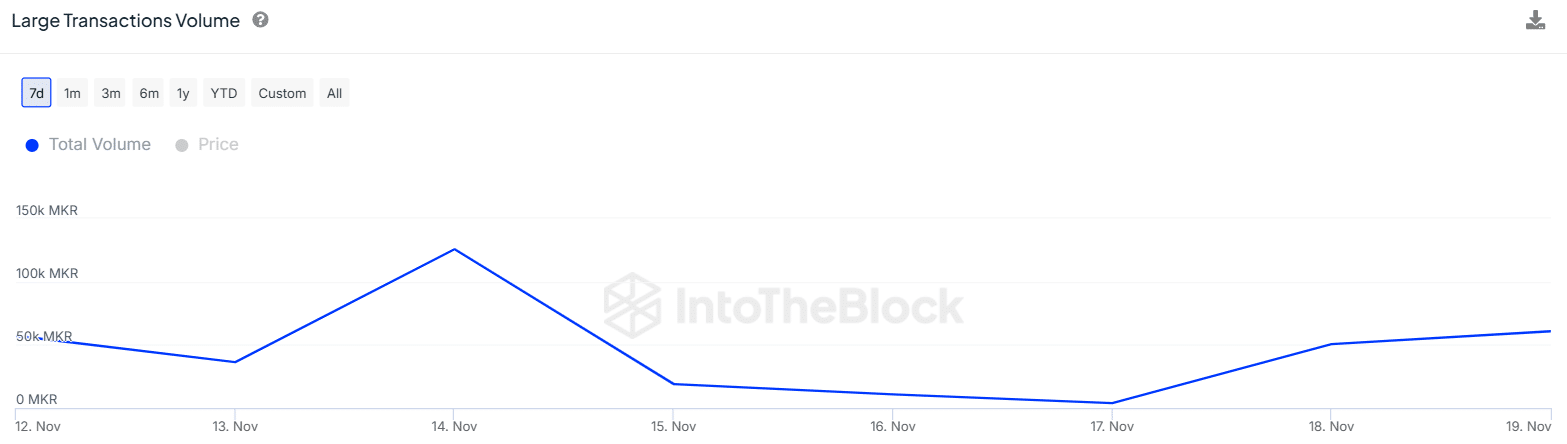

- Large transaction volumes for Maker rose by over 1,400% in just two days

- Despite rising whale activity, technical indicators and on-chain metrics flashed mixed signals for MKR

As a seasoned researcher with years of experience in the cryptocurrency market, I find myself intrigued by the recent developments surrounding Maker (MKR). The token’s performance over the last two days has been nothing short of remarkable, with transaction volumes skyrocketing by an impressive 1,400%. However, this surge seems to have elicited mixed signals from technical indicators and on-chain metrics.

As a crypto investor, I’m seeing Maker (MKR) currently valued at around $1,513, up approximately 2% in the last day. It’s interesting to note that the token’s trajectory has closely followed the broader cryptocurrency market, with a monthly growth of about 24%.

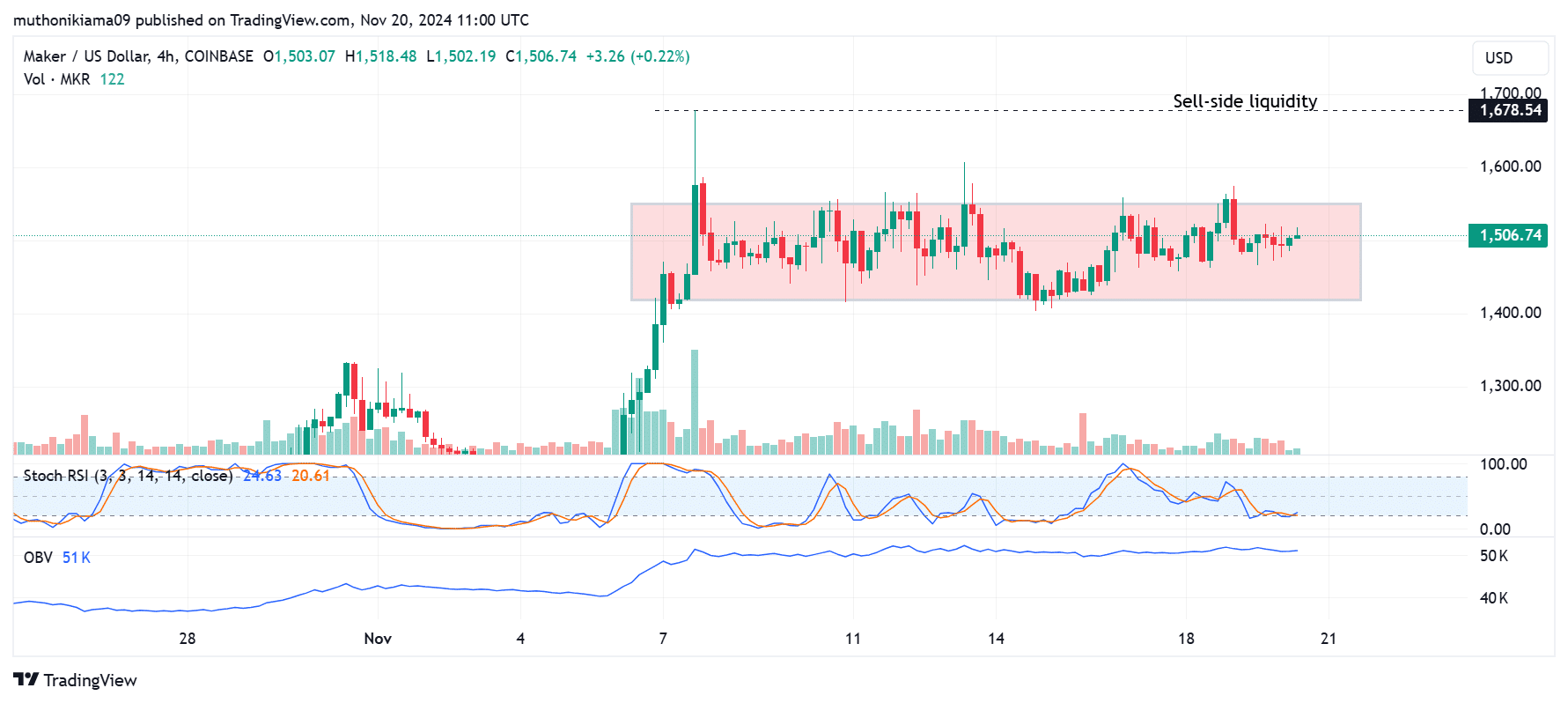

Although there have been advances lately, Maker has found itself trapped between $1,419 and $1,550 for the past fortnight. A surge in large-scale investor activity might help push it beyond these boundaries.

Over the past couple of days, I’ve noticed a significant surge in large MKR transactions worth more than $100,000. Data from IntoTheBlock shows this increase has been a whopping 1,400%, jumping from around 3,840 to an impressive 60,730 transactions!

Approximately half of the entire MKR supply is controlled by large investors, often referred to as ‘whales’. If these whales increase their trading activity, it could potentially push the price of MKR beyond its current range, either upwards if they’re buying more, or downwards if they’re selling off.

Key levels to watch

To verify a bullish breakout from the observed consolidation on the 4-hour chart, Maker should surpass the resistance level of $1,550 while also experiencing high trading volume in buy orders.

In simpler terms, the brief bars on the histogram suggested there wasn’t much enthusiasm among buyers to drive the price beyond the current resistance level. Additionally, the on-balance volume indicator showed a more even balance between buying and selling activity, hinting at a potential equilibrium in market pressure.

Investors should be alert for potential resistance at the price point of $1,678. If the market makers increase their supply to overcome this barrier, and traders decide to buy during this surge, it might initiate a prolonged upward momentum. However, if this attempt to break through fails to entice buyers, Maker could revert to its previous trading range or even trend downwards.

Currently, when this text is being penned, the Stochastic Relative Strength Index (RSI) stands at 24 for MKR, indicating it’s overbought. This situation might trigger a brief recovery or upturn in the near future.

As an analyst, I’m keeping a close eye on the critical support level at $1,419. A potential drop beneath this level might trigger a bearish breakout from the current consolidation phase, potentially leading MKR into a downward trend.

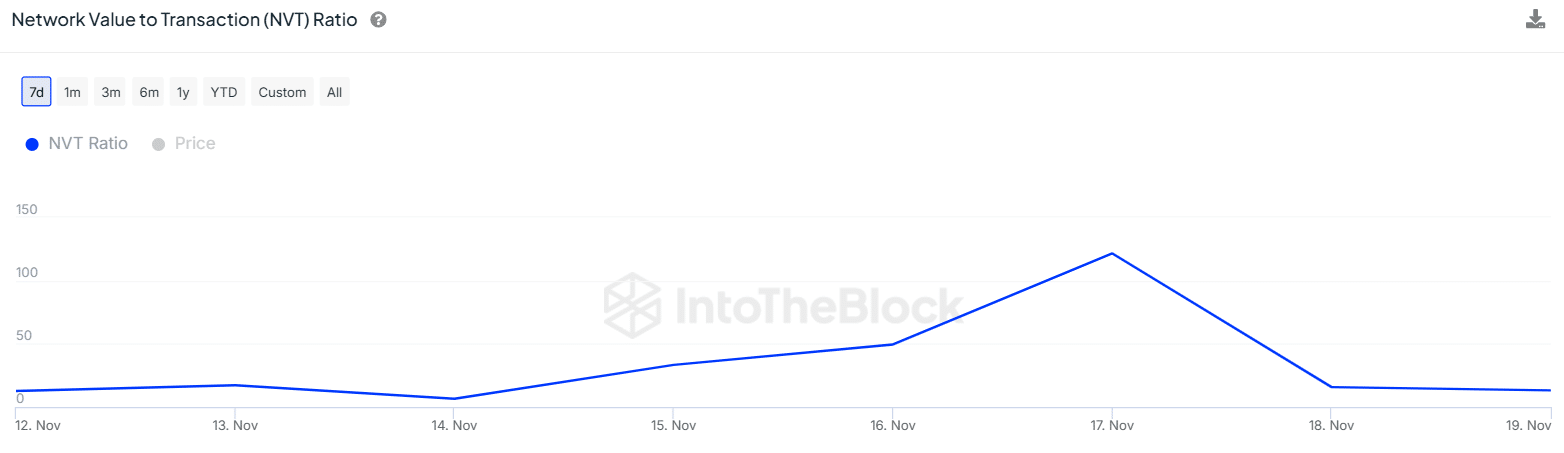

Declining NVT ratio shows THIS

Over the past two days, the Maker’s Network Value to Transaction (NVT) ratio dropped significantly, falling from 121.47 to 13.17. This substantial decrease suggests an increase in the number of transactions occurring within the network.

When the Net Value Transferred (NVT) ratio decreases, it’s possible that the token is being undervalued. However, an increase in the Market Value to Realized Value (MVRV) ratio, from 0.84 to 0.87 during the mentioned period, implies that this might not be a correct assumption.

As an analyst, I’ve observed a notable disparity that suggests heavy transactions might be driven by profit-taking actions from ‘whale’ investors. Such activity could potentially trigger a descending trend visible on the price charts.

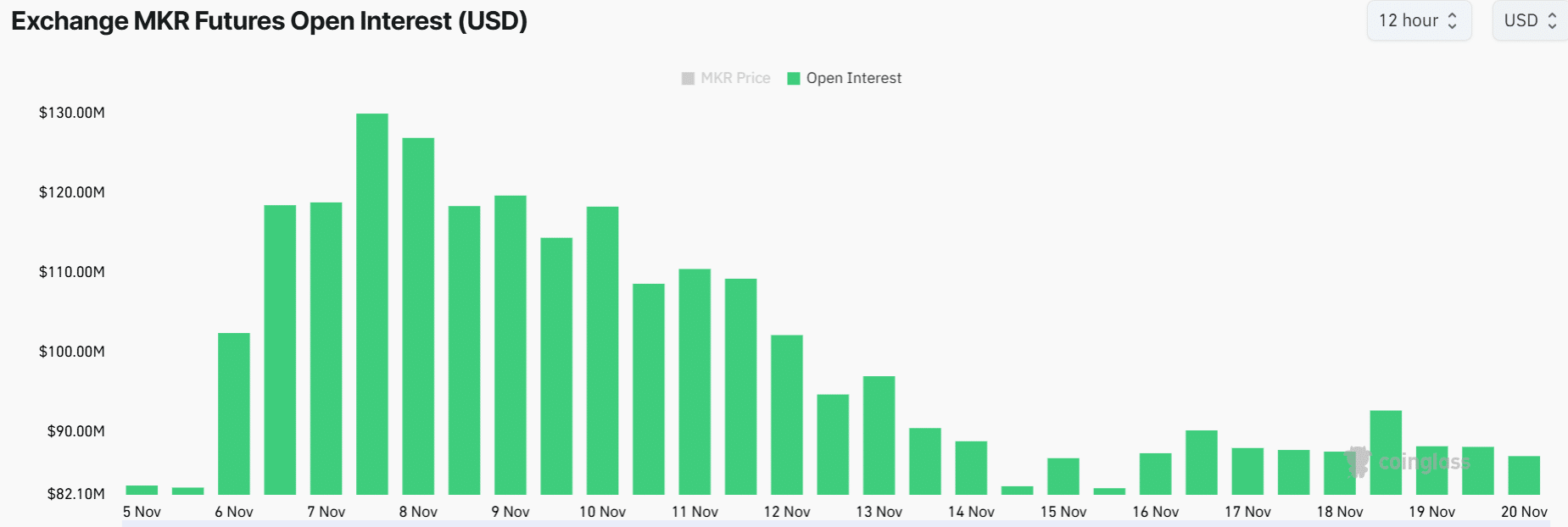

Derivatives market depicts uncertainty

In the world of derivative trading, there’s been a sense of apprehension among traders regarding Maker, following a significant drop in Open Interest. Specifically, the Open Interest decreased from $129 million to $86 million within a span of two weeks.

When the Open Interest decreases, it indicates that traders are winding down their positions on a particular token because they have doubts about its potential future price movements.

This decline in speculative activity could also be one of the key factors leading to Maker being stuck in a consolidation phase.

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Rick and Morty Season 8: Release Date SHOCK!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2024-11-21 09:43