As a seasoned analyst with over two decades of experience in the financial markets, I have witnessed the ebb and flow of various investment trends. The recent filing by Canary Capital for a Litecoin ETF has piqued my interest, not just as an observer but also as someone who has seen the rise and fall of countless investment vehicles.

The desire among institutions for cryptocurrency exchange-traded funds (ETFs) has experienced rapid growth, and Canary Capital is strategically poised to take advantage of this surge in demand.

On October 15th, the investment company filed an S-1 document with the U.S. Securities and Exchange Commission (SEC) for the purpose of introducing the first Exchange Traded Fund (ETF) based on Litecoin (LTC).

This document signifies the first stage in the legal procedure necessary to launch the fund. Subsequently, we need to submit a 19b-4 filing, which asks for Securities and Exchange Commission (SEC) approval to alter a rule at the exchange, thereby allowing the introduction of a new Exchange Traded Fund (ETF).

The proposed Canary Litecoin ETF will directly hold Litecoin and determine its net asset value [NAV] daily, referencing the CoinDesk Litecoin Price Index [LTX].

How did LTC react?

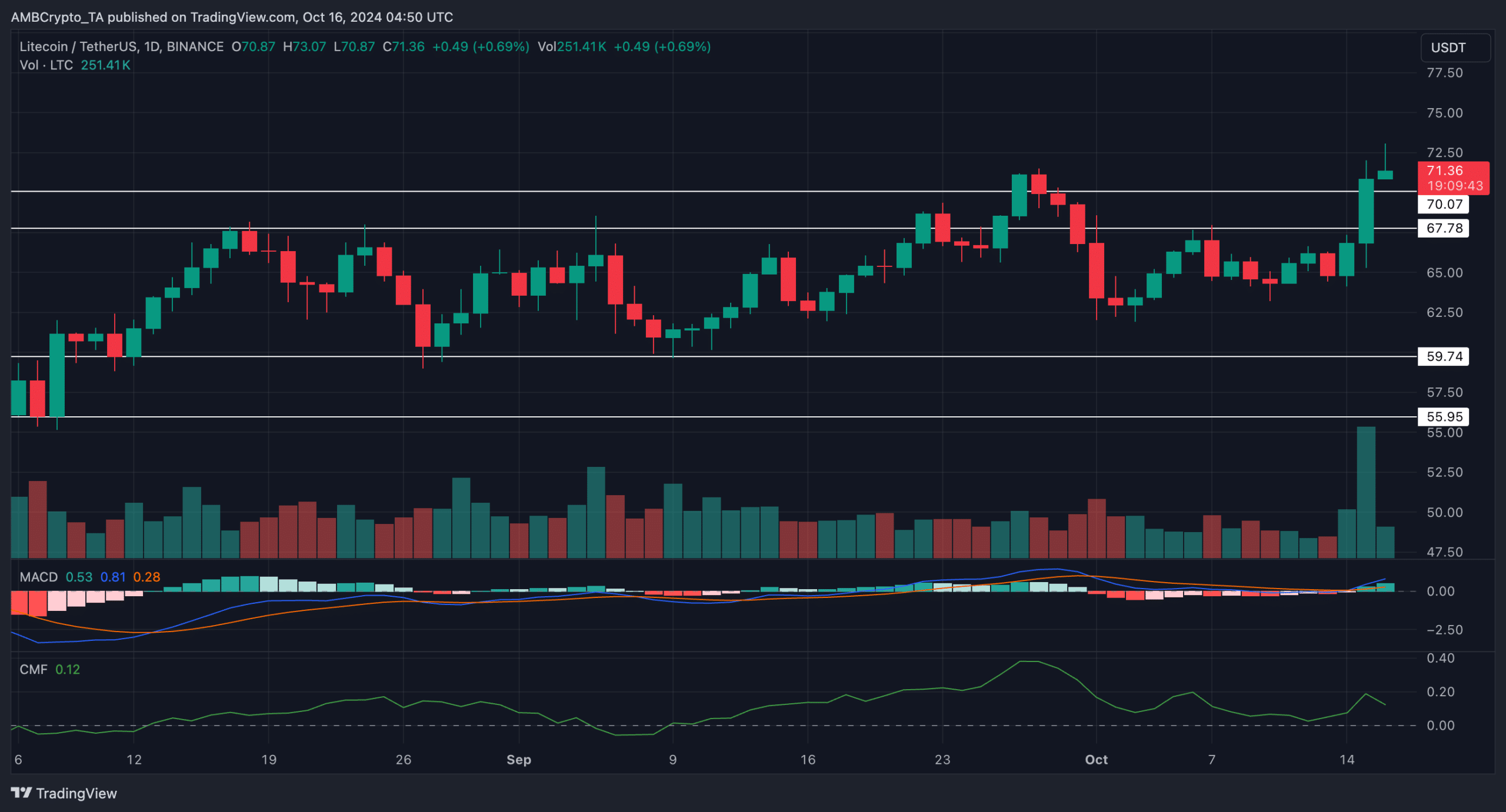

After the news about the ETF submission, LTC jumped above the $70 threshold. Upon examining the daily graph, it was observed that this asset had been oscillating within a particular price range for more than two months.

A decline occurred in late September due to the inability to maintain an upward trend above the price level of $67.

Regardless, the renewed demand caused this level to be surpassed around mid-October. Moreover, the Moving Average Convergence Divergence (MACD) showed a bullish signal, confirming the strong upward trend.

As a researcher, I’m observing that the Current Market Value Function (CMF) stands at 0.12, suggesting an ongoing process of asset accumulation. Meanwhile, at this moment, Litecoin (LTC) is trading at approximately $71, representing a significant increase of 6.3% over the past 24 hours.

After the ETH ETF slump, is LTC ETF a smart bet?

Although the submission of the ETF for Ethereum [ETH] has sparked optimism within the market, its lackluster results should prompt careful consideration.

Lately, it’s been observed by AMBCrypto that Ethereum (ETH) exchange-traded funds (ETFs) haven’t managed to draw in the same level of optimistic investments as Bitcoin (BTC) ETFs have.

The dominance of outflows in ETH ETFs also raises concerns about the potential success of the proposed LTC ETF.

Additionally, the smaller scope of Canary Capital’s market involvement and their inexperience with handling substantial funds might present difficulties.

In summary, unlike Bitcoin, Litecoin doesn’t have a captivating story that drives interest in Bitcoin ETFs, potentially making a Litecoin ETF less attractive to institutional investors.

Canary’s XRP ETF

It’s worth noting that the Litecoin ETF represents the second proposed move by the company in the realm of cryptocurrency-based Exchange Traded Funds (ETFs). As reported by AMBCrypto on October 8th, Canary Capital has also applied for a Ripple [XRP] ETF.

Despite some challenges, the XRP ETF’s approval is met with considerable hurdles because of the ongoing court case between the SEC and Ripple. Conversely, the prospects for the Litecoin ETF seem to be more promising.

Previously this year, the U.S. Commodity Futures Trading Commission (CFTC) classified Litecoin as a commodity within a lawsuit against KuCoin. This favorable legal decision might facilitate the approval of a Litecoin ETF.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

2024-10-16 23:04