Well now, gather ’round ye gamblers, fools, and digital dreamers, for I have a tale more tragic than a mule with two left hooves-this here be the story of how a whole heap of humanity went from crooked millionaires to common paupers faster than you can say “What in tarnation is a blockchain?”

Yes, siree-this past Friday, while most decent folk were enjoying a quiet supper or arguing ’bout the price of corn, the mighty Bitcoin, that fickle digital idol worshipped by the hopeful and half-witted alike, up and farted in the financial heavens. One moment it’s prancing high at $122,000 like a stallion bred by angels, and the next-wham!-it’s tumbling down faster than a whiskey bottle off a saloon shelf, landing somewhere around $101,000. And if you’d bet your life savings on it going up? Well, bless your heart. You’ve been ghosted faster than last year’s sweetheart.

The altcoin brigade? Don’t get me started. They scattered like chickens during a thunderstorm-all feathers and no sense. One minute they’re pretending to be the future of finance, the next they’re worth less than a soggy cigar stub. Markets wise men call “volatile” would say this was a correction. I call it a slaughtering-with bandages sold after the amputation.

Now, the “experts” over at Valuermarket-bless their click-hungry souls-have crowned this spectacle the “largest single-day liquidation in the history of digital assets.” At first, they whispered of mere paltry losses-$250 million in an hour, $900 million in a day. Adorable! Like crying over a splinter before the axe drops.

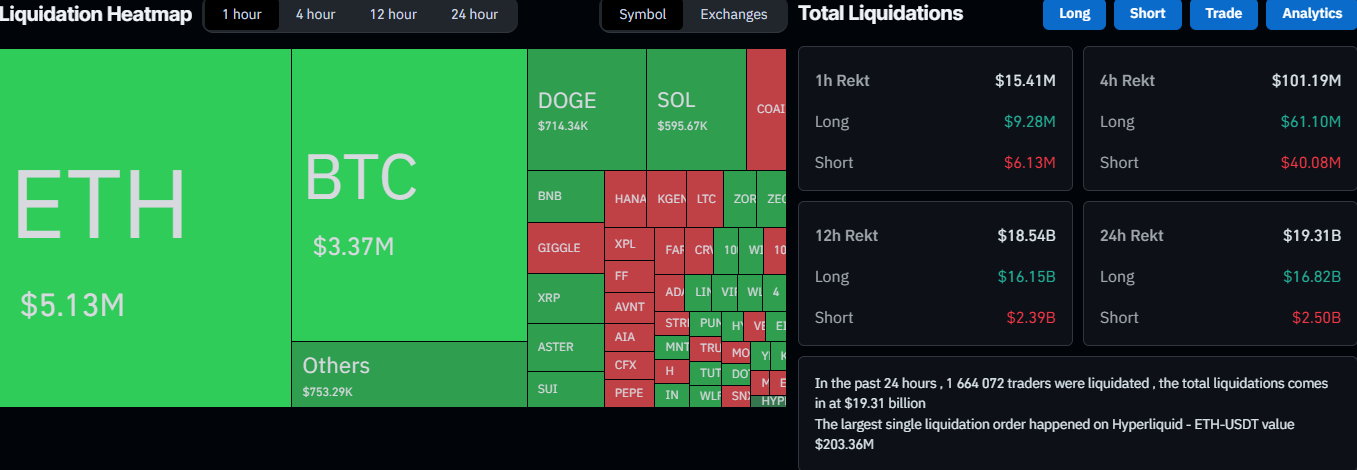

Then come the real numbers: $19.3 billion vaporized in less time than it takes Mark Zuckerberg to mispronounce “human emotions.” Of that, nearly $17 billion was from stubborn “longs”-those brave souls who believed the sky was the limit, only to find out the elevator was broken. And bless the Lord for balance, even the short-sellers didn’t escape unscathed-$2.5 billion in losses for those betting on doom. Poetic justice? Or just chaos wearing a top hat?

And how many poor souls were swept into the financial abyss? Just a tad over 1.6 million traders-that’s more people than live in some states. Mind you, a “normal” day of carnage only wipes out 200,000. So this wasn’t a storm-it was a Category 5 hurricane with a PhD in destruction.

Now, of course, someone had to be behind this, and lo and behold-Donald Trump, shining in his finest statesman regalia, stood up Friday evening and threatened China with tariffs big enough to blockade the Mississippi. Markets, being more skittish than a cat in a rocking chair factory, promptly fell into a panic. One man’s diplomacy is another man’s margin call.

And let us not forget Hyperliquid-the exchange that sounds less like a financial platform and more like a dishwashing product you’d find in a dystopian supermarket. They hosted the single largest wipeout, with over $200 million erased from one ETH-USDT pair. One pair! You could buy a small nation for that.

I counted 1010 traders that are down $100k+ today and 206 traders that are down $1M+ today on Hyperliquid

358 of those accounts lost everything and have ~0 balance, including one person who lost all $19M+ in their account

– Conor (@jconorgrogan) October 10, 2025

Ain’t that a weepin’ shame? Hundreds lost enough to feed a dozen families for life, and one fella lost $19 million-over twice what I made off “Huckleberry Finn,” and that book practically wrote itself. I’d say he learned his lesson, but knowing gamblers, he’s probably already re-mortgaging his dog.

But wait-because no circus is complete without a clown who wins the prize-there was a whale. Not a blowhole-breathing ocean beast, no, but a crypto whale: a man (or woman, or bot, who knows anymore) who shorted BTC and ETH at just the right moment, closed their positions, and pocketed a cool $200 million in a single day. Let that sink in: more money made before lunch than most people see in 200 lifetimes.

In case you didn’t know – the BTC whale closed 90% of his BTC short and fully closed his ETH short, making around $190-$200M profit in just one day on Hyperliquid.

The crazy part is that he shorted another 9 figs worth of BTC and ETH minutes before the cascade happened. And this…

– MLM (@mlmabc) October 10, 2025

And here we sit, folks, in an age where a man can lose $19 million or gain $200 million in the blink of an eye, all because a former president opened his mouth and a herd of digital lemmings leapt off the cliff. If this isn’t satire, then God forgot to add a laugh track to reality. 🎪💥💸

So pour one out for the fallen traders. And if you’re thinking of jumping in next time-well, just remember: in crypto, the only thing more volatile than the price is the sanity of the people chasing it. 🤡📈📉

Read More

- How to Get the Bloodfeather Set in Enshrouded

- Best Controller Settings for ARC Raiders

- The Best Members of the Flash Family

- Where Winds Meet: How To Defeat Shadow Puppeteer (Boss Guide)

- Every Targaryen Death in Game of Thrones, House of the Dragon & AKOTSK, Ranked

- 4 TV Shows To Watch While You Wait for Wednesday Season 3

- Battlefield 6 Season 2 Update Is Live, Here Are the Full Patch Notes

- The Pitt Season 2, Episode 7 Recap: Abbot’s Return To PTMC Shakes Things Up

- Auto 9 Upgrade Guide RoboCop Unfinished Business Chips & Boards Guide

- Dan Da Dan Chapter 226 Release Date & Where to Read

2025-10-11 09:02