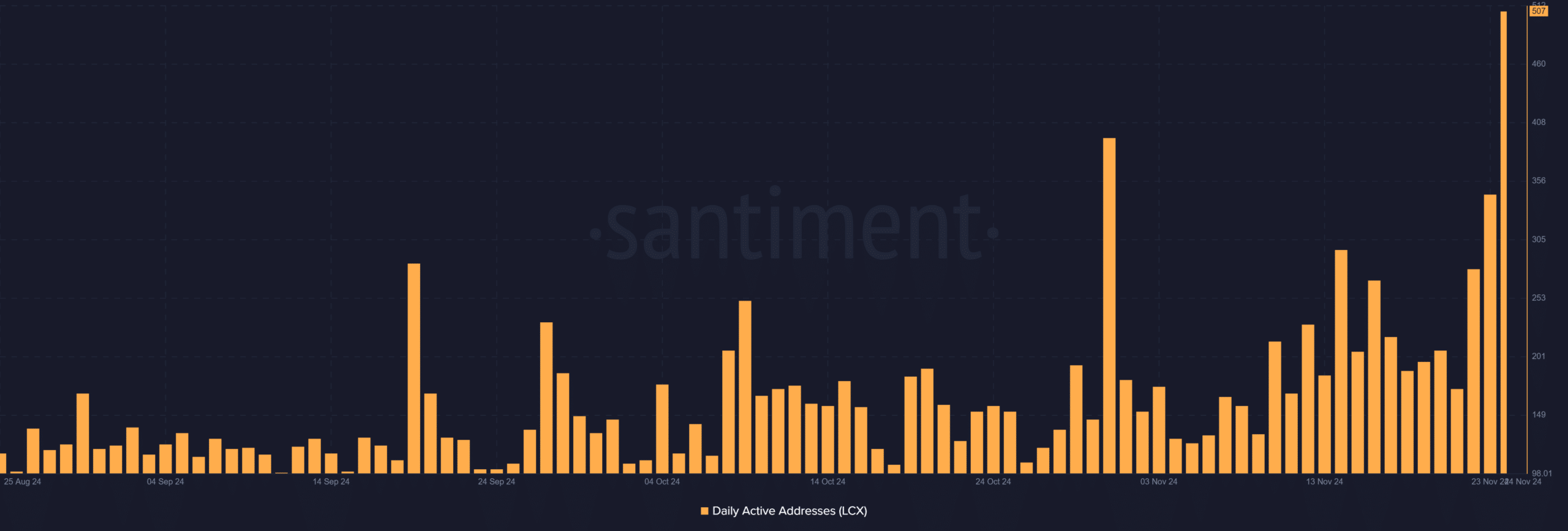

Daily active addresses surge alongside price

Recently, the number of daily active addresses for LCX has spiked to 507, marking a substantial rise. This upward trend in usage mirrors the token’s recent price surge. The boost in user activity lends credibility to this rally, as it’s common for increased network interaction to coincide with price hikes.

Can LCX sustain its momentum?

As an analyst, I’m observing a surge in LCX, primarily driven by technical breakouts and increased user engagement. Yet, concerning signs such as overextended RSI levels and ambiguous on-chain indicators are casting doubts about its longevity. Should LCX successfully surpass the $0.31732 resistance threshold, it could potentially open doors to additional gains.

In simpler terms, if the current momentum isn’t sustained, there could be a reversal. At present, LCX seems set to move upward strongly, but traders need to stay vigilant about crucial resistance points and overall market mood.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Masters Toronto 2025: Everything You Need to Know

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

2024-11-26 02:15