- LDO’s breakout above $1.68 and 8.36% surge targets $2.50 and potentially $3.50.

- Market sentiment is bullish with strong metrics, including a 26.25% open interest increase.

As a seasoned crypto investor with scars from a few bear markets and victories in bullish cycles, I find myself intrigued by Lido DAO [LDO]. The recent breakout above $1.68 has caught my attention, and its 8.36% surge puts it on the cusp of testing the critical resistance at $2.50.

As a crypto investor, I’ve noticed the intriguing surge in Lido DAO [LDO] recently. After escaping from a lengthy downward trend, it’s clear that this token is demonstrating strong bullish energy. In fact, over the last 24 hours, LDO has climbed an impressive 8.36%. At the time of writing, the price stands at $2.22.

Currently, LDO is challenging the significant barrier at $2.50 due to its price surge, hinting at potential additional growth. Yet, whether it can sustain this upward trend is questionable, as resistance levels might determine the direction of the market in the near future.

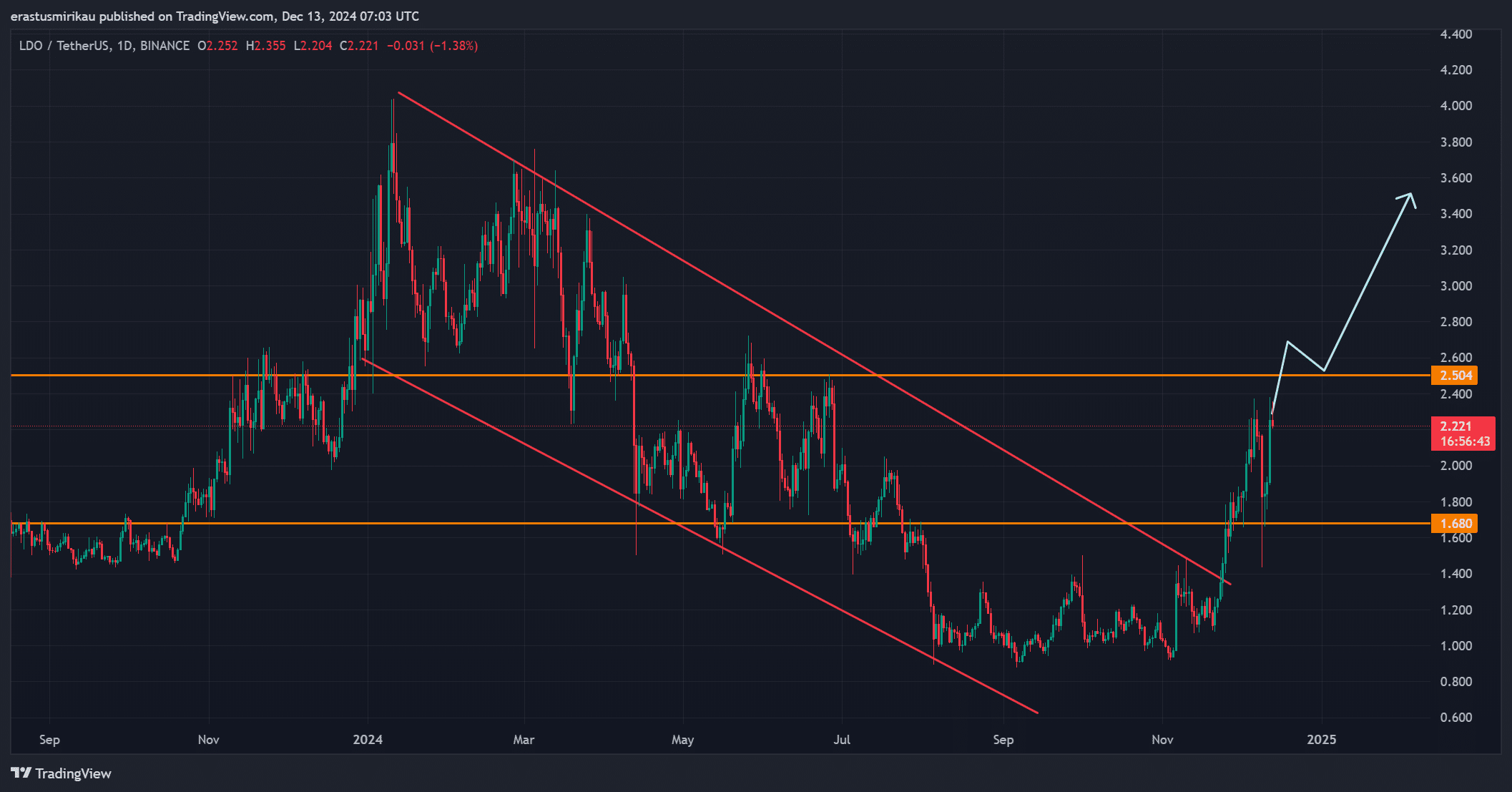

Lido price movement and key resistance levels

As a crypto investor, witnessing the surge of LDO, I’m thrilled to see it break above the $1.68 support level, indicating a significant positive shift in market sentiment. This token has soared by more than 32% over the past week, a testament to its potential for further growth.

Furthermore, currently, $2.50 serves as a significant level of resistance. If this level is successfully breached, it could pave the way for an upward trend towards $3.50. On the flip side, if the price cannot sustain above $2.50, it might lead to a phase of consolidation or pullback, necessitating a cautious approach from traders.

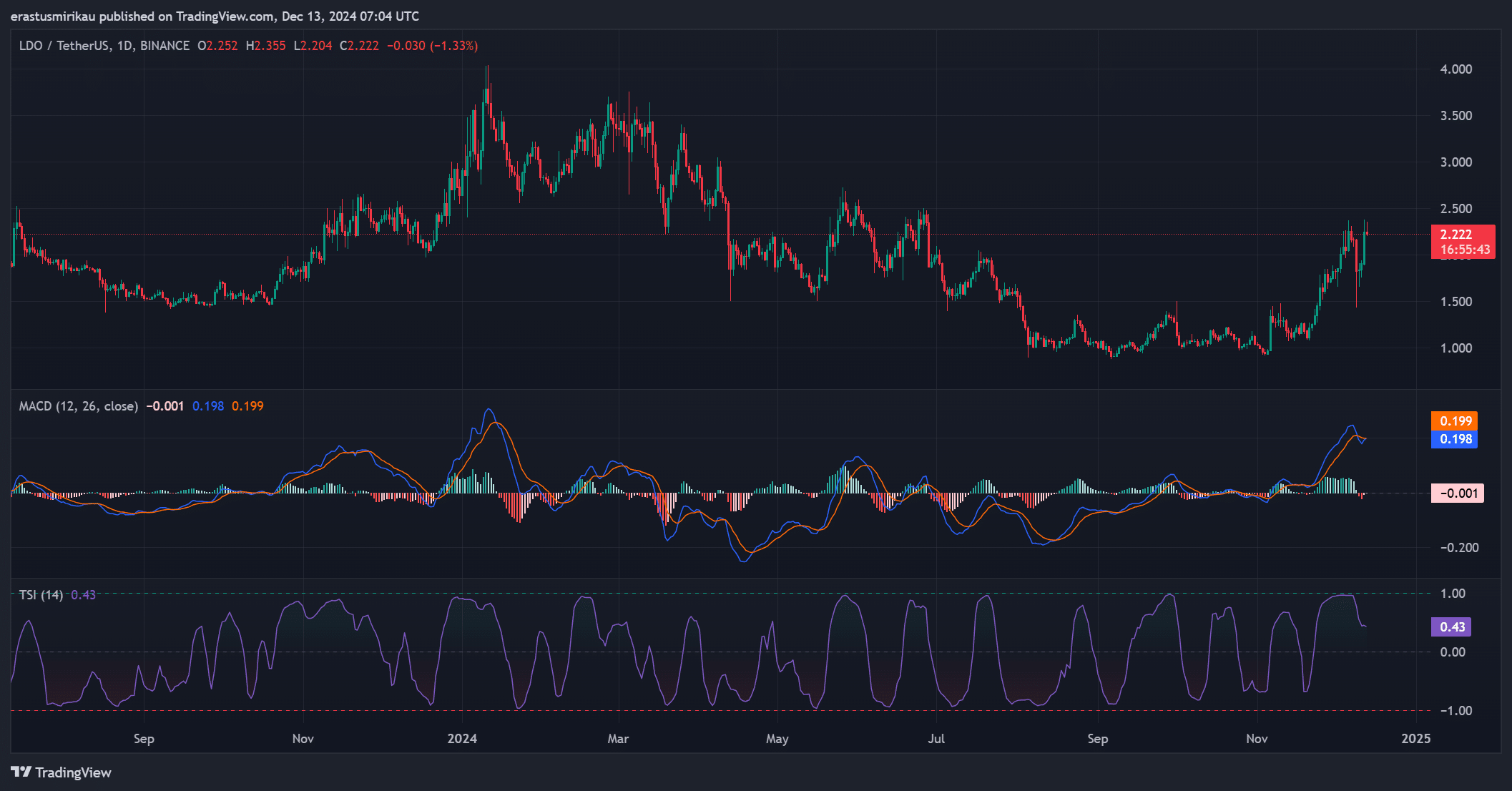

LDO technical indicators and momentum analysis

The technological arrangement seems to favor a bullish trend. For example, the MACD histogram is displaying a positive value of 0.198, suggesting increasing buyer enthusiasm. Additionally, the True Strength Index (TSI) currently reads +0.43, signifying a robust upward trajectory.

These signs suggest that the market conditions are supportive of continued price increases. Yet, traders need to keep a close eye on any deterioration in these factors, because volatility continues to play a significant role.

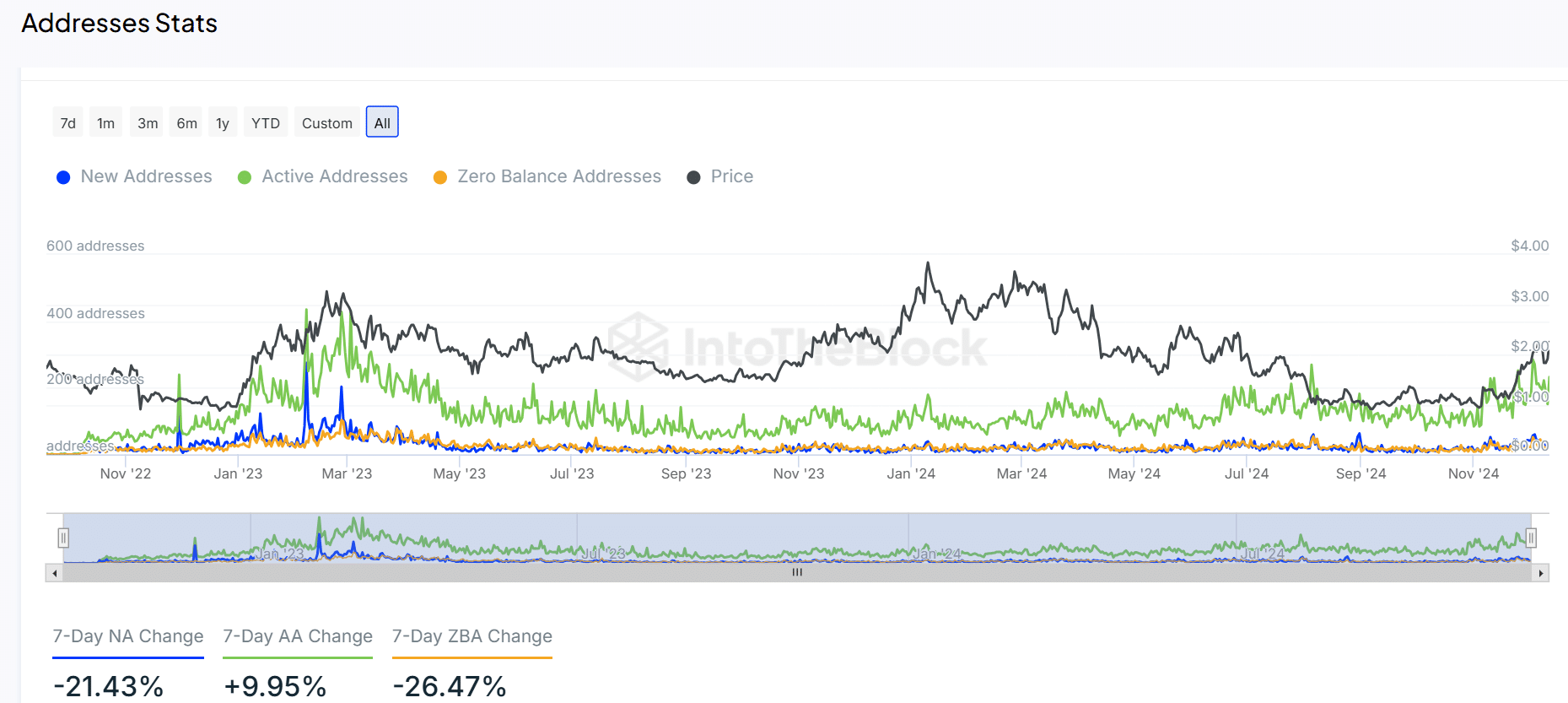

Network activity and address stats

Over the past week, on-chain activity shows some intriguing patterns. There’s been a 9.95% rise in active addresses, suggesting that current users are more actively participating.

On the other hand, there’s been a decrease of 21.43% in the creation of new addresses, indicating a more reserved attitude among newcomers.

As an analyst, I’m observing that our current network is operational. However, for a continued upward trend in prices, it seems essential to foster broader acceptance of this system and encourage new participants to join the ecosystem.

Market sentiment and open interest

The enthusiasm for the LDO market is growing significantly, as evidenced by a 26.25% jump in open interest in LDO futures, reaching $156.03 million. This surge in speculative activity suggests a positive outlook for LDO’s potential to reach even greater heights.

Furthermore, the gap between the cost and the Daily Average Users (DAU) remains consistent, suggesting that network activity supports the current price spike.

Read Lido DAO’s [LDO] Prie Prediction 2024-25

If the positive trend persists for Lido DAO and its network activity stays robust, reaching a price of around $3.50 could be within reach.

Maintaining and surpassing the $2.50 mark is essential for continued expansion. Traders must stay alert for indications suggesting a slowdown in momentum.

Read More

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- PI PREDICTION. PI cryptocurrency

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- How to Get to Frostcrag Spire in Oblivion Remastered

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- Disney Cuts Rachel Zegler’s Screentime Amid Snow White Backlash: What’s Going On?

- Whale That Sold TRUMP Coins Now Regrets It, Pays Double to Buy Back

2024-12-13 19:03