- Most traders are opting for for bullish bets despite the coin’s movement

DOGE’s hike to $0.29 now stalled thanks to the market’s correction

According to AMBCrypto’s market analysis, traders have remained optimistic about Dogecoin (DOGE), despite its previous signs of dropping to $0.30. For approximately four weeks now, DOGE’s price has been fluctuating between $0.18 and $0.22. At the moment, the coin is trading at a lower price of $0.17 following a 13% decrease due to Bitcoin experiencing a 5% decline in value during the past 12 hours.

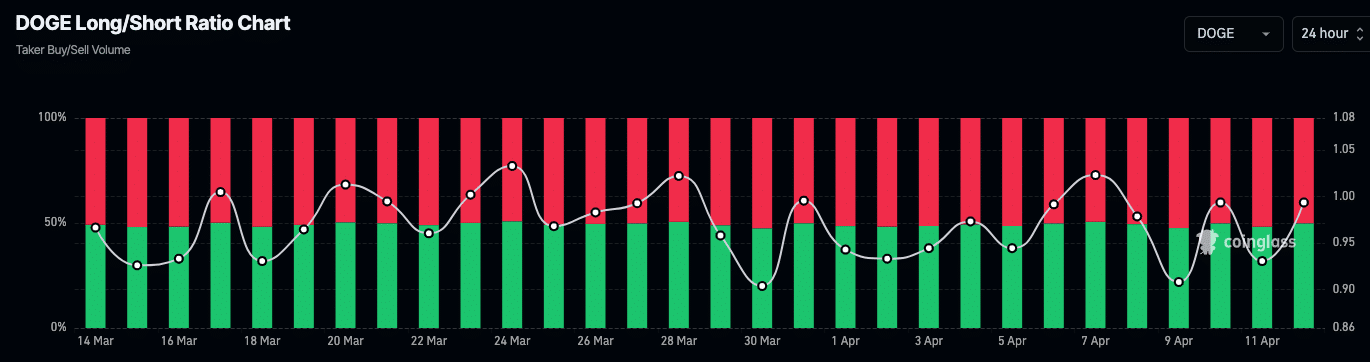

Despite the Long/Short ratio indicating that Dogecoin’s traders remained unperturbed by its recent performance, data from Coinglass showed a ratio of 1.02 for this cryptocurrency over the last 24 hours.

The Long-Short ratio is an essential tool for assessing the mood of futures market traders. When this ratio is less than 1, it signifies that more traders are betting on the markets to decline (shorting), while a reading above 1 suggests that more traders are optimistic and holding long positions.

DOGE is not ready yet

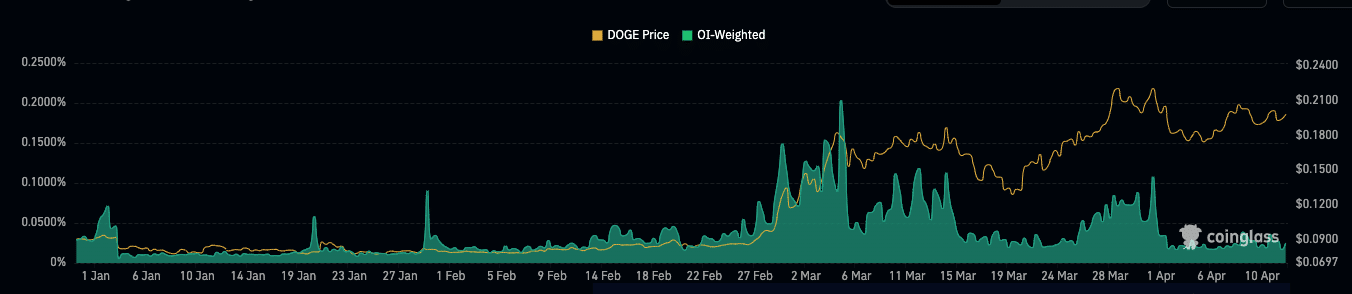

Unfortunately, just emotions won’t help DOGE break free from its narrow trading band. To gain a more comprehensive understanding, we also looked at other signals such as Open Interest (OI).

OI, or Open Interest, keeps track of the number of outstanding derivative contracts in the financial market. By observing this data, traders can identify patterns and anticipate price shifts. A rise in OI signifies that market players are expanding their position holdings.

In this scenario, purchasers have shown greater eagerness than vendors. However, when open interest wanes, the roles reverse.

Currently, Dogecoin’s open interest stood at $1.29 billion during the publication of this article, indicating that traders’ overall positions have remained relatively unchanged despite recent market turbulence.

In other words, if open interest (OI) remains constant and the market stabilizes, DOGE‘s price may not change significantly, excluding external factors. Subsequently, the cryptocurrency could regain its upward trend and potentially reach prices above $0.20, followed by an attempt to surpass $0.25.

Alternatively, if there is a significant reduction in buy and sell orders (i.e., net positions) for DOGE, then this forecast could be called into question, potentially leading to the price of DOGE decreasing even more according to chart trends.

Calm before chaos?

In simpler terms, the DOGE to USD graph indicated that the coin’s forward push had lost strength, noticeably following the recent industry-wide adjustment. The RSI value for Dogecoin dropped below the halfway mark at 0.50.

In a comparable manner, the Parabolic SAR’s dots moved upward to hover above the price candles – Indicating a bearish outlook.

Is your portfolio green? Check the Dogecoin Profit Calculator

If the market finds equilibrium, DOGE may be able to reverse its slide and surge past its current plateau. Nevertheless, it’s probable that DOGE will keep circulating between its present value boundaries in the coming days.

Confident investor attitudes and an influx of funds could potentially lead to price increases, while a message from Elon Musk on Twitter could also have this effect.

Read More

- LDO PREDICTION. LDO cryptocurrency

- JASMY PREDICTION. JASMY cryptocurrency

- Orca crypto price prediction: Buying opportunity ahead, or bull trap?

- Can Ethereum ETFs outperform Bitcoin ETFs – Yes or No?

- Chainlink to $20, when? Why analysts are positive about LINK’s future

- Citi analysts upgrade Coinbase stock to ‘BUY’ after +30% rally projection

- Why iShares’ Bitcoin Trust stock surged 13% in 5 days, and what’s ahead

- Spot Solana ETF approvals – Closer than you think?

- Solana memecoin BODEN feels the heat after Biden’s exit: Will SOL suffer?

- Ethereum ETF frenzy: $1B traded in 24 hours – What’s next?

2024-04-13 16:07