-

Whales accumulated almost $230 million worth of LTC.

The LTC price trend remained relatively flat.

As a seasoned crypto investor with a few years of experience under my belt, I’ve seen my fair share of price trends and market movements. The recent accumulation trend in Litecoin [LTC], despite the relatively flat price trend, has piqued my interest.

Over the past month, Litecoin (LTC) hasn’t shown any notable price improvement. After touching the $100 mark during March and April, it experienced substantial drops.

In spite of recent price decreases, major investors have regarded this as a chance to acquire more Litecoin, purchasing vast quantities within the past month. Conversely, Open Interest for Litecoin has shown little change throughout this timeframe.

Litecoin sees massive 30-day accumulation

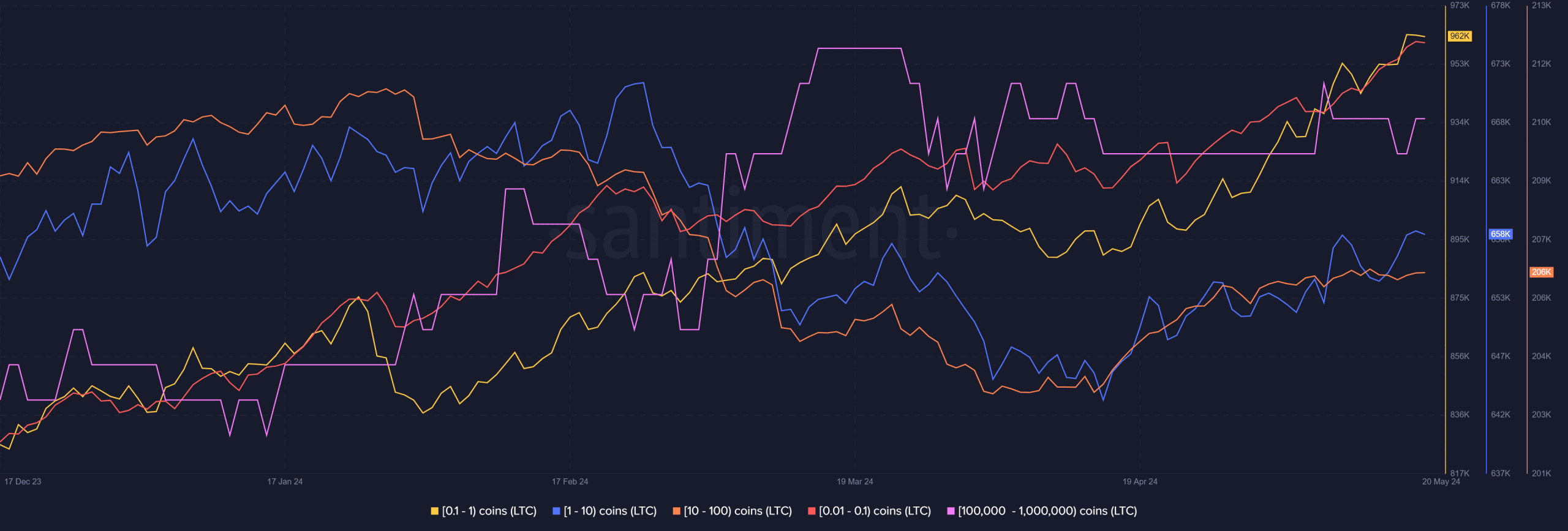

Based on the latest findings from IntoTheBlock, there has been noticeable buying activity from large investors or “whales,” who have amassed approximately 2.751 million Litcoin (LTC) within the past month.

As a financial analyst, I’ve calculated that the total value of this accumulation came in at over $229.7 million based on current market prices. Interestingly enough, on May 10th, these specific addresses experienced a significant inflow of around 900,000 Litecoins. This is the most notable increase in netflow for these addresses since February.

As a crypto investor, I’ve noticed an intriguing trend in the distribution of Litecoin (LTC) supply. Smaller wallets have been amassing LTC over the past few months, but it’s the larger wallets that have acquired the most during this period.

Interestingly, this accumulation trend has continued despite the declining price trend of LTC.

Litecoin hangs on to its bull trend

In analyzing Litecoin’s daily price trend with AMBCrypto, it was noted that the short moving average, represented by the yellow line, acted as a resistance barrier between the prices of $86 and $90.

Currently, LTC is priced approximately at $83.5 in the market, representing a growth of more than 1% based on AMBCrypto’s recent evaluation.

The long Moving Average (blue line) appeared to be a solid support level at around $77 to $78.

Following a close call where its value dipped beneath the horizontal support, the latest surge in the price of LTC has successfully propelled it above this level once more.

At the point of writing, the RSI analysis showed the indicator lying above the neutral threshold, implying a potentially bullish market trend, though not particularly strong.

LTC sees flat interest

As a researcher examining the data from AMBCrypto’s analysis on Coinglass, I discovered that Litecoin’s open interest surpassed $600 million in March. However, by April, it had decreased to approximately $500 million.

As an analyst, I’ve noticed that the figure dropped substantially towards the end of April, reaching approximately $330 million.

Currently, Open Interest for LTC hovers around $340 million – a figure that signifies a recent decrease in investment flow into this cryptocurrency.

AMBCrypto’s examination of LTC’s Funding Rate showed that it remained positive, staying above zero.

Despite a larger number of buyers than sellers, the volume was still relatively small, implying a subdued attitude towards Litecoin based on these market indicators.

Read More

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

2024-05-21 01:11