- Litecoin consolidation zone breakout underscores potential for a bigger rally in the second half of November.

- Litecoin hash rate hits new ATH while open interest demonstrates growing activity in the derivatives segment.

As a seasoned researcher with years of experience in the dynamic world of cryptocurrencies, I find myself intrigued by the recent developments in Litecoin [LTC]. The breakout from its consolidation zone and the soaring hash rate to an all-time high are clear indicators of growing interest and activity.

It’s been an exciting week for the market with multiple ATHs and Litecoin [LTC] was not left behind. The cryptocurrency has been on an overall uptrend in the last 10 days resulting in a pattern breakout.

Over the past week, Litecoin has been steadily strengthening within an uplifting trend, with strong foundational support and resistance levels. Notably, it has repeatedly breached the resistance level on several occasions this week. This suggests that the energy behind a potential bullish surge could be gathering steam, as the process of liquidity shifting gains traction.

Litecoin hash rate soars to new high

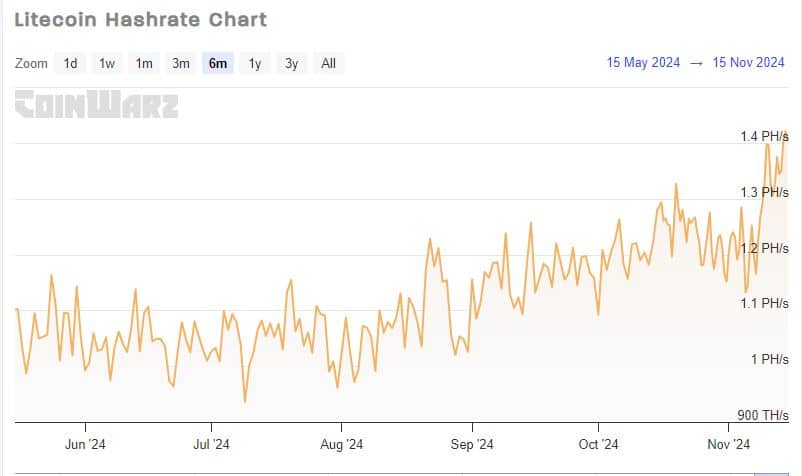

Besides maintaining its current advancements, several other indicators suggest that the activity around Litecoin (LTC) is intensifying. For instance, the Litecoin’s hashrate recently reached an unprecedented peak of 1.42 Petahash per second (PH/S).

As a crypto investor, I’ve noticed that the all-time high (ATH) hash rate indicates an upward trend in miner profits. This surge might be due to increased network activity, suggesting a busier and potentially more profitable mining environment.

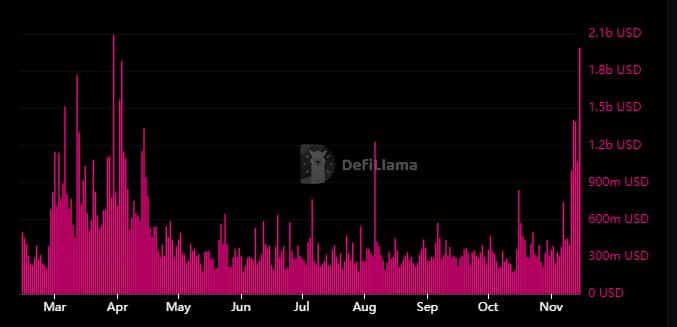

Since early November, on-chain trading activity, particularly with LTC tokens, has gradually increased. As per DeFiLlama’s reports, the trading volume of LTC tokens reached their minimum in November, hovering just under $250 million.

Over the past 24 hours, there’s been a substantial boost that took it to a record-breaking monthly peak of $1.98 billion at the moment of examination.

In the past six months, the current surge in volume is the most significant our network has encountered. Combined with resistance to falling prices, this may suggest that positive market trends are still robust and potentially on the rise.

LTC open interest soars to 5-month high

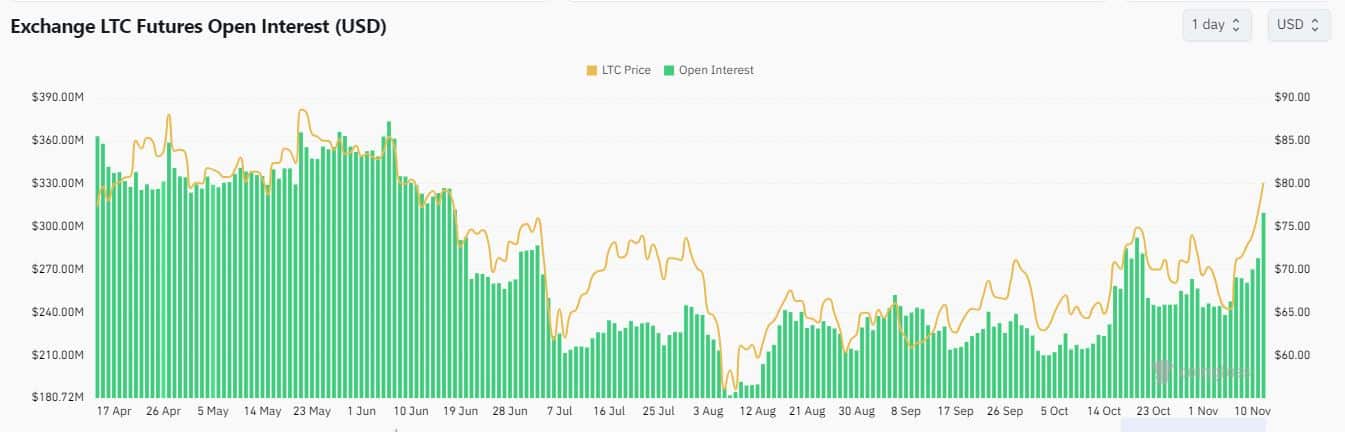

The need for Litecoin was increasing within the derivatives market as well. To clarify, the total amount of outstanding contracts across all platforms reached a high of approximately $309.87 million during the past 24 hours when the news was released.

The last time that LTC open interest was that high was in mid-June.

As a crypto investor, I can’t help but notice that despite the current market conditions, the open interest remains relatively low when compared to the heights it reached in April. However, it’s important to remember that as of March 2024, we ended with an impressive $708 million in open interest, suggesting that there is still significant potential for growth.

Read Litecoin’s [LTC] Price Prediction 2024–2025

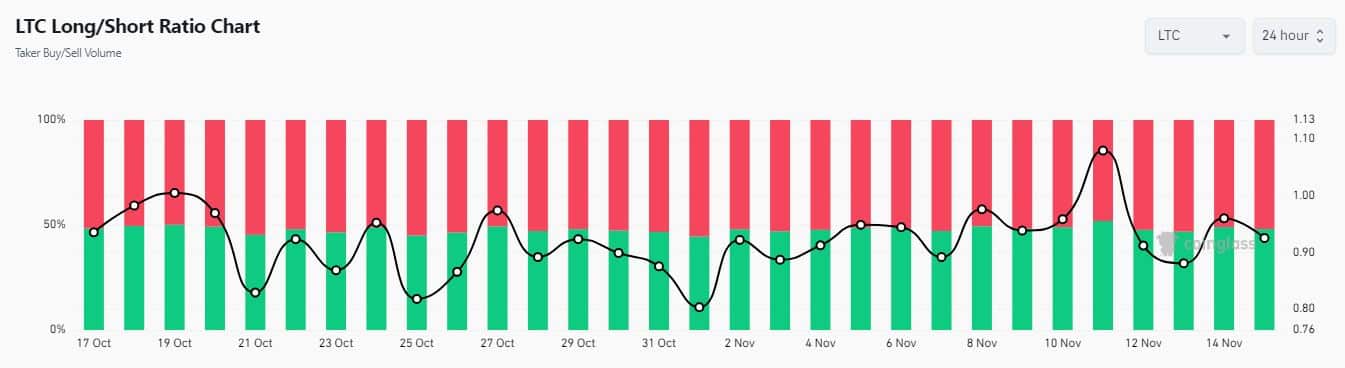

Given that open interest encompasses long and short positions equally, it was crucial to evaluate long positions against short ones. Interestingly, over the past three days, there’s been a higher proportion of long positions compared to short ones.

From the information presented, it appears that an increasing number of traders are adopting a bullish stance. This trend suggests a growing optimism among bulls. Yet, the significant increase in selling pressure towards the latter part of the week might lead to another unforeseen drop in LTC’s value.

Read More

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

2024-11-15 22:15