- LDO’s breakout from a descending wedge, with volume and market cap surging, points to a potential bullish trend.

- Strong Price DAA divergence and rising open interest support continued upward momentum for Lido DAO.

As a seasoned crypto investor who has witnessed numerous market cycles, I find myself intrigued by the recent surge of Lido DAO (LDO). The breakout from a descending wedge, coupled with surging volume and market cap, is reminiscent of a well-timed bullish move that I’ve come to appreciate over the years.

In the last 24 hours, the value of Lido DAO (LDO) has skyrocketed by 32%, causing its market capitalization to reach a staggering $1.22 billion, which represents an impressive 19.3% growth. Moreover, trading activity has significantly risen by 188.65%, resulting in a massive $306.58 million being exchanged, indicative of a surge in investor enthusiasm.

This surge in volume indicates substantial buyer demand, potentially leading to more price increases. Currently, Lido DAO is valued at $1.36, suggesting robust optimism among investors, which might propel further positive trends.

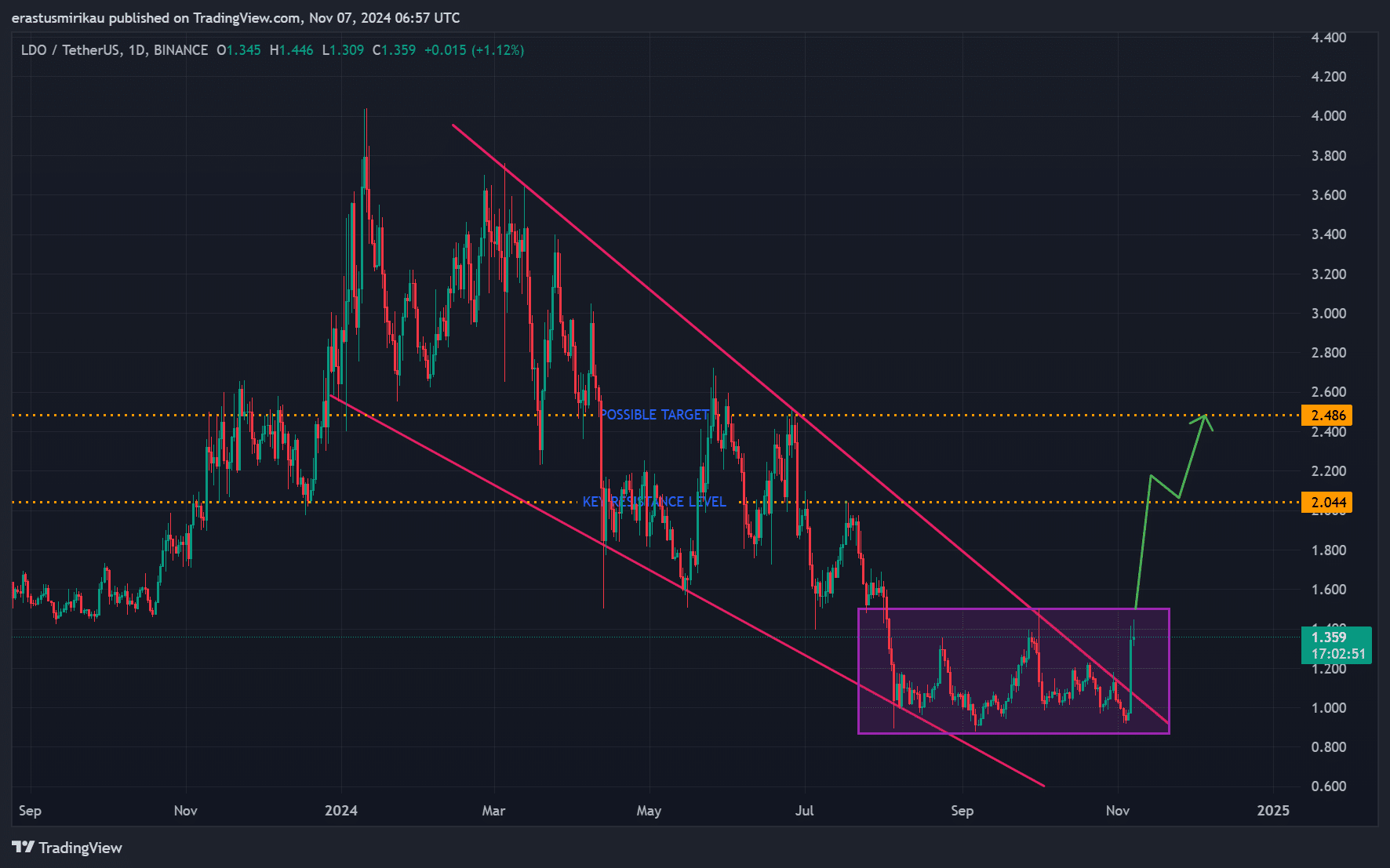

Chart analysis: Breakout from a descending wedge and price prediction

As a researcher studying cryptocurrency trends, I’ve noticed an intriguing development in the price movement of LDO. Specifically, there appears to be a breakout from a descending wedge formation on its chart – a pattern often indicative of a bullish reversal. This breakout could imply a possible shift towards an upward trend for LDO.

LDO has pushed past a crucial resistance level at $1.36, aiming for higher levels. The next significant resistances are $2.04 and $2.48, levels that could act as key price targets.

Therefore, if Lido DAO continues this breakout, a sustained rally could be on the horizon.

As I observe the ongoing trend, it seems that we’re inching closer to the $2.04 mark. If Lido DAO continues its upward trajectory, breaching the $2.04 barrier might trigger a surge towards $2.48. Should this resistance be overcome, it could fuel even more bullish momentum.

To reach this goal, it’s crucial that we maintain buyer enthusiasm. Steady trading volumes and robust price momentum are key factors if LDO is to attain such lofty heights.

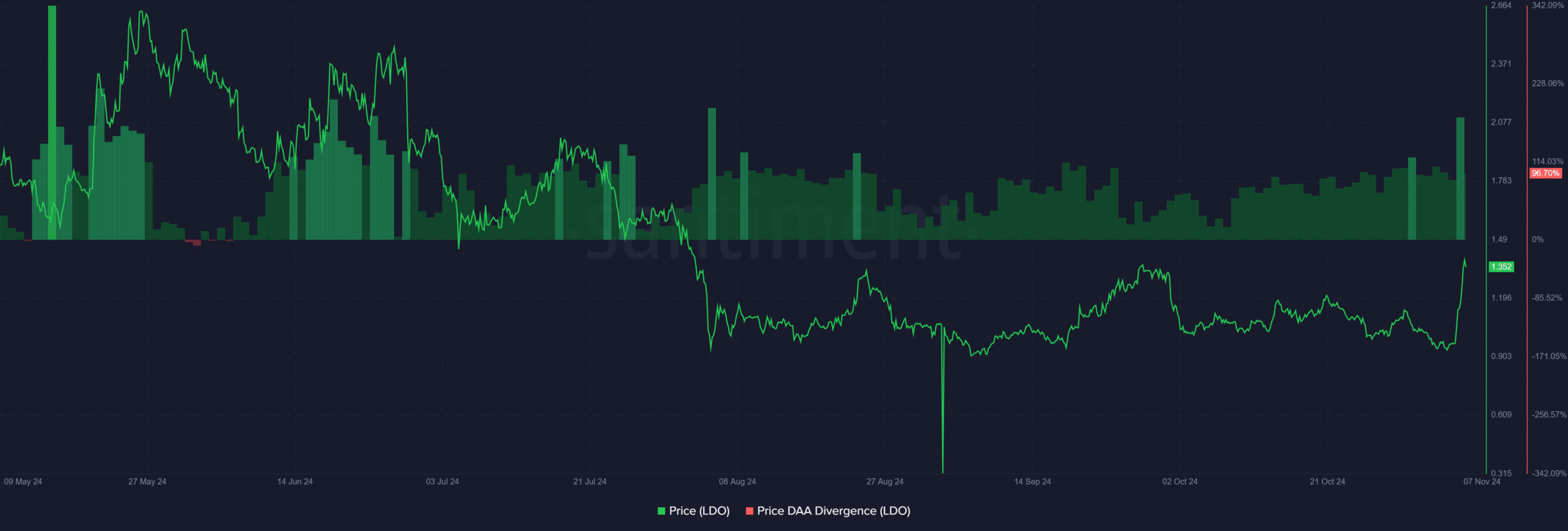

LDO price DAA divergence: Bullish confirmation?

According to the DAA Divergence graph, there’s a significant 96.7% increase in positive divergence, suggesting that the uptick in on-chain actions is consistent with the recent price rise. Usually, this divergence signals forthcoming increases and hints at robust backing from user engagement.

The reinforcement of this blockchain-verified power boosts trust in a long-term upward trend, lending credence to a positive outlook.

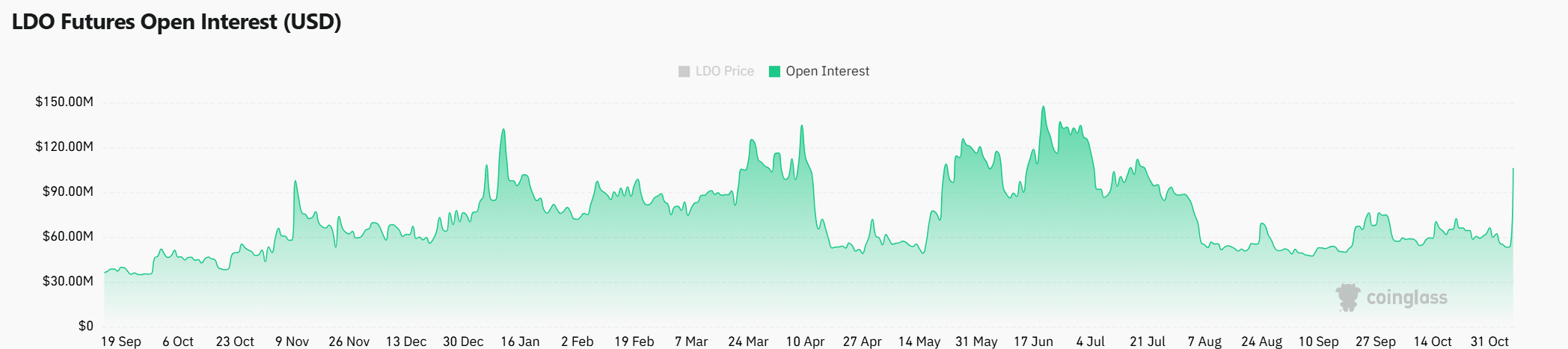

Market sentiment: Open interest surge strengthens outlook

Furthermore, there’s been a significant increase of 47.4% in open interest, which now stands at $112.97 million. This suggests that more and more traders are actively involved with LDO.

The growth in open interest together with an uptick in trading volume indicates a positive outlook, or optimism, towards LDO’s price surge in the derivatives market, hinting at increasing faith in its upward trend.

Read Lido DAO’s [LDO] Prie Prediction 2024-25

Can LDO sustain the rally?

Based on a breakout from LDO, along with growing trading volume, a positive Price DAA Divergence, and an uptick in open interest, there’s a strong possibility of further price increases. If the Lido DAO manages to stay above $1.36 and moves towards $2.04 and $2.48, it could trigger a prolonged upward trend.

Keeping up the current pace necessitates continuous support from buyers. Given its present bullish configuration, LDO’s surge could potentially benefit investors who are prepared to profit from this breakthrough.

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Rick and Morty Season 8: Release Date SHOCK!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

2024-11-07 23:03