-

LUNA’s 295% volume surge following USTC burn proposal signals a potential bullish rally in the market.

LUNC sees a 14% price rise amid a 275% jump in volume, driven by community-led USTC burning efforts.

As a seasoned crypto investor who’s been through multiple market cycles and witnessed the rise and fall of various coins, I must admit these recent price movements in LUNA and LUNC have caught my attention. The surge in trading volume and open interest following the USTC burning proposal is undeniably impressive.

The Terra Luna Classic [LUNC] community recently introduced a new USTC burning proposal.

This proposal targets the burning of 46.55 million USTC through contract migration, specifically focusing on wallets linked to the Mirror Protocol.

Previous attempts at increasing the value of LUNA and LUNC tokens did not significantly affect their prices, but this new plan is designed to rekindle investor enthusiasm for both cryptocurrencies.

Although they initially seemed unrelated, there appears to be a connection between the changes in the prices of these two assets and this particular initiative.

LUNC jumps 14% amid volume surge

Terra Luna Classic (LUNC) has also seen a price rise, currently trading at approximately 0.00009694 USD, and boasting a 24-hour trading volume of about 172 million dollars.

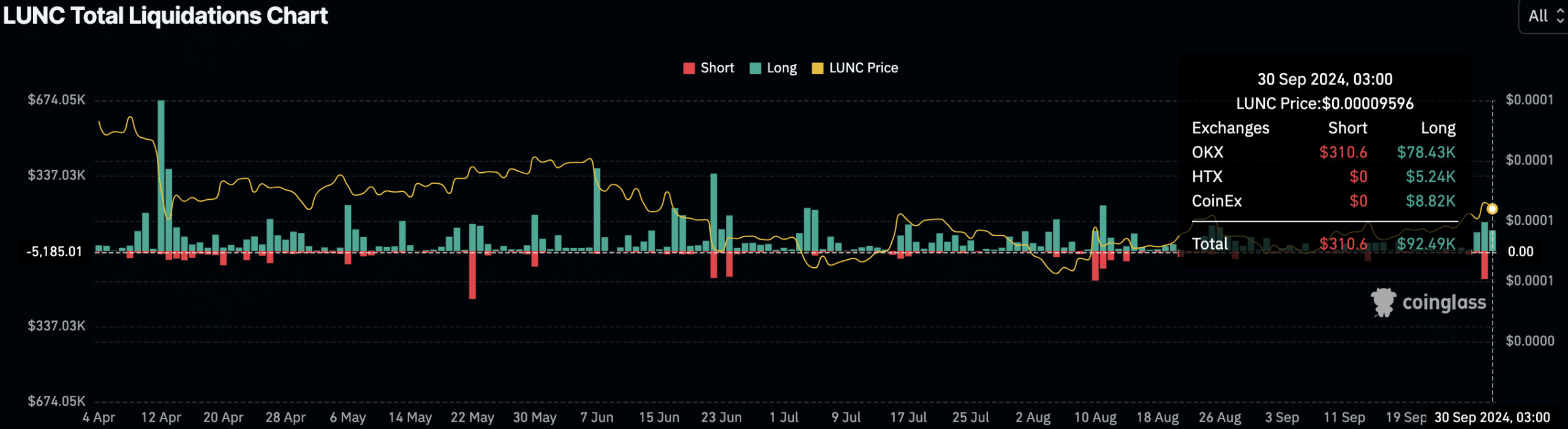

Over the past day, LUNC experienced a 3.13% growth, while its value increased by 14.50% over the last week. According to Coinglass data, trading activity has significantly spiked, with a 275.11% jump in volume and an additional 21.61% boost in Open Interest.

Liquidation data also indicated bullish market pressure, with $92.49K in long liquidations, compared to only $310.6 in shorts.

LUNA’s 295% volume surge signals bull run?

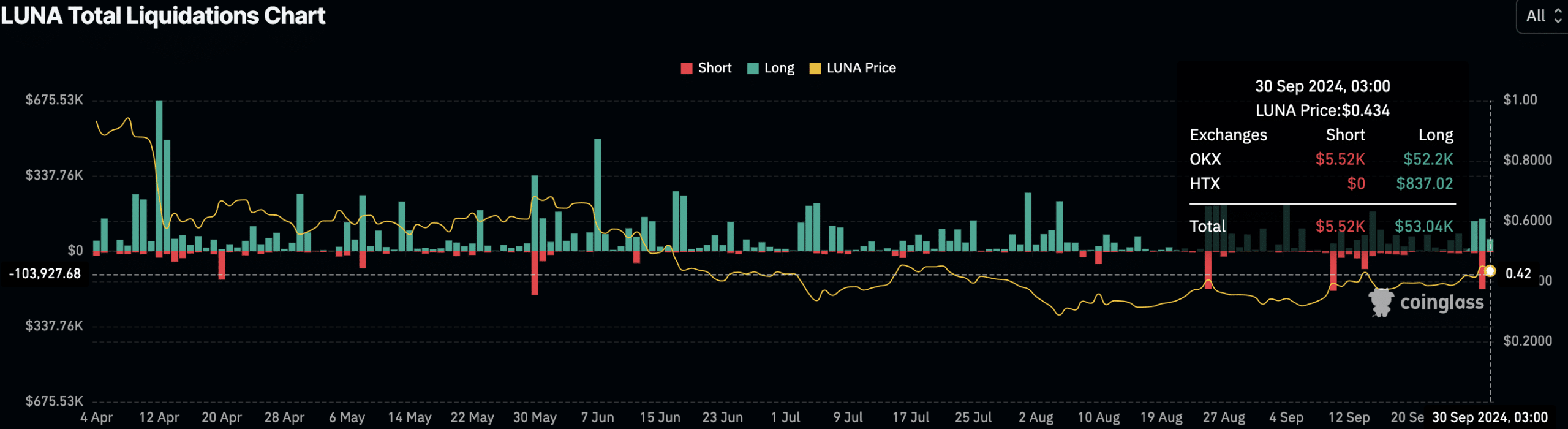

Currently, LUNA is experiencing a continuous price surge, currently valued at $0.4317 per token, as of the latest update. The trading volume within the past 24 hours amounts to $203,145,216. This price hike translates to a 1.6% growth in the last day and a significant weekly increase of 14.44%.

The trading volume for LUNA has significantly increased by 295.94%, while its open interest has grown by 14.22%, based on information from Coinglass, indicating a surge in market activity related to this cryptocurrency.

The data from the liquidation process shows a significant discrepancy, where there are longer positions totaling $53,040, contrasted with much fewer short positions amounting to just $5,520.

Even with sudden increases in market turbulence causing forced sales, particularly for highly-leveraged traders, these indicators show that overall optimism remained high among investors.

As a researcher, I’ve noticed an increasing trend in trading activity and open positions, which could signify a growing sense of confidence among investors.

The main aim of the USTC burning proposal seems to be focused on Terra Classic assets, but it’s also had a significant effect on the value of LUNC.

The rise in volume and Open Interest pointed to heightened market participation, likely spurred by renewed community efforts.

Both LUNA and LUNC have seen parallel price increases following the announcement of the USTC burning proposal.

Regarding trading activity, it’s notable that the token LUNA experienced a more substantial surge in trade volumes as compared to LUNC. Both coins demonstrated robustly positive trends in their liquidation statistics, suggesting a bullish outlook.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Elden Ring Nightreign Recluse guide and abilities explained

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

2024-10-01 03:03