-

LTC’s recent gains might be hindered by large holders’ sell-offs

On-chain data revealed a strong support at $61.27, and could be critical to overcoming the overhead resistance

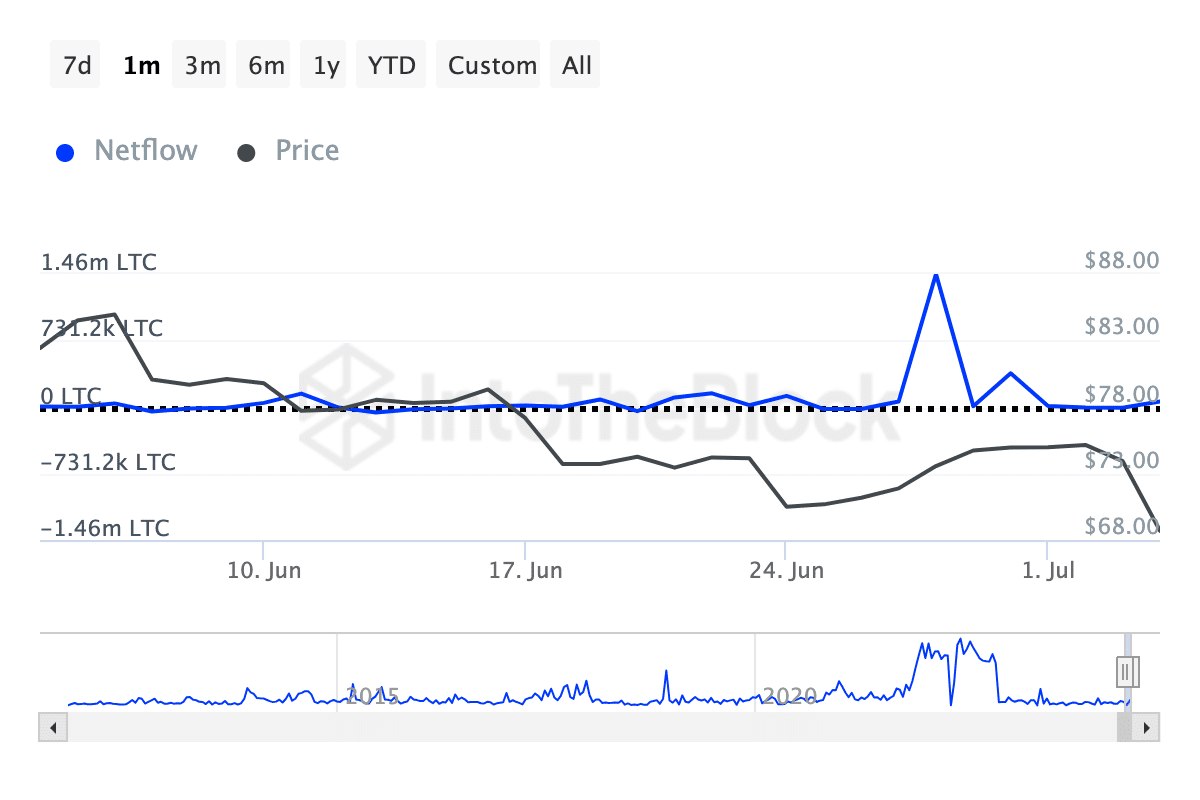

As an experienced analyst, I believe that Litecoin’s [LTC] recent gains could be under threat due to the large-scale sell-offs by holders. The Large Holders Netflow data reveals a significant outflow of LTC from large investors in the last week, which is a concerning sign for the altcoin’s price action.

As an analyst, I’ve examined Litecoin‘s [LTC] price recovery and found that while some losses have been recouped, the altcoin encounters significant hurdles based on my assessment of its Large Holders Netflow data from AMBCrypto.

This week, just like other cryptocurrencies, Litecoin’s price took a dive. On July 5th, its value reached a low of $57.55. But there was some good news in the last 24 hours: Litecoin experienced a 7.05% increase and was now being traded at $62.50.

Litecoin hotshots are leaving the coin

Although the cryptocurrency has experienced a rise recently, it’s uncertain whether this trend will continue. Notably, large holder transactions have decreased by 95.84% over the past week, as indicated by IntoTheBlock data.

In simpler terms, the metric represents the net flow between cryptocurrency being bought by larger investors (Large Holders Inflow) and sold by them (Large Holders Outflow). To clarify further, large holders refer to wallets possessing between 0.1% and 1% of the total circulating supply.

When the net flow is positive, large investors are purchasing more LTC than they’re offloading. Conversely, when the net flow is negative, these investors are disposing of more LTC than they’re acquiring.

If the metric continues to be negative, Litecoin’s upward trend may come to a standstill. On the other hand, if inflows surpass outflows, the price could rise above $60 temporarily, potentially approaching $70 in the near future.

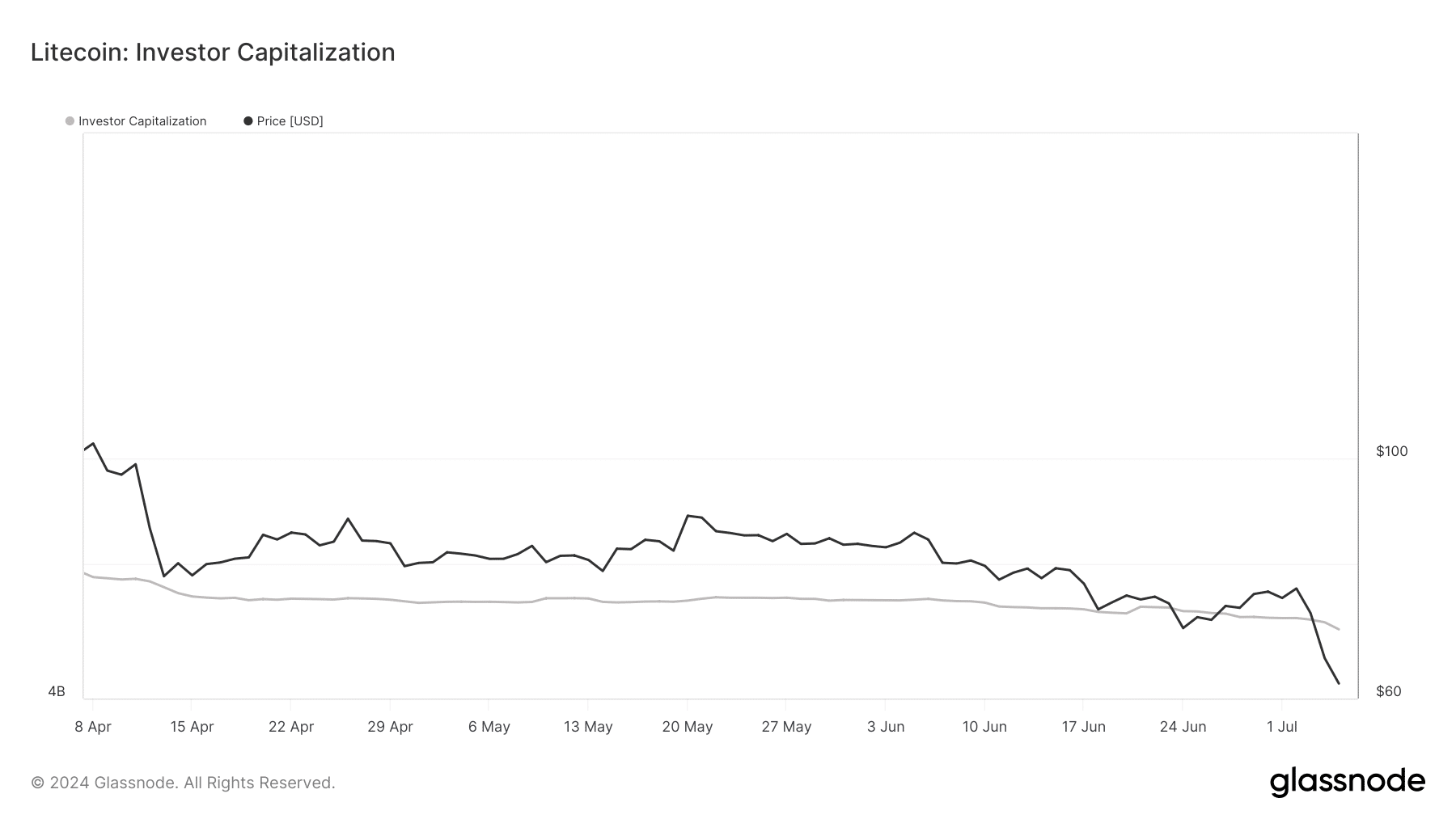

As an analyst, I recognized the importance of examining various data sets to gain a more comprehensive understanding of Litecoin’s (LTC) future trajectory. To accomplish this, I delved into the investigation of its Investor Capitalization.

LTC’s price close to the bottom, could trade higher

As a crypto investor, I’d interpret this by saying: “The gap between Realized Capitalization and Thermocap is an essential metric for me. A larger difference suggests the coin may have reached its peak, while a smaller one could indicate that the bottom is near.”

As a crypto investor, when I notice a significant increase in Investor Capitalization for a particular coin, I interpret it as a potential sign that we’re nearing the peak of the current market cycle for that coin. Conversely, if the reader shows a low Investor Capitalization figure, it may indicate that the price of the coin is close to hitting its bottom in this market cycle.

According to Glassnode, the metric was at a low point, indicating that LTC might be undervalued.

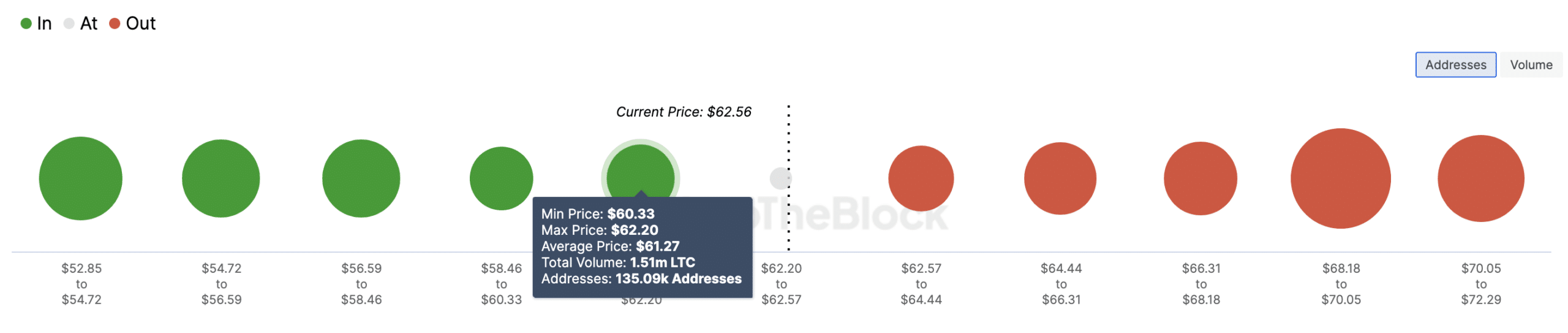

Regarding the near-term perspective, AMBCrypto examined the In/Out of Money Around Price (IOMAP) marker. This tool categorizes wallets based on profits or losses, using their average purchase prices as a benchmark.

From an analysis perspective, the size of a cluster of prices determines its role as either support or resistance. The bigger the grouping of addresses at a specific price level, the more robust the support or resistance becomes.

At the moment when the data was collected, it was revealed that approximately 128,140 unique addresses had bought a total of 485,190 Litecoin units, with an average purchase price of $63.39 per LTC. These addresses had spent all their funds on LTC. Conversely, around 135,090 distinct addresses had transacted 1.51 million Litecoin units at an average price of $61.27 per LTC. These addresses were in a financially favorable position after their LTC purchases.

As a researcher studying the cryptocurrency market trends, I’ve noticed an intriguing pattern with Litecoin’s price action. The larger number of addresses trading at lower prices indicates robust support for Litecoin on the charts. Given this context, it’s plausible that Litecoin could potentially reverse its trend and surmount the resistance level at $63.39.

Is your portfolio green? Check the Litecoin Profit Calculator

Should this event transpire, the price of Litecoin (LTC) may reach $65.35 within a short timeframe. Nevertheless, this forecast could be rendered inaccurate should significant LTC holders persist in selling the coin.

Should this be the case, LTC might drop below $60 again.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

2024-07-07 03:03