- Crypto markets are in the green once again, thanks to factors like CME, U.S. economy and long-term holders.

- Bitcoin bulls are facing the stress of pulling prices back to the immediate support level of $68,000.

As a researcher with a background in cryptocurrencies and market analysis, I find the current state of the crypto markets intriguing. The recent green wave is a welcome sight after a weekend of uncertainty, with factors like CME open interest, U.S. economic data, and long-term holders contributing to the upward trend.

In the last 24 hours, the total value of all cryptocurrencies has risen by approximately 1.8%. This marks a small rebound following a subdued start to the weekend.

As of yesterday at the same hour, Bitcoin [BTC] was teetering around $60,000. Current value stands at $63,111, marking a 4% increase in just one day. However, what triggered this sudden spike in price? And can we expect it to sustain?

Why Bitcoin is up

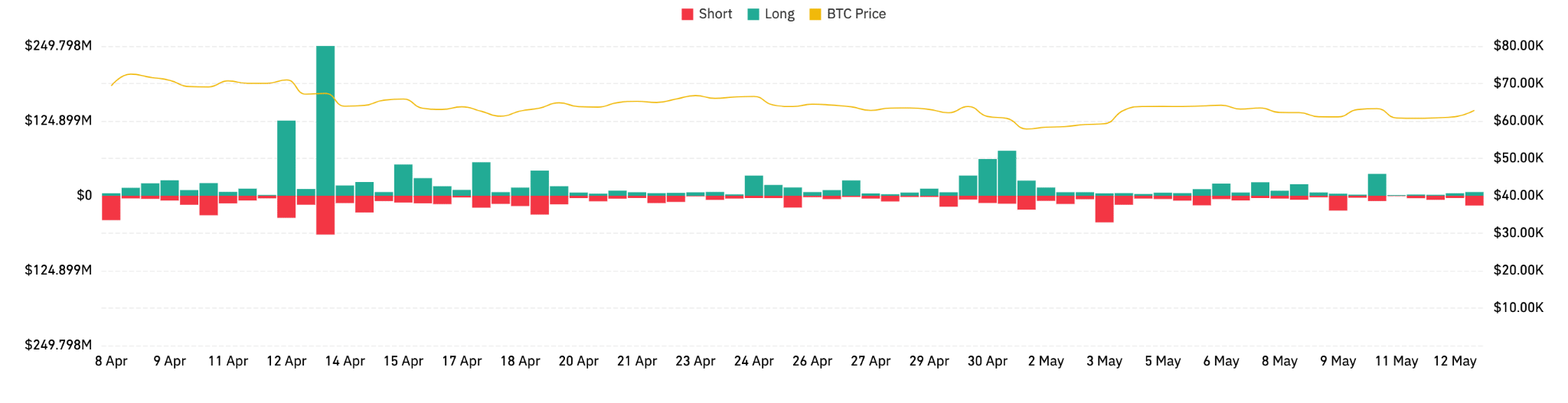

According to data from Coinglass, Bitcoin was the most traded cryptocurrency in the past 24 hours, with approximately $36 million worth of trades taking place. A significant portion of these trades, around $25 million, were conducted on Binance using its native currency, BNB.

The data indicates that traders are rapidly adjusting their market positions in reaction to price fluctuations, suggesting a market that is greatly influenced by external factors as well as internal emotions.

Bitcoin continues to rise, defying recent setbacks. According to Coinglass data, one potential reason for its sudden strength is a nearly 3% surge in Bitcoin’s CME open interest within the past day.

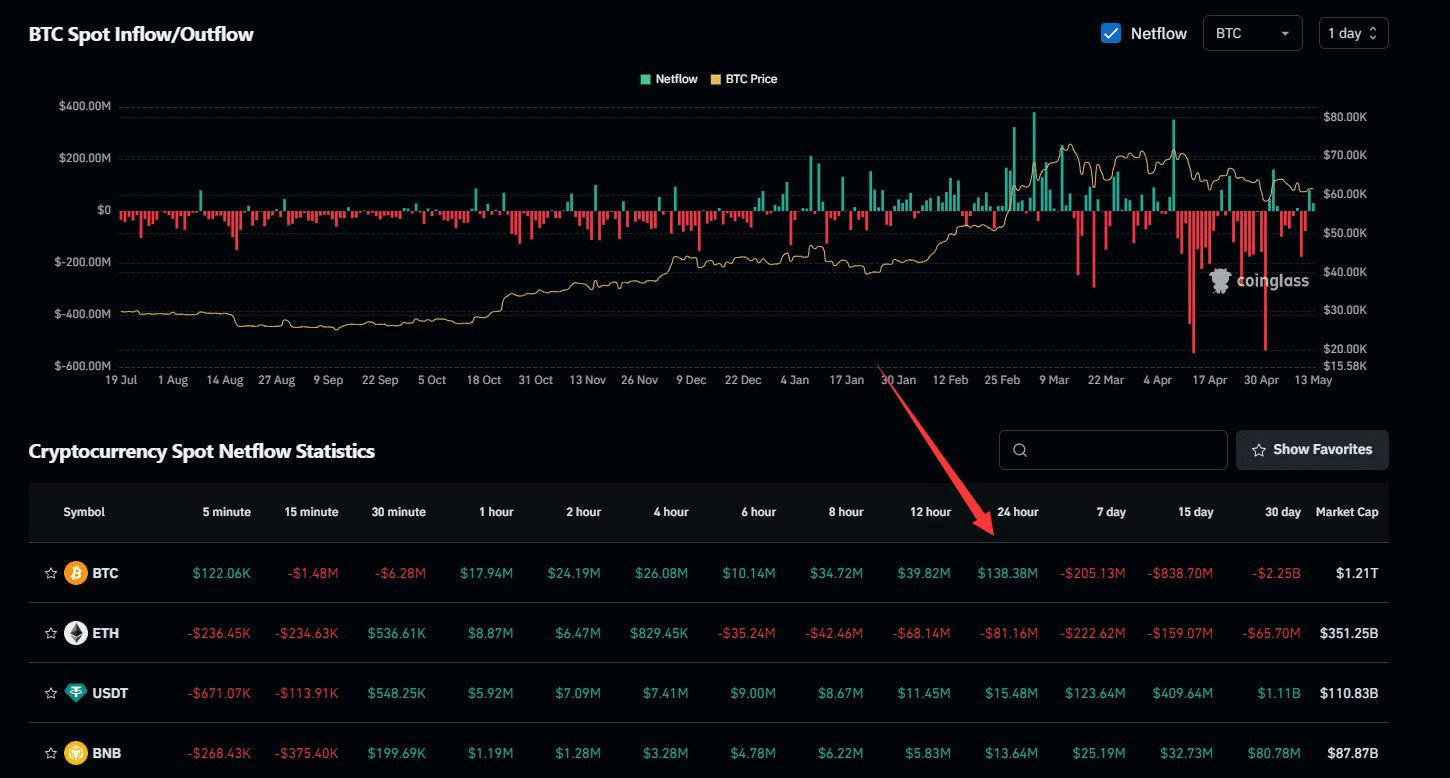

Moreover, spot netflow has seen nearly $140 million over the same timeframe.

As a financial analyst, I’ve observed that Bitcoin’s resilience can be attributed in part to the upcoming U.S. economic data release on May 14th.

Based on Jerome Powell’s pattern of decision-making this year, it seems that rate cuts are unlikely in the near future. This trend has historically been positive for Bitcoin.

Currently, seasoned Bitcoin investors are expressing sentiments reminiscent of last year’s bull market based on certain on-chain indicators.

At present, individuals holding Bitcoin for the long term (LTHs) have been buying more of the cryptocurrency following earlier sales in 2021.

Based on current data, it appears that, much like mid-2021, these long-term investors are actively seeking to increase their ownership of Bitcoin.

From an analytical perspective, I believe that the current low Bitcoin prices present an opportunity for investors to add more coins to their portfolio at a lower cost. The intention is to eventually sell these coins once market enthusiasm returns and potentially realize a profit.

There is a recognizable trend that has emerged between the years 2018 and 2021. This pattern involves investors who hold assets for extended periods buying when markets experience downturns, and selling when prices reach peaks.

In spite of the recurring patterns, there is a clear and enduring tendency: A larger proportion of Bitcoin is progressively being hoarded by investors with a long-term perspective.

Bitcoin’s current stand

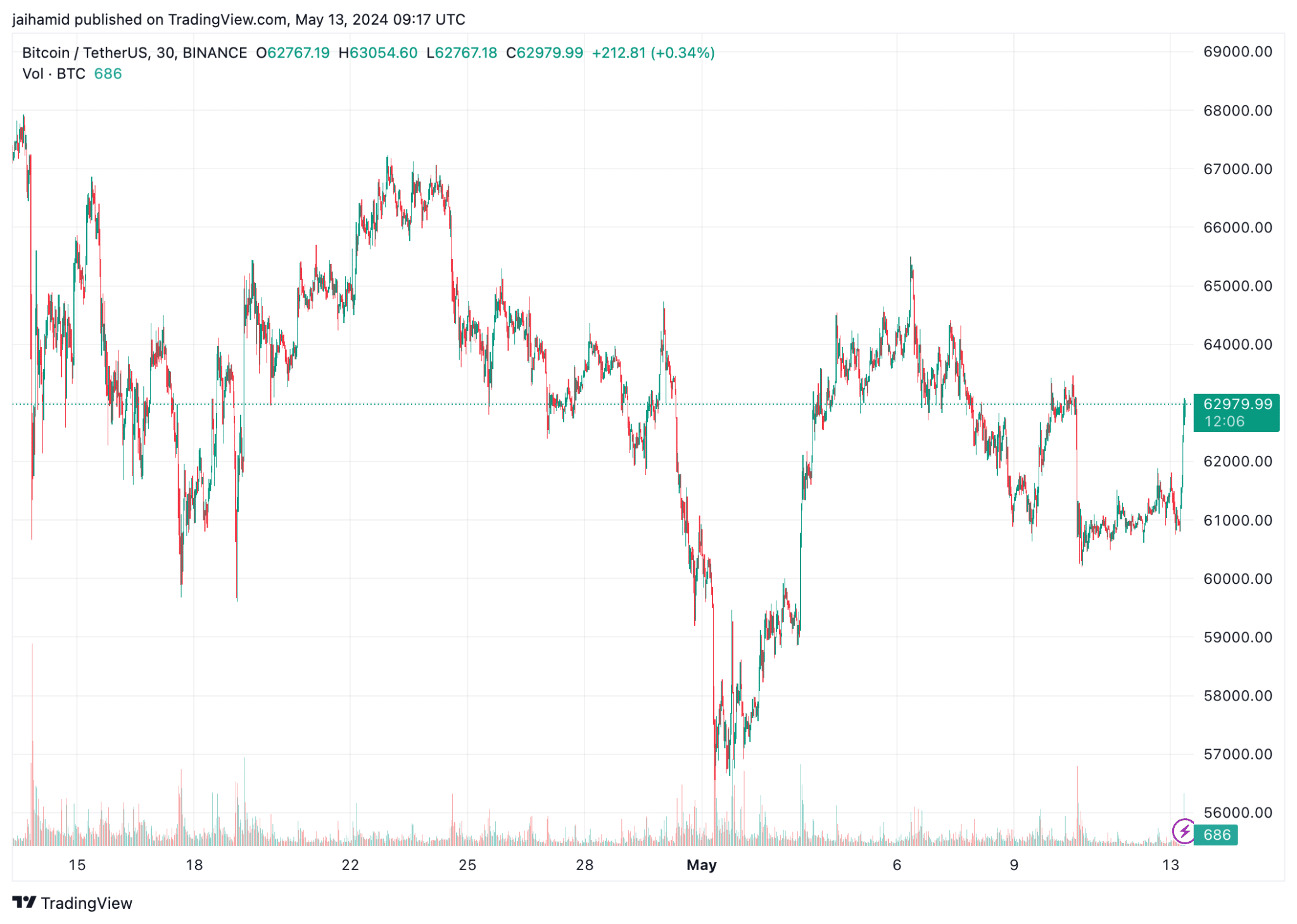

An analysis by AMBCrypto of the TradingView data for the BTC/USDt pair indicates a significant resistance point near the $68,000 price level. Bitcoin has attempted to breach this barrier several times in the last month but has yet to succeed in doing so permanently.

In other words, there’s a strong resistance level for Bitcoin around $60,000. If the price drops below this point, it’s likely that we may see additional decreases towards $55,000 or even lower.

The significant and frequent changes in Bitcoin’s price, as indicated by the size of its candlesticks on a chart, underline the market’s current high level of volatility.

As an analyst, I would interpret this pattern as indicating a trading environment that favors quick profits from short-term price fluctuations.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Based on the most recent information available, the price is currently retreating back towards its resistance level, which has been supporting its upward trend.

Based on past trends, this situation might signal another chance to buy if the pattern continues. In simple terms, the bears (those betting on a price decrease) have the upper hand at present.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-05-14 02:16