- MKR broke a long-term downtrend, with analysts forecasting a $5K target.

- 62% of holders profit as MKR aligned with Ethereum growth.

As a seasoned analyst with over two decades of experience navigating the volatile waters of the financial markets, I must say that the recent performance of Maker [MKR] has piqued my interest. The token’s breakout from a prolonged downtrend and its alignment with Ethereum’s growth trajectory are signs that could indicate a potential bull run in the coming months.

As Ethereum [ETH] reaches unprecedented peaks, Maker [MKR] is garnering interest. Analysts foresee MKR potentially reaching $5,000 by 2025, bolstered by a breakout from a prolonged slump and optimistic chart indicators that point towards a possible surge.

At the moment of printing, Maker (MKR) was priced at $1,727.42 following a minor 0.69% decrease in the past day and a more significant weekly decrease of 15.47%. Despite this downward trend, its market capitalization remains substantial at $1.54 billion, with approximately 890,000 MKR tokens currently in circulation.

The increase in Ethereum’s price along with MKR’s current technical trends indicates that the token may pick up speed over the next few months.

Experts have pinpointed essential points where ETH’s price could stabilize, and they emphasize that Ethereum’s market trends significantly impact the direction of Maker (MKR)’s pricing.

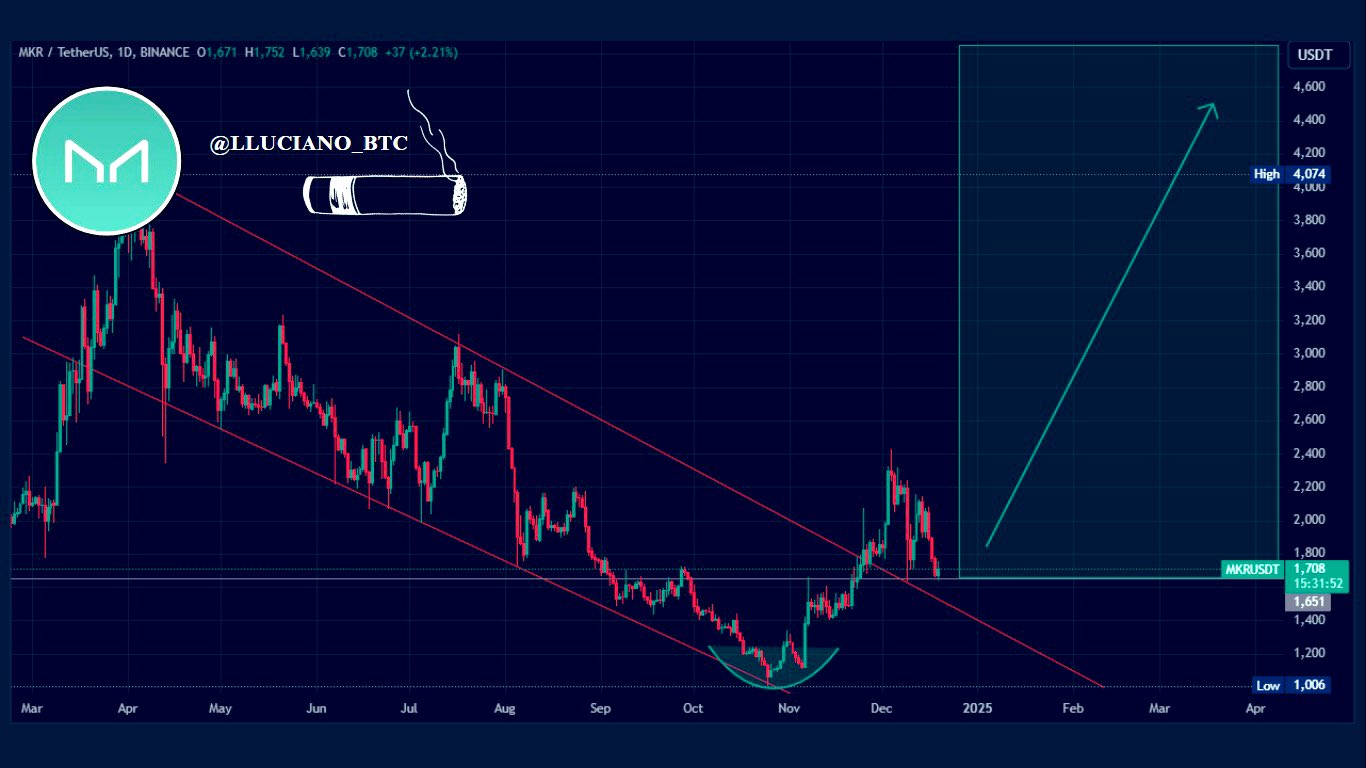

Breakout from a prolonged downtrend

From March to November 2024, MKR showed a continuous decrease in value, moving along a falling trendline that featured progressively lower peak and trough points.

But in late November, the price managed to break free from its channel, suggesting a possible change in direction.

Furthermore, the bullish cup-and-handle chart formation, evident from September to November, strengthens the optimistic perspective.

As a researcher, I’ve observed that the pattern in question often coincides with market rallies. The “cup” portion symbolizes a gradual amassing of resources or assets, while the “handle” represents a brief period of consolidation or stabilization prior to a significant upward movement or breakout.

These technical indicators suggest potential upward price movement in the medium term.

Key technical levels to watch

Right now, the price is generally around $1,746. Key support points are found at $1,760 and lower at $1,440. On the other hand, possible resistance can be seen at $2,200, along with $3,800, and potentially reaching as high as $4,400.

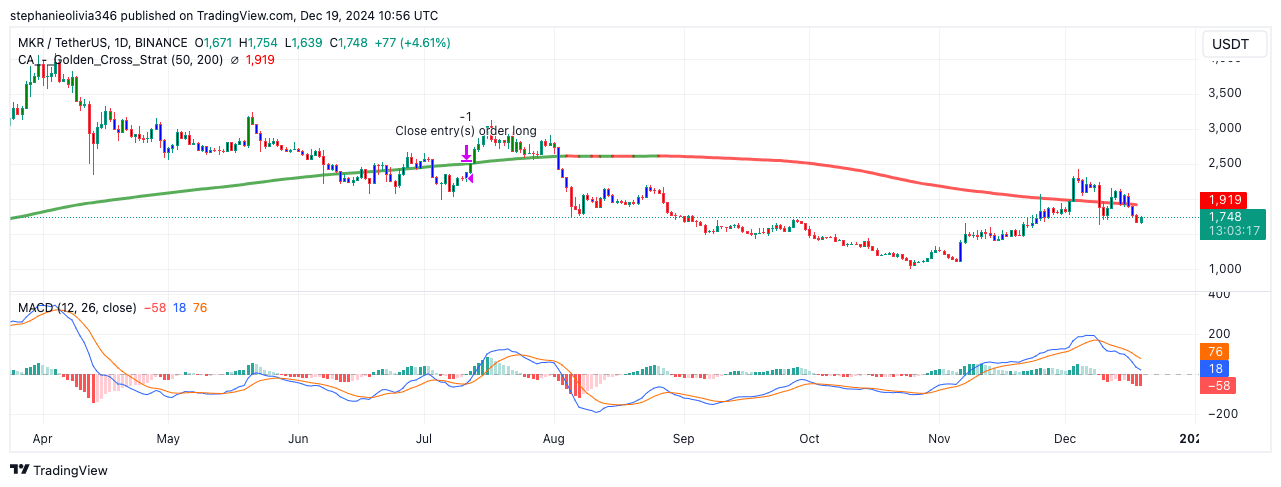

As an analyst, I’ve observed a significant shift in market trends. Specifically, the 50-day moving average has climbed over the 200-day moving average, forming what is known as a ‘golden cross’. This technical pattern often indicates a bullish phase, suggesting that the market may be poised for an upward trend.

As a crypto investor, I’ve noticed that the current trading price of MKR sits below its 200-day moving average at $1,919. This suggests that this particular level might serve as a formidable resistance, making it challenging for the token to break through and potentially rise further in value.

To sustain bullish momentum, the price must reclaim this critical level. If MKR fails to hold above $1,700, it may test support near $1,500.

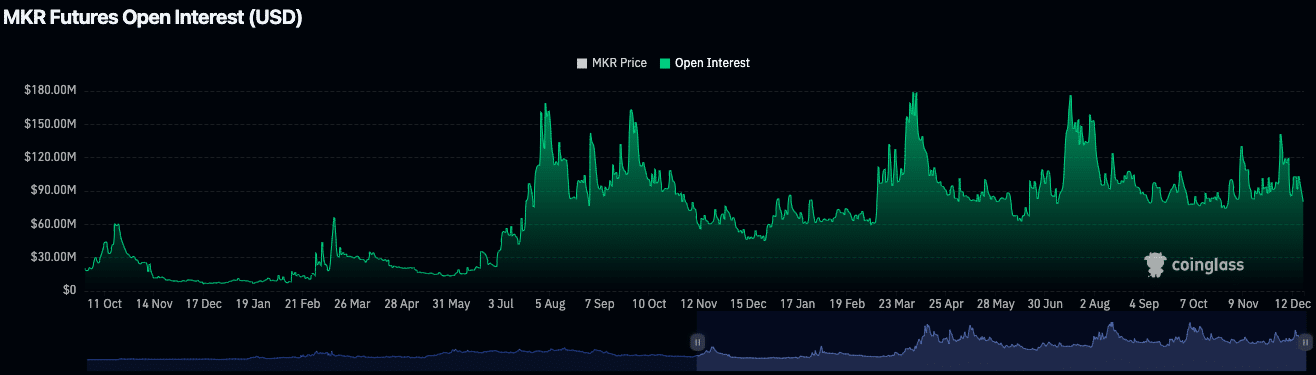

Reduced futures market activity for MKR

According to Coinglass, MKR’s futures market Open Interest (OI) dropped by approximately 8.67%, landing at $78.83 million, suggesting a decrease in market activity. However, it’s worth noting that trading volume has significantly risen by 41.59% during the same timeframe, amounting to $184.94 million.

The decrease in OI may reflect waning speculative activity or a reduction in leveraged positions.

Historically, OI (Open Interest) tends to increase during times of high market volatility. Lately, however, it seems to be experiencing a lull, suggesting a temporary halt in speculative energy. Yet, this doesn’t rule out the potential for renewed activity as positive sentiment towards Ethereum’s development continues to grow.

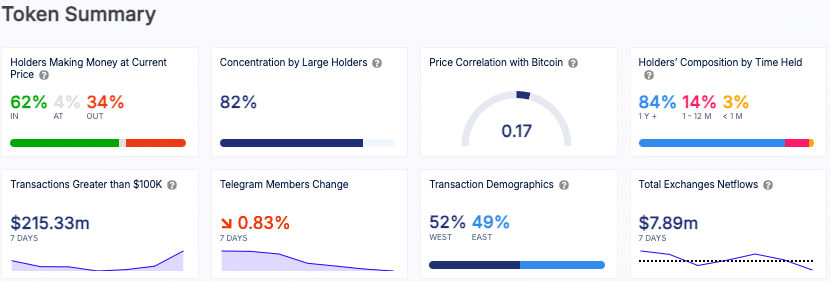

Long-term holder confidence in MKR remains high

62% of MKR token owners currently have a profit due to the current price, as indicated by on-chain data, and 84% of these investors have held onto their tokens for more than a year, categorizing them as long-term investors.

A significant portion (82%) of the token’s supply is held by a few large entities, indicating a high level of concentration but also suggesting lasting faith in the token’s future prospects.

With Ethereum hitting fresh records, it seems that MKR’s performance is closely linked to the overall direction of the cryptocurrency market.

Read More

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

2024-12-20 09:12