-

Both Litecoin and XRP registered double-digit growth last week.

LTC’s network activity remained considerably higher than that of XRP.

As a seasoned crypto investor with years of experience under my belt, I have closely observed the recent price movements and metrics of Litecoin (LTC) and Ripple’s XRP. Last week, both cryptos registered impressive gains, with LTC rising by 13% and XRP soaring by over 26%.

I’ve observed a shift in the cryptocurrency market towards bullish trends recently. Consequently, coins such as Litecoin (LTC) and Ripple‘s XRP have seen their prices rise, indicating green gains on their respective price charts.

If the most recent assessment holds true, Long Term Coin (LTC) could potentially mount a rally that surpasses XRP‘s current performance. Let’s delve deeper into which cryptocurrency presents a stronger short-term outlook.

Litecoin and XRP bulls are here

Last week, the pricing trends for XRP and LTC took a bullish turn according to data from CoinMarketCap. Specifically, XRP experienced a surge of over 26%, while LTC saw its price climb by nearly 13%.

At the time of writing, XRP and LTC were trading at $0.53 and $70.6, respectively.

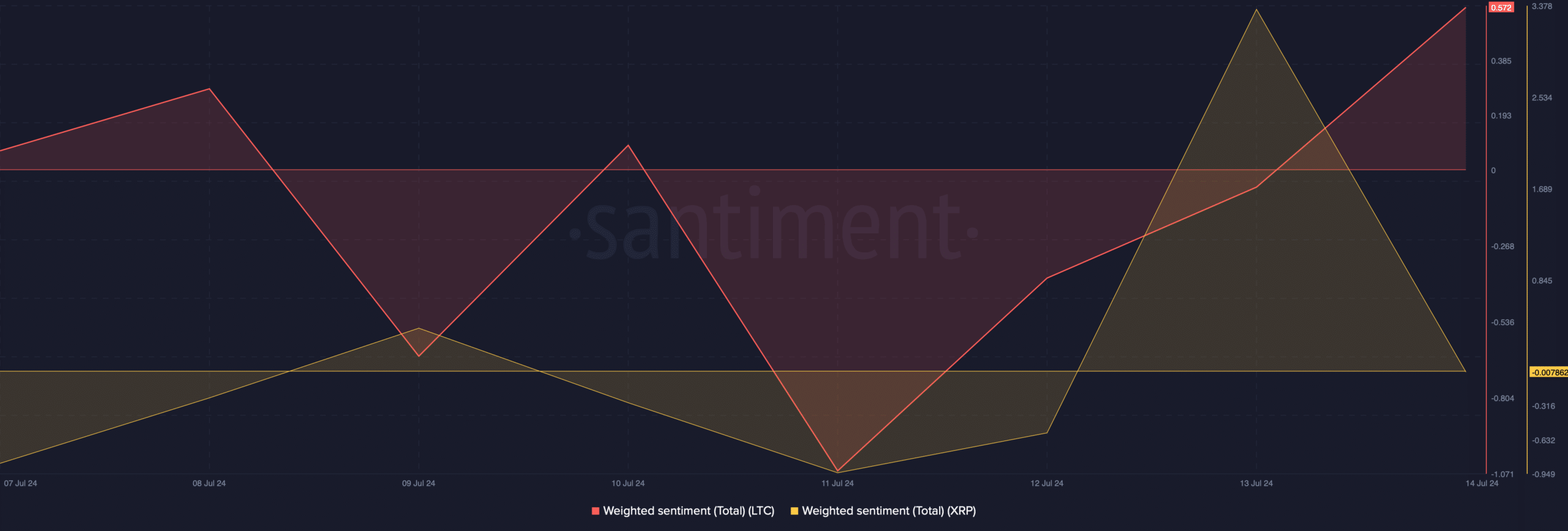

Due to the latest price surge, the sentiment scores for both cryptocurrencies have shifted positively. This signifies that optimistic views towards them are gaining traction within the market.

Despite XRP experiencing almost twice the growth as Litecoin (LTC) recently, current market forecasts indicate that LTC may outperform XRP in the future.

Expert note: Master, a well-known cryptocurrency analyst, recently shared on Twitter his observation that the Livingston Token (LTC) and Ripple (XRP) chart has been forming a consolidation pattern.

If LTC manages to surpass its current pattern in price, this could lead to a significant price increase, potentially making Litecoin a stronger contender than Ripple in the upcoming period.

LTC vs XRP

To determine if LTC might surpass XRP‘s performance in the future, AMBCrypto examined their respective short-term indicators based on the possibility of LTC’s superiority in the long run.

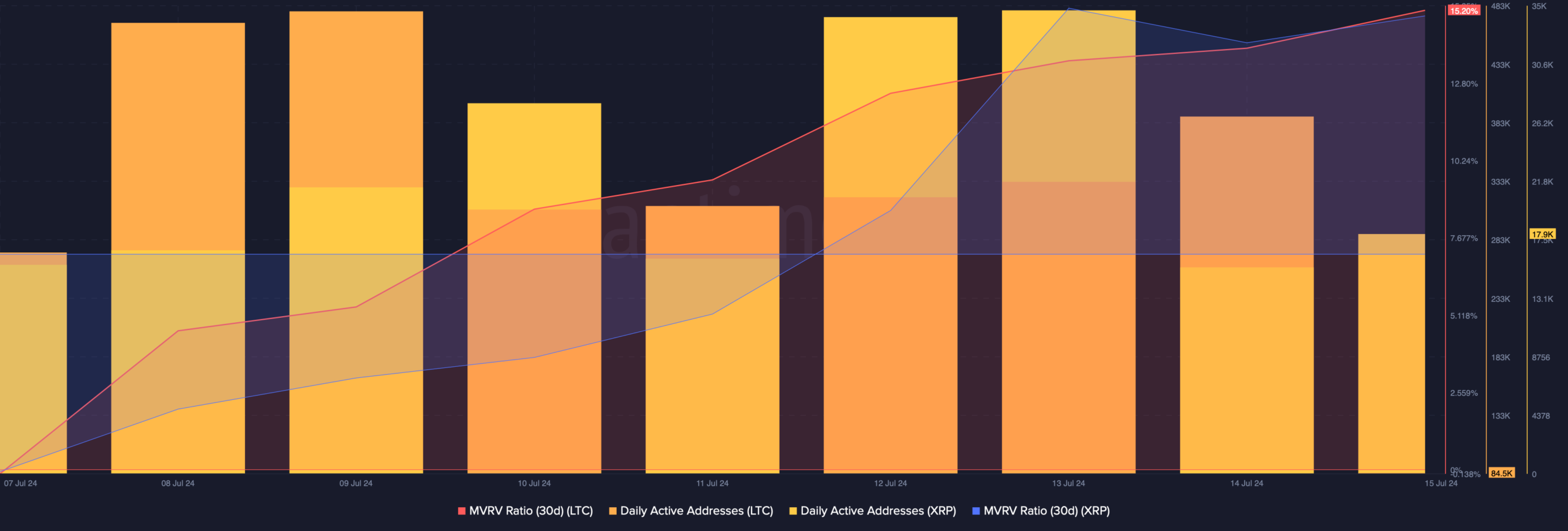

According to AMBCrypto’s interpretation of Santiment’s findings, an uptick in the MVRV (Market Value to Realized Value) ratios for both Litecoin and XRP signifies a potential bullish trend. Specifically, XRP’s MVRV ratio was at 11.8%, while Litecoin’s metric registered a higher value of 15%.

Despite XRP and other competitors having their merits, Bitcoin stood out with more network activity as indicated by a greater number of daily active addresses in comparison to Litecoin and other altcoins.

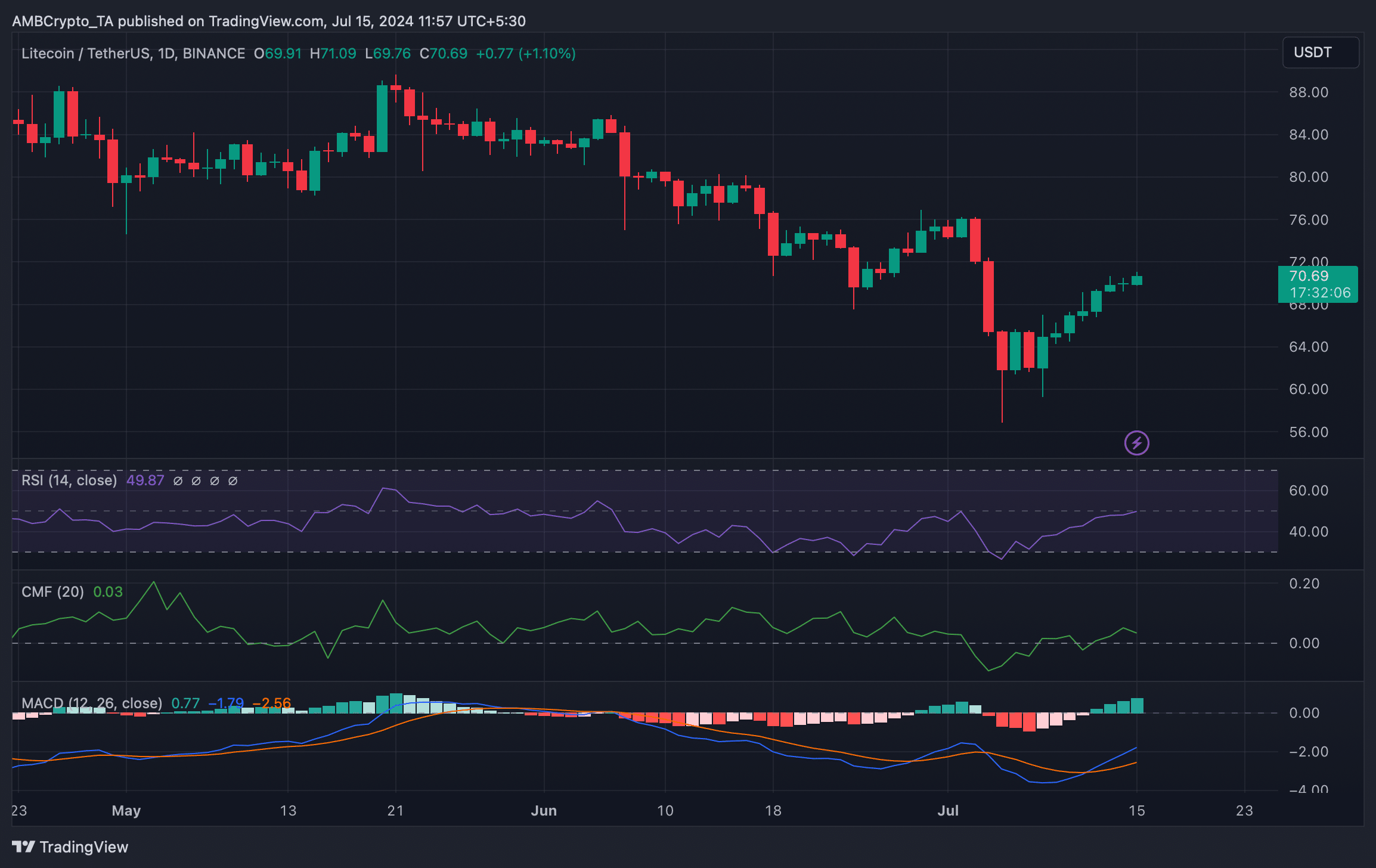

In examining LTC‘s daily price chart, we identified several bullish indicators. One such indicator was the Moving Average Convergence Divergence (MACD) line, which showed a positive difference between the two moving averages, indicating a potential buying opportunity in the market.

The RSI indicator signaled a surge, implying further price growth, yet the CMF indicated contradictory information with its decline.

Is your portfolio green? Check the Litecoin Profit Calculator

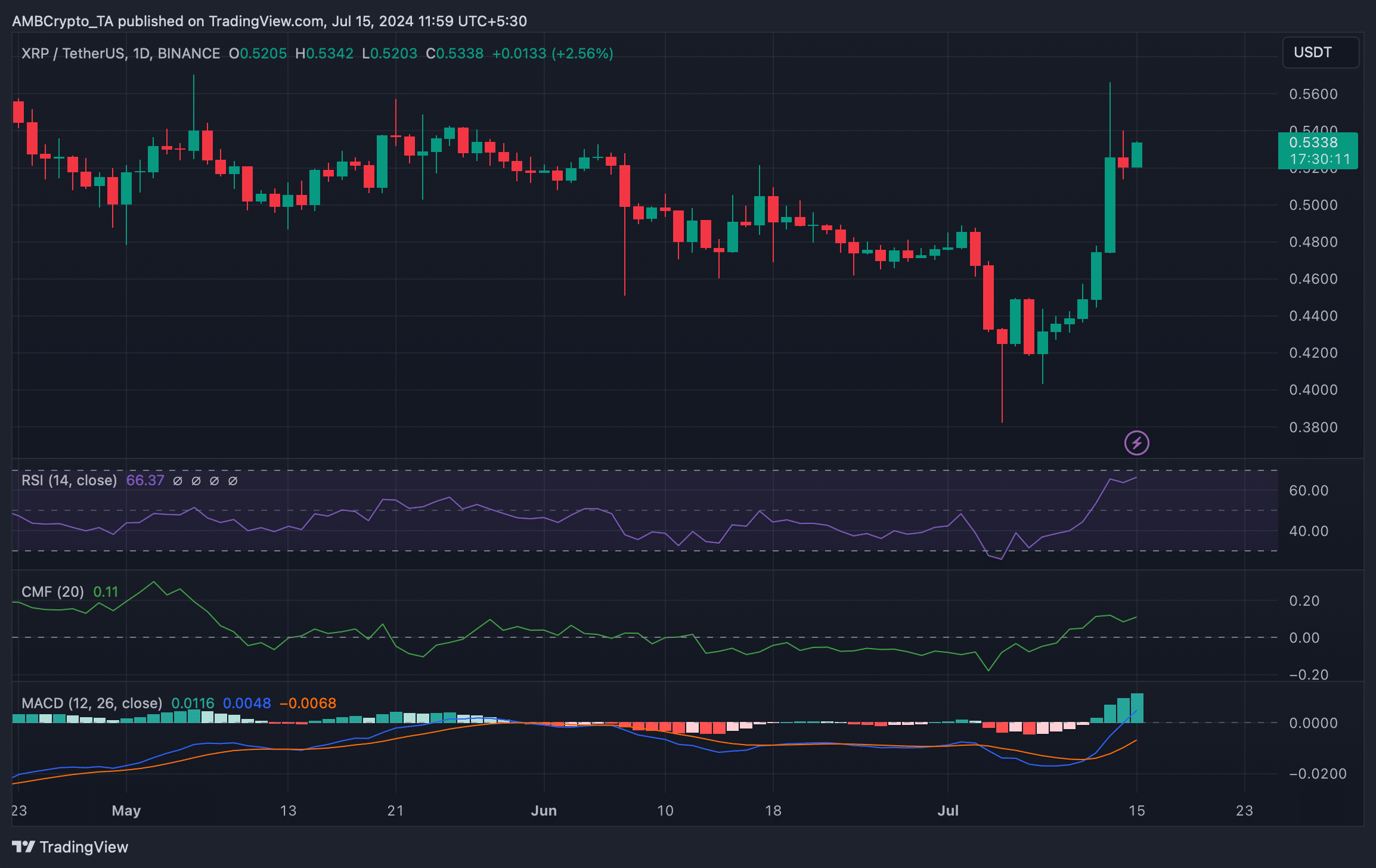

As a researcher observing the cryptocurrency market, I noticed that despite some instability in the market, XRP‘s position appeared more secure. This was evident in the bullish signals from several key indicators. For instance, both its Chaikin Money Flow (CMF) and Relative Strength Index (RSI) showed positive upticks.

Just as Litecoin’s moving average convergence divergence (MACD) signaled a bullish trend in the market, so did Ripple’s MACD. This implies that if this trend continues, it may take more time for Litecoin to surpass Ripple in performance.

Read More

- Disney’s Animal Kingdom Says Goodbye to ‘It’s Tough to Be a Bug’ for Zootopia Show

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- The Weeknd Shocks Fans with Unforgettable Grammy Stage Comeback!

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- Taylor Swift Denies Involvement as Legal Battle Explodes Between Blake Lively and Justin Baldoni

- Hut 8 ‘self-mining plans’ make it competitive post-halving: Benchmark

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- Elevation – PRIME VIDEO

2024-07-15 20:08