- 78% of Litecoin addresses have held their LTC for over a year.

- LTC has decline by 11.09% over the past 24 hours.

As a seasoned researcher with years of experience studying cryptocurrency markets, I find myself intrigued by the current state of Litecoin (LTC). The 78% of long-term LTC holders remain steadfastly optimistic, despite the recent 11.09% decline over the past 24 hours and a 20.12% drop in the last week. This resilience is reminiscent of the phoenix that rises from its own ashes, only to soar higher than before.

Over the past fortnight, Litecoin [LTC] has found it challenging to sustain its upward trend after reaching a peak price of $147.

Over the last 24 hours, there’s been an unprecedented drop in the altcoin, with its value reaching a low of $94. As I write this, Litecoin is being traded at $96, representing a 11.09% decrease on daily charts. Moreover, over the past week, the altcoin has experienced a significant downturn of approximately 20.12%.

Regardless of the current drop in its value as shown by its graphs, long-term investors in LTC maintain their positive outlook and anticipate further increases.

78% of Litecoin long term addresses remain bullish

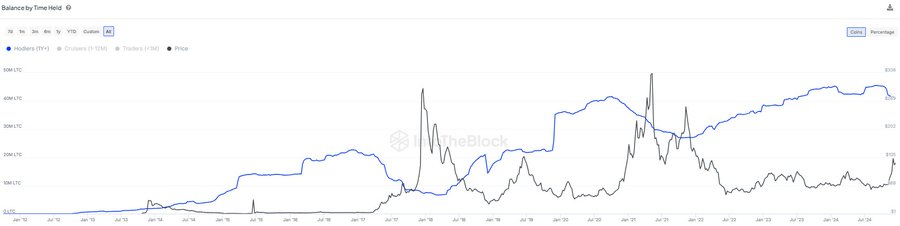

Approximately 78% of Litecoin wallets have held onto their LTC for over a year, suggesting that they’ve amassed these coins during market downturns and then sold them close to peak prices. (IntoTheBlock data)

In contrast to past cycles, I’ve observed a distinct shift this time around with more long-term investments being offloaded. However, what sets this cycle apart is its unique character.

During this cycle, there’s been a modest decrease in long-term LTC holdings. Yet, the decrease isn’t as significant as it was during prior cycles. This suggests that fewer long-term holders are offloading their LTC compared to past market upswings.

Consequently, numerous investors are expecting continued price increases, since they believe the peak of this cycle has yet to be reached. This suggests a positive outlook amongst long-term investors.

What LTC charts suggest

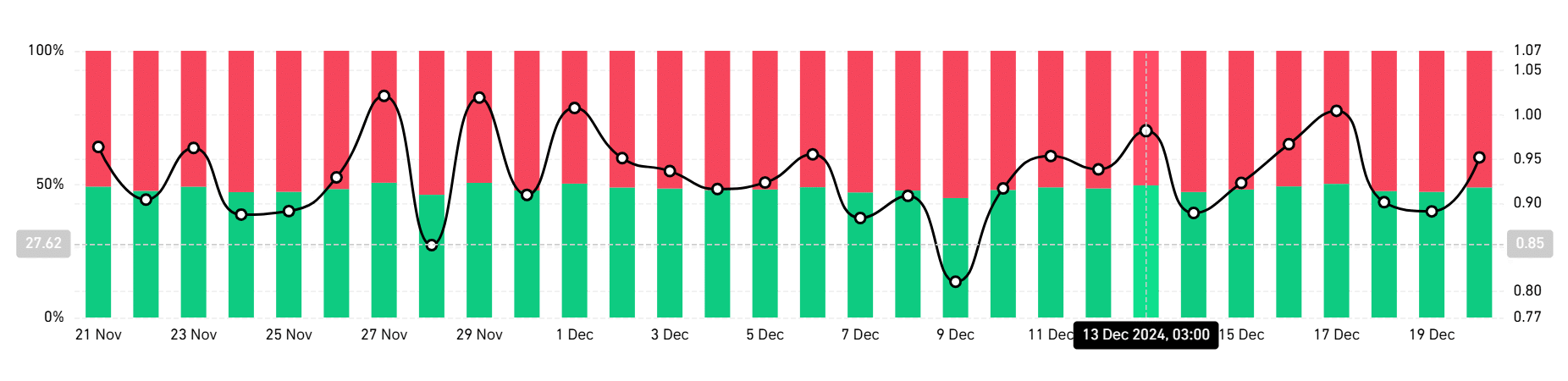

Despite long-term investors selling relatively less than in previous periods and staying hopeful, the broader market still shows a pessimistic trend.

From the data we’ve seen, it appears that many investors are choosing to bet on price decreases by taking short positions. The dominance of these shorts, as indicated by the long/short ratio from Coinglass, suggests that the majority of traders expect prices to decline in the near future.

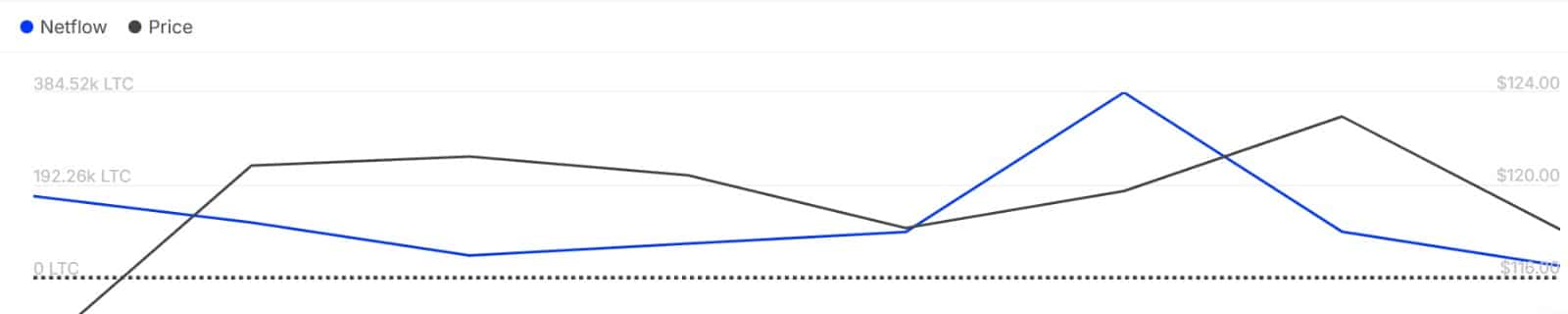

Furthermore, significant investors are exhibiting a bearish sentiment and have been decreasing their investments in Litecoin. Consequently, the outflow of capital from major Litecoin holders has significantly reduced, going from 384,520 to just 21,890.

This implies that outflow has surpassed inflow for 4 consecutive days.

For the past twelve consecutive days, it’s been the sellers who have held sway over the market. Their influence is clear as the Relative Strength Index (RSI) shows a consistent downtrend. Starting at 71, the RSI has fallen to 40, approaching the oversold zone.

Read Litecoin’s [LTC] Price Prediction 2024–2025

In summary, though I remain hopeful in the long term, my observations suggest that retail traders are less optimistic at present. This apparent short-term pessimism could potentially drive down the price of LTC to approximately $91.47 if this trend persists.

However, if long-term holders’ bullishness spreads across the market, LTC will reclaim $100 levels.

Read More

2024-12-21 05:11