-

Lido and Rocket Pool’s staking tokens got labeled as securities by the SEC

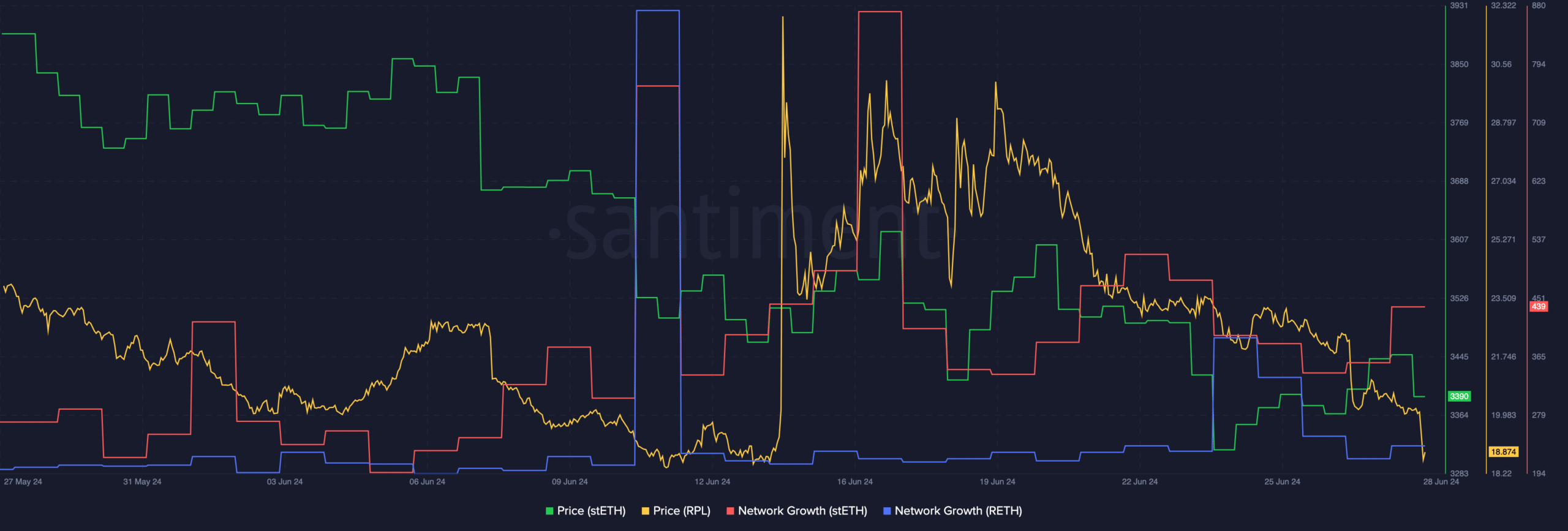

LDO’s price plummeted on the charts, while RPL’s price remained relatively stable

As a researcher with experience in the cryptocurrency market, I find the SEC’s decision to label Lido and Rocket Pool’s staking programs as securities concerning. The potential consequences of this classification could be significant, especially given the recent history of regulatory actions against similar projects.

As a crypto investor, I’ve been following the latest developments at the Securities and Exchanges Commission (SEC) in the United States with a mix of curiosity and concern. Once again, the committee has made headlines, this time for classifying projects like Lido [LDO] and Rocket Pool [RPL] as securities. This classification could potentially bring significant changes to how these decentralized finance (DeFi) platforms operate, and I’m keeping a close eye on the situation to assess any potential impact on my investments.

SEC strikes again

As an analyst, I would explain it this way: From the SEC’s perspective, Lido and Rocket Pool’s staking programs are akin to investment contracts because they share key characteristics. When investors deposit their ETH into these pools, they anticipate returns that hinge on the program managers’ efforts rather than their own actions. Consequently, the SEC interprets this as an investment transaction.

Classifying Lido and Rocket Pool’s staking programs as securities according to the SEC may bring about several undesirable outcomes. The process of registering and adhering to securities regulations can be financially burdensome and time-consuming for both platforms. Consequently, Lido and Rocket Pool might encounter substantial obstacles in fulfilling these requirements.

The ongoing lawsuit has instilled apprehension in the market, which could result in decreased user engagement and a consequent decrease in the value of stETH and rETH tokens.

Based on my observation as a crypto investor, the expansion of the networks supporting stETH and rETH, as indicated by Santiment’s data, has seen a noticeable decrease over the past few weeks. This reduction in network growth implies that the influx of new investors interested in these staking tokens has significantly dwindled.

If new users continue to lose interest in them, both these protocols could suffer.

Further, functioning as a security provider could impose constraints on the freedom of Lido and Rocket Pool to extend their services. Potential restrictions may include limitations on the eligibility of clients or the design of their programs.

Deja Vu

The SEC’s legal action against Ripple Labs offers important perspectives on the possible repercussions for Lido and Rocket Pool. If history repeats itself, the lawsuit may cause a substantial decrease in XRP‘s value due to exchanges removing it amidst doubt over its lawful status. Notably, LDO and RPL have both experienced price declines following the SEC’s announcement. It’s worth noting that further drops could still be a possibility.

As I pen this down, LDO has experienced a decline of 18.17% over the past 24 hours. In contrast, RPL saw a smaller decrease, amounting to 1.08%.

Realistic or not, here’s LDO’s market cap in BTC’s terms

The Securities and Exchange Commission (SEC) maintained that XRP, in the context of the Ripple case, represented a security which was distributed via an unregistered offering.

The situations of Lido and Rocket Pool differ subtly from other cases. According to the SEC’s perspective, their staking programs are considered investment contracts rather than the tokens themselves – stETH and rETH. This classification might pose potential risks for stETH and rETH. However, the consequences for LDO and RPL remain uncertain and may take some time to clarify.

Read More

- Gold Rate Forecast

- Masters Toronto 2025: Everything You Need to Know

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

2024-06-30 05:11