- LTC has seen declines after its spike in November.

- It has managed to stay above critical levels despite the declines.

As a seasoned analyst with years of experience navigating the complex and ever-evolving world of cryptocurrencies, I’ve seen my fair share of market ebbs and flows. Litecoin (LTC) has been a consistent player in this game, and its recent breather after the November spike is just another chapter in its intriguing narrative.

In the recent trading session, Litecoin (LTC) experienced a brief pause before embarking on a significant upward trend that followed periods of decline. The market has become more active, and there’s been an observable increase in the number of daily active addresses for LTC, indicating that it’s reclaiming its position in the market.

This piece delves into the movement of Litecoin’s pricing, patterns in its active addresses, and the implications of these indicators.

Key levels to watch in Litecoins’s price trend

The present value of Litecoin, approximately $106, slightly surpasses its vital support point at $100. This important barrier is further bolstered by the 50-day moving average, a line that has frequently acted as a protective cushion for this digital currency.

Positively speaking, the $120 mark continues to be a significant barrier due to the heavy selling pressure experienced during past attempts to surpass it in December.

The intersection of the 50-day and 200-day moving averages, with the former rising above the latter, consistently indicates a positive outlook. If Litecoin maintains its current pace and surpasses the $120 barrier, it might trigger a more robust upward trend that could potentially reach $140.

Active addresses surge: Growing network activity

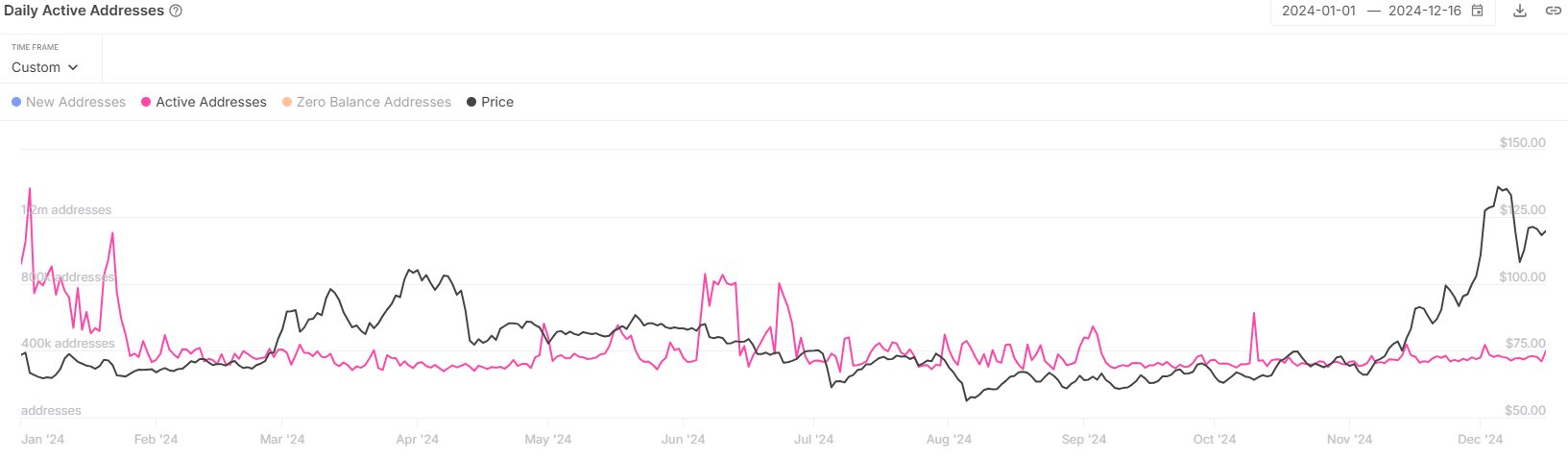

As per data from IntoTheBlock, it’s been observed that an upward trend in daily active addresses has coincided with Litecoin’s price recovery. This increase in active addresses, which rose from October to December, indicates a surge in user activity and interest.

In the year 2024, the number of daily active Litecoin addresses climbed up to 401,000, representing a boost compared to the 366,000 recorded in the previous year, 2023.

It seems that this surge in LTC is probably due to traders taking advantage of its positive trend (bullish momentum). The graph suggests a connection between these changes and actual prices, especially during times when the market gets particularly lively. This interaction demonstrates how increased involvement can influence LTC’s worth.

Market outlook: Bullish signs persist

The rising trend and increased activity within Litecoin’s network suggest a positive outlook for this digital currency. Nevertheless, it is essential to exercise caution since the significant barrier at around $120 could pose a challenge.

If we surpass this level, it may indicate a prolonged upward trend (bull run). On the other hand, if we’re unable to maintain the $100 level, it could trigger more selling activity.

By the close of 2024, the performance of Litecoin will garner significant attention, as its transactional data offers intriguing clues about its future prospects.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- SOL PREDICTION. SOL cryptocurrency

- Solo Leveling Arise Tawata Kanae Guide

2024-12-24 18:15