-

LTC has diverged notably from Bitcoin’s recent plunge, holding an 8% upward swing.

Will it maintain this trend or succumb to Bitcoin’s volatility?

As a seasoned crypto investor with over a decade of experience under my belt, I’ve seen my fair share of market swings and trends. Litecoin [LTC], for one, has been an intriguing case study this year, especially with its recent 8% upward swing while Bitcoin [BTC] plunged.

Over the last week, Litecoin (LTC) has experienced a rise of about 3%, buoyed by Bitcoin’s [BTC] inability to maintain its critical $57K support level. At the moment of writing, it’s trading at $66.37.

Historically, September tends to be a positive period for LTC according to analysts’ reports. On the other hand, AMBCrypto points out that Bitcoin usually experiences a downturn during this season.

Could it be that Bitcoin’s drop in September is sparking Litecoin’s surge? Are investors viewing Litecoin (LTC) as a more secure option, or are they drawn to it as an emerging standout choice? Let’s delve into this intriguing possibility with AMBCrypto.

Bitcoin’s influence on LTC remains strong

Source : TradingView

It’s worth noting that starting from early August, Litecoin (LTC) has experienced a notable rise, jumping approximately 17% and moving up from $56 to $66. The strong upward trend of Bitcoin, which reached as high as $64,000 during this timeframe, may have contributed to this price increase in Litecoin.

However, while Bitcoin started September on a bearish note, dropping below $57K, LTC bulls have prevented a similar decline.

Based on AMBCrypto’s assessment, since the 28th of August, Bitcoin’s downward trend has been prominent, but Litecoin has managed a rise of approximately 8%.

While Bitcoin’s influence on altcoins is well-known, this level of divergence is unusual.

To figure out if this unusual occurrence in the prices is just a fleeting incident or hints at a more significant trend, AMBCrypto analyzed past price graphs.

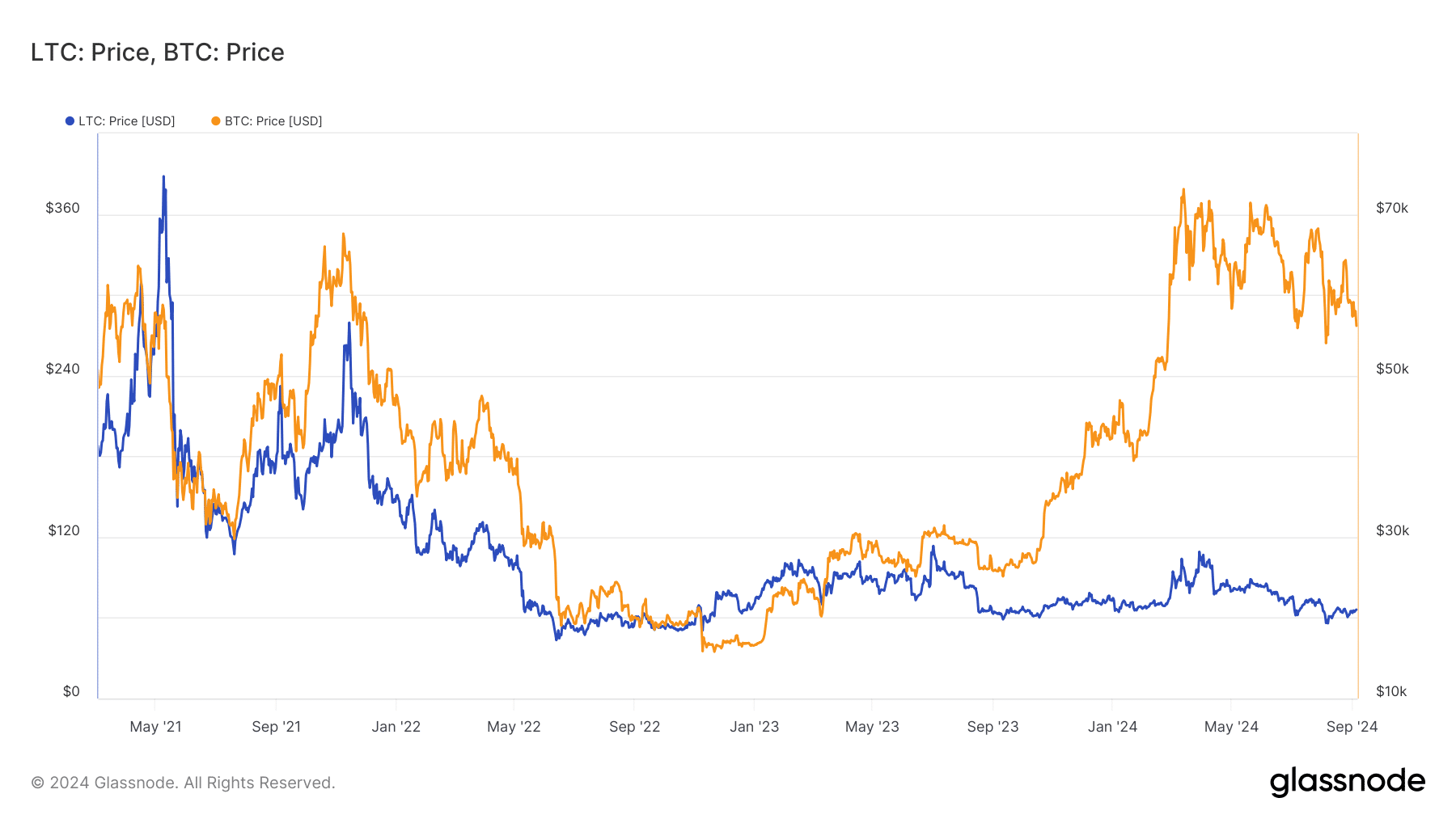

Source : Glassnode

The chart above revealed a striking correlation between the two coins. Three years ago, during an early September rally, LTC tested the $200 mark while BTC broke through the $50K resistance level.

After that, Litecoin’s price decreased as Bitcoin moved towards the $40,000 support level. Moreover, whenever Litecoin gets close to its high points, it tends to be boosted by Bitcoin’s positive market trends.

Essentially, this pattern shows Bitcoin’s superiority compared to Litecoin, implying that the current discrepancy might only be a brief fluctuation. This leads us to wonder: What factors led to this separation?

Behind Litecoin’s surge is a tactical development

In a recent update from what was once known as Twitter, I’ve noticed that the Litecoin team has made an impressive announcement. They’ve stated that Litecoin is currently processing more transactions than Bitcoin by a substantial 10% margin. Quite fascinating, isn’t it?

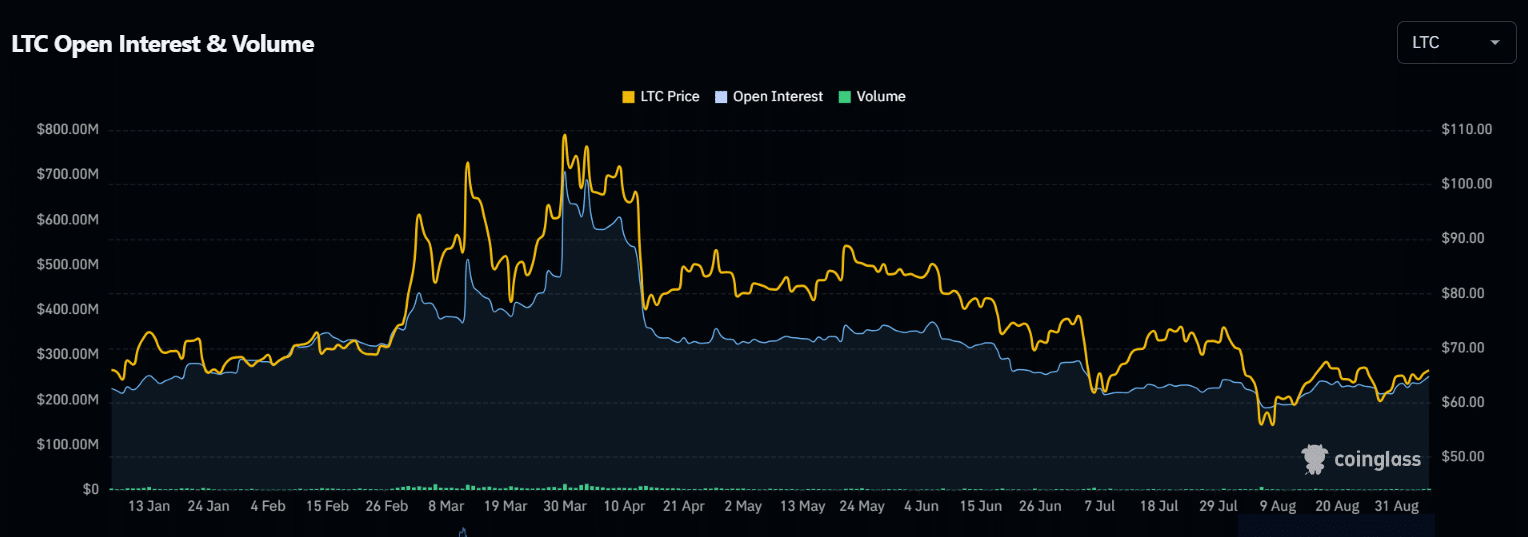

Furthermore, Bitcoin’s continuous price fluctuations have caught the eye of potential investors, as suggested by the substantial open positions depicted in the following data.

Source : Coinglass

After the day ended, Bitcoin’s bears threatened to halt a hoped-for recovery. Meanwhile, Litecoin’s Open Interest grew significantly from $213 million to $252 million, representing an 18.3% increase. Furthermore, its trading volume experienced a substantial surge, climbing from $277 million to $482 million, which equates to a 74% rise.

Instead, the Open Interest (OI) for Bitcoin fell from $31 billion to $29.07 billion, representing a drop of 6.2%. Simultaneously, its trading volume decreased from $78 billion to $68 billion, indicating a decrease of 12.8%.

As more users are becoming active, this coincides with Litecoin’s recent rise, highlighting Litecoin’s approach of processing transactions quicker and charging less than Bitcoin. This approach seems to be effective, as demonstrated by the positive results.

However, caution is warranted, given the earlier September trend where LTC mirrored BTC’s decline.

Read Litecoin’s [LTC] Price Prediction 2024–2025

In essence, should Litecoin maintain trader attention, it could potentially reach a level where it was previously turned down, which was around $76.

Conversely, if Bitcoin’s volatility overwhelms LTC’s gains, the price could retrace toward $50.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- SOL PREDICTION. SOL cryptocurrency

- Solo Leveling Arise Tawata Kanae Guide

2024-09-06 20:08