- Hayes urged aggressive investment amidst market decline.

- Hayes saw Bitcoin as a hedge amid negative real yields, despite skepticism.

Undeniably, the most debated issue in the world of cryptocurrencies is: Does Bitcoin (BTC) serve as a protective asset against the depreciation of fiat currencies?

The Bitcoin halving has generated much buzz lately, but Arthur Hayes, ex-CEO of cryptocurrency exchange BitMEX, shared his perspectives on a robust tendency that may fuel Bitcoin’s ongoing growth.

Arthur Hayes’s left curve approach

In a recent essay named ‘Left Curve’, Hayes didn’t just provide investment tips but also challenged conventional financial advice, encouraging investors to embrace bolder tactics to secure higher yields.

He said,

It’s unfortunate when you correctly predict a bull market but fail to capitalize on it to the fullest. Bull markets don’t occur frequently, so it’s essential to seize opportunities when they arise.

Moreover, Hayes highlighted the significance of making the most of gains during bull markets, while expressing reservations about exchanging cryptocurrencies for traditional currencies.

If you’ve sold cryptocurrencies with questionable value for actual currency that you don’t need right away, you may be making a mistake.

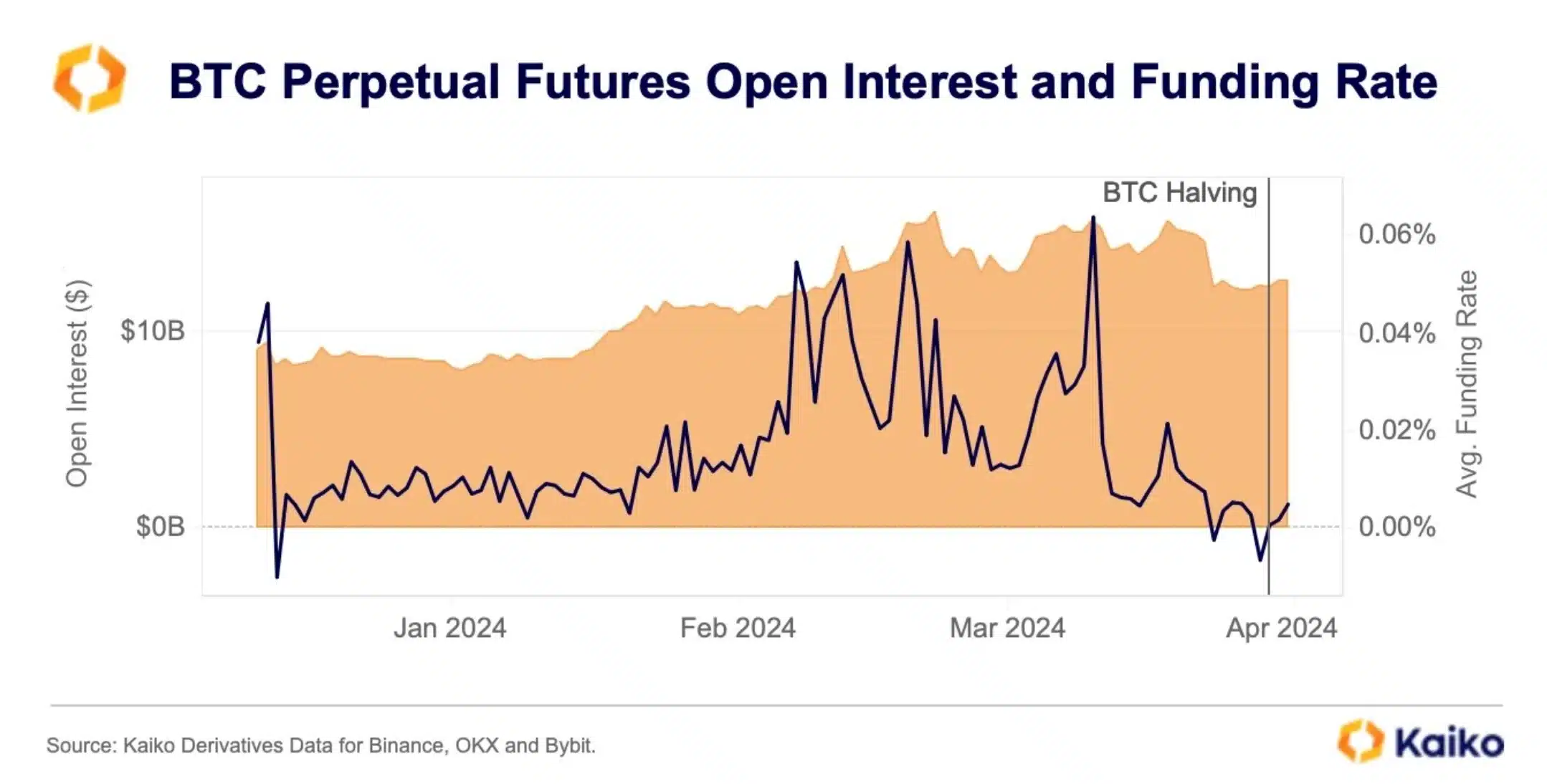

Also, shedding light on the investor’s behavior, Kaiko noted,

The funding costs for Bitcoin perpetual contracts dipped into the negative territory for the first time since late 2023, preceding the upcoming bitcoin halving event.

The market indicated a stronger demand for selling Bitcoin, causing traders to be ready to pay an extra fee to obtain Bitcoins on loan for opening short positions.

Bitcoin stands the test of time

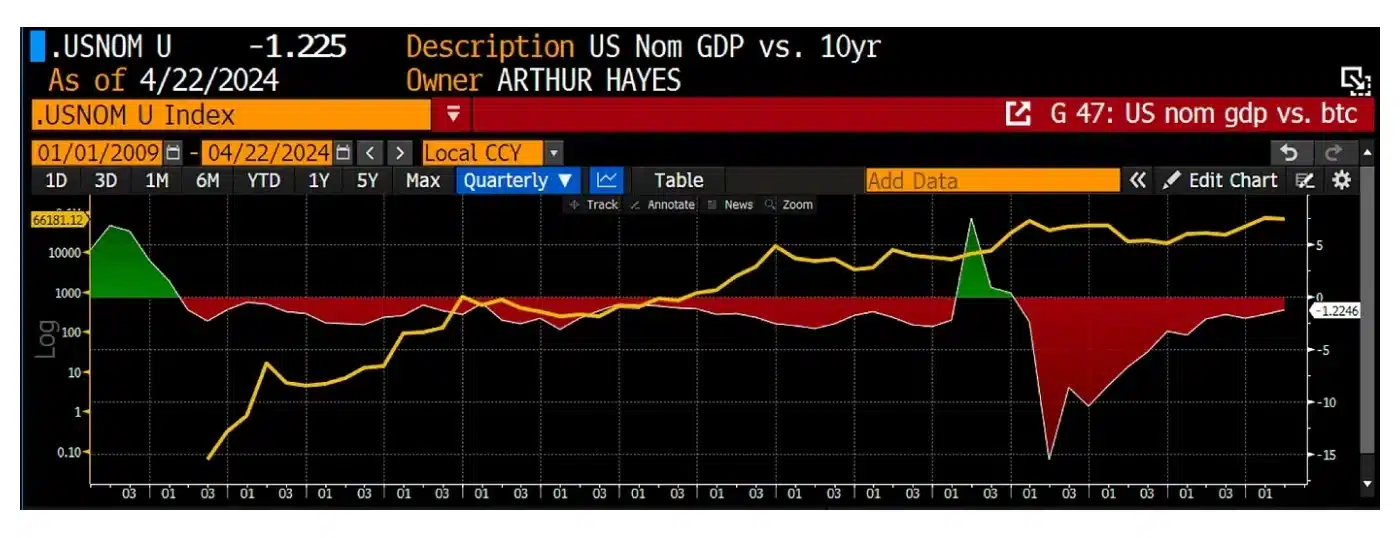

Hayes examined the connection between actual bond yields and the Federal Reserve’s balance sheet, as well as how economic jolts influence yields.

He suggested,

“The value of Bitcoin is increasing at an irregular rate when plotted on a logarithmic graph. This growth solely reflects the pricing of this scarce asset using progressively less valuable fiat money.”

During times when real yields turn negative, Bitcoin (BTC) has come to be seen as a viable investment option. It serves as a shield against the depreciation of fiat currencies.

Despite expressing caution about the investment hype surrounding Bitcoin, Peter Brandt, the CEO of Factor LLC, took a more measured approach.

“Three years have passed since Bitcoin’s $BTC price, when adjusted for inflation, reached a new peak. This is intriguing given that Bitcoin underwent a halving and saw the introduction of Bitcoin ETFs during this period.”

In the face of this criticism, Hayes remained optimistic and proposed that crypto market volatility may lessen during the summer season.

“This is the perfect time to take advantage of the recent crypto dip to slowly add to positions.”

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- PI PREDICTION. PI cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- Sea of Thieves Season 15: New Megalodons, Wildlife, and More!

- Peter Facinelli Reveals Surprising Parenting Lessons from His New Movie

- MrBeast Slams Kotaku for Misquote, No Apology in Sight!

- Has Unforgotten Season 6 Lost Sight of What Fans Loved Most?

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

2024-04-25 11:21