-

Investors are willing to hold LTC, indicating the price might get close to 2021’s peak.

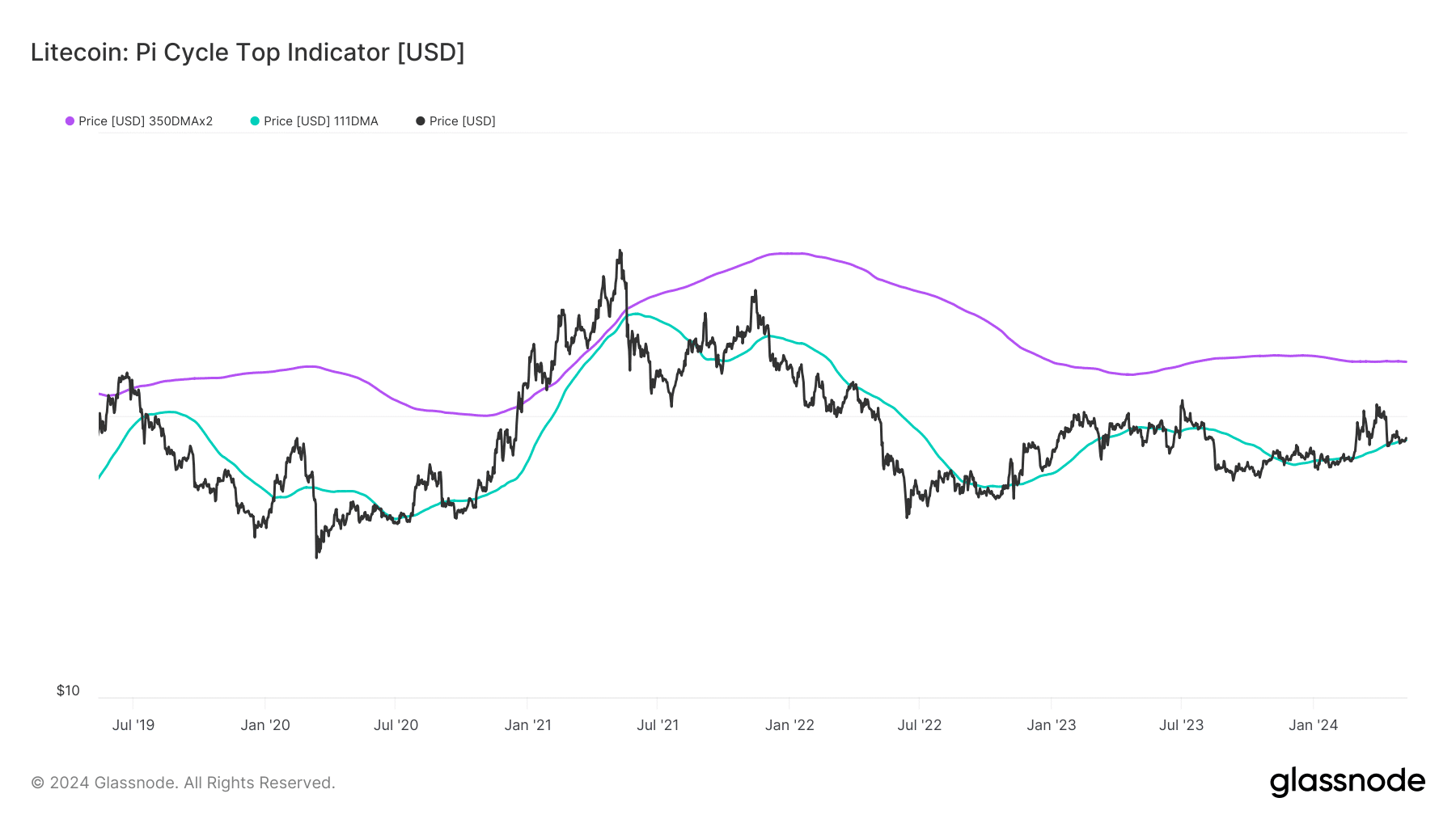

The Pi Cycle Top showed that LTC was not yet overheated.

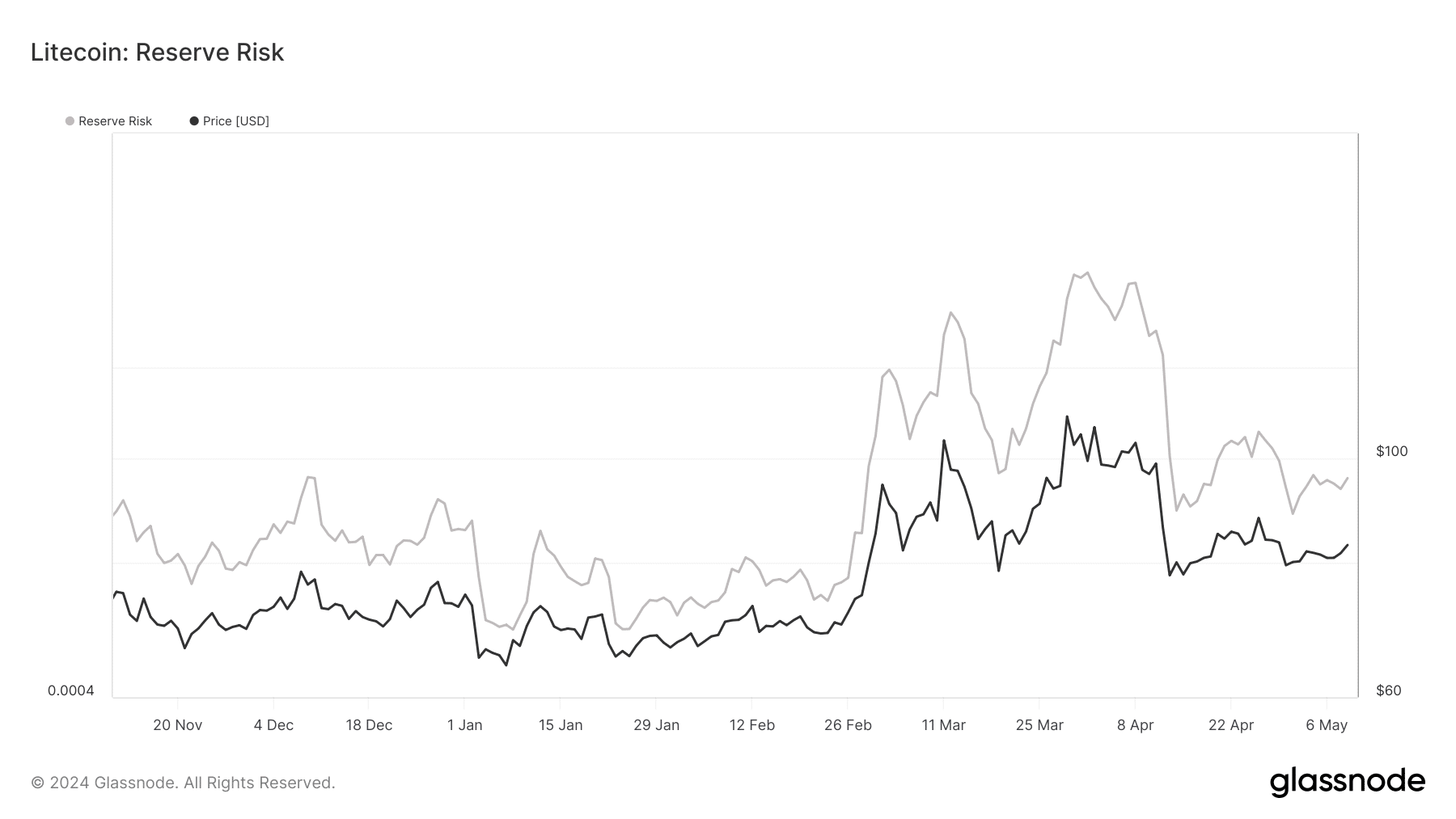

As a seasoned crypto investor with a few years of experience under my belt, I’m keeping a close eye on Litecoin (LTC) and the signals it’s sending. The recent correction in its price to around $80.61 from its previous high was a 15.60% drop within the last month. However, AMBCrypto’s analysis of Litecoin’s Reserve Risk has piqued my interest.

To reach a price of $250 for Litecoin (LTC), its value must rise by over 150% compared to its current price of $80.61.

In the past thirty days, there was a 15.60% decrease in this value. Yet, according to AMBCrypto’s evaluation of Litecoin’s Reserve Risk, more favorable conditions may lie ahead.

As a dedicated crypto investor, I’d like to introduce an alternative label for Reserve Risk – it goes by the name of “HODL bank” in our community. For those newcomers, HODL is an acronym derived from the typo of an early Bitcoin forum post where the author urged others to “hold on to their bitcoins dearly,” regardless of price fluctuations.

The stakes are high

Using the Reserve Risk, traders can determine if long-term investors are assured about the asset’s price or not. A high price accompanied by low confidence implies an uncertain risk-to-reward ratio, potentially making it less attractive for trading bets.

Yet, an increasing Reserve Risk in conjunction with a low value suggests strong belief in the coin’s long-term worth, which applied to Litecoin as well.

Based on current trends, it’s possible that this metric will go on to record further growth. If so, the value of LTC could potentially reach and even surpass the $100 mark once more. Should LTC succeed in breaking past $100, a potential increase of another 100% could follow.

If the current trend continues, reaching a price of $250 for Litecoin is a distinct possibility. This was the last recorded price back in November 2021.

Following that point, the value has seen a downward trend. Nevertheless, AMBCrypto identified another potential factor contributing to the price rise. Specifically, they referred to the Pi Cycle Top indicator.

LTC shows signs of expanding

In this graph, there are two distinct lines. The first line is green and signifies the 111-day Simple Moving Average (SMA). The second line is purple and indicates the 350-day Simple Moving Average (SMA).

As a researcher studying historical price trends, I’ve observed that prices tend to peak when the shorter Simple Moving Average (SMA) aligns with the longer SMA. For instance, in the last quarter of 2021, Litecoin’s price dropped significantly from $385 to $136 over a period of months after these averages converged.

At the moment of reporting, the data indicated that the 111-day simple moving average (SMA) was situated at a lower level than the 350-day SMA for Litecoin (LTC). This observation suggests that there is significant potential for LTC to continue rising during the ongoing bull market.

As a researcher studying the trends of the cryptocurrency market, I can affirm that the current standing of this specific metric adds credence to my hypothesis that Litecoin’s value could potentially reach $200 or even $250 within the next few months. However, it is essential to note that this may not occur right away.

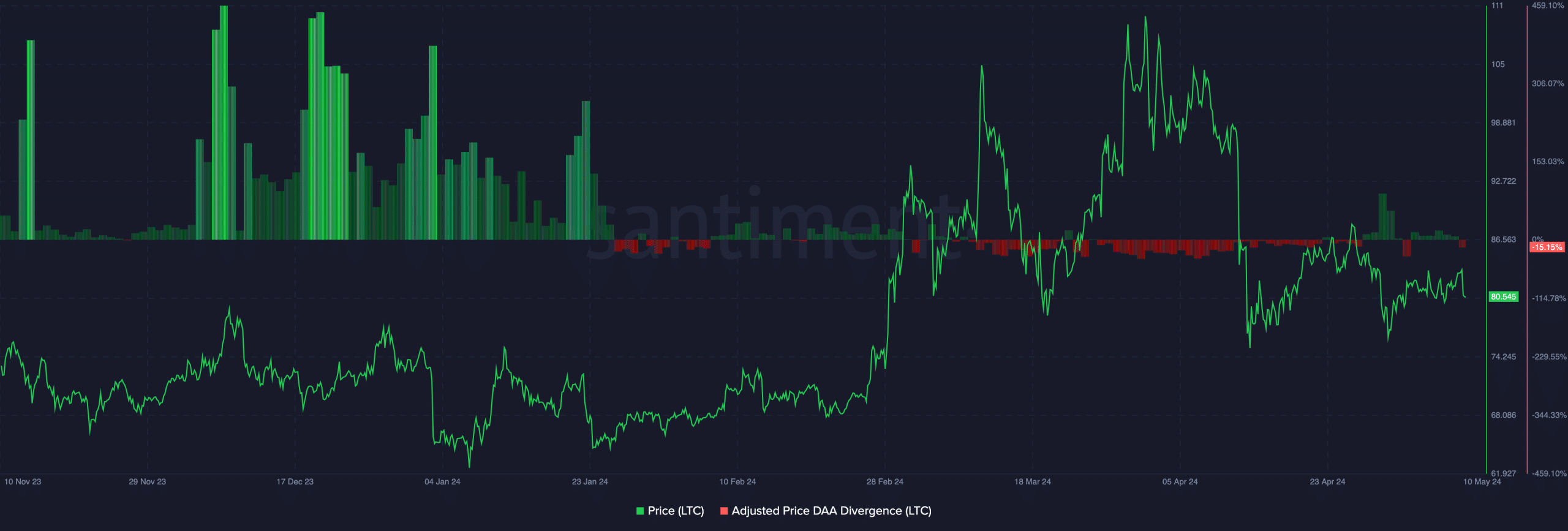

During the same period, the price difference against the daily active address activity indicator (DAA) stood at a discrepancy of 15.15%, based on information from Santiment. The DAA represents the count of distinct cryptocurrency addresses engaging in transactions within that network.

As a market analyst, I would interpret this by saying: When considering both the price and the number of active addresses (DAA) for Litecoin, potential entry and exit points can be identified. The price data indicated that it had increased at a faster rate than the number of active addresses in recent times, suggesting a negative trend.

Read Litecoin’s [LTC] Price Prediction 2024-2025

As a market analyst, I would interpret this situation from a trading standpoint as indicating a buy signal for Litecoin (LTC). This potential development could represent a unique chance for investors to accumulate Litecoin at relatively lower prices.

Market players should be cautious and consider additional indicators before committing to a purchase price.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- Sea of Thieves Season 15: New Megalodons, Wildlife, and More!

2024-05-11 13:11