- LINK has made impressive strides in network activity, but the exit of whales has put a dampener on the surge

- Can retail capital and Trump’s advocacy give LINK the boost it needs?

As a seasoned crypto investor with over a decade of experience navigating the volatile and unpredictable world of digital assets, I can confidently say that Chainlink (LINK) has been one of the most intriguing projects to watch in recent times. The impressive strides it’s made in network activity are undeniable, but the exit of whales has put a bit of a damper on its surge.

Two weeks past, Chainlink (LINK) ignited the graphs with an impressive 21% one-day spike, attributed to World Liberty Financial (WLF)’s $1 million investment.

As a crypto investor, I’ve experienced firsthand how the “Trump pump” propelled LINK into the limelight, making it a crucial figure where politics and cryptocurrency intersect. Yet, just as swiftly as the excitement escalated, it dissipated, leaving an impact on the altcoin itself.

Presently, the price of LINK is approximately $22.8, and a bearish MACD crossing suggests potential for a decline. Consequently, one may wonder about its performance in the forthcoming year.

LINK’s comeback is FOMO worthy

Over the last four years, Chainlink has made incredible strides. The number of addresses on its network has surged from 213k to 690k. Also, in December, its total value locked (TVL) crossed $1 billion for the first time.

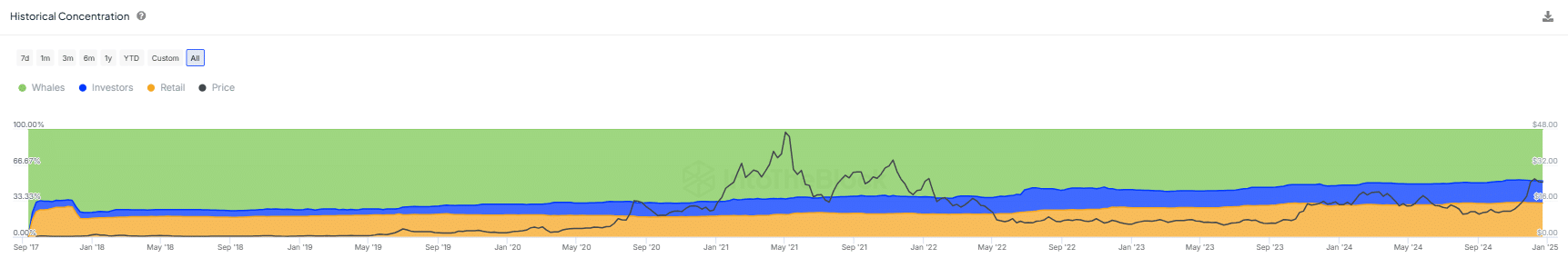

As a crypto investor, I find it fascinating to observe the changing distribution dynamics of LINK’s tokens. Previously, a small group of major holders controlled around 70% of the supply, but this has significantly decreased to approximately 48%. Conversely, retail investors have been increasingly active, now accounting for around 32% of LINK’s total supply. This shift suggests a more decentralized and inclusive ownership structure, which could potentially lead to greater community involvement and long-term growth.

However, what makes this interesting? A recent AMBCrypto report revealed Ethereum‘s [ETH] growing centralization, as whales hold excessive influence and prevent the price from surpassing $4k. Consequently, Chainlink’s [LINK] efforts towards a more equitable distribution could give it an advantage in the long run.

However, there’s a catch – Despite LINK’s strides in decentralization, its price has struggled to regain its all-time high of $53 set three years ago. Even with strong volume and network growth, LINK hasn’t been able to break into the top 10.

In simpler terms, the combined influence of external market conditions and a significant number of large investors (whales) selling their LINK tokens might be causing the price of LINK to decrease.

Given this context, the “Trump bump” significantly fueled enthusiasm, igniting a wave of fear-of-missing-out (FOMO) amongst novice investors. The query then arises: Will this trend persist?

Will it last?

Over the past month, LINK has significantly increased due to strong double-digit expansion, leaving many other similar companies trailing behind. Looking at the bigger picture, it’s worth noting that LINK’s price has risen by 50% this year, keeping pace with Ethereum.

Nevertheless, it’s Chainlink’s wider popularity that truly sets it apart. The endorsement from President-elect Donald Trump has ignited renewed curiosity, and the decrease in manipulation by ‘whales’ has facilitated a market growth that is more naturally driven.

Moreover, LINK’s Oracle network is finding increasing applications across multiple sectors, thereby establishing itself as a practical, real-world solution.

Considering all these variables, Chainlink is making a strong case as a leading candidate in the altcoin competition. It’s drawing interest from investors who are keen on short-term trades for a sound diversification strategy, as well as those who prefer long-term investment, aiming for consistent growth.

Investors betting on LINK could find that holding tight is the best strategy for a potential 2025 rebound, dismissing doubts about a retracement in favor of steady gains ahead.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

2024-12-28 00:07