- Social dominance and circulation escalated, suggesting a return to $11 in the short term.

- On-chain analysis suggested that perp sellers might lose while spot buyers might gain.

People holding the UNI governance token from Uniswap have been alarmed and concerned since the US Securities and Exchange Commission announced its intention to file a lawsuit against the prominent Decentralized Finance (DeFi) platform.

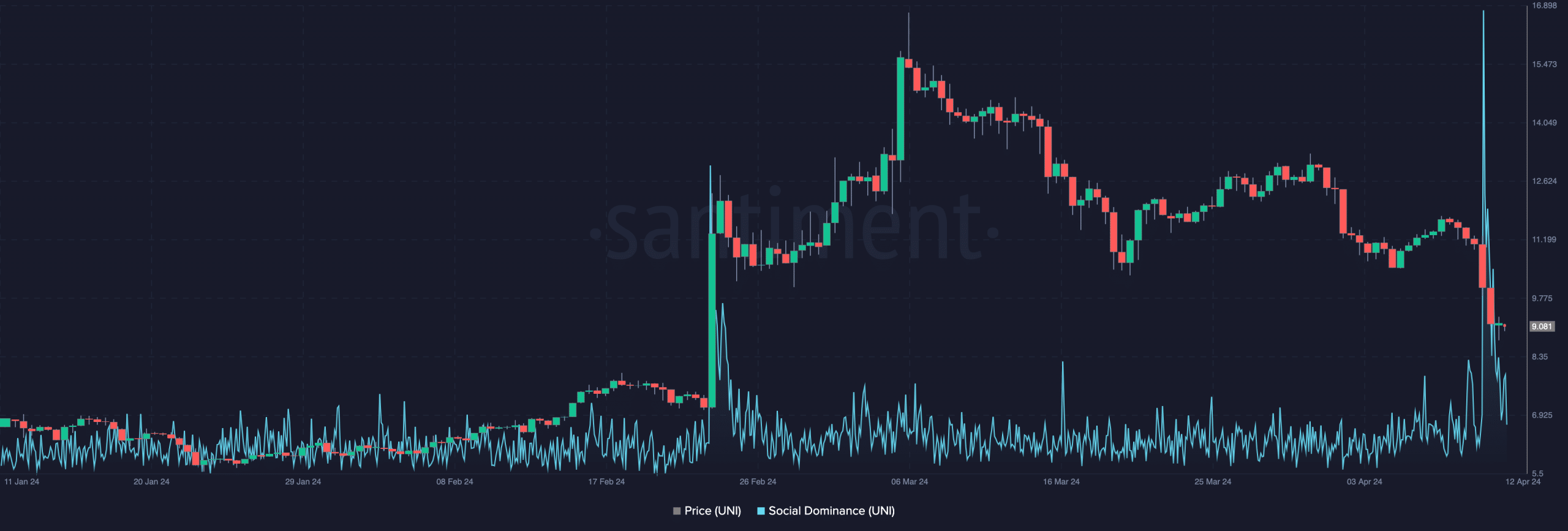

Upon analyzing the social dynamics, AMBCrypto identified instances of Fear, Uncertainty, and Doubt (FUD) in the crypto sphere. In the cryptocurrency market, FUD signifies the apprehension or anxiety among traders due to unfavorable news or speculation.

Based on data from Santiment’s blockchain analysis, there was a significant increase in mentions of Uniswap across social media platforms on April 9th. This surge in conversation suggested heightened interest and activity surrounding the decentralized exchange.

UNI likely to follow XRP’s steps

It’s worth noting that this metric marked an all-time high in the previous 15 months. Contrary to popular belief, intense fear isn’t universally detrimental to a token’s price. Ripple [XRP] serves as a case in point, having experienced regulatory scrutiny as well.

At various instances, the cost of XRP surged following weeks of negative sentiment surrounding the token. Similar to Uniswap, XRP‘s popularity on social media platforms significantly increased prior to its price recovery.

At present, the price of UNI has significantly dropped. The coin was sold for $9.08 during the latest press check, indicating a 15.27% decrease over the past week. However, a considerable portion of these gains was lost starting from April 119th, when relevant news was made public.

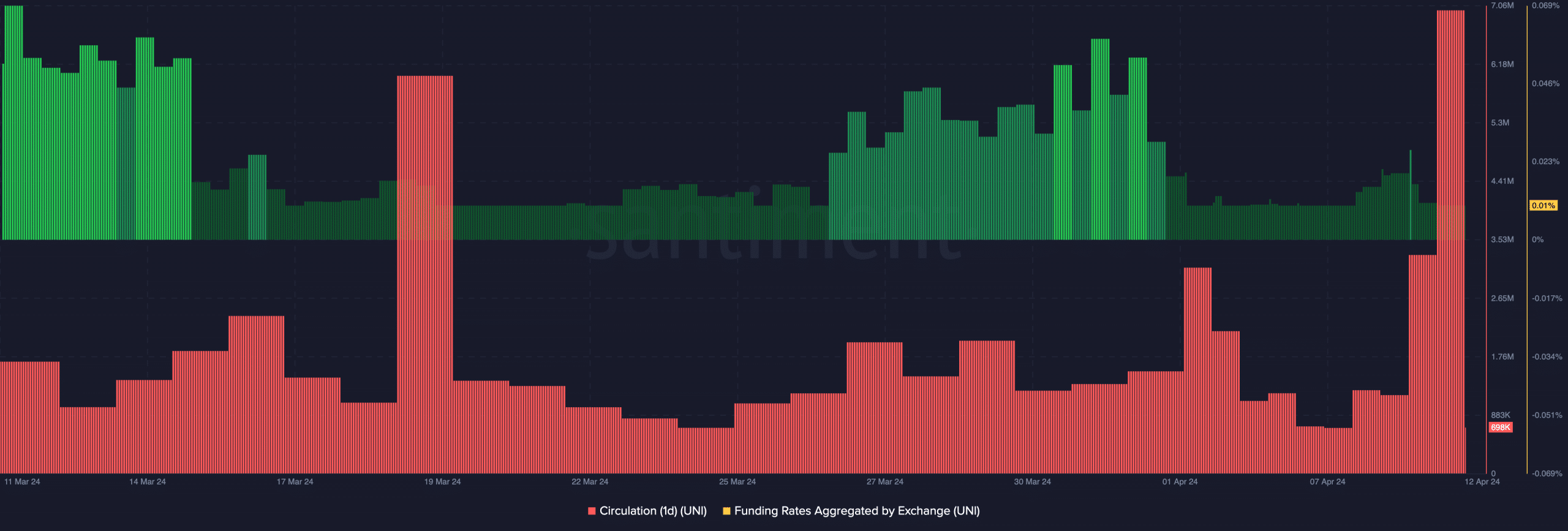

An alternative measurement supporting a bounce in UNI‘s performance was its daily circulation figure. Based on our findings, UNI‘s one-day circulation reached approximately 6.99 million.

Yet, the hike indicated stronger demand to sell. Nevertheless, the figure was significantly smaller during the reporting period, implying that selling pressure had eased off.

Should you get your spot bags ready?

If the token continues in this downward trend, it may eventually level off and potentially rise back up towards the $11 mark. However, it’s crucial to keep an eye on the actions of traders in the futures market as well.

In this instance, AMBCrypto analyzed Uniswap’s Funding Rate for this particular aspect. A positive funding rate signifies that long positions holders are paying fees to the short positions in order to maintain their open positions.

In contrast, a pessimistic interpretation implies that short sellers are buying from long holders. The Funding Rate, which affects pricing in addition to transaction fees, plays a role in this dynamic based on its direction.

At the moment of publication, UNI‘s Funding Rate stood at 0.01%, yet it was less favorable compared to the April 9th figure. For clarification, when funding rates turn more advantageous as prices decrease, this is generally considered bearish in nature. In light of this situation, the price could continue to fall.

Realistic or not, here’s UNI’s market cap in XRP terms

Despite a sluggish improvement over the past hour for UNI, the decreasing positivity of funding suggests that aggressive sellers may be backing off. In turn, this could pave the way for more active buyers to push the price upward.

Currently, it’s unclear whether Uniswap’s legal situation will drag on indefinitely, similar to Ripple‘s. If so, negative sentiment (FUD) could surface at various points in time. Conversely, if the outcome isn’t prolonged, UNI as a token could experience considerable growth like other altcoins.

Read More

- LDO PREDICTION. LDO cryptocurrency

- JASMY PREDICTION. JASMY cryptocurrency

- Orca crypto price prediction: Buying opportunity ahead, or bull trap?

- Can Ethereum ETFs outperform Bitcoin ETFs – Yes or No?

- Chainlink to $20, when? Why analysts are positive about LINK’s future

- Citi analysts upgrade Coinbase stock to ‘BUY’ after +30% rally projection

- Why iShares’ Bitcoin Trust stock surged 13% in 5 days, and what’s ahead

- Spot Solana ETF approvals – Closer than you think?

- Injective at risk of pullback as key resistance holds strong – What now?

- Crypto mining ‘strengthens America’s energy grids’ – A 30% tax means…

2024-04-12 18:15