-

LTC’s price increased by more than 8% in the last seven days.

Most metrics and market indicators looked bullish on the coin.

As a seasoned researcher with extensive experience in cryptocurrency market analysis, I have closely monitored Litecoin’s [LTC] recent price movements and market indicators. Over the past week, I’ve observed a notable surge in LTC’s price, which increased by more than 8%. This upward trend was further supported by most metrics and market indicators, which looked bullish for the coin.

At present, Litecoin [LTC] has regained a position in the top 20 cryptocurrencies by market capitalization. The question is: Will this ranking be sustained or will it be short-lived? To shed light on Litecoin’s potential future, let’s examine some price prediction perspectives.

A look at Litecoin

As a researcher examining the cryptocurrency market trends, I discovered that Litecoin (LTC) experienced a significant surge over the past week, with an increase of over 8%. Furthermore, in the previous 24 hours, Litecoin underwent a noteworthy price hike, exceeding a rise of 1.5%.

Currently, Litecoin (LTC) is priced at $71.53 in the markets and boasts a market capitalization exceeding $5.3 billion. The recent surge in value enabled it to regain a spot among the top 20 cryptocurrencies by market cap.

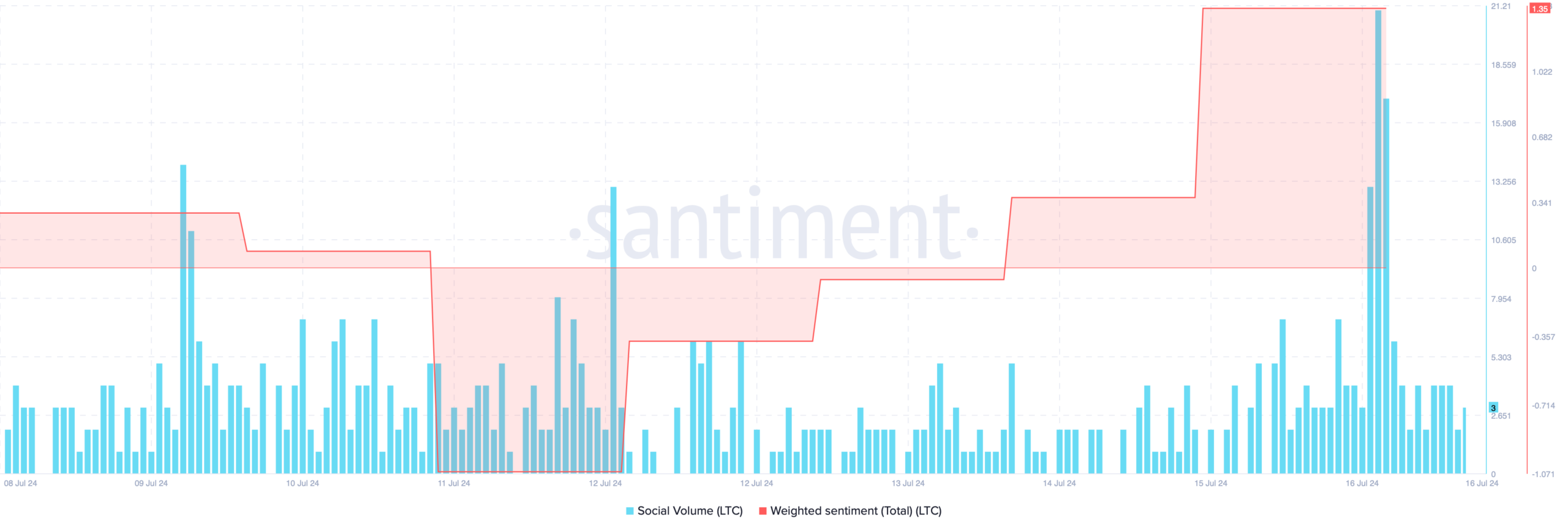

In addition to the market value increase, the bull market also influenced the social metrics of the coin. For example, according to AMBCrypto’s analysis of Santiment’s data, there was a significant surge in social activity on July 16th.

During the same time frame, the Weighted Sentiment experienced an uptick, indicating a surge in positive or optimistic views among market participants.

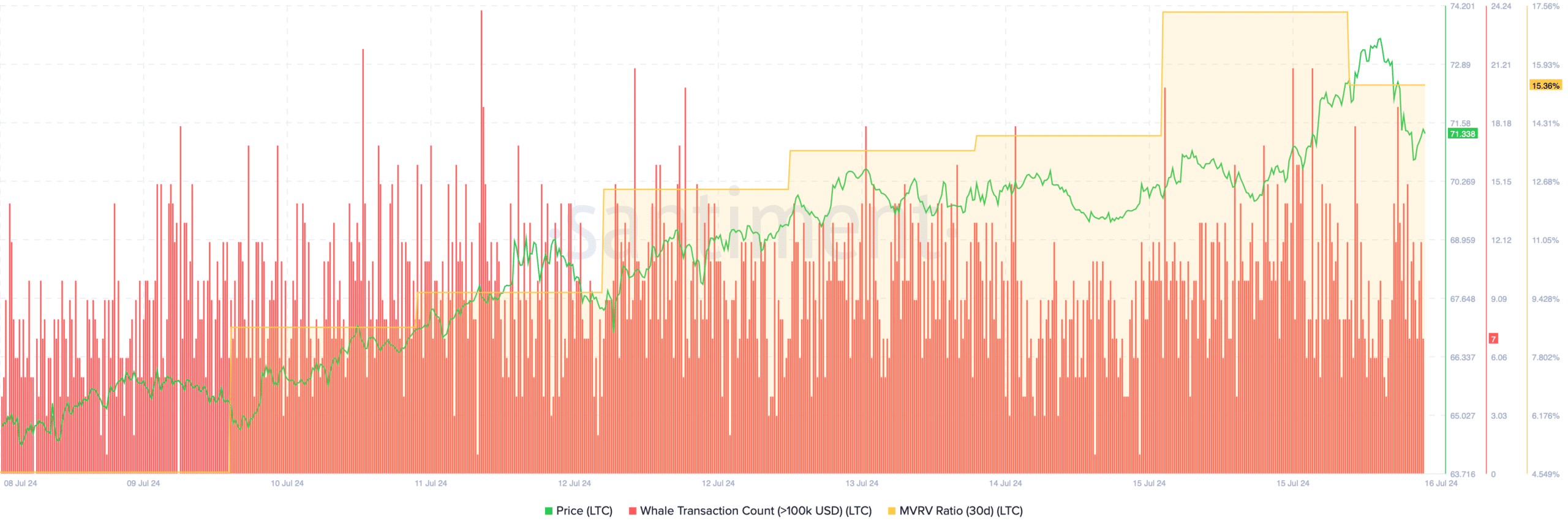

As a crypto investor, I’ve noticed that there has been significant whale activity surrounding this coin, which can be observed through its consistent high whale transaction count.

Similarly, the MVRV ratio increased in the last few days.

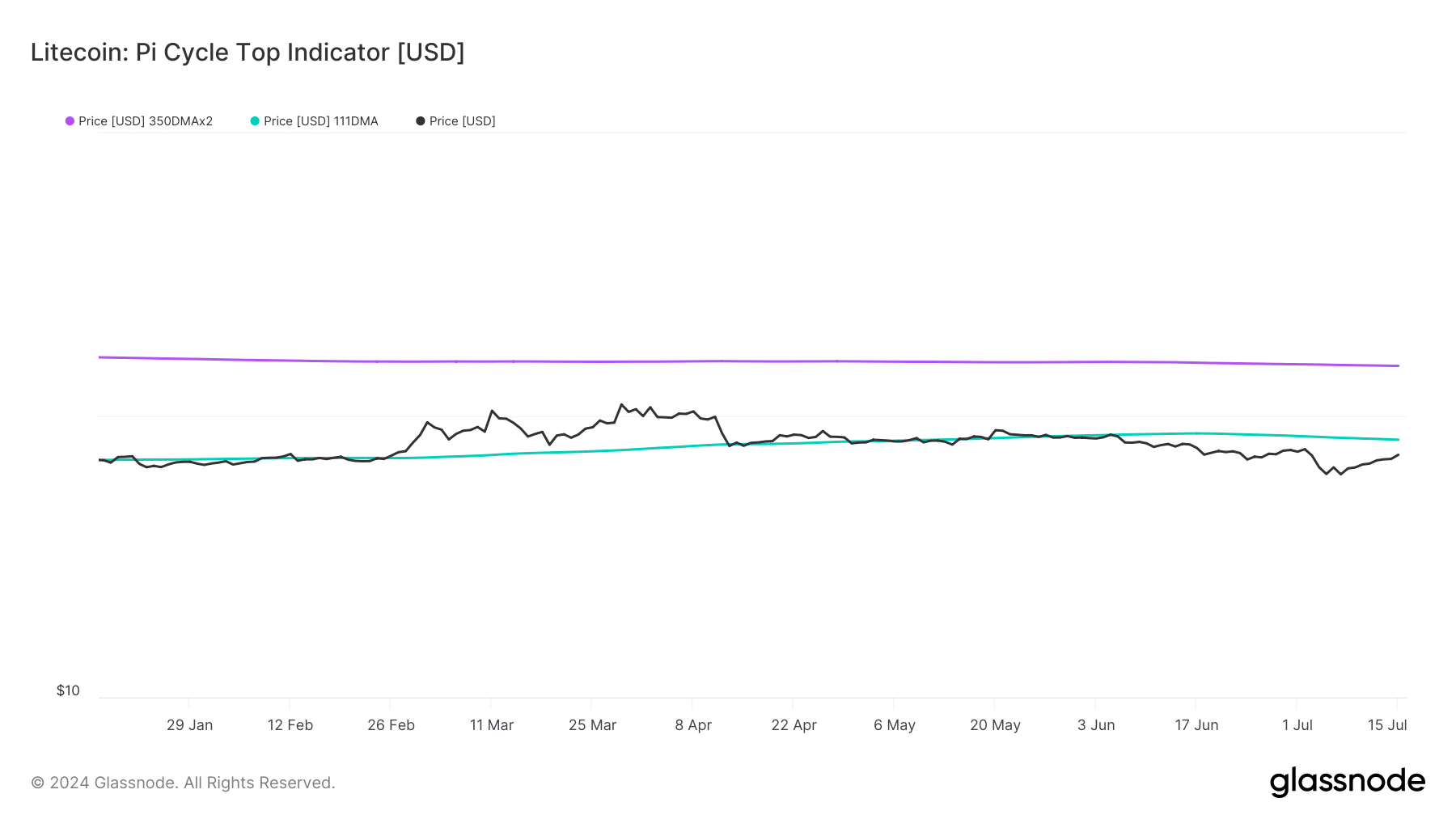

As a crypto investor, I’ve been keeping an eye on the latest insights from AMBCrypto and Glassnode’s analysis. According to their findings, Litecoin’s price has remained below the potential market bottom of $81.9 for several weeks now. This could indicate that the digital asset might be due for a potential rebound or further downside depending on broader market trends. Keeping tabs on these reports is essential for informed investment decisions.

The encouraging development saw the LTC gain steadily gaining ground towards the target mark, with the bullish trend showing significant momentum according to the Pi Cycle Top indicator. This suggests that Litecoin could reach a price of around $149 within the upcoming period.

Litecoin price prediction

The analysis conducted by AMBCrypto on Litecoin’s daily chart indicated a notable surge in the token’s value. However, this rise was followed by a decline in the Relative Strength Index (RSI), signaling a potential reversal or correction in the price. Despite this, the Moving Average Convergence Divergence (MACD) line remained bullish, suggesting continued buying pressure.

As an analyst, I would recommend examining LTC‘s liquidation heatmap to identify potential short-term price levels of resistance and support. In the event that bearish sentiment prevails, LTC may encounter initial support around $69.

In the event of a continued price rise, it might first reclaim $73.

Is your portfolio green? Check the Litecoin Profit Calculator

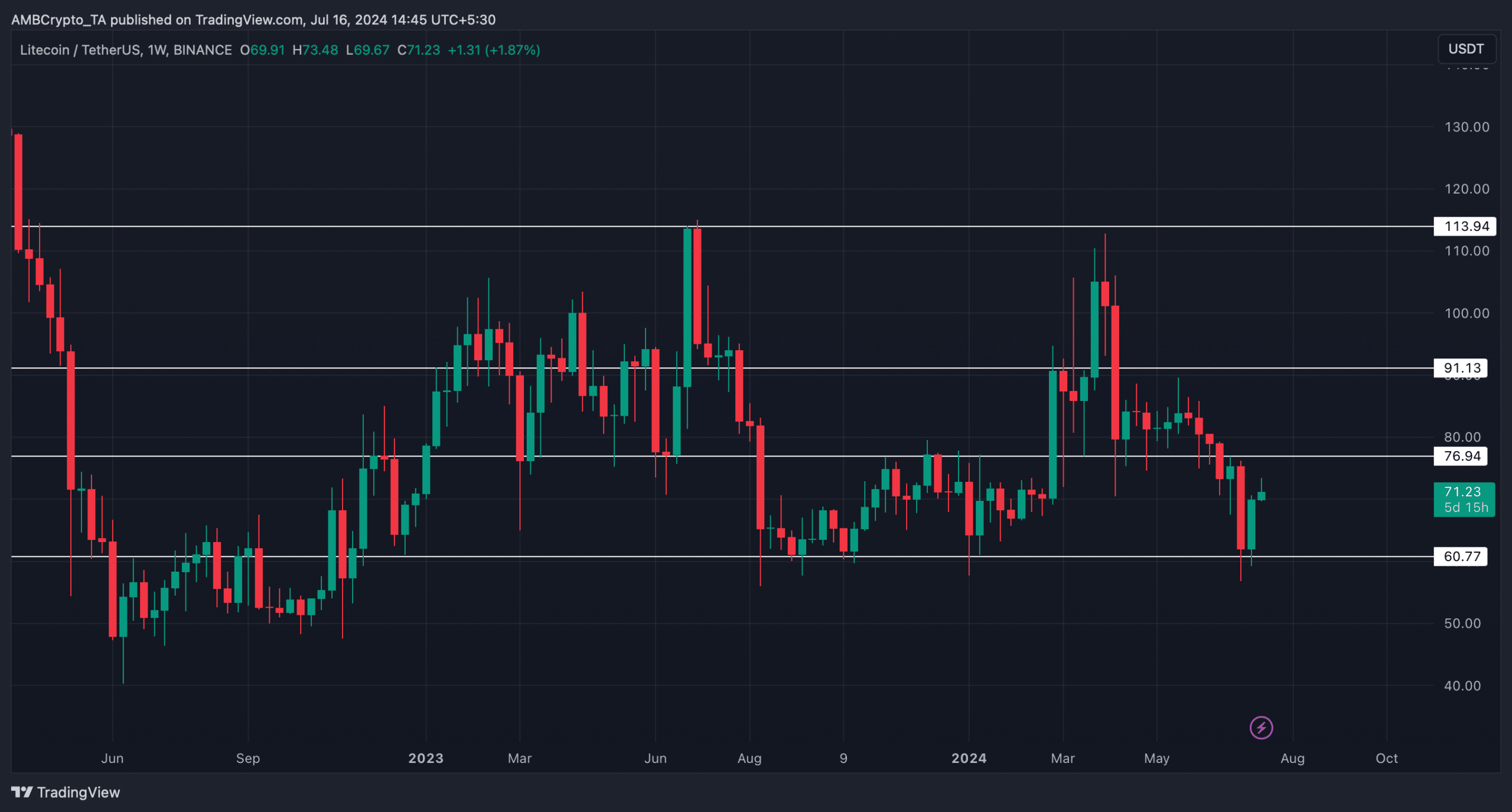

As a researcher at AMBCrypto, I examined Litecoin’s weekly chart to determine potential long-term goals. A key step in this bull market would be for LTC to surpass the resistance level of $76 before sustaining further gains.

A breakout above that would allow it to reach $91 before it reaches $113.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-07-17 02:15