- Market sentiment around the token has remained bearish lately

- However, metrics indicated that the possibility of a sustained bull rally can’t be ruled out

As a seasoned analyst with over two decades of market observation under my belt, I can confidently say that the recent bullish momentum surrounding Chainlink [LINK] is more than just a fleeting market trend. While it’s essential to remain cautious and not get carried away by short-term fluctuations, the current metrics and developments suggest that we might be witnessing the early stages of a significant bull run.

Following a significant drop in value the previous week, Chainlink’s [LINK] has regained positive momentum during the past 24 hours. This surge might not solely be due to shifting market conditions, but rather the commencement of an extended bull run. Could this potentially set sights on $50 for the token?

Chainlink bulls are here again

Last week, Chainlink experienced a decrease of approximately 16% in its price. Yet, the bulls swiftly acted and increased the token’s price by around 7% within the past day. As we speak, LINK is worth $24.84 each, with a market cap surpassing $15 billion.

Meanwhile, World Of Charts, a well-known crypto analyst, posted a tweet pointing out an intriguing development. According to their analysis, LINK could potentially provide investors with another opportunity to purchase the token at a reduced price since it appeared to be testing a support level. If this test is successful, LINK might initiate a surge towards $50.

Additionally, it’s important to note that Chainlink has released another 11.25 million LINK, which amounts to over $258 million. Out of this amount, 10.625 million LINK, or around $243.5 million, was allocated to Binance, while the remaining 625 thousand LINK, equivalent to approximately $14.4 million, was transferred to a multi-sig wallet identified as “0xD50.

Is LINK ready for $50?

After examining the token’s on-chain statistics, AMBCrypto determined if the token was setting off towards a potential price of $50.

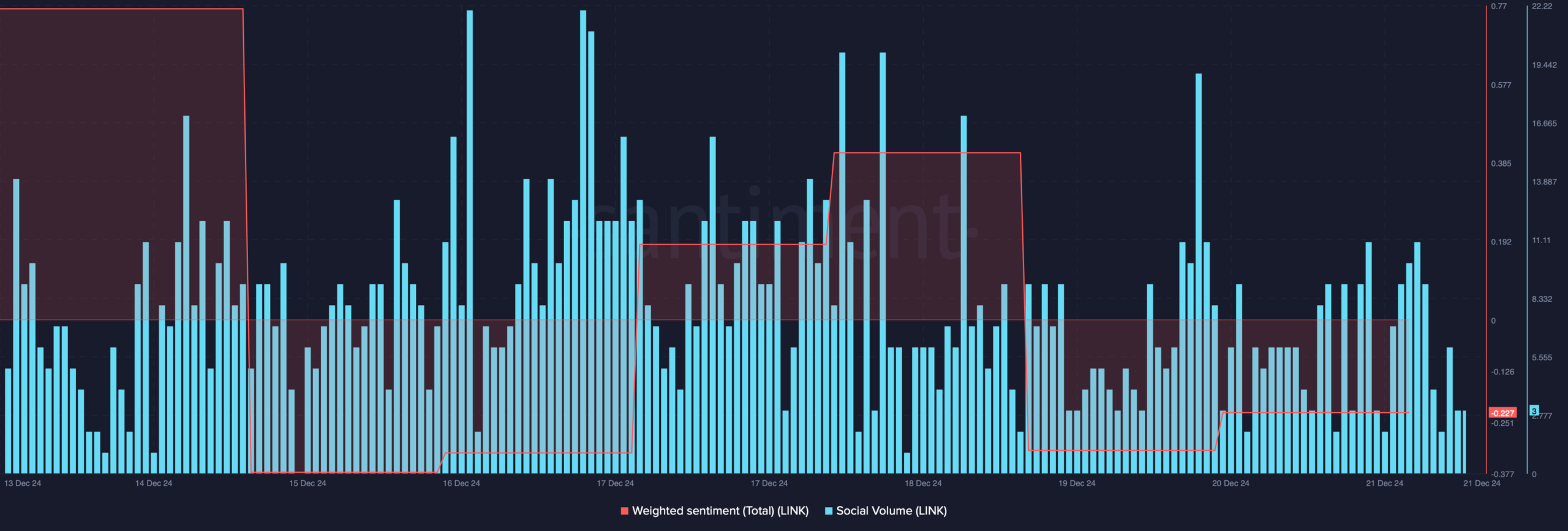

Interestingly, while the price of this altcoin increased significantly (bullish), the overall opinion about it within the crypto market shifted negatively (bearish). This negative shift was noticeable in the decrease of Chainlink’s weighted sentiment. However, last week, its social activity level, or popularity, remained relatively steady.

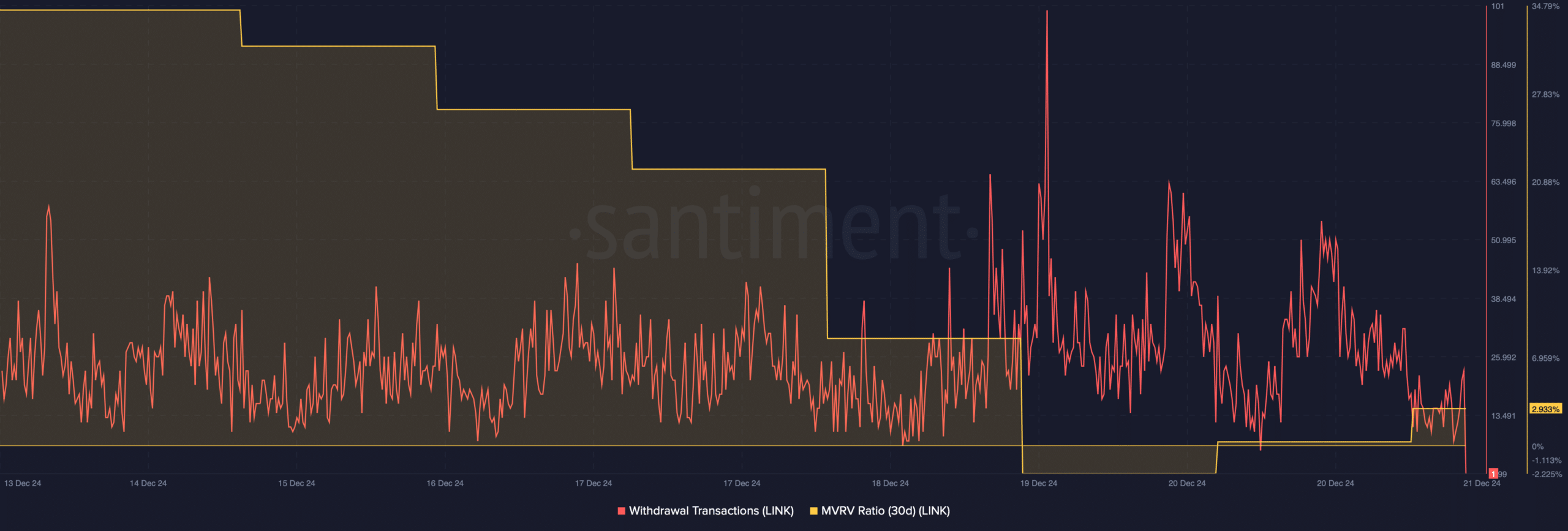

As reported at the current moment, the number of withdrawals for LINK had been on an upward trend, peaking last week. This surge suggested a growing demand for the token, potentially signaling a continuation of its price increase.

Furthermore, the MVRP ratio showed improvement following its dip to -2%. When this indicator reaches this point, it often suggests an increase in price.

In summary, it was observed from Coinglass’ data that Chainlink’s long/short ratio experienced a significant increase over a 4-hour period. An uptick in this indicator suggests that there are more long bets in the market compared to short bets, which could potentially prolong a bullish trend.

If the current metrics and market trends for LINK persist, it’s quite plausible that the token could reach around $50 within the next few months.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

2024-12-21 16:07