-

Maker price has bounced from a nine-month low, suggesting that the price may have bottomed.

However, exchange data shows an influx of MKR held on exchanges.

As a seasoned crypto investor with battle scars from the infamous bear markets of 2018 and 2022, I find myself once again scrutinizing the performance of Maker [MKR]. After plummeting to a nine-month low last week, the token seems to be showing signs of a bounce, but I’m not holding my breath just yet.

Since MakerDAO changed its name to Sky, the Maker [MKR] token has struggled to perform well. Just last week, Maker reached a nine-month low, although it seems to be showing some signs of recovery. However, there are still several indicators suggesting a bearish outlook for the token.

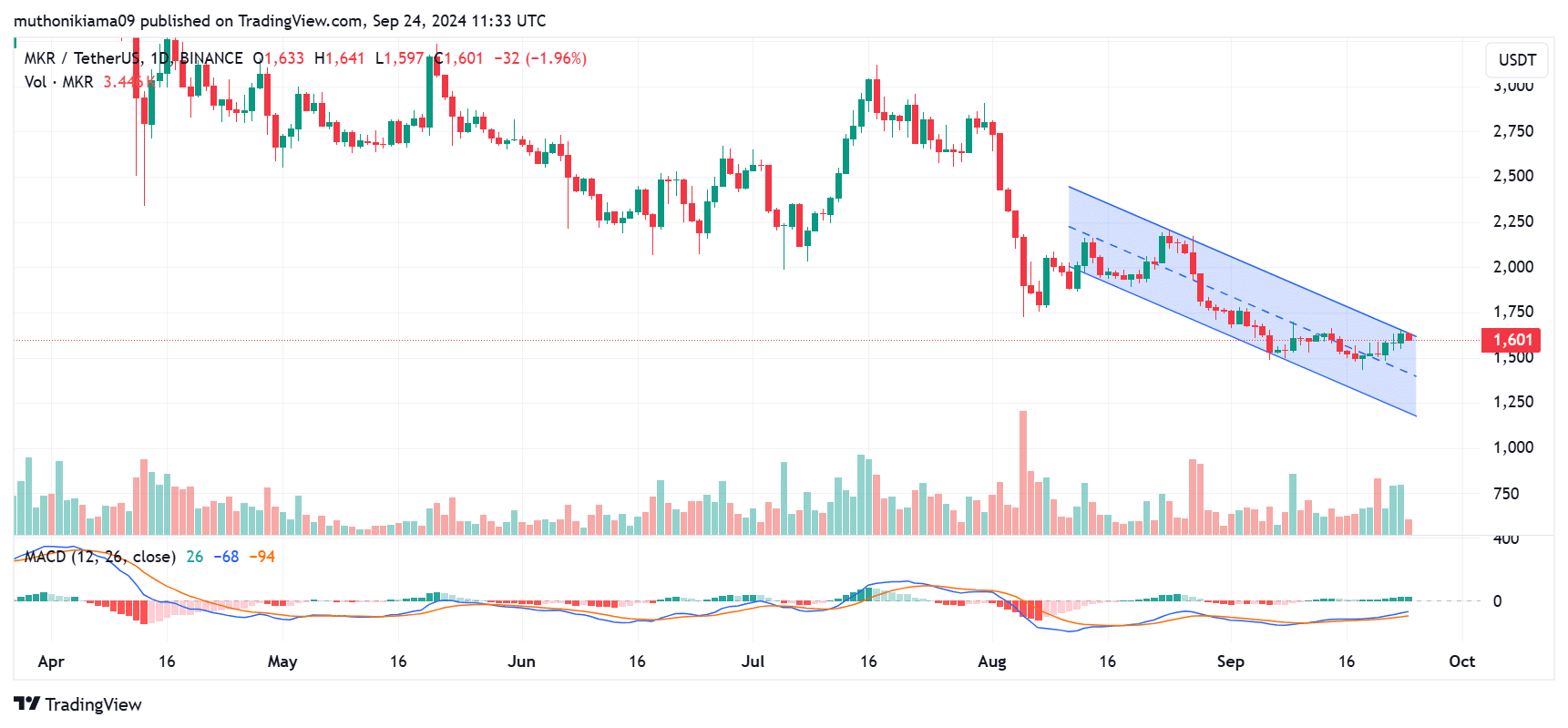

MKR traded at $1,600 at press time, having dropped by 24% in the last 30 days. The token’s market capitalization has also fallen to $1.4 billion per CoinMarketCap.

For approximately three months now, MKR has been creating successively lower peaks, suggesting an extended downtrend. Additionally, this token has been confined to a falling trendline, yet it’s presently trying to break free from it.

Yet, outbursts from falling channels usually coincide with an increase in purchasing activity. At present, this isn’t occurring because trading volumes have decreased, as indicated by the volume indicator.

The bars on the volume histogram are now red, indicating that the demand for selling assets has surpassed the demand for buying them.

Simultaneously, the Moving Average Convergence Divergence (MACD) line displays a bullish trend as it diverges. Although the MACD line remains below zero, it’s now risen above the signal line, indicating an upward shift.

So, bullish momentum could be building up.

As an analyst, I’ve noticed a similar pattern emerging with the green MACD histogram bars. For a robust bullish reversal to be validated, it would be crucial to witness an increase in buying activity alongside this trend.

Maker exchange flow data

The shift of Maker’s branding to Sky encountered a storm of debate when they unveiled their plan to switch the DAI stablecoin into USDS.

Recently, it announced that the USDS stablecoin will launch on Solana [SOL], which stirred slight gains for MKR.

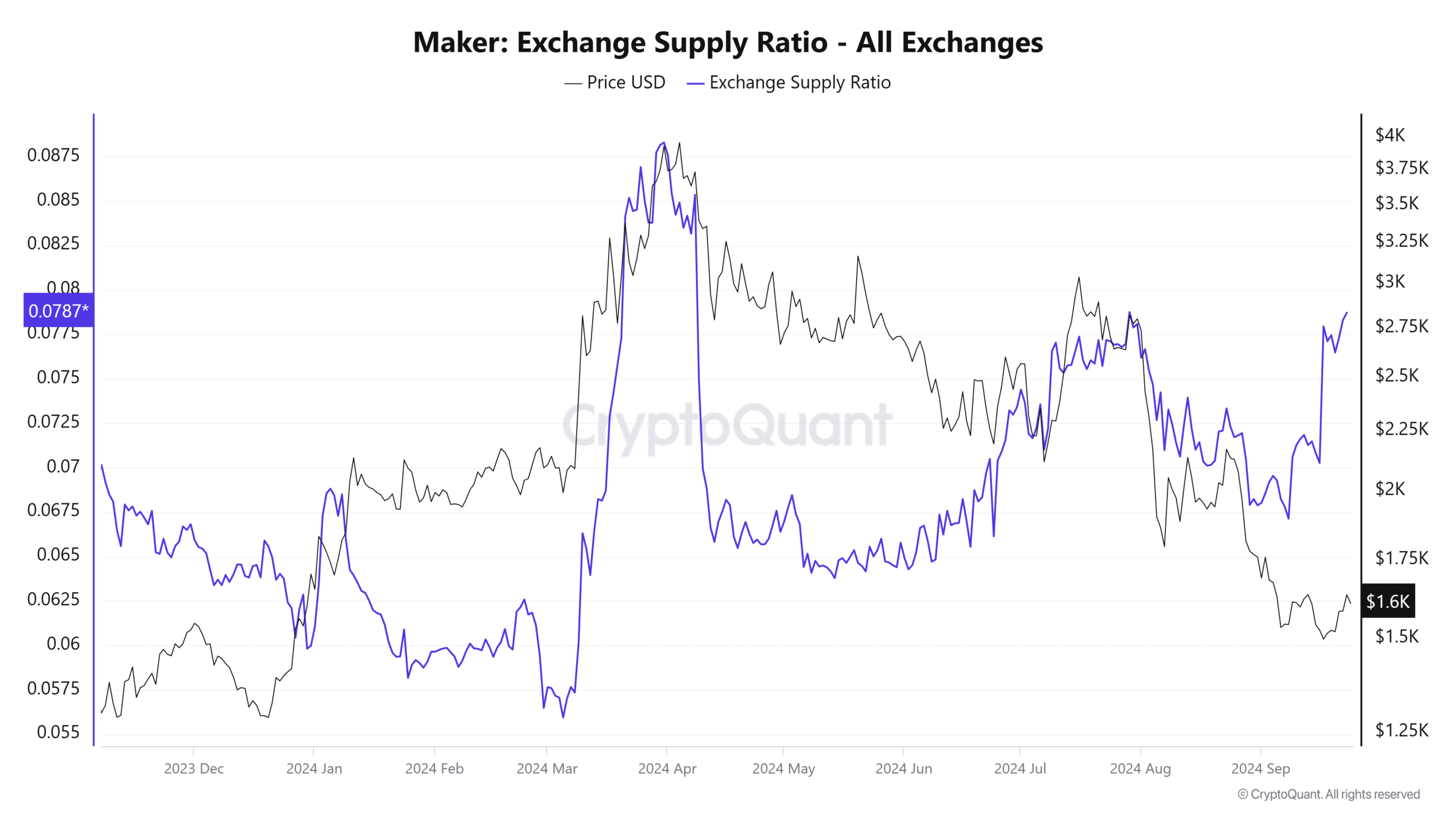

However, the positive sentiment was shortlived as exchange data suggests that selling activity could be rising. Per CryptoQuant, the MKR exchange supply ratio has increased to the highest level since April.

This data suggests an increase in MKR supply on exchanges. While this could show some traders are swapping their MKR tokens for SKY, it could also indicate selling pressure given the recent drop in price.

Read Maker’s [MKR] Price Prediction 2024–2025

To balance out the current selling pressure, we’re in search of purchasers. Their involvement could help Maker recuperate from its recent low points. Yet, it seems that many traders may not be inclined to engage in the market at this time due to the generally bearish trend persisting.

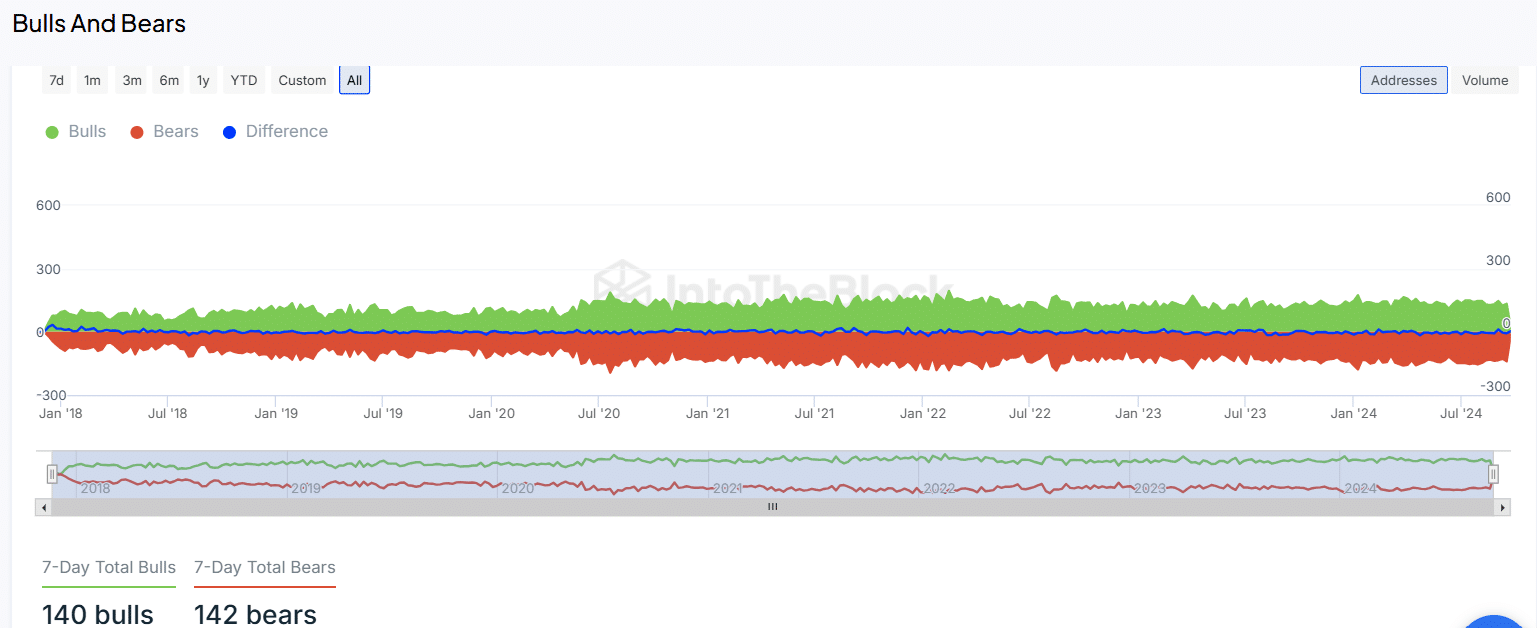

According to IntoTheBlock’s data, there are more investors who are bearish rather than bullish, indicating a predominantly negative mood among them regarding the market.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Elden Ring Nightreign Recluse guide and abilities explained

2024-09-25 01:43