-

LDO has surged by 5.64% in the last seven days, defying all market odds.

A wave of partnerships, adoptions, and integration have driven LDO’s positive market sentiment.

As an experienced analyst, I believe that Lido DAO (LDO) has defied the bearish market trends with its impressive 5.64% surge in the last seven days. This growth can be attributed to several factors, including the development of ETH 2.0 staking and the unique services offered by LDO for users to stake their Ethereum tokens without having to run their validator nodes.

In recent times, the cryptocurrency market has experienced notable downturns. Bitcoin (BTC), for instance, plummeted by 7.68% to reach a price of $60,782. This substantial decrease in BTC’s value led most altcoins to endure considerable losses.

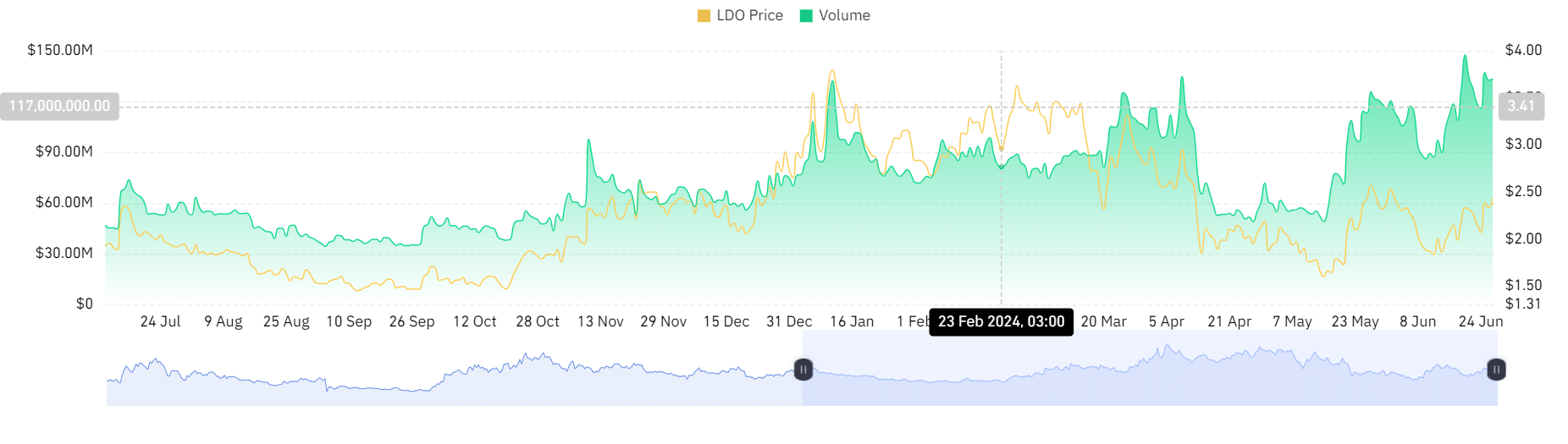

Lido DAO’s token, LDO, has experienced significant growth over the past week, increasing by 5.64%. Currently, LDO is priced at $2.39, marking a 0.54% upward trend within the last 24 hours.

At the same time, LDO has experienced a 26.75% increase in trading volume to $190M.

The significant increase in LDO‘s value has left many puzzled as to its causes, despite the market experiencing ongoing losses.

What’s driving LDO’s surge?

LDO’s recent gains bucked market trends for several reasons. One significant factor was the advancement of Ethereum 2.0 staking.

LDO goes on providing options for users to deposit their Ethereum [ETH] tokens for validation without having to manage their own validator nodes.

This unique aspect of ETH has increased staking activities, thus driving Lido DAO’s trading volume.

Partnerships with important Decentralized Finance (DeFi) platforms, like Mellow Finance, that allow staked assets to be used as collateral, have significantly contributed to Lido DAO’s ability to weather market fluctuations.

Coinbase International Exchange announced that on their X (formerly Twitter) page,

Coinbase International Exchange and Coinbase Pro will introduce new perpetual futures for Aptos (atelier), Lido DAO, and Pendle, which will be accessible starting from 9:30 PM on June 27th.

Lido DAO’s present robustness can be attributed to these advancements, collaborations, and integrations. They have significantly improved Lido DAO’s functionality and broadened its network.

LDO’s market outlook and sentiment

DeFi adoption, partnerships, and collaborations have considerably impacted LDO’s market sentiment.

Based on the latest data from AMBCrypto’s analysis on Coinglass, Lido DAO’s trading volume experienced a significant boost over the past week. The volume dipped to a minimum of $108 million but subsequently surged to reach a maximum of $147 million.

The surge in volume indicated higher buying interest and confidence in the asset.

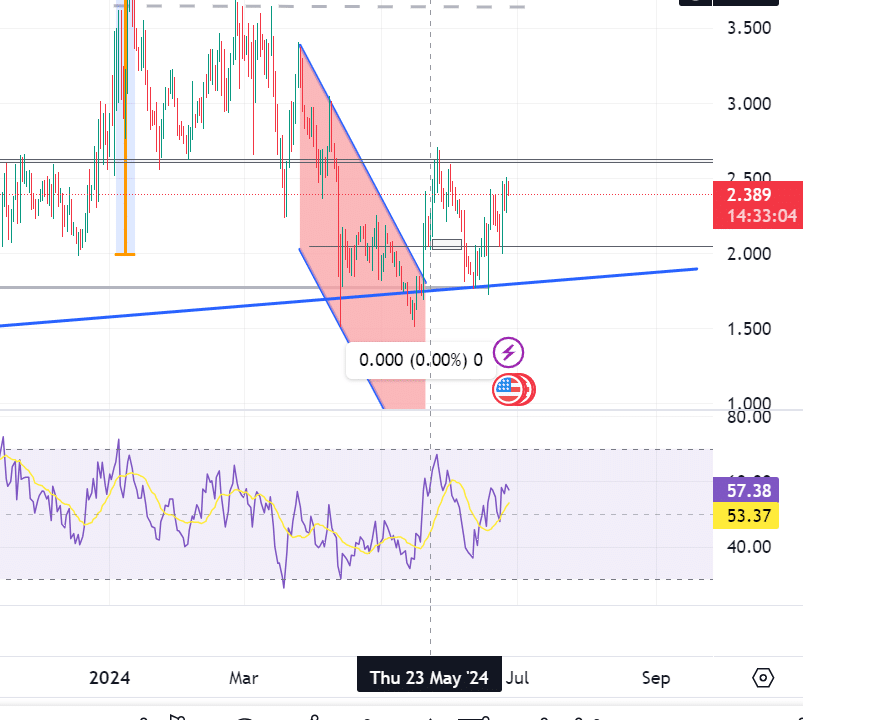

As an analyst, I’ve noticed that LDO‘s Relative Strength Index (RSI) has risen significantly over the past week. Specifically, it went from 46 to 57, indicating a strong uptrend in the stock’s price movements.

As an analyst, I’ve observed a noteworthy uptick in buying pressure based on the RSI indicator’s reading. This surge in demand can be attributed to the prevailing optimistic market sentiment. Consequently, we’ve seen prices rise significantly, as evidenced by both daily and weekly chart analyses.

As a crypto investor, I’ve noticed that LDO‘s Chaikin Money Flow (CMF) currently stands at 0.12, indicating that buying pressure has been stronger than selling pressure in the market right now. This is a bullish sign for me, suggesting potential price growth for LDO.

With increased trading activity, the Cumulative Moving Average (CMA) signaled that Lido DAO was in an accumulation stage, leading to a price rise. This trend is expected to persist.

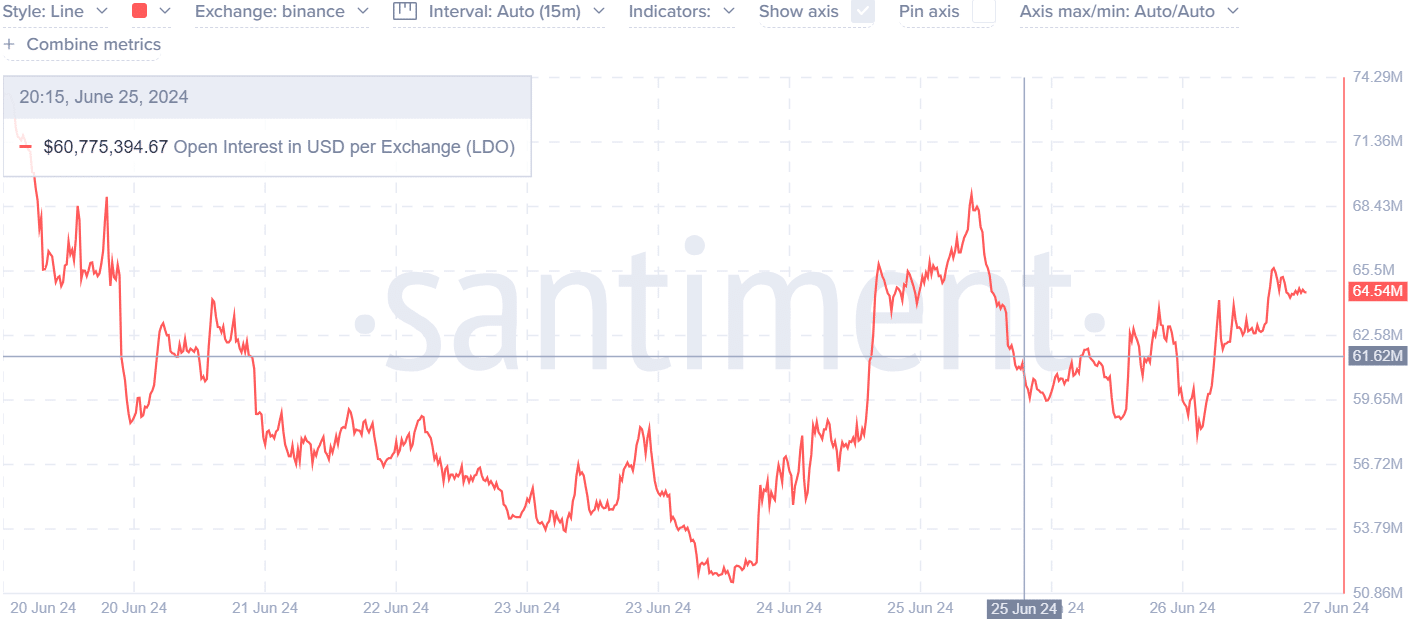

According to AMBCrypto’s analysis of Santiment data, Lido DAO’s Open Interest saw significant growth over the past week. The Open Interest in LDO rose from a minimum of $51 million to a maximum of $68 million during this period.

As an analyst, I would interpret the increase in Open Interest as a sign that traders are actively entering the market by establishing new positions, while simultaneously maintaining their current positions. Their objective is to profit from potential price increases in the future by selling at a higher point than they bought in.

Realistic or not, here’s LDO’s market cap in BTC’s terms

Therefore, the market sentiment remains bullish, with long holders accumulating to sell in profit.

If the positive trend in LDO‘s price continues, there is a possibility that it may challenge its resistance at approximately $2.624 for another test. Conversely, should the market undergo a correction, LDO could drop down to the significant support level of around $2.048.

Read More

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

2024-06-28 03:03