- LCX flipped its daily market structure bullishly, gaining by 43% in a day

- High trading volume and rising capital inflows meant more gains were possible

As a seasoned researcher with a penchant for deciphering market trends and a soft spot for LCX, I must admit this recent surge has piqued my interest. The 43% leap in a single day is reminiscent of a gazelle bounding across the savannah, an exhilarating sight indeed!

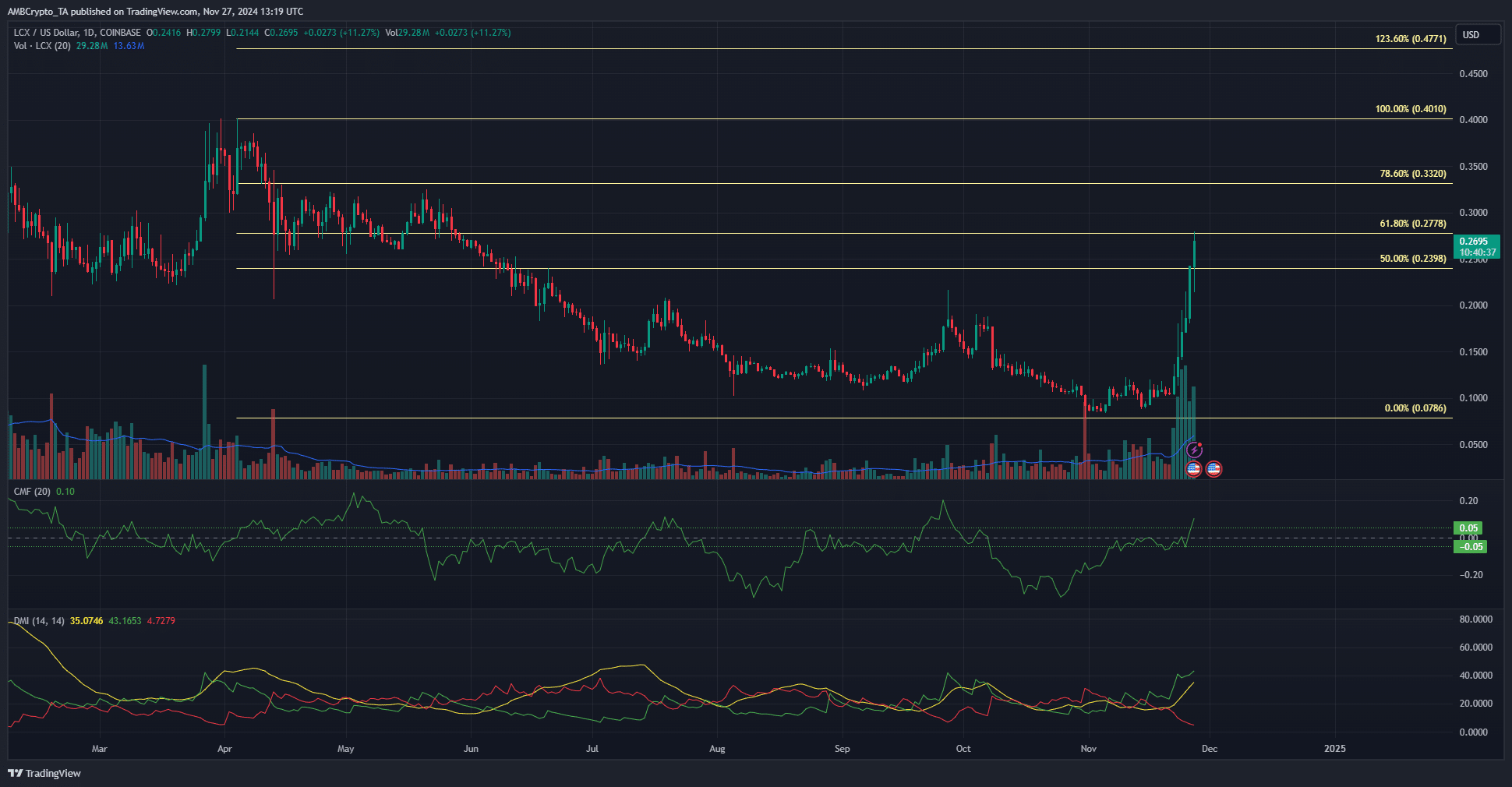

For the first time in approximately two months, the 1-day chart pattern of LCX [LCX] indicates a resurgence in bullish momentum. Notably, the digital token associated with the LCX cryptocurrency exchange has experienced a prolonged downward trend since June.

Between June 5th and October 31st, the token’s worth decreased by 70%. For approximately two weeks, it established a price range near the $0.1 level and stabilized. Interestingly, over the last seven days, it has surged by an impressive 163%.

As we speak, over the past 24 hours, LCX has increased by 43%. It surpassed the anticipated resistance level of $0.24, raising questions about how far it could potentially rise. What might be LCX’s next price target?

The importance of $0.2-$0.25 for LCX

As a researcher, I observed in March that the range between $0.223 and $0.232 functioned as a demand zone. Towards the end of the month, there was a significant surge up to $0.4. However, this upward momentum shifted into a retreat shortly after the $0.32 area transformed from a support level to resistance. This marked the beginning of a downtrend.

Currently, LCX is being exchanged for approximately $0.2695. In the past few hours, it reached a high of $0.2778. Notably, it managed to break through the resistance level of $0.223 fairly effortlessly.

On the 21st of November, the trading volume was $4.43 million, but it surged to $16.16 million on the 22nd and peaked at an impressive $35.9 million by the 25th. This substantial increase in trading activity, coupled with swift price increases, is generally interpreted as a robust positive indicator.

Read LCX’s [LCX] Price Prediction 2024-25

Looking at the chart, Fibonacci retracement lines were drawn as the overall market trend was bullish, but the long-term outlook has been bearish for LCX token. For the token to demonstrate a robust and lasting uptrend, it must surpass the $0.332 mark.

The Cash Money Flow (CMF) was slightly positive at 0.1, highlighting substantial investments flowing into the market. In the end, the Directional Movement Index indicated a robust upward trend in motion, with both the +DI (represented by green) and the ADX (yellow) surpassing the 20-threshold.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- SOL PREDICTION. SOL cryptocurrency

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

2024-11-28 13:11