- Mining supply dropped from 655k LTC to 645k LTC as the CMF hovered at 0.07

- Accumulation/Distribution line has climbed from 60M to 67.37M since March 2024

1) Litecoin (LTC) miners have been increasing the rate at which they sell, causing a surge in supply. This is evident from on-chain data. Currently, Litecoin is being traded for $119.06, marking a 4.96% decrease over the past day. The trading volume stands at 156.29k as miners adapt their positions to the market’s fluctuations.

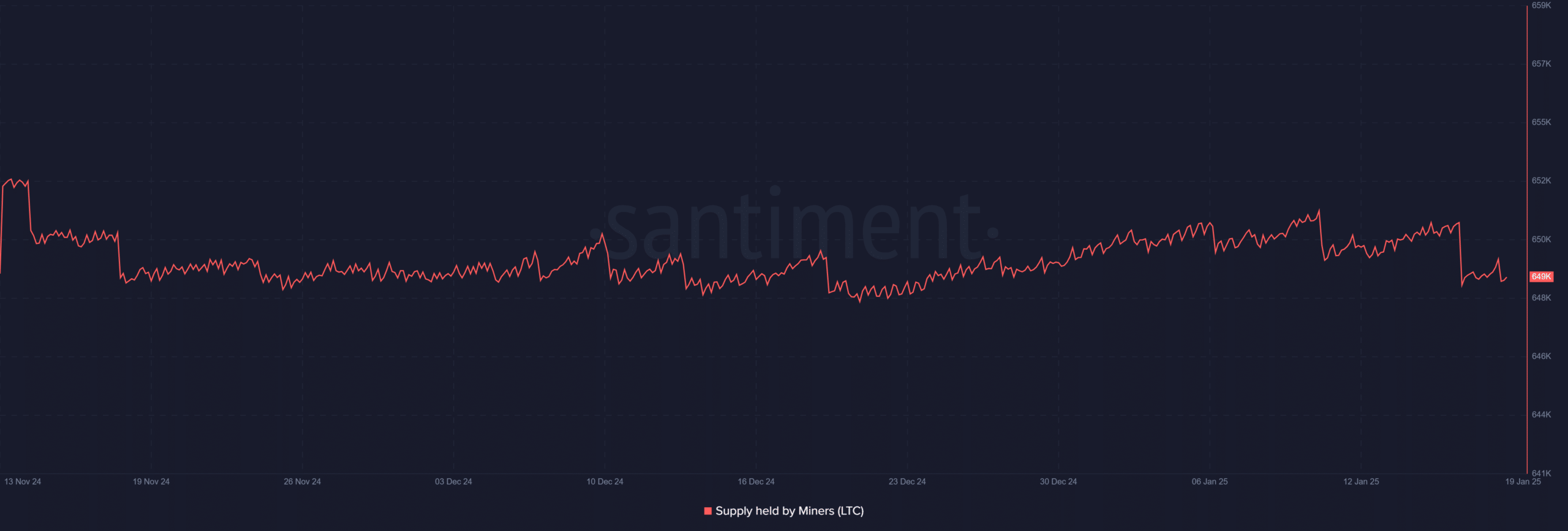

Litecoin supply movement and miner behavior

Information from on-chain sources indicates a discernible decrease in the amount of Litecoin held by miners. Their holdings have dropped to around 645,000 LTC, down from earlier highs of approximately 655,000. This reduction, though not extreme, appears to reflect a consistent trend of selling over the last two months.

This gradual decline in value, as opposed to sudden drops, suggests a methodical process for disposals, implying a strategic liquidation rather than panicked selling.

Significantly, the supply graph showed increased variability around mid-January, suggesting that miners were more active during periods of price instability.

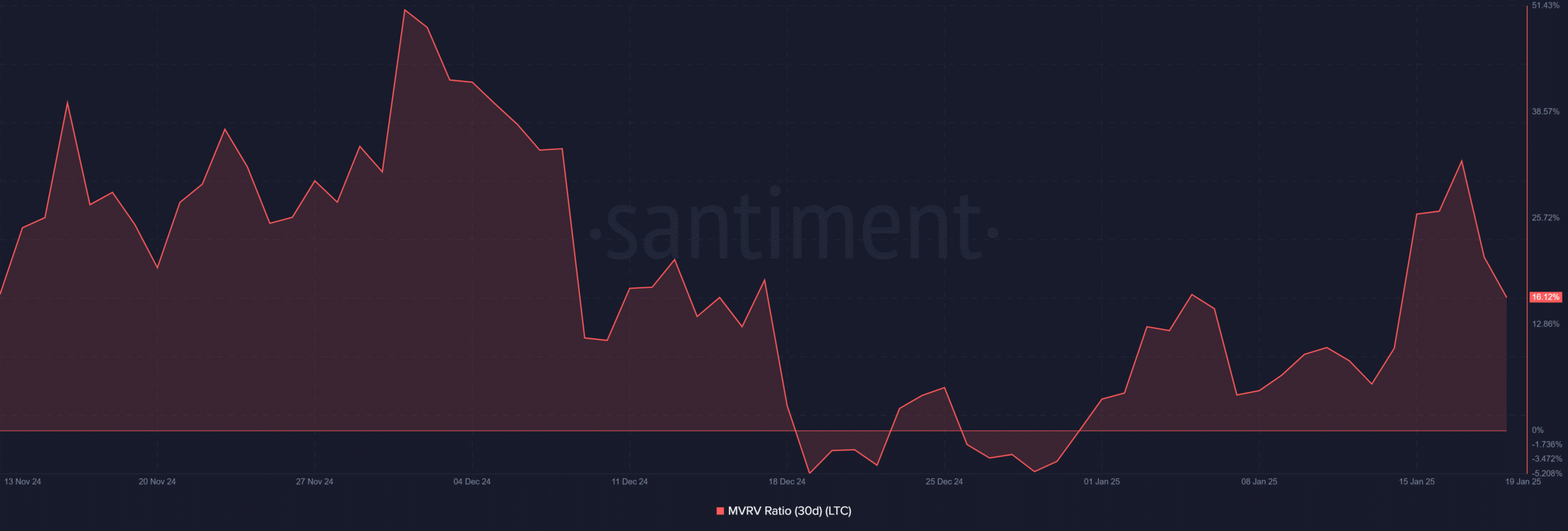

MVRV analysis points to market sentiment

The 30-day Market Value to Realized Value (MVRV) ratio for Litecoin offers an intriguing narrative about the changing attitudes in the market.

In early December 2024, the ratio peaked at 38.57%, but it has since dropped significantly to its current level of 16.12% as of this writing.

A substantial decrease suggests that recent investors, those who purchased within the last month, are experiencing notably smaller profits due to reduced profitability margins.

In reality, the decline in the MVRV’s trend since December suggests a decrease in speculative excitement, possibly indicating a transition toward a more realistic market evaluation.

Litecoin’s technical analysis and price action

Litecoin’s daily chart underlined several critical technical developments too.

In simpler terms, the 50-day and 200-day averages crossed each other in an upward pattern (bullish cross) at approximately 113.31 and 80.84 respectively. This is typically a favorable sign for the market’s trend over the mid-term.

In simpler terms, the Accumulation/Distribution line showed significant growth, rising from 60 million in March 2024 to 67.37 million. This could suggest that there’s ongoing buying interest, even with miners selling off their shares.

As a crypto investor, I noticed that the Chaikin Money Flow (CMF) hovered around 0.07, hinting at an intriguing scenario. Despite the recent dip in prices, there was a slight edge in buying over selling pressure, which could be a promising sign. Interestingly, this contrasts with the miners’ selling trend, implying that retail and institutional investors might be taking up the slack in the market by counteracting the selling pressure.

Furthermore, there were noticeable increases in trading activity during price drops, especially over the past few weeks. A high volume of 156,290 was recorded during these selling phases, suggesting intense market involvement.

In my analysis, even though there’s been a surge in selling activity, the price has remarkably held above the pivotal 50-day moving average, suggesting resilience in the underlying market dynamics.

Looking ahead – Market implications

In this current market setup, it’s fascinating to observe a contrast between Litecoin miners and broader market trends. Miners seem detached from the general market mood as they persistently sell off, likely driven by profit-taking or operational expenses. However, indicators showing accumulation suggest robust buying interest at current prices. The MVRV ratio, though lower than previous highs, stays in positive territory – suggesting a possible price rebound if selling pressure decreases.

It appears that the balance among these different indicators implies Litecoin is at a pivotal point, where miners’ actions could substantially impact short-term price movements. The upcoming weeks will hold importance in deciding if the current miner sell-off is just a normal market readjustment or the start of a more prominent trend change.

– Read Litecoin (LTC) Price Prediction 2024-25

Maintaining the $113 price range, which aligns with the 50-day moving average, is crucial in preserving the market’s structure. Should this level persist even under continuous miner selling, it might indicate robust underlying demand for LTC at its current value.

Read More

2025-01-20 01:12