- MANA and AXS shared similar price trajectories over the last few weeks

Investigation of other metrics revealed who the crowds favoured more

A more simplified version could be: In a recent analysis by Santiment on X (previously Twitter), it was brought to light that Decentraland’s [MANA] development activity significantly trails behind Axie Infinity’s [AXS]. This is noteworthy as both tokens were among the top virtual reality and gaming sector picks in 2020.

The development activity behind MANA far outpaced that of Axie Infinity. In fact, according to Santiment, the 30-day Dev activity for Decentraland was at 168.33, compared to a paltry 19 for Axie Infinity. Ergo, AMBCrypto decided to dig deeper and investigate if the latter has been lagging in other metrics as well.

Development activity lead for MANA isn’t something new

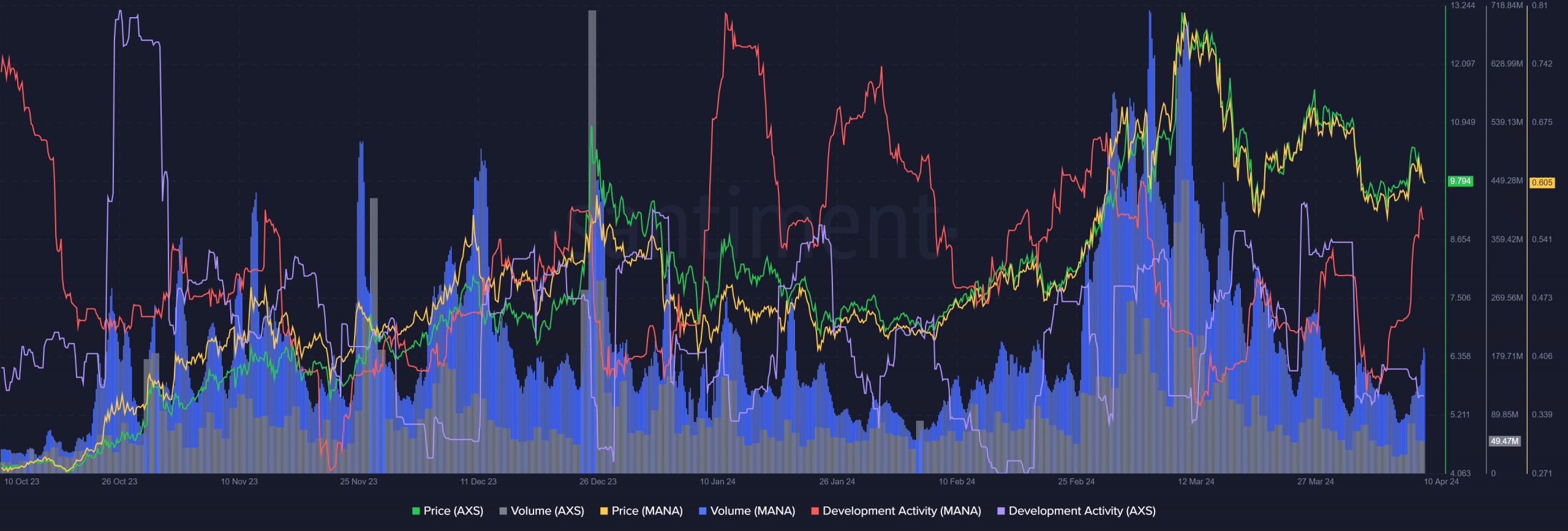

In simple terms, the pricing trends for the two tokens have been quite alike over the past few months. This similarity is particularly noticeable since late February when they have moved in unison on price charts. As a result, it’s reasonable to assume that the same market influences affected the prices of both tokens.

Despite a significant difference in trading volume between MANA and AXS, MANA typically sees more trading activity. Furthermore, it’s important to note that the leadership in development activity for MANA isn’t limited to just the most recent month.

To put it simply, according to Santiment’s findings, the development activity for MANA surpassed that of AXS starting around mid-December. This gap was most pronounced towards the end of January.

Investor sentiment also in favor of Decentraland

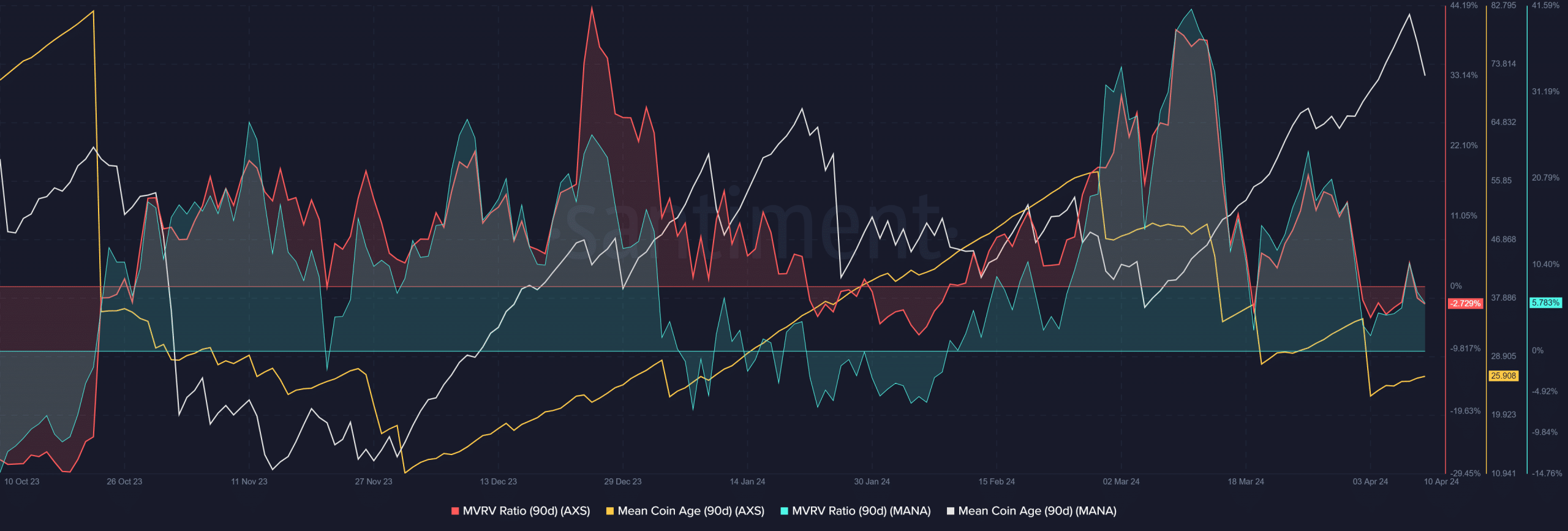

An increased level of development work on the project results in more new features being released, improved issue resolutions, and a lower risk of being a fraudulent venture. This significantly enhances investor trust and faith in MANA. Furthermore, the 90-day average age of its circulating coins serves as additional evidence supporting this belief. Since late November, this metric has consistently risen for the token.

In recent weeks, the average age of coins in the AXS supply has decreased significantly, starting from early March. Additionally, based on Market Value Realized Value (MVRV) ratio, AXS appeared to be slightly underpriced as an asset.

Is your portfolio green? Check the Decentraland Profit Calculator

Finally, MANA holders were accruing a small profit at press time, in contrary to AXS holders.

Although the price trends were alike for MANA and Decentraland, on-chain data revealed distinct perspectives of users towards both projects. In essence, at present, MANA and Decentraland hold an edge over AXS based on user engagement.

Read More

- LDO PREDICTION. LDO cryptocurrency

- JASMY PREDICTION. JASMY cryptocurrency

- Orca crypto price prediction: Buying opportunity ahead, or bull trap?

- Can Ethereum ETFs outperform Bitcoin ETFs – Yes or No?

- Chainlink to $20, when? Why analysts are positive about LINK’s future

- Citi analysts upgrade Coinbase stock to ‘BUY’ after +30% rally projection

- Why iShares’ Bitcoin Trust stock surged 13% in 5 days, and what’s ahead

- Spot Solana ETF approvals – Closer than you think?

- Injective at risk of pullback as key resistance holds strong – What now?

- Crypto mining ‘strengthens America’s energy grids’ – A 30% tax means…

2024-04-11 05:43