-

MKR has surged by 11.52% over the past week

Analyst predicted MKR might be set for a rally, in light of a key buy signal

As a seasoned crypto investor with years of experience navigating market fluctuations and trends, I find myself intrigued by Maker’s recent performance. After a rough couple of months, it appears that MKR might finally be turning the corner. The 11.52% surge over the past week is a promising start, although it’s still shy of its all-time high.

Over the past week, the cryptocurrency market has seen significant recovery on the charts. Although Maker [MKR] has been lagging behind, its gains over the past few days have outweighed weekly losses. In fact, at the time of writing, MKR was trading at $1683. This marked a 11.52% hike over the past week.

Prior to this, Maker had been on a downward trajectory, declining by 6.68% on monthly charts.

Even though Maker’s price has seen a rise lately, it’s important to note that it’s still significantly lower than its peak of $3,125 in July. In fact, it’s currently around 72.2% below its all-time high of $6,391.

Consequently, recent market trends have sparked discussions among analysts about the reasons behind its current spike. One of these analysts is Ali Martinez, who attributes MKR‘s rise to its performance in the RWA sector. To support his claim, he referenced the TD sequential Indicator as an indicator pointing towards potential future growth.

Maker’s performance in the RWA sector

As stated by Martinez, Maker is considered a major contender within the Real World Assets (RWA) sector. By mid-2023, MakerDao had significantly increased its presence in the RWA market. By the year 2023, the total value of RWAs backed by DAI surpassed $2 billion, demonstrating a strong dedication to incorporate these assets into Decentralized Finance (DeFi). Moreover, in September 2024, MakerDao announced plans to allocate an extra $1 billion from its reserves towards purchasing tokenized U.S Treasuries, thereby deepening its engagement with the RWA sector.

Furthermore, MakerDao has sought to incorporate Real World Assets (RWA) as collateral in an effort to strengthen the stability of DAI. These endeavors have led to a significant increase in DAI’s market value, reaching a whopping $5.3 billion, and its daily trading volume skyrocketing to approximately $86.8 million.

These developments in Maker’s ecosystem have left Martinez to predict an upcoming rally.

What does market sentiment say?

In his analysis, Martinez cited the TD Sequential indicator as a sign of a potential bull rally.

As an analyst, I’ve observed four buy signals appearing over a three-day period in my analysis. This pattern indicates a prime opportunity for accumulation. Consequently, based on these findings, I believe MKR could potentially reach $1,850.

According to this comparison, it seems we might be nearing the end of the decline, with a turnaround potentially happening soon. The TD sequential showing four buy signals on the extended 3-day graph suggests a high probability for an uptrend. Longer timeframes like the 3-day chart are generally more dependable than short-term indicators.

Thus, multiple buy signals reinforce the likelihood of a bullish reversal.

On the metrics front…

On multiple aspects as well, MKR appears to have a promising outlook, potentially leading to further increases in its pricing graph.

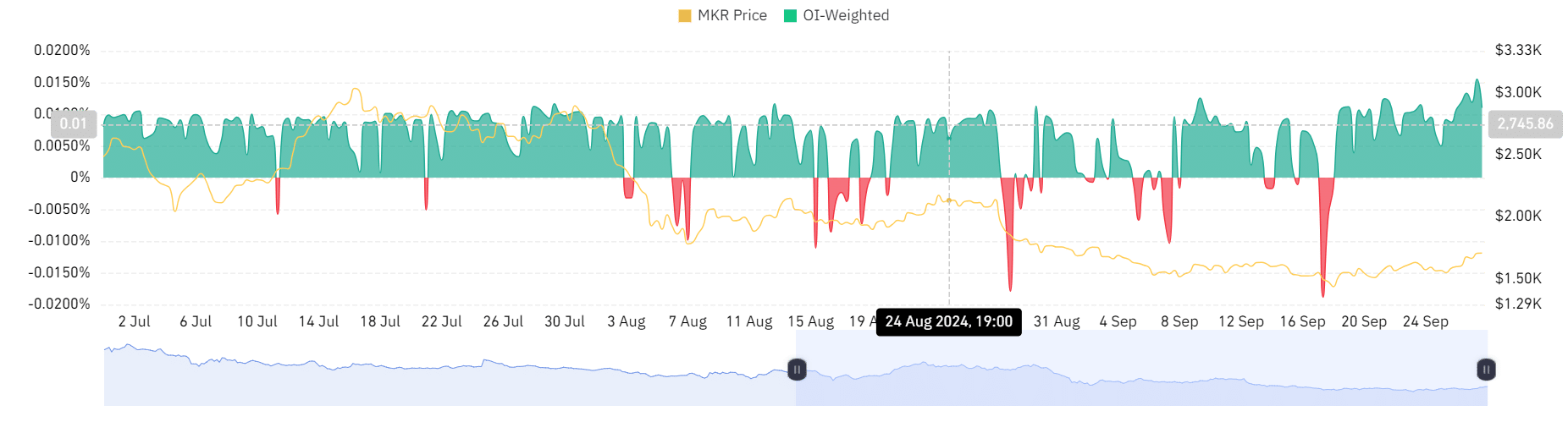

In simpler terms, the overall interest rate for Maker’s funding, as calculated across various exchanges, has stayed above zero during the last week. This indicates that those who have taken long positions (betting on an increase) are compensating those with short positions (betting on a decrease). Essentially, this is a sign of their belief and optimism about the future value of the altcoin.

This is a bullish signal as longs are willing to pay a fee to hold their trade.

The increased preference for long positions over short ones in MKR over the past 10 days can also be reinforced by a favorable overall open interest (OI)-adjusted funding rate.

Investors seem to be expecting an increase in the altcoin’s value, which is yet another positive indication.

To sum up, the total value of open contracts on each trading platform increased from approximately $40 million to $52.55 million as we speak. Essentially, this means more money flowing into these exchanges, as traders are both entering new trades and maintaining their current positions.

Consequently, following Martinez’s observations, it appears that the current market sentiment may lead to increased prices for MKR. If this market sentiment persists, MKR might reach approximately $1,760 in the near future.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Elden Ring Nightreign Recluse guide and abilities explained

2024-09-29 07:04