-

PEPE maintained a long-term bullish structure, but has a short-term bearish structure.

The momentum and volume indicators showed a bullish reversal was underway.

On the larger charts, PEPE showed a strong, upward trend with no signs of dropping down to significant support levels, which had previously halted price declines during the early March market bounceback.

The recent bounce in prices also buoyed market sentiments.

An AMBCrypto analysis revealed that both profits and trading volumes have decreased in response to price drops.

The profits were still holding steady with regard to address counts. Will this lead to a price surge, or is it time for investors to brace for a prolonged period of price stabilization?

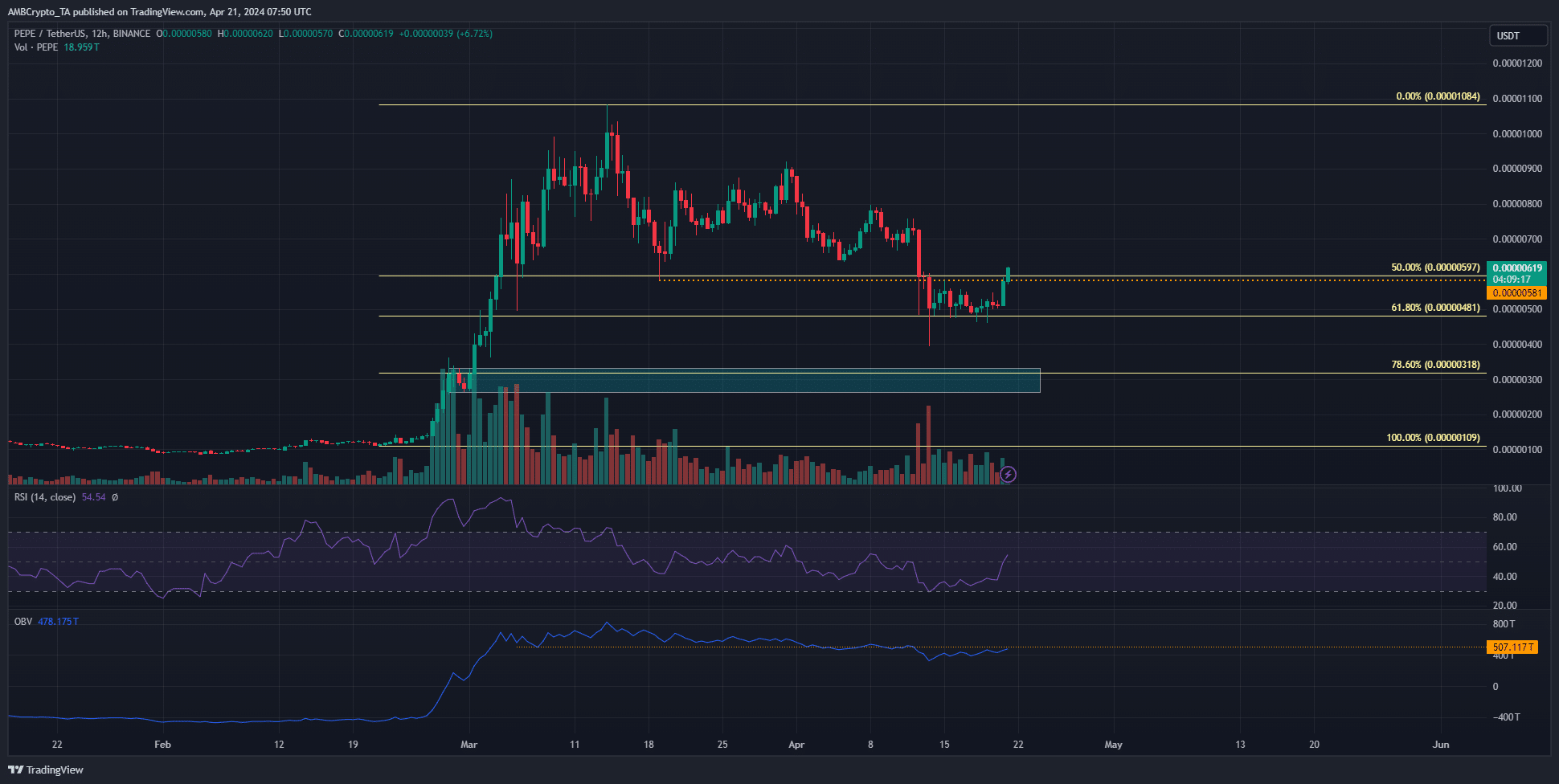

The consolidation and reversal at the 61.8% retracement

PEPE experienced a 34.9% increase in value starting from its low on the 19th of April, pushing prices beyond the previous low of $0.00000581.

In this price range between $0.000006 and $0.000007, the bears currently hold the upper hand and view it as a resistance. However, the bulls possess sufficient power to potentially reverse things and make this region a new level of support instead.

To begin with, although the On-Balance Volume (OBV) showed a declining trend for over a month, it has recently formed new lows that are slightly higher than previous ones during the last week. This is a positive sign even if the improvement is small.

An additional element was the Relative Strength Index (RSI) on the 12-hour chart surpassing the 50-neutral mark, indicating a potential early surge in buying power.

On the shorter timeframes like 4 hours and below, the market continued to display a bearish structure. But it was a positive sign that the 61.8% Fibonacci level at $0.00000481 held during the previous week.

If the OBV (On-Balance Volume) manages to rise above the indicated line again, this could be an early indication of increasing buying pressure and a potential bull market trend.

The next magnetic zone for PEPE prices

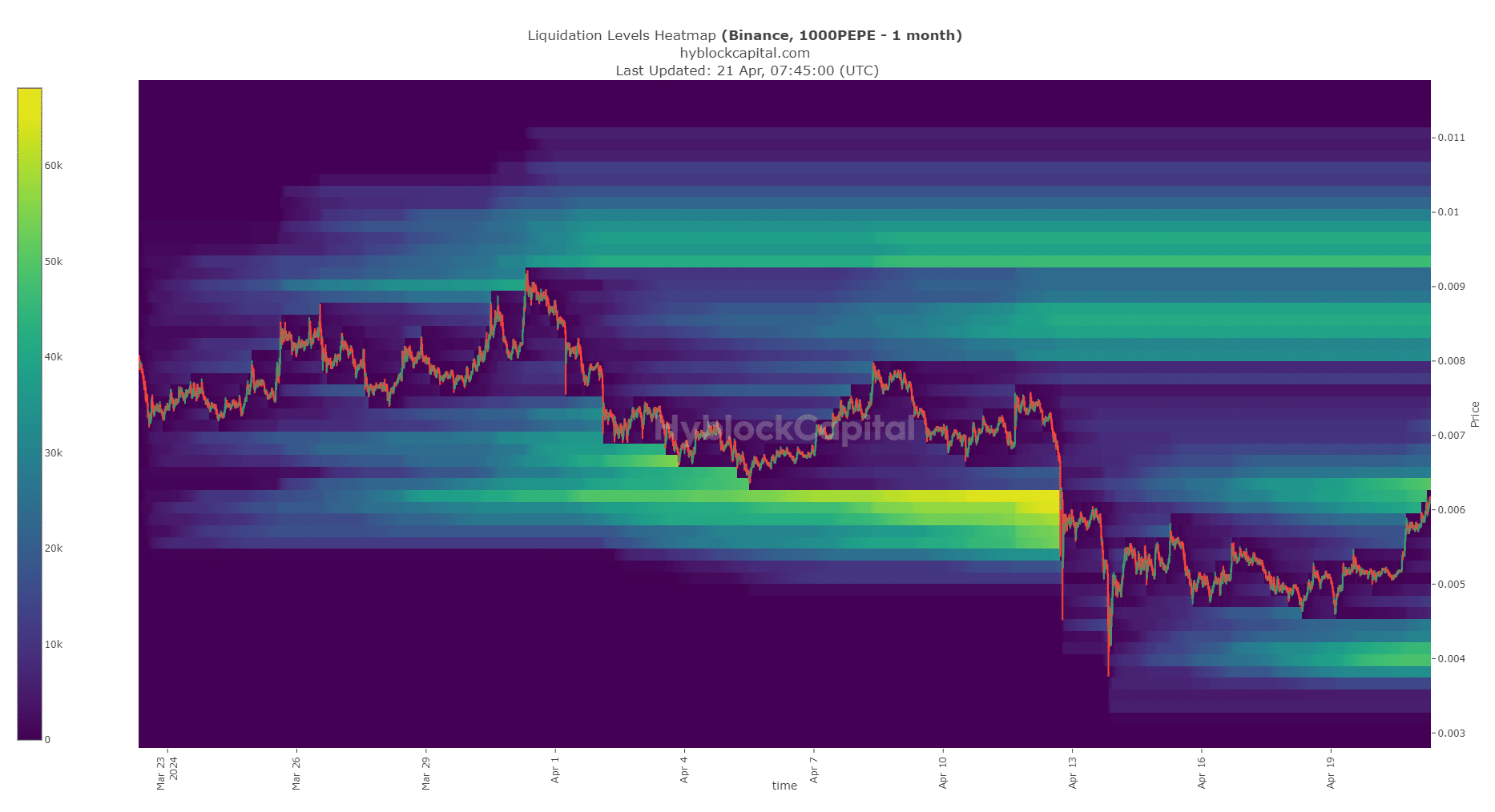

From a technical standpoint and based on the liquidation map, the range between $0.000006 and $0.000007 served as a significant resistance area.

At around $0.0000065, a group of bid prices were ready to be met, potentially causing prices to rise.

Two potential focus points for PEPE lie at the prices of $0.000004 and $0.0000084. If PEPE fails to overturn its current bearish trend in the short term, investors should brace themselves for further price decreases.

Read More

- WCT PREDICTION. WCT cryptocurrency

- PI PREDICTION. PI cryptocurrency

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- Sea of Thieves Season 15: New Megalodons, Wildlife, and More!

- Sacha Baron Cohen and Isla Fisher’s Love Story: From Engagement to Divorce

- SOL PREDICTION. SOL cryptocurrency

- 7 Chilling Horror Films Born from The Twilight Zone’s Dark Legacy

- Michelle Trachtenberg’s Mysterious Death: The Unanswered Questions

- EastEnders’ Balvinder Sopal hopes for Suki and Ash reconciliation: ‘Needs to happen’

- McDonald’s Japan Confirms Hatsune Miku Collab for “Miku Day”

2024-04-21 16:07