-

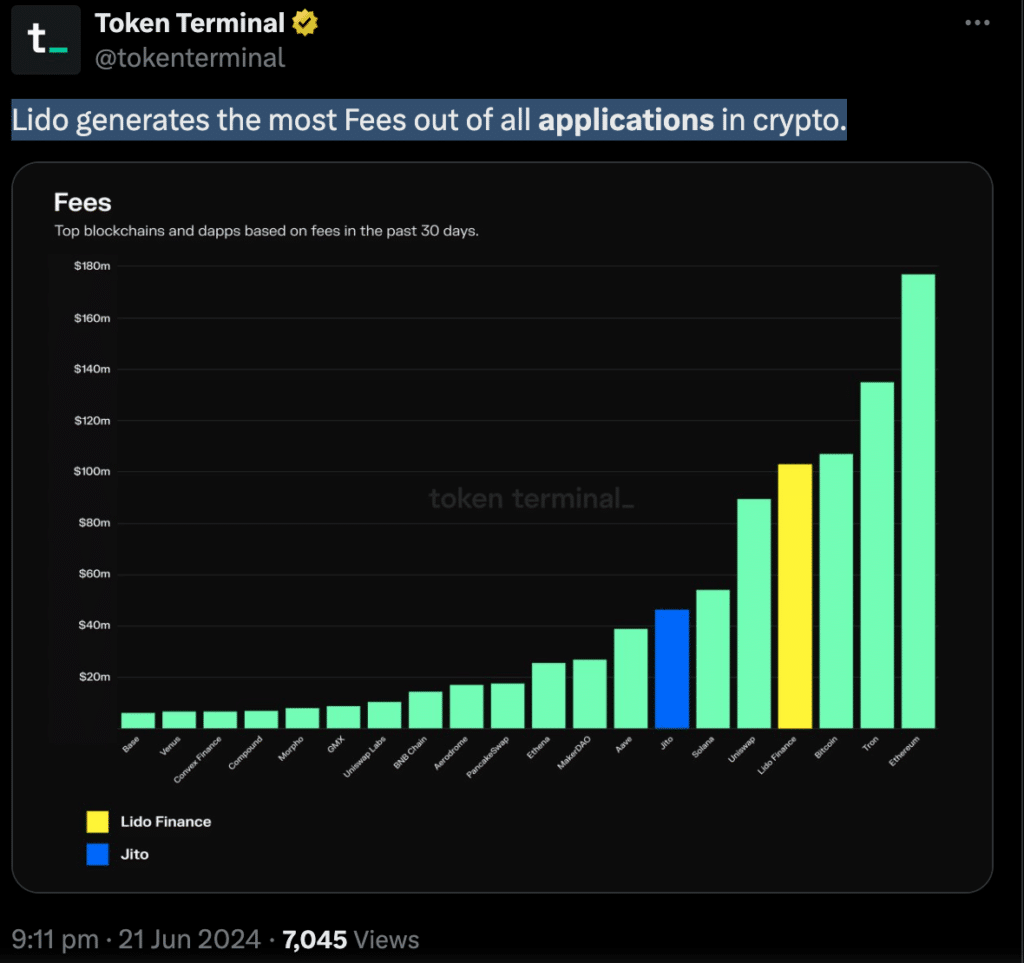

Lido raked in the most amount of fees, compared to other protocols

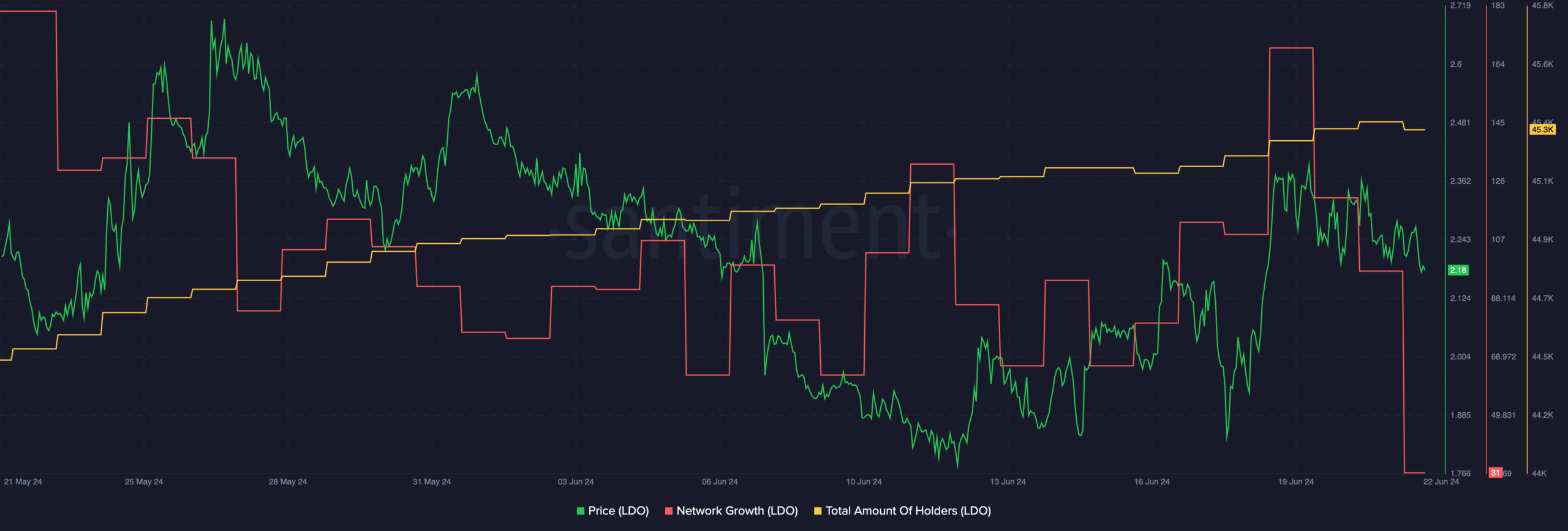

Price of LDO fell significantly along with network growth

As a researcher, I find Lido’s performance in the crypto space to be quite intriguing. On one hand, the protocol has been raking in the most fees compared to other protocols, which is a clear indication of its dominance and high activity on the network. This trend is not new, as Lido has consistently been at the top of the list when it comes to fee generation.

As a seasoned analyst, I’ve observed that Lido [LDO], a leading player in the staking sector, has been making significant strides. However, it hasn’t garnered the same level of popularity or recognition as some other cryptocurrency networks.

Lido outperforms them all

Based on recent figures, Lido has been the leading application in terms of fee generation within the crypto sphere. The significant volume of fees collected by Lido indicates a robust level of network activity and consistent usage by users seeking its staking services.

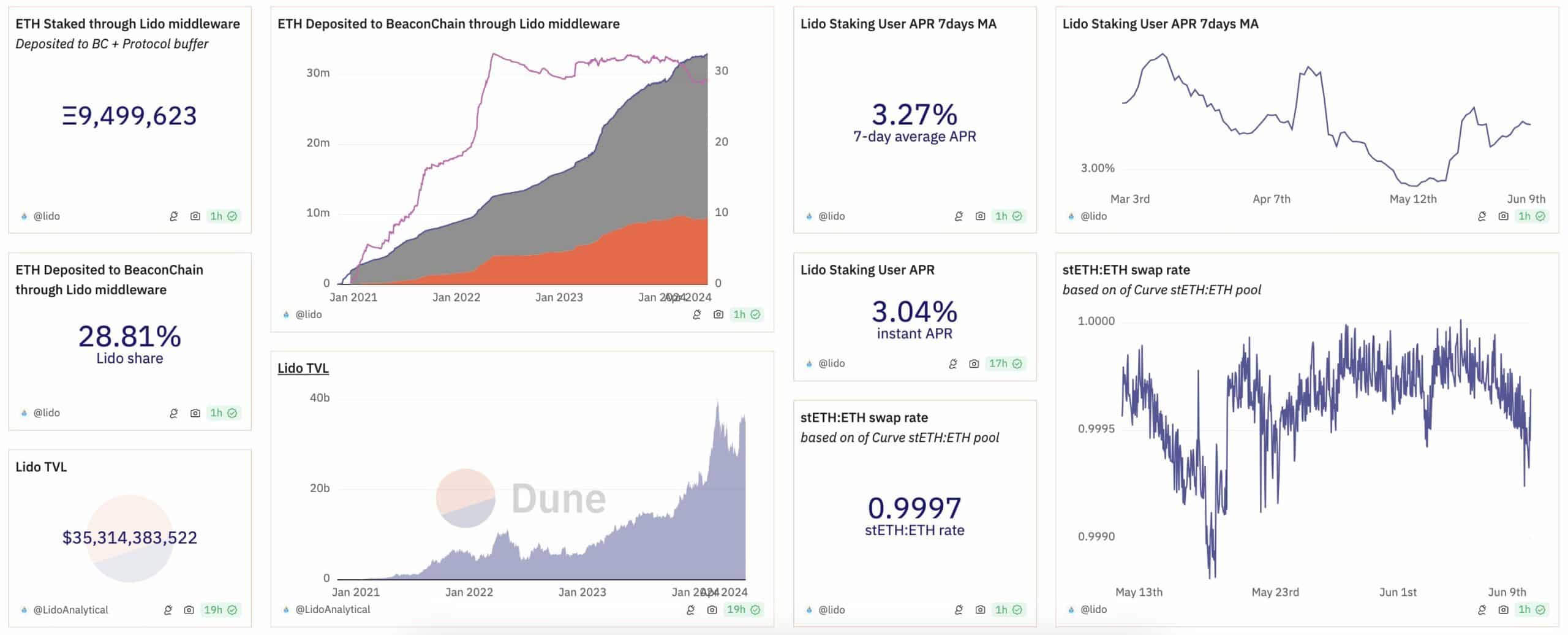

As a crypto investor, I’ve noticed that Lido’s past week performance showed some ups and downs. The Total Value Locked (TVL) decreased by approximately 1.70% to $35.39 billion, possibly because of ETH‘s slight price drop. However, there were also some promising signs.

As a crypto investor, I’d put it this way: Lido has seen a significant inflow of new stakers, adding 19,392 more Ether to its pool, which equates to a 0.26% growth rate. This means that the total amount of Ether locked in for staking on the platform now stands at a robust 9,513,384 Ether.

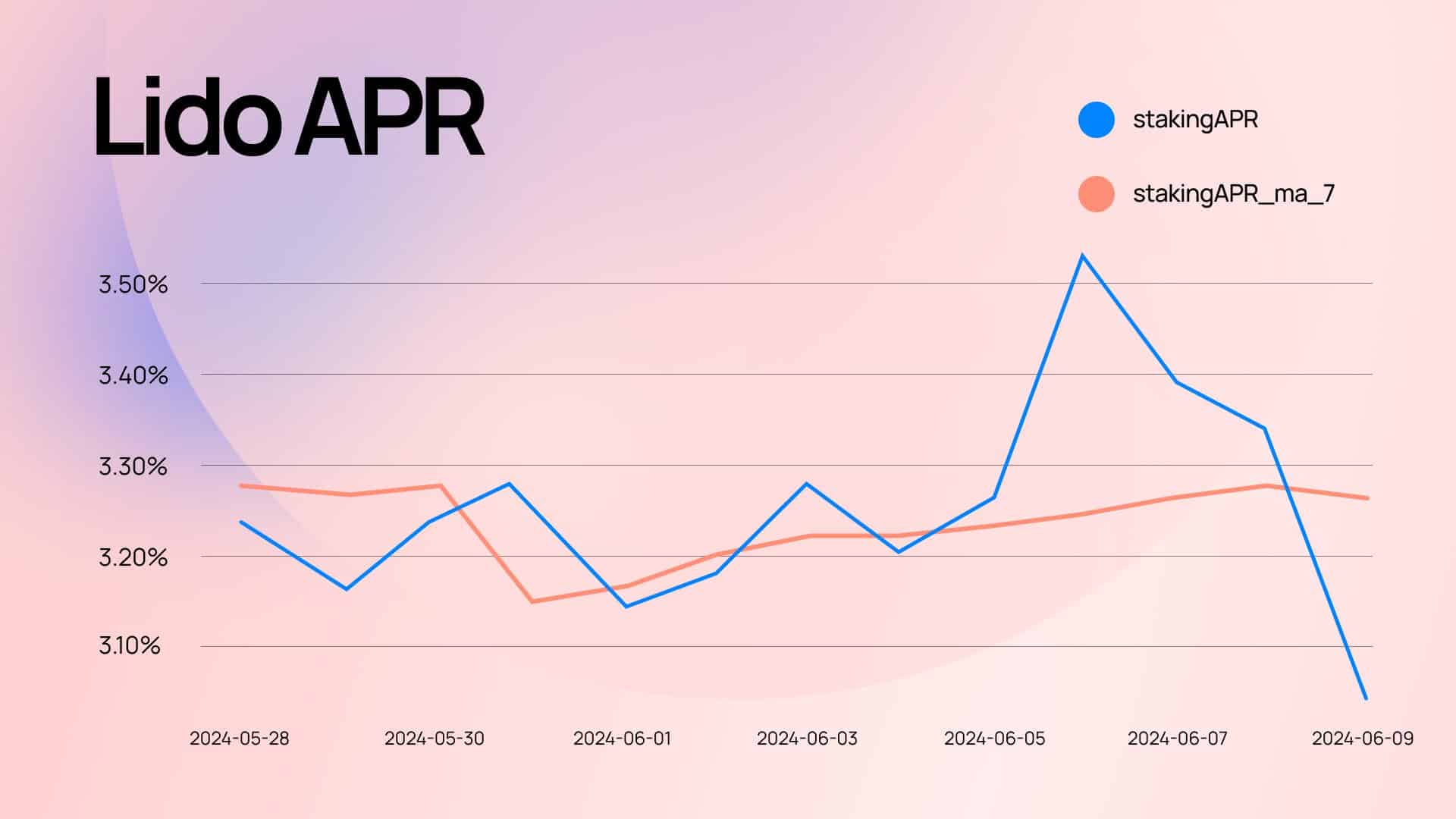

As a researcher studying the trends of stETH’s Annual Percentage Rates (APR), I’ve noticed an upward trajectory. Specifically, the 7-day moving average (7d MA) for stETH’s APR has risen by 0.09% to reach a new high of 3.27%. This development could translate into increased staking rewards for Lido users.

Contrary to the previous week’s trend, the trading volume for wstETH saw a decrease of nearly 20%, amounting to $1.03 billion in the past seven days.

Looking at the data

It’s intriguing to note that despite a 2.86% decrease in total wstETH transferred to Layer 2 (L2) solutions, resulting in 136,893 wstETH, there was merely a 0.16% reduction in the amount bridged to Cosmos over the past week.

As a crypto investor, I’d say at the current moment, LDO is being transacted at a price of $2.18. Unfortunately, its value has decreased by 4.11% over the past 24 hours. The trading volume for LDO has also taken a hit, shrinking by 34.57% within the same timeframe. Additionally, there’s been a noticeable decline in network growth around LDO, suggesting that fewer new addresses are expressing interest in this crypto asset.

Realistic or not, here’s LDO’s market cap in BTC’s terms

Despite recent price fluctuations, the total count of LDO addresses has persistently increased in the past few days. This could indicate smaller-scale accumulation.

Read More

2024-06-23 02:15