- Litecoin exhibited bearish long-term signals, with a “death cross” of the MA50 below the MA200.

- Indicators like the Fear & Greed Index and RSI indicated a bullish turn.

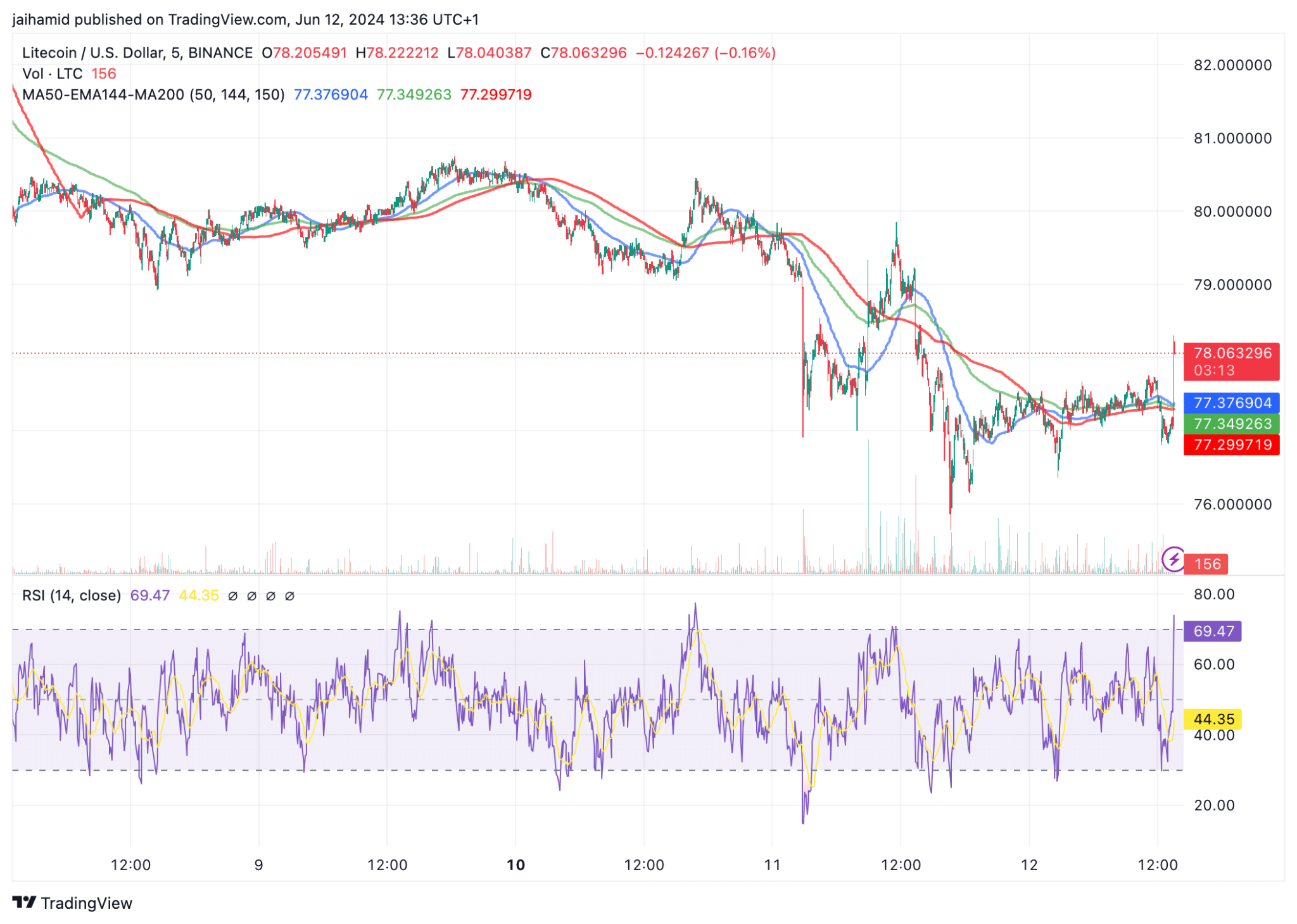

As a seasoned crypto investor with several years of experience under my belt, I’ve learned to read the charts and interpret various indicators. Litecoin (LTC) has been exhibiting bearish long-term signals for quite some time now. The death cross formed on its chart when the 50-day moving average crossed below the 200-day moving average, a classic bearish signal that indicates the long-term momentum has turned bearish.

As a crypto investor, I’ve noticed that Litecoin [LTC] has been displaying ominous bears signs for the past month. It seems like an invisible force is preventing the bulls from making a comeback.

As of now, the value of the altcoin has risen by 2% within the last day due to the recently released U.S. Consumer Price Index (CPI) figures. Could it be possible that the bulls are regaining control?

In simpler terms, the graph of LTC to USDT’s value indicates that the 50-day average (represented by the blue line) has lately dropped beneath the 200-day average (signified by the red line). This occurrence is commonly referred to as a “death cross,” which is a bearish indication.

As a crypto investor, I’ve noticed a shift in the market trend which suggests that the long-term momentum has become bearish. Yet, there are signs of shorter-term volatility as my exponential moving average (represented by the green line) continues to fluctuate above these bearish indicators.

The RSI was at 61.78 at press time, which was neither in the overbought nor oversold territory.

The market indicated a slight inclination toward positive sentiment in the immediate future, despite the absence of significant purchasing or selling activity.

As a researcher observing the financial markets, I’ve noticed a persistent downtrend over the last month, which may have dampened investors’ optimism. For the bulls to make a comeback, we would require a significant market-moving event or a broader market upturn.

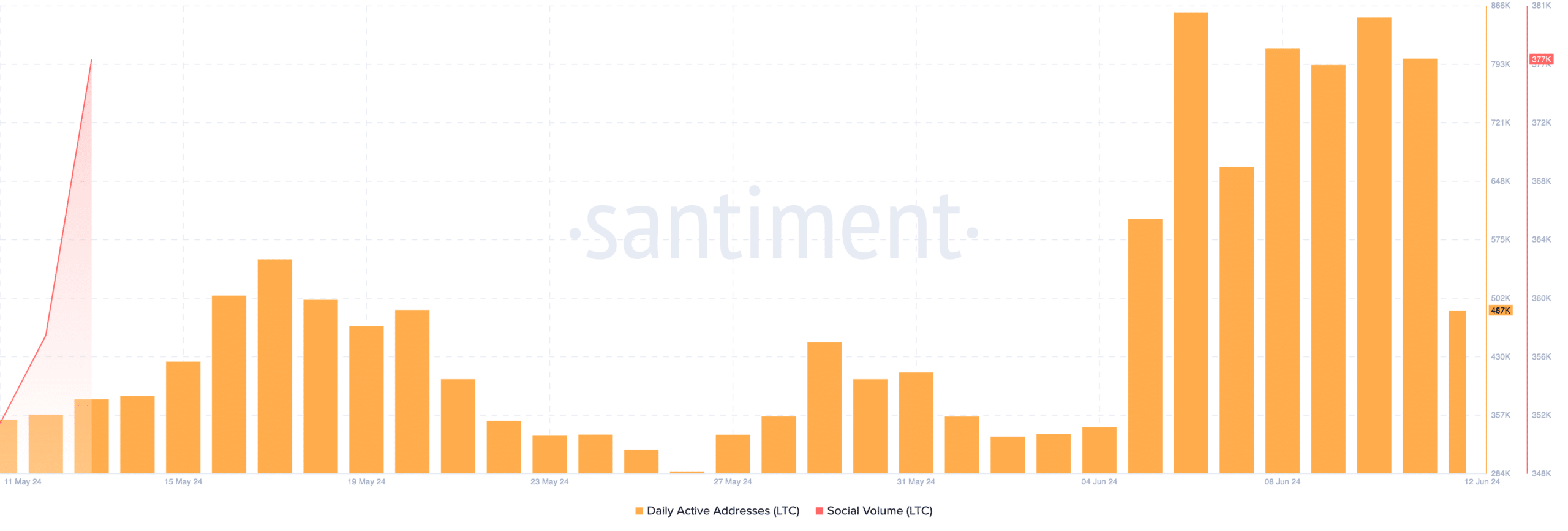

I’ve noticed an intriguing uptrend in the number of daily active addresses, which has recently hit a new high point coinciding with a price reversal. Additionally, there’s been a surge in social media buzz and influence surrounding this asset.

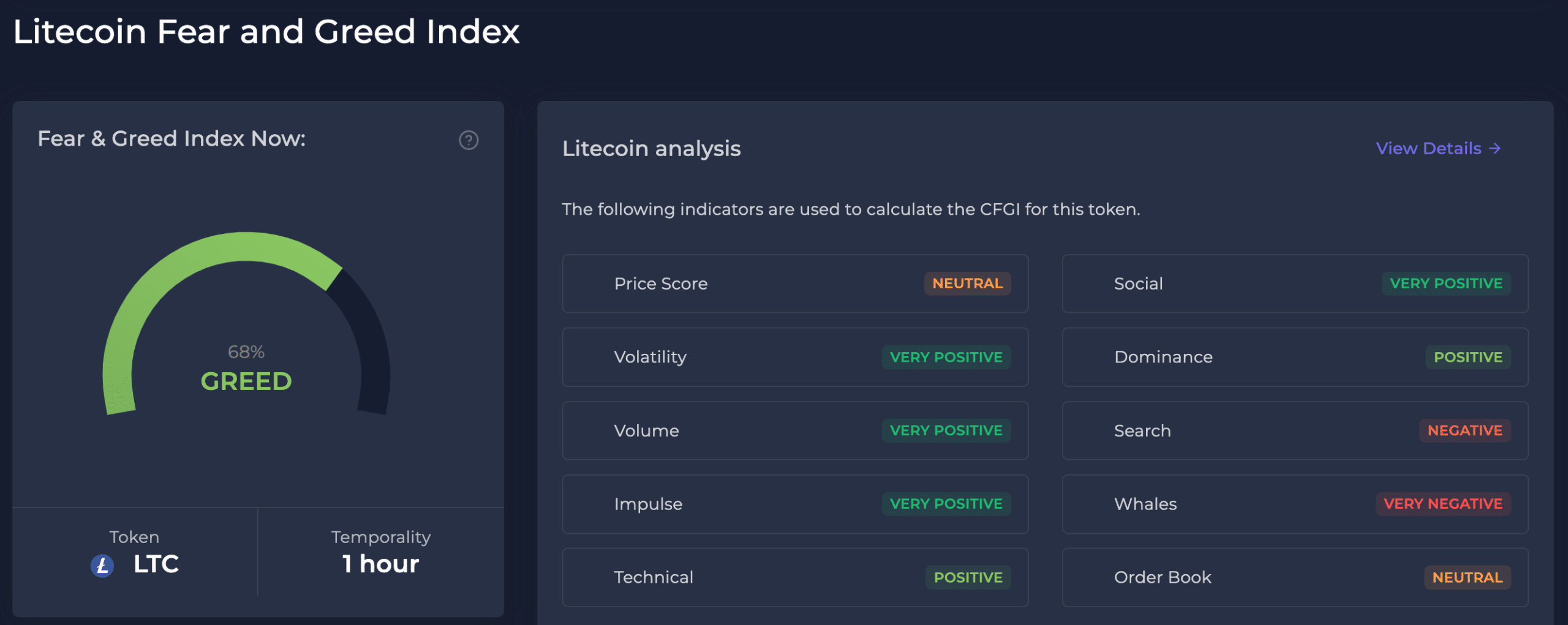

At the present moment, Litecoin’s Fear and Greed Index indicated optimistic signals, registering a “Greed” level of 68%.

As a researcher, I’ve observed that during the period when I penned down my findings, both traders and investors found themselves amassing or accumulating assets. This phase often precedes a market rally.

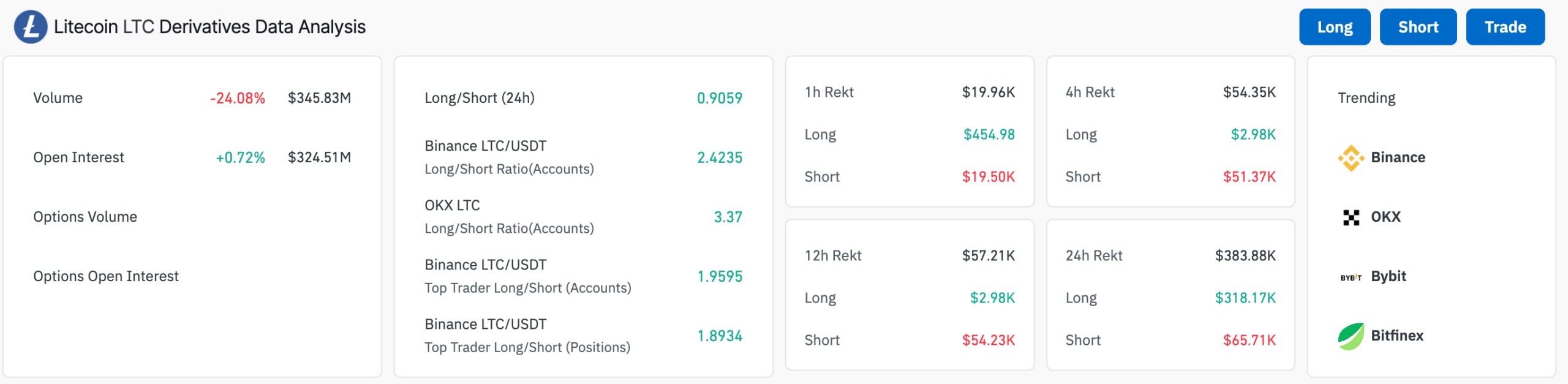

In the derivatives market, the bearish sentiment towards LTC remained strong. Despite a slight uptick in Open Interest, the trading activity for this cryptocurrency had significantly decreased.

Realistic or not, here’s LTC’s market cap in BTC terms

The long-to-short ratio indicated a pessimistic outlook, but traders on Binance and OKX showed signs of optimism.

As a researcher studying Long-Term Care (LTC) investments, I’ve observed that despite limited market involvement, there has been a slight shift towards optimism among participants. In other words, the number of bullish investors has slightly surpassed the bearish ones in this niche market.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Gold Rate Forecast

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- SOL PREDICTION. SOL cryptocurrency

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Solo Leveling Arise Tawata Kanae Guide

2024-06-13 10:15