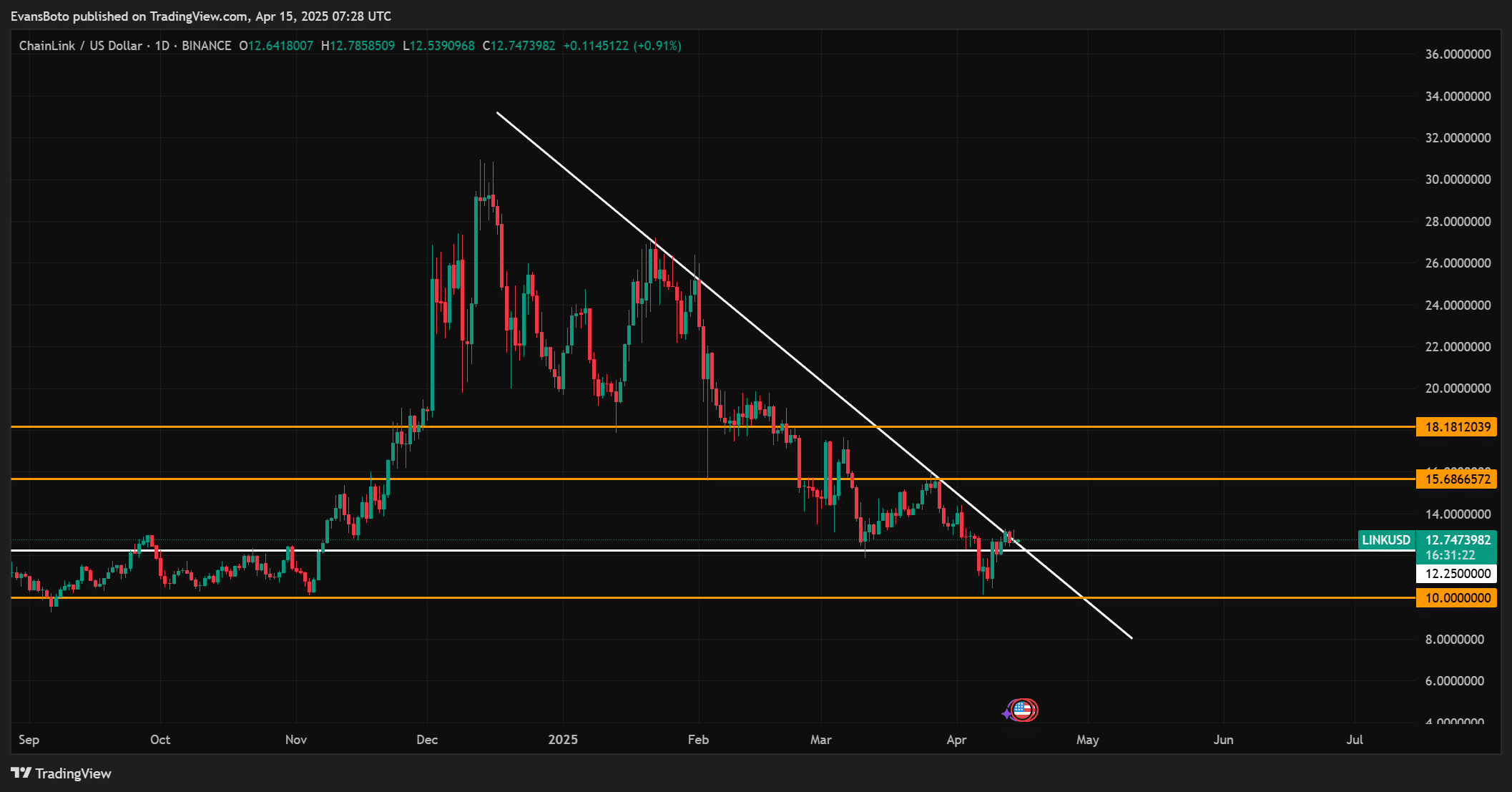

- The ever-courageous LINK, not content with languishing in the depths, made a spirited attempt to reclaim its daily trendline. Bulls, those eternal optimists, staged a valiant defence at $12.25—one might say they brought out the cavalry for this rather drab field skirmish. Momentum: mild, like English breakfast tea left an hour in the pot. ☕

- The blockchain grapevine reports that on-chain activity has wilted dramatically. And yet, behind closed doors, hopium hovers: sober reserves and steadfast fundamentals whisper of revival, much like a butler assuring the guests that the wine cellar isn’t quite empty yet.🍷

Chainlink [LINK], as I pen this dispatch, gazes nervously over the edge of a perilous breakdown zone, having only just crashed through what was, for a time, its cherished ascending trendline. Picture a character in Chapter Twelve of one of my novels, realising the family fortune has—once again—been misspent, and now must contemplate a decisive moment: to rally, or to abscond to South America.

Not to put too fine a point on it, the $12.25 mark has become a veritable field of Waterloo for our bullish actors. Should the clasp on this purse-string loosen, one might spy far less appetising targets in the neighbourhood of $10 and $7.50—a descent reminiscent of a fallen debutant at her first ball.

Technically speaking (for those not distracted by the canapés), LINK broke above a descending trendline in daily dispatches, offering a glimmer of hope for narrative reversal. Yet, the enthusiasm has all the punch of watered-down gin. The price, as ever, flirts dangerously close to the support, much like a dowager eyeing her last shilling.

At the hour of reporting, LINK trades blithely at $12.67—a gain of 0.41% in the past 24 hours, which, in crypto circles, is as thrilling as a tax rebate. Bulls, those plucky chaps, need to keep up appearances above $12.25 if they wish to avoid an ignoble retreat.

Strategic Alliances, Shrinking Piggy Banks, and the Return of Hope

Chainlink’s latest intrigue—an alliance with Pi Network—was trumpeted by the band, promising to elevate decentralized applications to new heights (or at least, to the first floor). These advances in smart contract sophistication are meant to invigorate the cause, though the crowd remains stubbornly indifferent, more concerned with the ballroom acoustics than any high-minded talk of fundamentals.

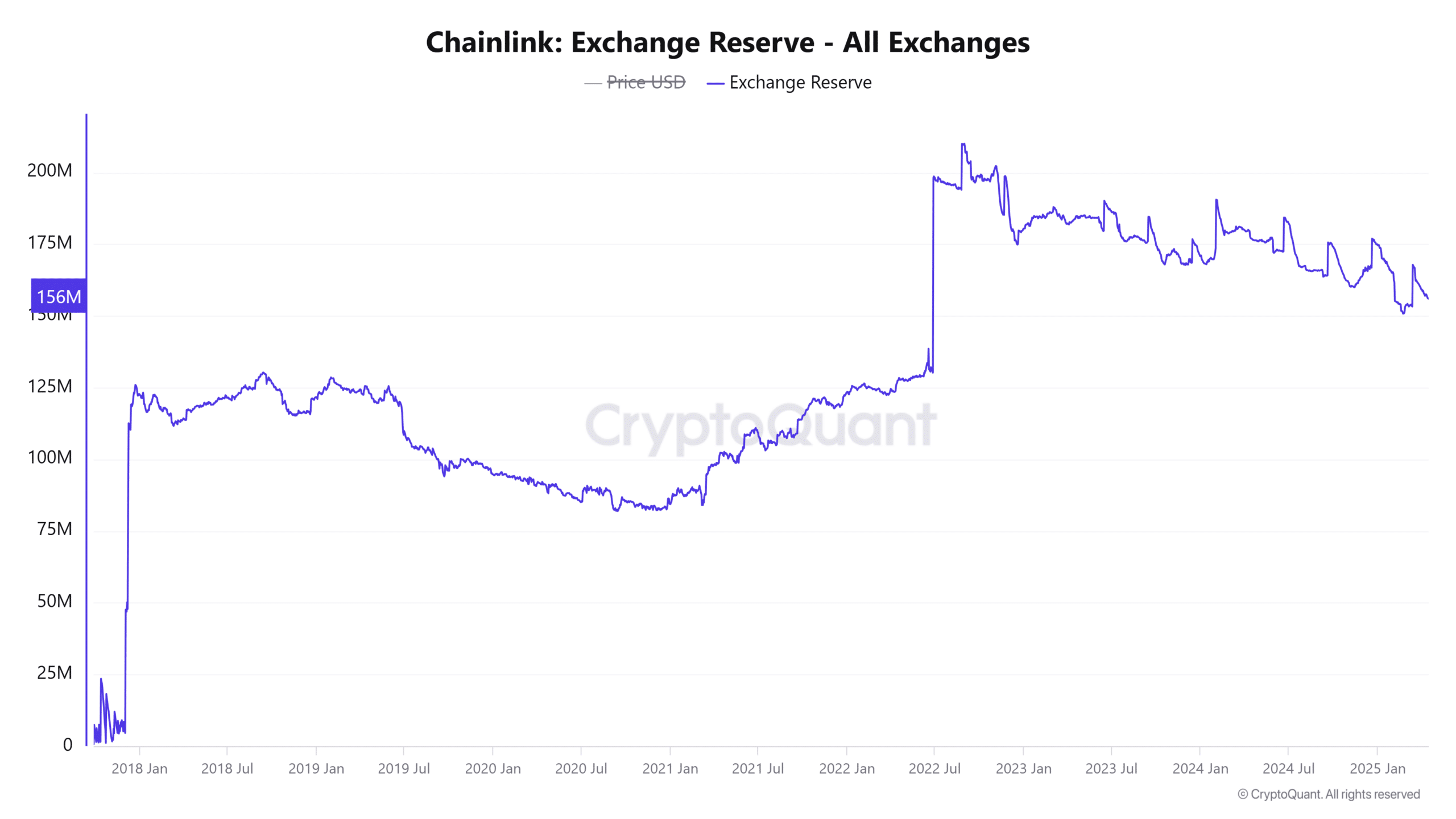

Reserves on exchanges have dwindled by a paltry 0.2% over the last day, leaving 156 million LINK at the ready. This gentle ebb in ready-to-depart LINK hints at a world where speculators are, by some miracle, holding rather than bolting for the exits. Accumulation, they call it. Optimists, bless them, suggest a tide may be turning—assuming demand can rouse itself from its fainting couch.

Whales, Minnows, and the Odd Duck 🐳🐟

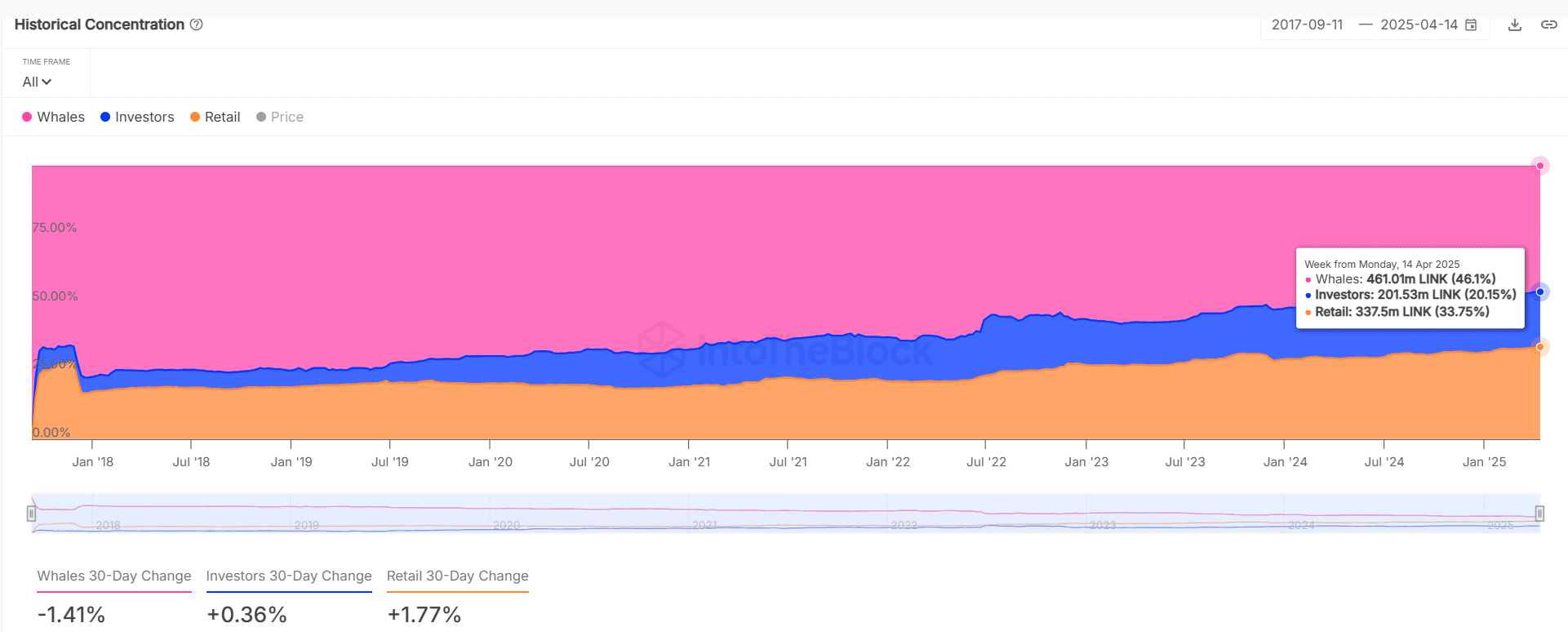

Whales, those bloated grandees of the crypto aristocracy, still control 46.1% of the supply—a proportion which, were it sherry at a weekend house party, would be alarming. Yet, their grasp slipped by 1.41% this month; perhaps a few have grown weary and retired to St. Moritz.

Meanwhile, the rabble—retail investors—are trickling in, with their share swelling by 1.77%, and overall holdings nudging up by 0.36%. The redistribution smacks of newfound ambition among the little people, while the gentry discreetly offload their burden to the unsuspecting.

But oh, the apathy! Activity on the chain suggests that actual traders are off playing croquet or nursing last weekend’s hangover. New addresses have plummeted by 44.25%, active addresses by 49.5%, and the number of empty-wallet dreamers by 56.62%. One could be forgiven for thinking the season is over and everyone has gone to the country.

Without an uptick in participation or volume, LINK’s fortunes may remain as flat as last night’s champagne. Volume and engagement: the eternal cure for crypto ennui, forever just out of reach. 🥂

A Summing Up for the Discerning Reader

Chainlink, in its current predicament, is much like the guests at an overlong weekend retreat—trapped between the hope of reinvigoration and the despair induced by dwindling supplies of enthusiasm (and port). The $12.25 support is the last bastion, bolstered by strategic news and slightly lighter exchanges, but undermined by a growing sense of listlessness among both whales and commoners.

If the bulls muster enough zest for a push upwards, we could see a burst of revelry. Otherwise, the whole affair may collapse into a rather unseemly correction—a spectacle to delight cynics and profit only the short sellers. 😏

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- SOL PREDICTION. SOL cryptocurrency

- Solo Leveling Arise Tawata Kanae Guide

2025-04-15 17:17