- On-chain metrics supported a Litecoin significant increase before the halving.

Those who bought LTC at lower prices have quit profit-taking.

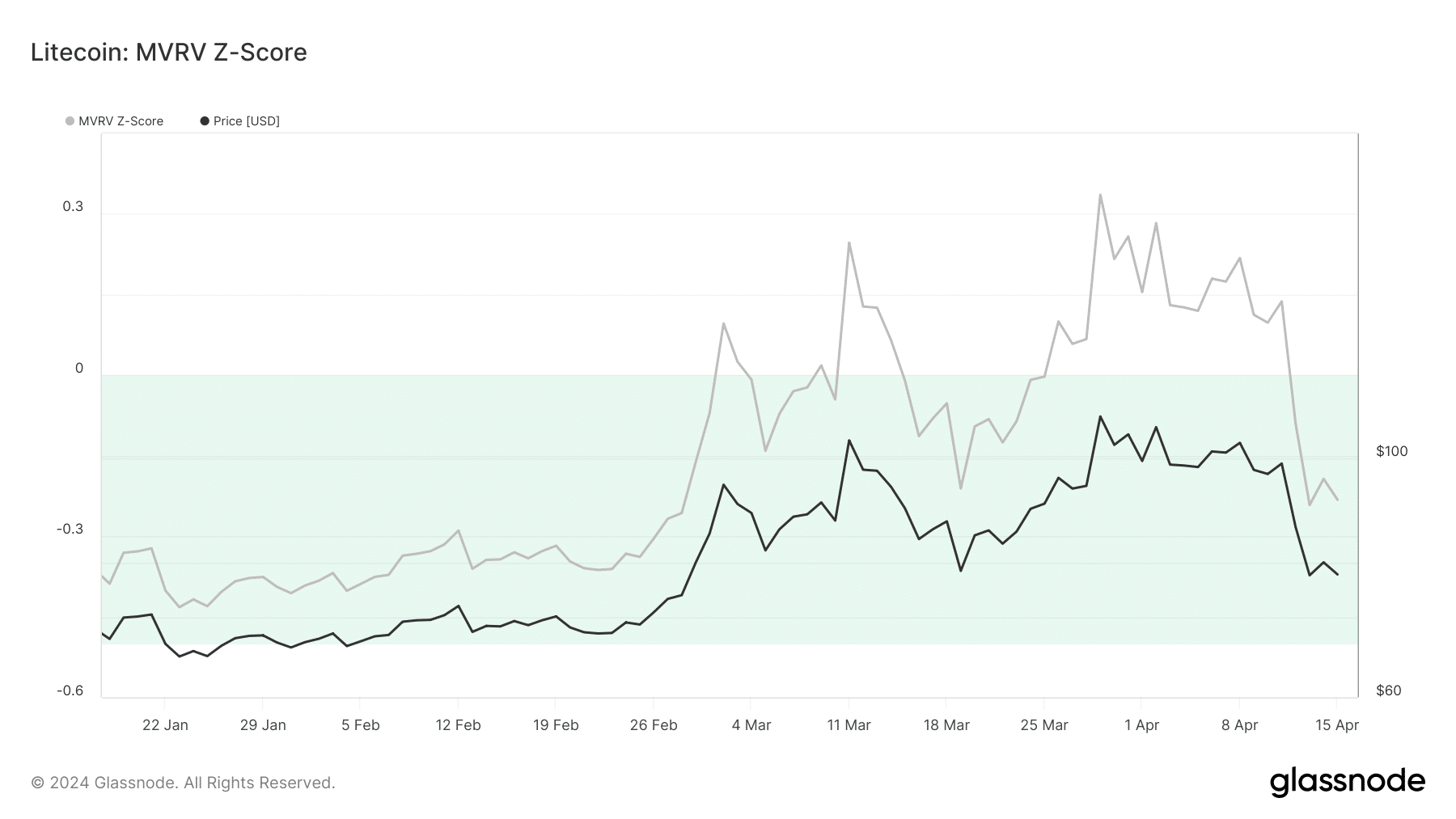

According to AMBCrypto’s observation, Litecoin (LTC) has reached a significant point that could lead to a price rebound. The Market Value to Realized Value (MVRV) Z-Score, which can be derived from Glassnode, currently stands at -0.23.

The value of this cryptocurrency is assessed by this metric around the end of February, and on that date, the MVRV Z-Score displayed a comparable value.

At that time, LTC changed hands at $74.62. Two days later, the price of the coin jumped to $94.47.

But that was not the only instance in which Litecoin displayed such. In March, the metric was negative, and its price had dropped. But 10 days later, the value rose to $109.29.

Does LTC care about 2020?

Currently, Litecoin (LTC) was priced at $78.62 in the media. The Bitcoin (BTC) halving was scheduled to occur within the next few days. Based on past trends, there is a possibility that the value of Litecoin could increase prior to the Bitcoin event.

It’s worth considering the past behavior of the coin during its last two halvings before jumping to the conclusion that a price increase is unavoidable.

Back in 2016, just before Litecoin’s halving, its price was around $3.19. However, on the actual day of the event, the value had risen to $4.12. Contrastingly, during Litecoin’s halving in 2020, the coin didn’t show a significant increase. Instead, it fluctuated between approximately $43 and $46.

Nowadays, the market situation is different from what it used to be when AMBCrypto last assessed LTC. Therefore, in light of this shift, AMBCrypto decided to reassess Litecoin by examining additional factors.

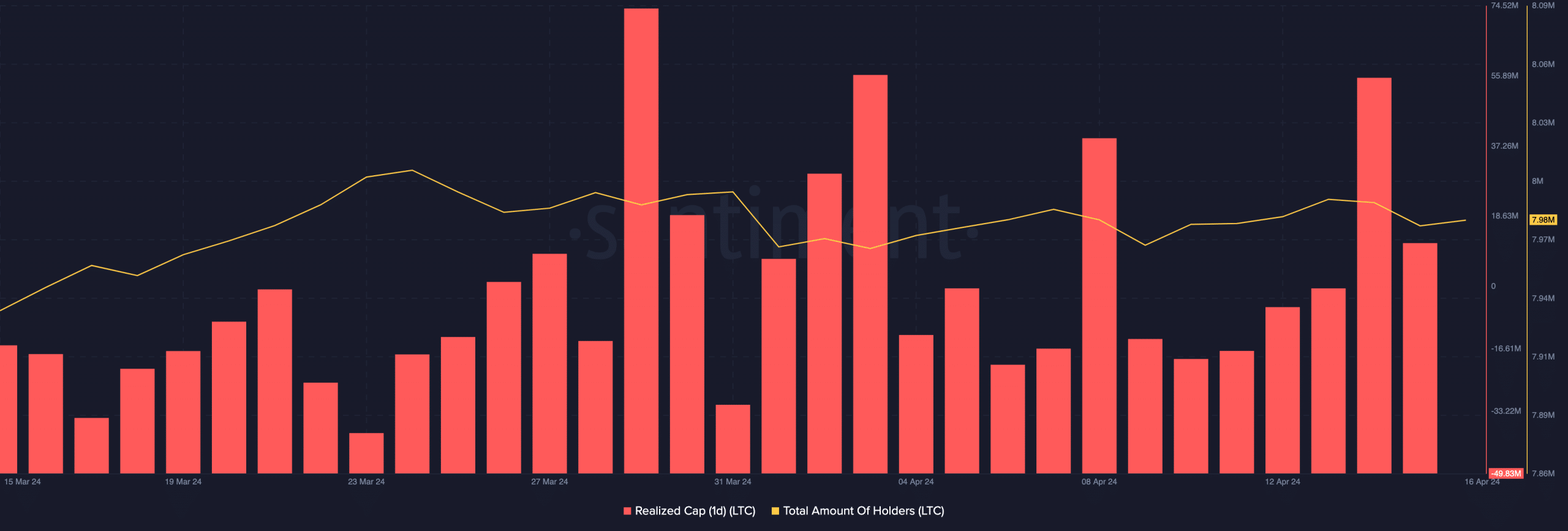

One metric we examined was Market Sentiment, represented by Realized Cap. This figure offers some insight into the current market mood.

When the Realized Cap reaches a peak, it indicates that coins previously purchased at cheaper costs are being utilized, and traders are cashing in on their gains.

The downward trend in Litecoin’s Realized Cap could signal undervaluation, contrary to the expectation for more corrections. At present, the one-day Realized Cap stands at a deficit of $49.83 million, implying a potential price rebound may be imminent.

After the event comes the parabola

If the metric decreases, it may boost the likelihood of LTC‘s price surge before Bitcoin’s halving. Conversely, if the metric goes up, this prediction could be invalidated.

Even though some believed in the coin’s optimistic future, not all investors were fully on board with its near-term prospects. This hesitance was reflected in the number of holders.

Based on Santiment’s data, the number of Litecoin holders dropped from 8 million to approximately 7.98 million.

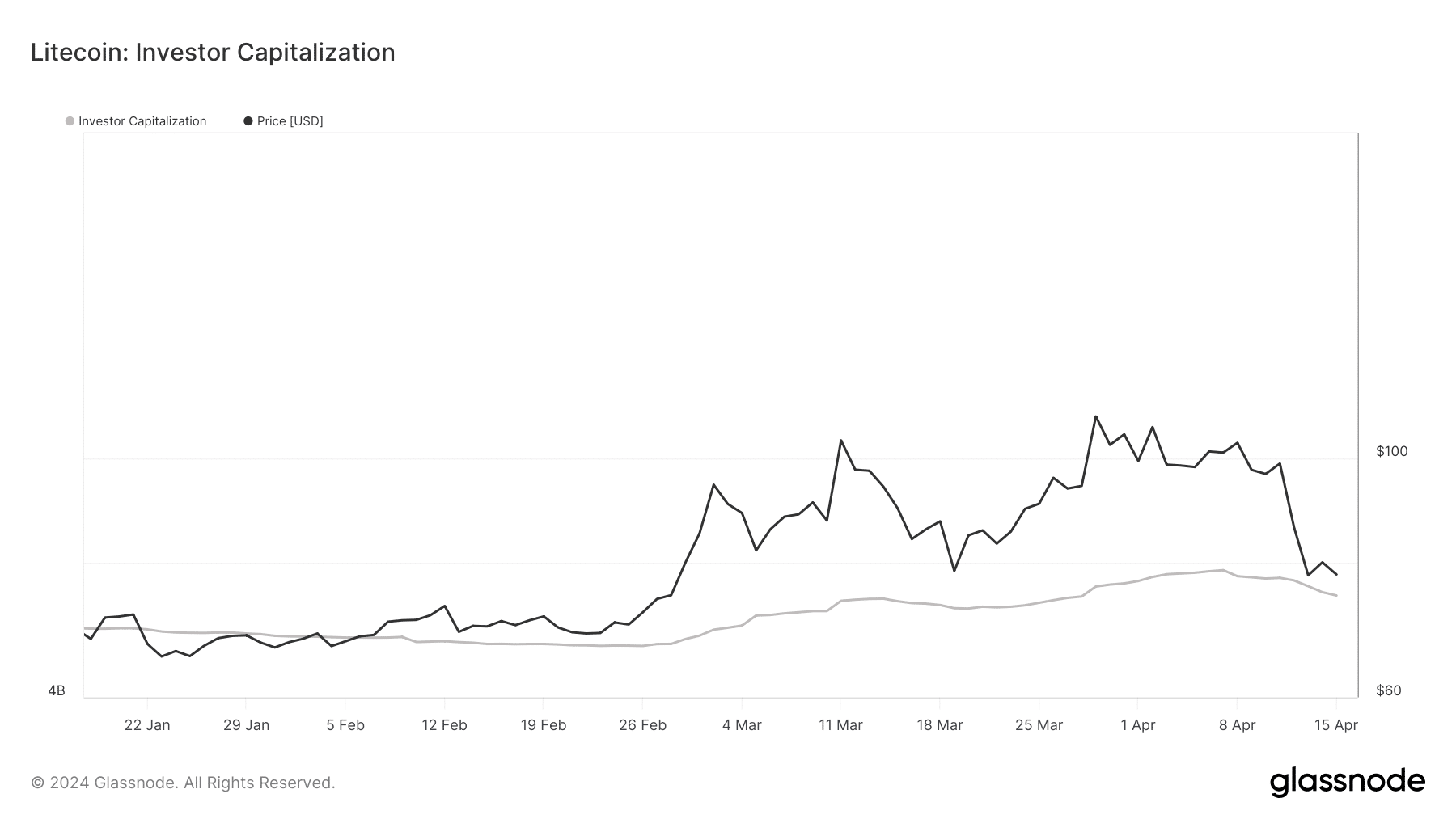

In summary, AMBCrypto determined the Investor Capitalization by calculating the gap between Thermocap and Realized Cap. This figure plays a role in identifying potential market turning points.

Realistic or, not, here’s LTC’s market cap in BTC terms

At present, the Investor Capitalization indication suggests that Litecoin is nearing its lowest point rather than its highest.

In other words, the cost of Litecoin could rise prior to Bitcoin’s halving event, and following this event, its value may further climb up.

Read More

- LDO PREDICTION. LDO cryptocurrency

- JASMY PREDICTION. JASMY cryptocurrency

- Why iShares’ Bitcoin Trust stock surged 13% in 5 days, and what’s ahead

- Spot Solana ETF approvals – Closer than you think?

- Orca crypto price prediction: Buying opportunity ahead, or bull trap?

- Can Ethereum ETFs outperform Bitcoin ETFs – Yes or No?

- Chainlink to $20, when? Why analysts are positive about LINK’s future

- Citi analysts upgrade Coinbase stock to ‘BUY’ after +30% rally projection

- THETA PREDICTION. THETA cryptocurrency

- Crypto week ahead: Will Bitcoin, Ethereum hit new highs?

2024-04-16 20:07