- Litecoin bulls made a comeback within the 0.5 and 0.618 Fibonacci range.

- On-chain data revealed that whales have been accumulating LTC.

As a seasoned analyst with years of experience in the cryptocurrency market, I have seen my fair share of bull and bear runs. The recent Litecoin (LTC) price action has piqued my interest, especially given the resurgence within the Fibonacci range and the increased whale activity.

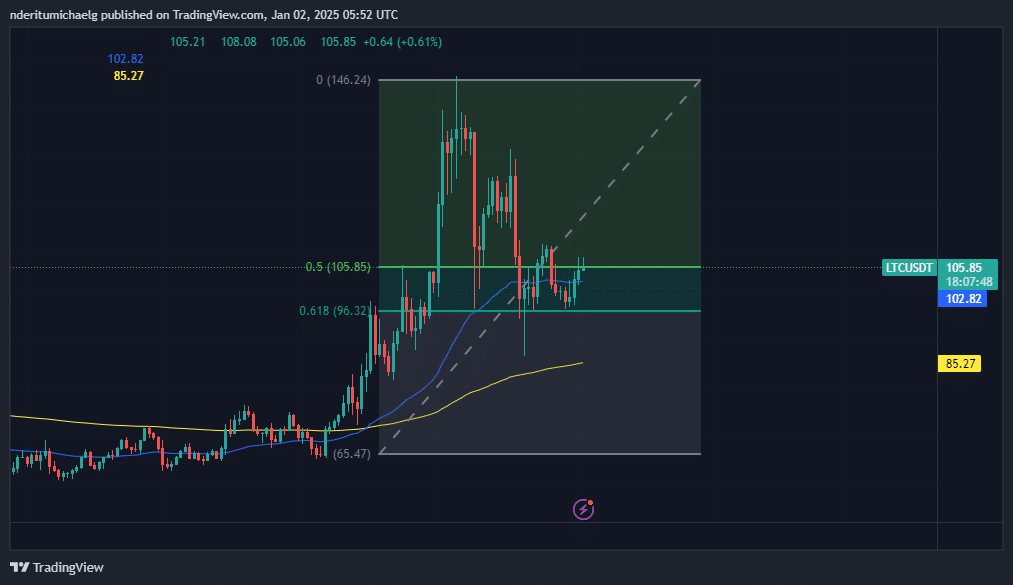

Having closely monitored LTC’s movements since its drop from $147 in December to a low of $86.69, I must admit that the subsequent consolidation between $96 and $105 has been intriguing. The bullish comeback within the 0.5 and 0.618 Fibonacci range suggests a potential significant rally could be on the horizon.

However, with LTC needing to rally by over 38% to reclaim its December highs, it’s essential to remain cautious. Nevertheless, the renewed interest from whales, as evidenced by the increase in their holdings, is a positive sign that should not be ignored.

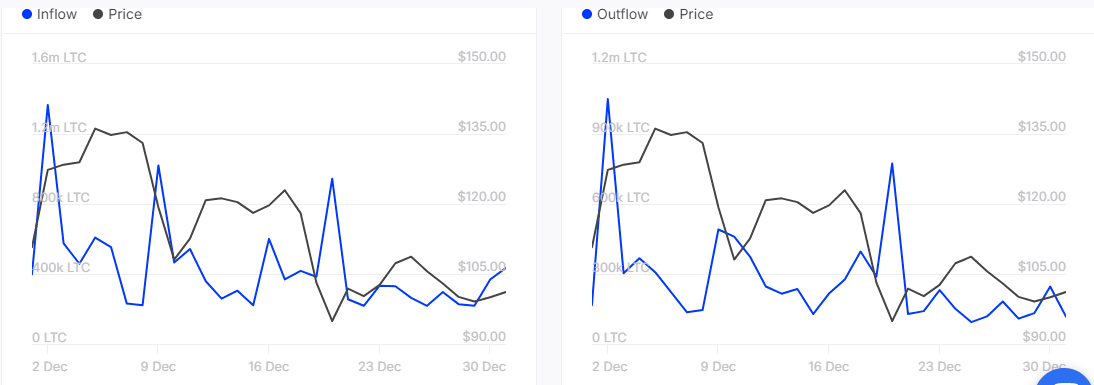

The large holder flows data indicates a 65% uptick in inflows in the last seven days, with notable inflows peaking at 435,260 LTC on the 31st of December. This strong demand could put Litecoin on the path to a bullish start for January and potentially underscore its 2025 outlook.

While I don’t claim to have a crystal ball, I must say that if LTC continues this momentum, it might just be ready for another sizable uptick. But as they say in the crypto world, never invest more than you can afford to lose – even when the whales are buying!

Joke: And remember, in the world of cryptocurrency, the only certainty is uncertainty… and the occasional pump and dump!

It looks like Litecoin [LTC] might be aiming for another bullish uptick. Following a generally downward trend in December, this upward movement might hint at an upcoming major surge, potentially fueled by the actions of large-scale investors (whales).

In December, LTC reached a peak of $147. However, it dipped significantly and reached a low of $86.69, which represents a decrease of approximately 40.75%.

On the other hand, the price has been stabilizing at a range of $96 to $105, an interesting development considering it falls within the 0.5 and 0.618 Fibonacci retracement levels during the correction.

At the moment of this writing, Litecoin was priced at $105.85, rebounding into positive territory over the past four days. However, the question remains: Can Litecoin’s native cryptocurrency sustain this momentum and reach even higher than its projected 2024 peak prices?

It would have to rally by over 38% to reclaim the December top.

However, that may not be far-fetched, considering renewed interest from whales.

LTC finds favor with the whales

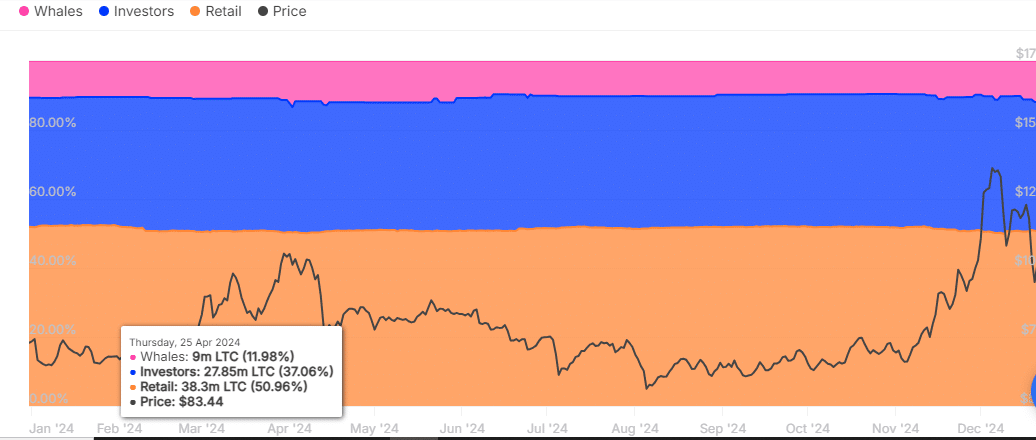

It’s been observed that large investors, or “whales,” have been purchasing Litecoin during its recent price drop, according to on-chain data. They initially owned approximately 7.44 million LTC at the start of December, which represents around 9.79% of the total circulating supply.

Whale balances grew to 9.06 million LTC or 11.91% as of the 30th of December.

The number of investor-held Litecoins decreased slightly, from approximately 29.8 million at the beginning of December to about 28.31 million by the end of the month.

During this timeframe, the number of coins held by retail increased very slightly, going up from 38.64 million to approximately 38.67 million coins.

As an analyst, I observed a significant surge in large holder inflows towards the end of 2024, marking a 65% increase over the past week. The peak inflow on December 31st reached approximately 435,260 LTC, while outflows were relatively minimal at 117,340 LTC during the same period.

Over the past few days, the significant increase in the volume of big investors has mirrored a positive market trend, suggesting that ‘whales’ played a leading role in the recent surge.

A robust interest might steer the cryptocurrency towards a positive start in the first seven days of January, while simultaneously emphasizing Litecoin’s potential trajectory by 2025.

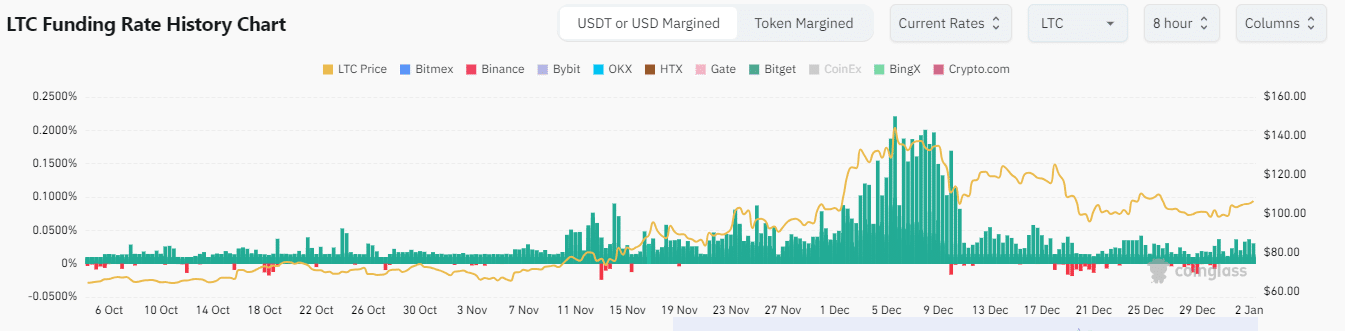

The funding rates, too, signaled vibrant trading within the derivatives market. In the past three days, there has been an observable surge in favorable Long-Term Contract (LTC) Funding Rates.

Read Litecoin’s [LTC] Price Prediction 2025–2026

In the previous 24-hour period, the volume of Litecoin rose by 11.40%, reaching a level of approximately $596.94 million. This increase suggests that there has been renewed investor interest in Litecoin. Additionally, this surge was supported by an uptick of 2.12% in Open Interest, which now stands at around $439.10 million.

2025 has seen an increase in activity surrounding LTC, indicating a promising bullish trend at the beginning of the year. It might even be poised for a significant price surge again.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Florence Pugh’s Bold Shoulder Look Is Turning Heads Again—Are Deltoids the New Red Carpet Accessory?

- Katy Perry Shares NSFW Confession on Orlando Bloom’s “Magic Stick”

- Quick Guide: Finding Garlic in Oblivion Remastered

- How to Get to Frostcrag Spire in Oblivion Remastered

- Disney Quietly Removes Major DEI Initiatives from SEC Filing

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- Unforgettable Deaths in Middle-earth: Lord of the Rings’ Most Memorable Kills Ranked

- BLUR PREDICTION. BLUR cryptocurrency

2025-01-02 16:08