- Whales accumulated 250K LTC in six days as holdings surge to 48.89M – largest sustained buying spree since December rally.

- CanaryFunds’ amended S-1 filing coincides with LTC’s 16.1% market cap jump and $118 breakthrough.

The price of Litecoin (LTC) has climbed beyond important resistance points, reaching a high of $118.35. This increase is being driven by rising institutional investment and substantial purchases by large investors, commonly known as “whales.

The action aligns with CanaryFunds revising their S-1 ETF filing, implying possible regulatory interaction that may redefine the market flow of Long Term Care (LTC).

ETF optimism: CanaryFunds’ filing sparks speculation

As a crypto investor, I’ve been riding the waves of excitement since CanaryFunds submitted an amended S-1 filing for a Litecoin ETF. While it’s important to note that this filing is yet to receive the SEC’s 19b-4 approval, it’s a promising sign of potential regulatory involvement in the world of Litecoin. This news has rekindled my hope for increased institutional investment opportunities in Litecoin, and I can’t help but feel optimistic about the future.

Historical patterns indicate that the possibility of an ETF might trigger speculative purchasing, similar to what happened with Litecoin separating from other cryptocurrencies during its rise. If it gets approved, an ETF could revolutionize the market, leading to increased adoption and liquidity.

Whale activity: The fuel behind Litecoin’s rally?

Data from blockchain transactions indicates a significant increase in large-scale LTC holders’ actions. Specifically, wallets containing more than 10,000 Litecoins have amassed approximately 250,000 Litecoins since the 9th of January.

This rapid build-up trend recalls the actions seen back in early December, as whales’ collective ownership of LTC reached approximately 48.89 million LTC.

This build-up occurred as Litecoin’s price surpassed $118 for the initial time in 2025, and the intense purchasing demand from substantial holders typically precedes major price changes in the past.

Market cap surge reflects growing confidence

In the past eleven hours, Litecoin’s total market value surged by an impressive 16.1%, signaling a resurgence of investor trust within the market.

This spike in value, diverging from overall altcoin patterns, occurs concurrently with the revised ETF application submission. This could indicate that institutions are preparing their positions in anticipation of possible future regulatory changes.

The behavior of LTC’s price suggests a strong technical structure, as its 50-day moving average sits at $111.62, noticeably higher than its 200-day moving average which stands at $80.01.

Based on the Bollinger Bands (which currently stand at 105.90, 118.43, and 93.36), we can expect heightened market volatility. The price is approaching the upper band, suggesting a robust bullish movement, even after the recent price increase. In simpler terms, this means that the stock’s price fluctuations may become more pronounced, and the optimistic outlook remains strong.

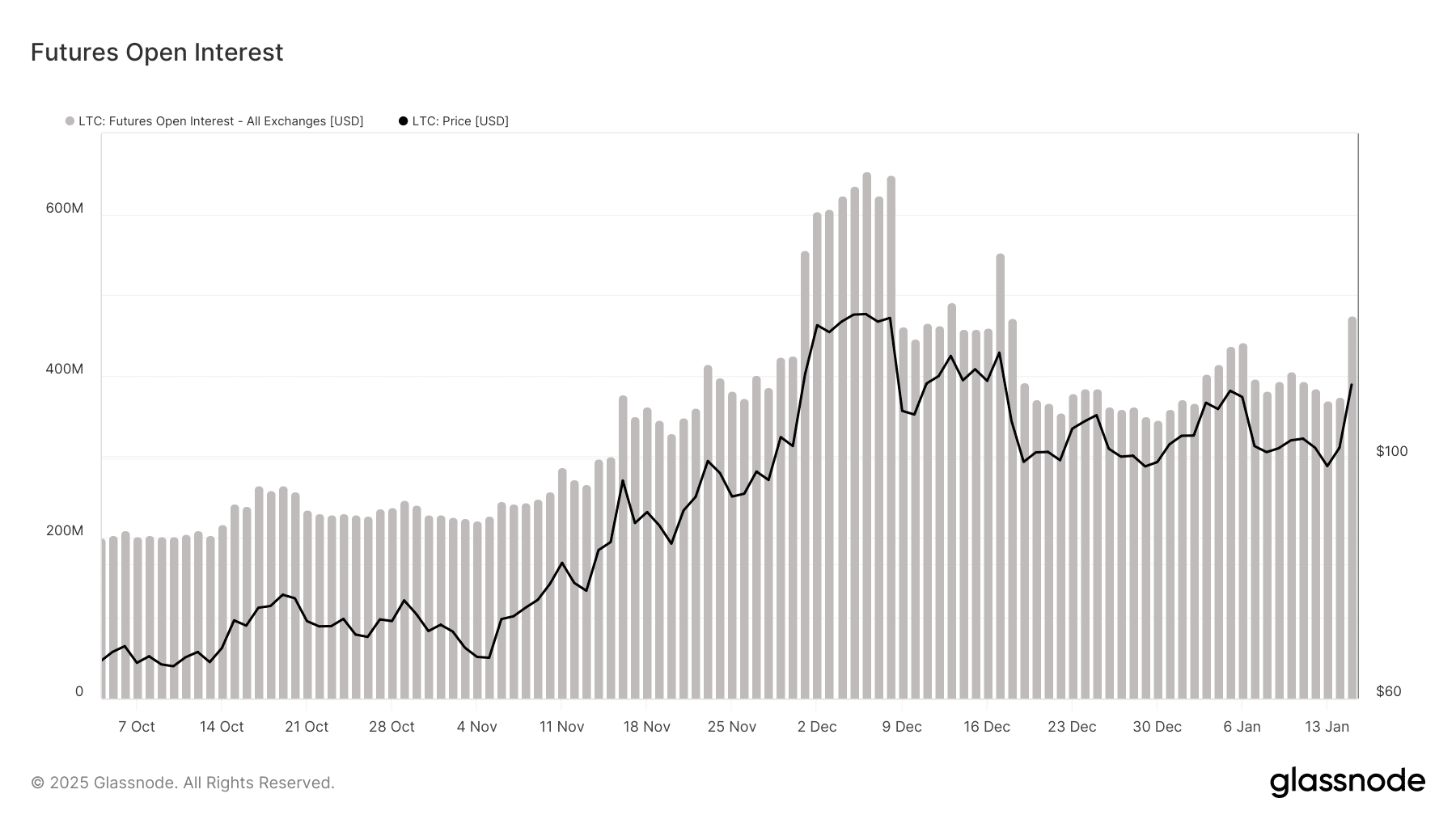

Derivatives market shows increased interest

The total amount of Litecoin contracts being held open on various trading platforms now exceeds $474 million, indicating a surge in trading volume and increased institutional trust.

The pattern indicates that experienced investors might be accumulating holdings, possibly in expectation of favorable news concerning the ETF submission.

Moving forward, the short-term hurdle for LTC is located around the $120 mark, where there’s been significant whale buying activity that offers robust support at approximately $115.11.

The combination of institutions building up their holdings through direct purchases (spot accumulation) and strategic placement in derivative markets (derivatives positioning) indicates a possible prolonged upward trend, especially if the ETF application process maintains steady advancement.

The strong foundation, backed by significant whale investment and growing institutional attention, strongly suggests that the positive trend will persist. Yet, traders need to keep an eye on ETF advancements as they might trigger further momentum.

Read More

2025-01-16 20:09