- Analysts have drawn striking parallels between LTC and XRP, fueling speculation of a potential breakout.

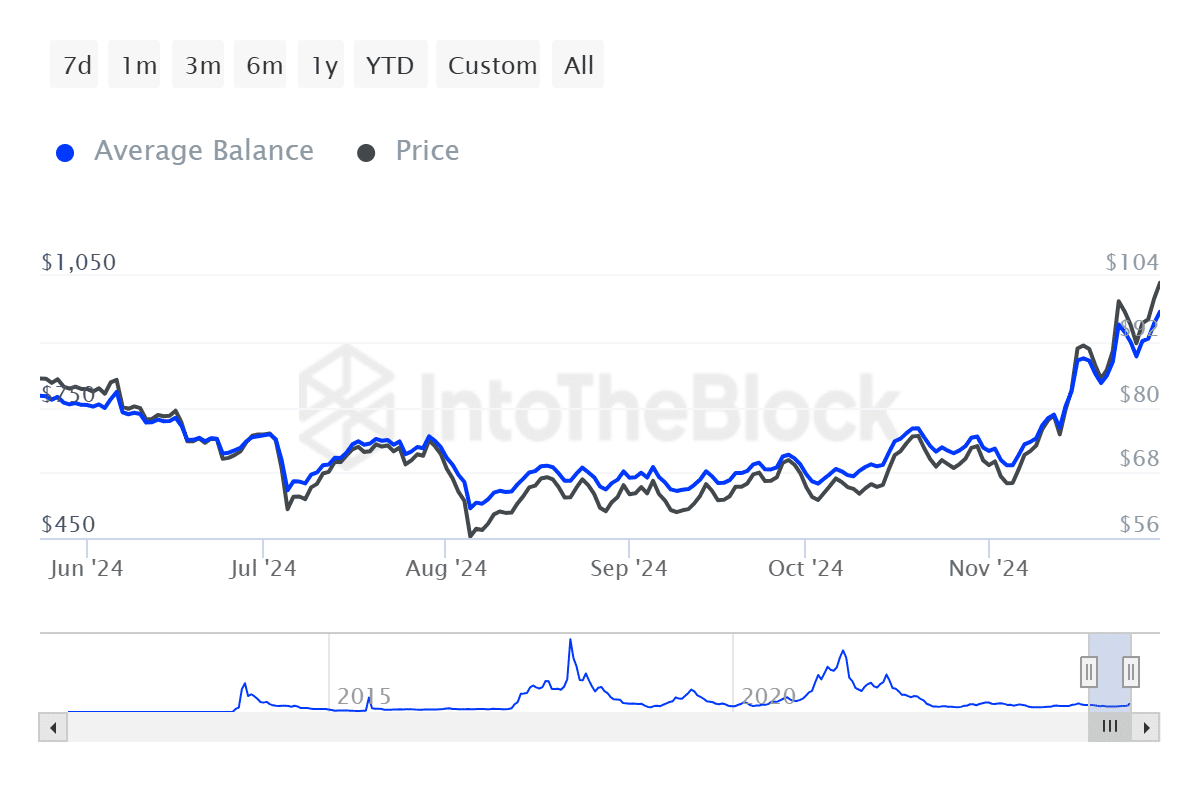

- Investor activity also supports this outlook, with the average balance of LTC-holding addresses showing a notable increase.

As a seasoned researcher with over a decade of experience in the cryptocurrency market, I have witnessed many bull and bear cycles. The recent surge in Litecoin [LTC] has caught my attention, especially given the striking parallels drawn between it and XRP.

In the last day, there’s been a 18.31% increase in Litecoin [LTC], fueled by growing investor attention and market momentum.

This increase in trading volume experienced a significant surge of approximately 305.15%, driven primarily by higher transaction activity.

As an analyst, I’ve noticed some intriguing similarities between Litecoin (LTC) and Ripple (XRP) in terms of price behavior. This observation leads me to speculate that Litecoin might experience a significant upsurge, reminiscent of XRP’s trend. Interestingly, this potential rise could occur independently of a broader altseason, suggesting a unique momentum for LTC.

THIS points to potential LTC breakout

As a keen crypto investor, I’ve noticed an intriguing observation by analyst Moonshilla – there appears to be a similar fractal pattern emerging in LTC’s price movement that resembles XRP’s trajectory when it was trading within the range of $0.40 and $0.60. This could potentially indicate a similar price trend for LTC, which is worth keeping an eye on.

Should this trend continue to unfold, there’s a possibility that LTC might surge by 3.5 times its current value, or even exceeding it, potentially reaching prices similar to those observed during the peak of the May 2021 bull market.

Moonshilla commented:

“LTC [is] about to print a god [candle] like XRP.”

The information hints at the significant upward trend that catapulted XRP to unprecedented peaks, according to its three-month graph analysis.

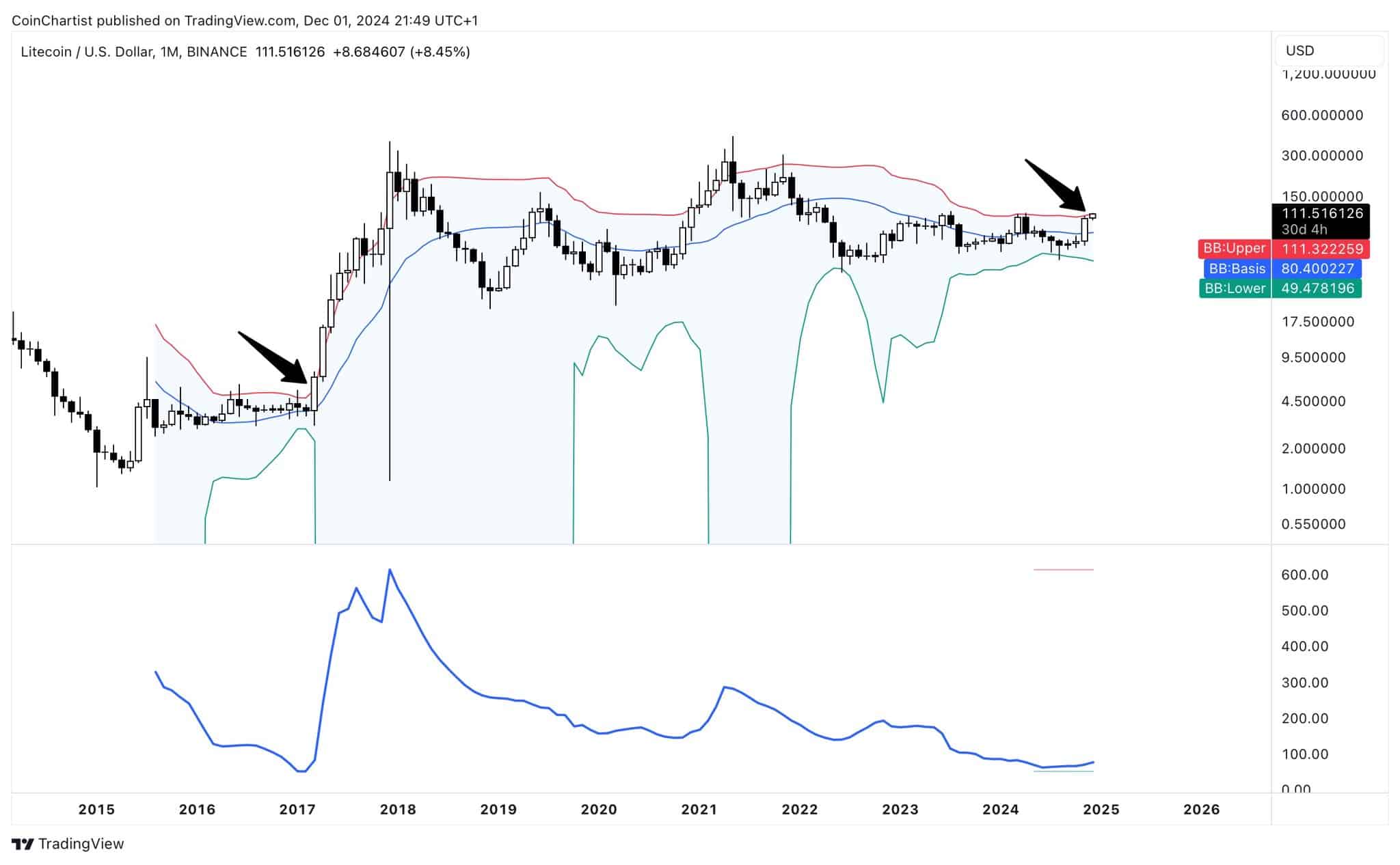

Analyst Tony, who correctly foresaw the significant price surge of XRP using Bollinger Band indicators when its value was at $0.726, has now spotted a similar pattern for Litecoin (LTC).

Tony’s examination indicates that Long Term Coin (LTC) is approaching the red outer limit on its monthly Bollinger Bands chart, reminiscent of XRP’s price action preceding its rally.

An increase in bandwidth, though slight, suggests rising market instability, typically followed by a rise in prices.

To clarify, the Bollinger Bands are formed by a midline representing a moving average, with upper and lower lines that adjust according to the level of market volatility.

The Bollinger Band Width, which measures the gap between the bands, is a reliable indicator of market volatility.

Historically, when a price exceeds the upper limit (peak) of the Bollinger Bands, and there’s also an expansion in the Bollinger Band Width, it frequently leads to significant market surges.

If LTC follows this pattern, it could be ready for a substantial breakout in the near term.

LTC gearing up for a potential rally

According to findings from IntoTheBlock and Coinglass, it appears that both spot and derivative investors are showing heightened buying activity regarding LTC, suggesting a growing level of enthusiasm towards Litecoin.

Over time, the typical amount of LTC (Litecoin) being stored across various wallets (Average Balance) has been consistently increasing. As I’m typing this, it has peaked at an impressive seven-day maximum of $968.16.

This rise indicates that an increasing number of digital wallets are stockpiling Litecoin, which is typically a positive sign that may lead to price increases in the future.

The data derived from this process lends credence to this perspective. As per Coinglass, we’ve witnessed a substantial closing out of bearish positions amounting to approximately $5.51 million – an event that takes place when the market shifts adversely for such positions.

Read Litecoin’s [LTC] Price Prediction 2024–2025

Such liquidations often amplify bullish momentum as traders reposition.

Should these tendencies continue in tandem with increasing trade volume and ongoing acquisition, it’s likely that the price of LTC might witness additional growth.

Read More

2024-12-02 17:12