-

Litecoin found favor with Fidelity Digital, after getting added to its portfolio

Update could have implications for LTC’s price action in the short term

As a seasoned crypto investor with a few battle scars from the volatile market, I’ve seen my fair share of ups and downs when it comes to investing in digital currencies. Litecoin (LTC), for a long time, has been a coin that’s held potential but hasn’t quite managed to reach its full potential due to being overshadowed by more popular coins like Ethereum (ETH) and Bitcoin (BTC).

Litecoin has been outshined by more widely known cryptocurrencies such as Ethereum and Bitcoin in terms of recent market performance. Nevertheless, potential shifts may be on the horizon for Litecoin due to Fidelity Digital’s recent actions.

On Friday, it was announced that Fidelity Digital Assets has incorporated Litecoin into its collection of digital investment options. This significant move enables Fidelity’s American customers, including institutional investors, to invest in Litecoin. Currently, Fidelity oversees assets valued at more than $12 trillion.

Fidelity Digital’s decision to include Litecoin in their holdings signifies a bullish outlook on the digital currency’s prospect.

Paving the road for a Litecoin ETF?

The inclusion of Litecoin (LTC) in Fidelity Digital Assets’ investment offerings generates buzz about potential future Litecoin Exchange-Traded Funds (ETFs). Bitcoin ETFs have garnered massive investments, and Ethereum ETFs have recently been approved.

Litecoin shares characteristics with Bitcoin, including scarcity and the use of a proof-of-work consensus algorithm. However, it’s important to note that Fidelity Digital has not indicated plans for a Litecoin ETF in the near future.

Despite this, the cryptocurrency’s attention could serve as a catalyst for its advancement, should institutional demand bounce back strongly.

Will Litecoin reclaim the $100 price level?

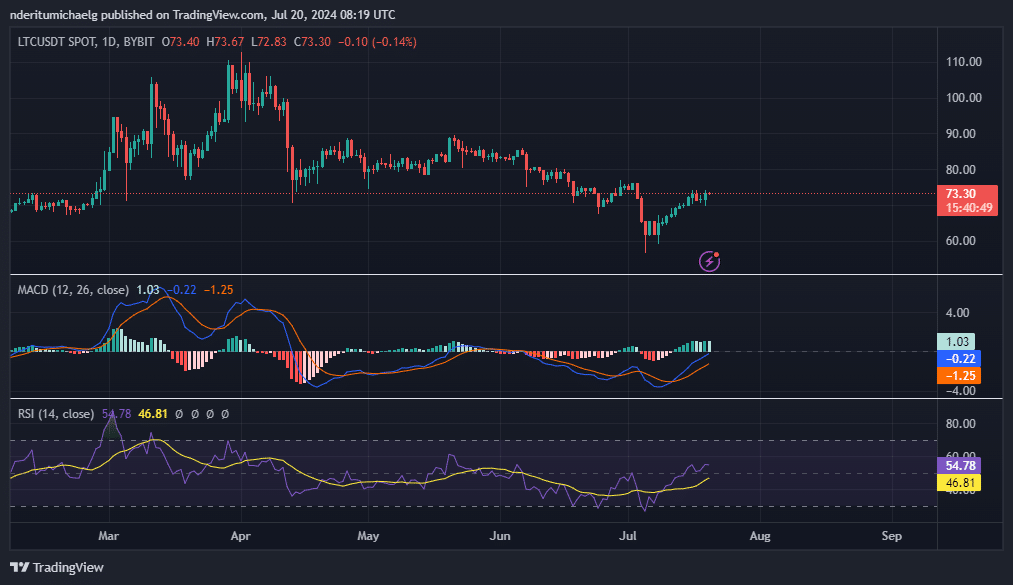

In March 2024, LTC experienced a brief surge above $100, reaching as high as $112.83 at the onset of April. However, this upward trend was short-lived, leading to a 49% decrease in value that brought it down to a low of $56.62.

The cryptocurrency was trading at $73.33, at the time of writing.

Simply put, LTC has some ground to cover before pushing back above the illusive $100 price level.

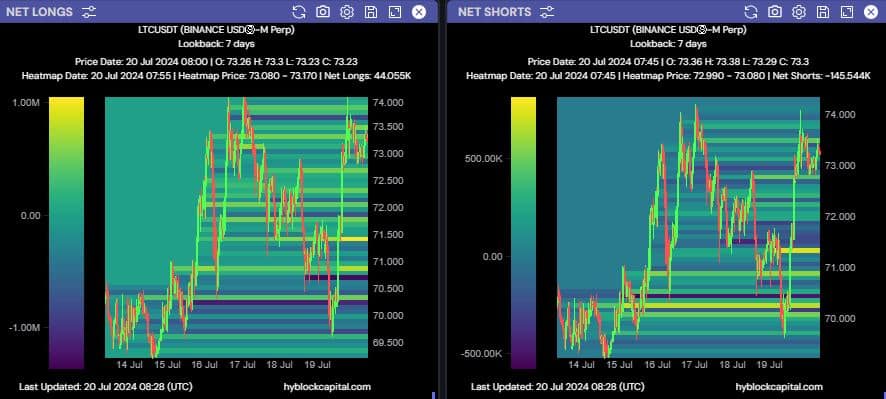

Despite this, the RSI and MACD signals indicated a bullish trend. However, can it sustain this trend? Recent data on open positions shows a significant decrease in shorts numbering 145,540, while the net longs stood at 44,055.

A decrease in the quantity of short positions indicates a shift in investor sentiment, although it’s unclear at this moment if this development is connected to Fidelity Digital’s recent announcement regarding the inclusion of Litecoin in their investment portfolio.

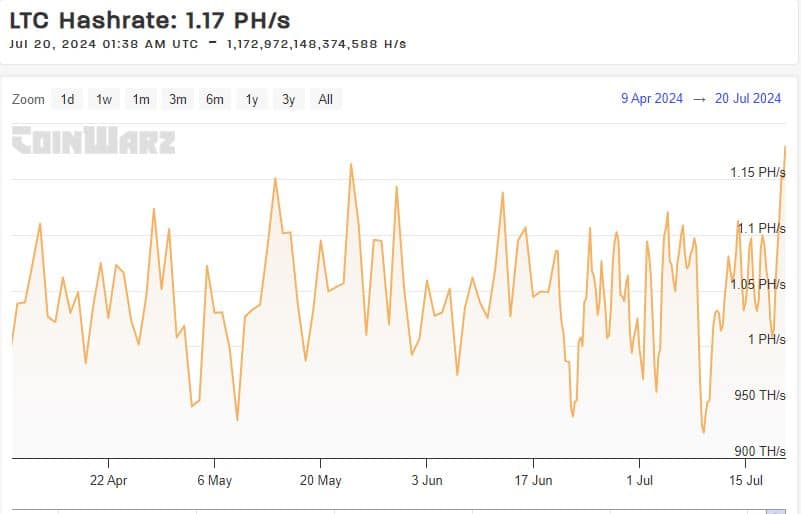

Hashrate soars to new 3-month high

In the past two days, Litecoin’s hashrate experienced a significant increase, reaching a new three-month peak of 1.179 PH/s. This surge in mining power brought the cryptocurrency nearer to hitting a six-month high on the charts.

The previously mentioned increase in Litecoin’s price correlates with the changing market attitude and heightened transaction activity on this cryptocurrency. This trend became more noticeable as the market shifted towards a bullish stance.

Based on all the findings, Litecoin appears to have potential for a bullish comeback. Nevertheless, whether it can surge past the $100 mark in the near future relies significantly on the existing market demand.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-07-21 02:15