-

Litecoin’s price might keep trading below $80 as Puell Multiple rose above $0.50.

A rise in Bitcoin and Ethereum’s prices might not influence LTC.

As a seasoned crypto investor with a keen interest in Litecoin (LTC), I believe that the current market conditions might keep LTC’s price below $80. The recent rise in Puell Multiple, which stands at 0.88, indicates that miners are experiencing increased revenue and may be inclined to sell some of their holdings. This selling pressure could further push down Litecoin’s price.

In this article from AMBCrypto, we’ll discuss how the activities of Litecoin (LTC) miners have historically influenced the digital currency’s pricing. We’ll then explore the latest news and developments that could potentially shape LTC’s value in the near future.

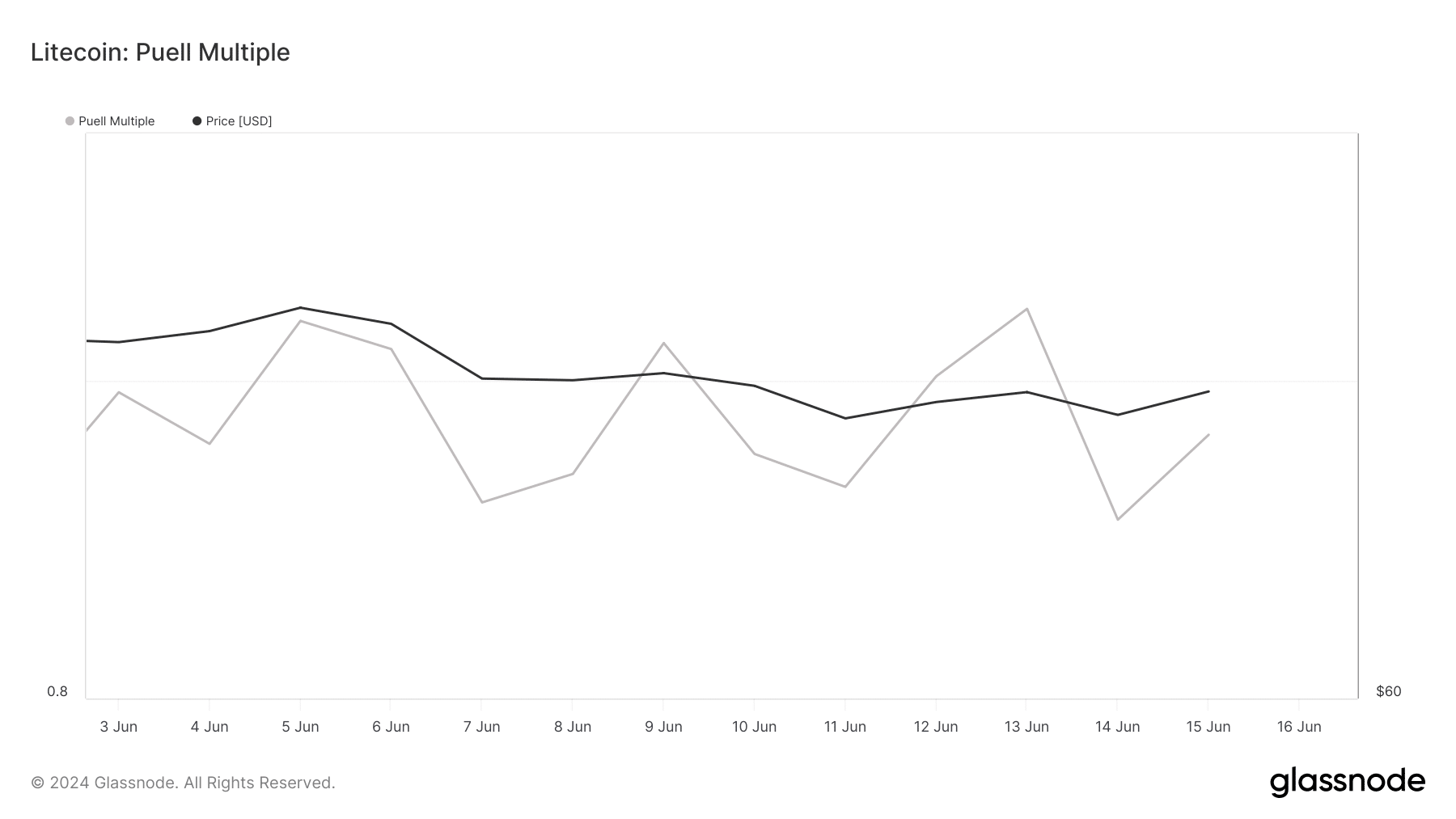

As a crypto investor, I started by examining the Puell Multiple. To put it simply, this indicator measures the relationship between the cost of mining a coin and its current market price.

As a crypto investor, I would interpret a decrease in the metric as miners experiencing lower returns on investment than their operational costs. On the other hand, an upward trend in the same metric implies that miners are generating more income than what it costs them to mine the cryptocurrency.

Increasing revenue has opened the floor for selling

When the value of a metric decreases, Litecoin may exhibit instability in the market. However, it’s essential to note that during this period, the cryptocurrency is considered underpriced based on historical standards. Currently, Litecoin’s Puell Multiple stands at 0.88.

A rise above 0.50 for LTC‘s reading indicates that it could be overpriced, potentially. Additionally, this surge could motivate miners to liquidate some of their assets, as they had previously been earning profits.

If the metric persists in increasing, there’s a possibility that Litecoin’s price may fall. At present, Litecoin is priced at $79.01, marking a 5.50% decline over the past 24 hours.

In the past, AMBCrypto evaluated the possibility of Litecoin trading below $80 for an extended period. Should miners opt to dispose of some of their LTC holdings, this forecast may materialize.

However, if they refrain from selling, it does not mean LTC would go on a long rally.

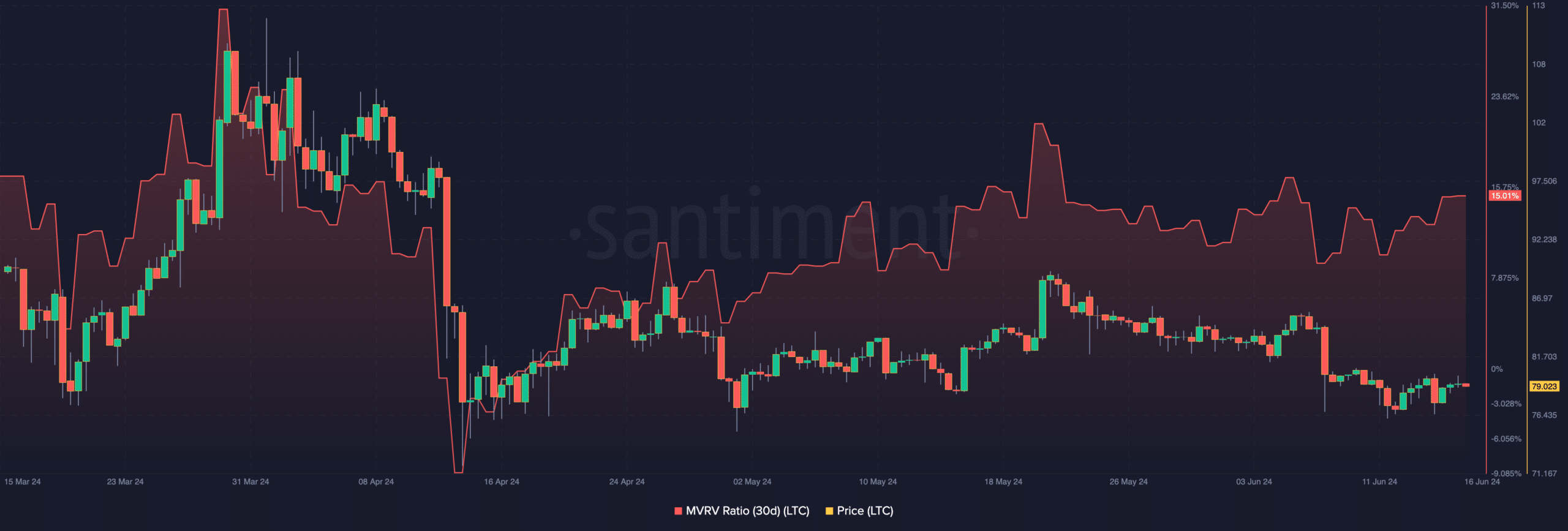

At present, the coin’s price could fluctuate between the $75 and $80.50 mark. Additionally, I noticed that the Market Value to Realized Value (MVRV) ratio stood at 15.01%.

LTC at risk, can’t depend on BTC and ETH

The MVR Realized Value (MVRV) indicator assesses the profitability for crypto holders, while simultaneously helping determine if a particular cryptocurrency may be underpriced.

Based on my analysis of the data, if the typical Litecoin investor were to sell their holdings, they could expect an average return of approximately 15%. Given the present market situation, this figure suggests that Litecoin may be underpriced.

As an analyst, I would put it this way: When Litecoin’s price drops, it’s likely that the ratio between its price and another asset may follow suit. Yet, over a longer time horizon, I anticipate Litecoin’s price to climb back up.

In a bull market, where prices are generally rising, the value of the coin could potentially increase to reach around $105.

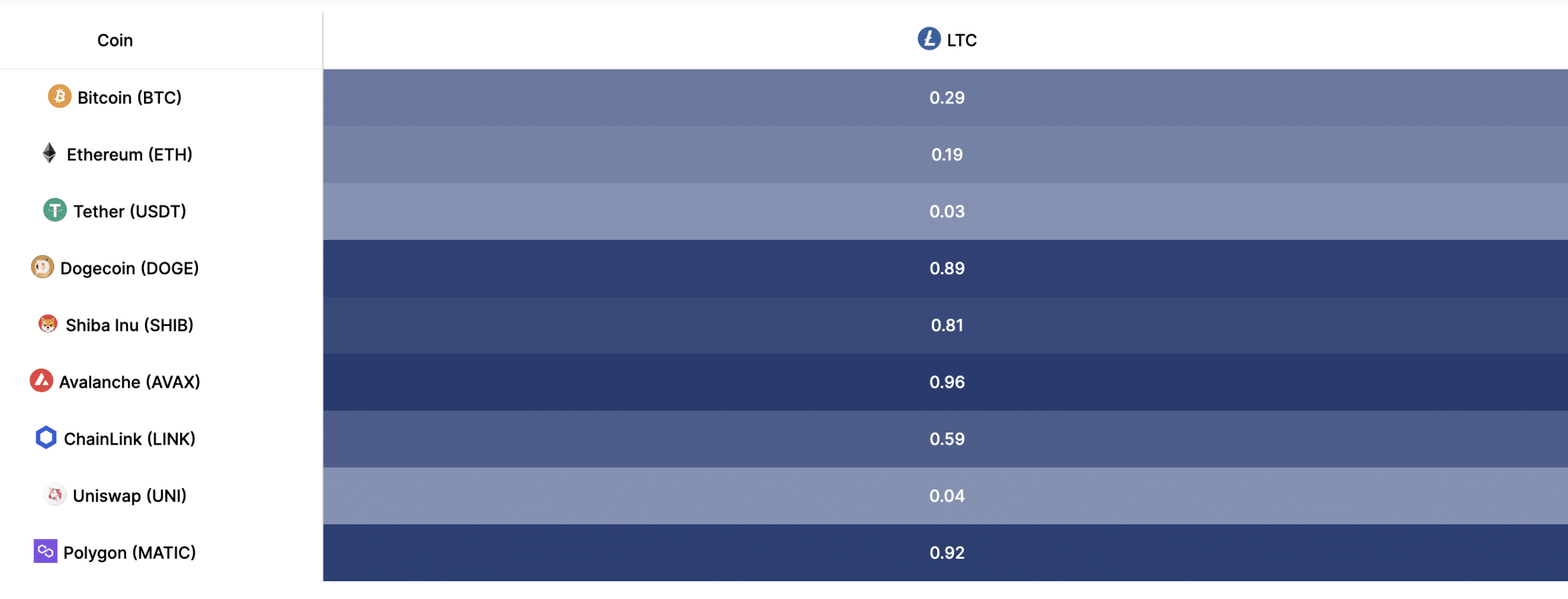

From my perspective as a researcher, setting a mid-to-long-term goal is an appropriate approach. Regarding your query, I investigated the potential influence of Bitcoin (BTC) and Ethereum (ETH) price movements on Litecoin (LTC).

In evaluating this, we examined the correlation measure given by IntoTheBlock. Ranging between -1 and +1, values closer to +1 signify a strong positive correlation.

In contrast, a value nearer to the negative end implies disparate results for LTC. At this moment, LTC’s correlation with Bitcoin is 0.29, while its correlation with Ethereum stands at 0.19.

Realistic or not, here’s LTC’s market cap in BTC terms

Therefore, if Bitcoin or Ethereum’s price increases, it is no guarantee that Litecoin would follow.

As a researcher studying the relationship between various cryptocurrencies, I find it intriguing that memecoins and other alternative large-cap coins exhibit a more pronounced correlation with Litecoin (LTC), rather than Bitcoin (BTC) or Ethereum (ETH).

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2024-06-17 10:15