- Aptos tested critical resistance at $14.15 with Fibonacci levels signaling bullish potential.

- Market sentiment reflected cautious optimism, with long positions slightly outweighing shorts at 51.83%.

As a seasoned researcher with years of experience in the cryptocurrency market, I have witnessed the rise and fall of countless projects. Yet, Aptos [APT] has managed to pique my interest due to its impressive growth and expanding ecosystem.

Aptos (APT) has rapidly emerged as one of the swiftest expanding ecosystems within the blockchain sector, witnessing a remarkable 7-fold increase in on-chain activity. Furthermore, the number of active users has exploded from 1.3 million to an astounding 8.8 million by the year 2024.

As a seasoned investor with over two decades of experience in the cryptocurrency market, I’ve witnessed numerous projects that experienced rapid growth only to falter under pressure. The latest network that has caught my attention is Aptos, which has shown remarkable growth recently. This growth underscores the expanding adoption and usefulness of this platform. However, as someone who has seen promising projects derail due to scalability issues and market volatility, I can’t help but ponder: will Aptos be able to maintain its current momentum amid escalating scalability concerns and unpredictable market fluctuations?

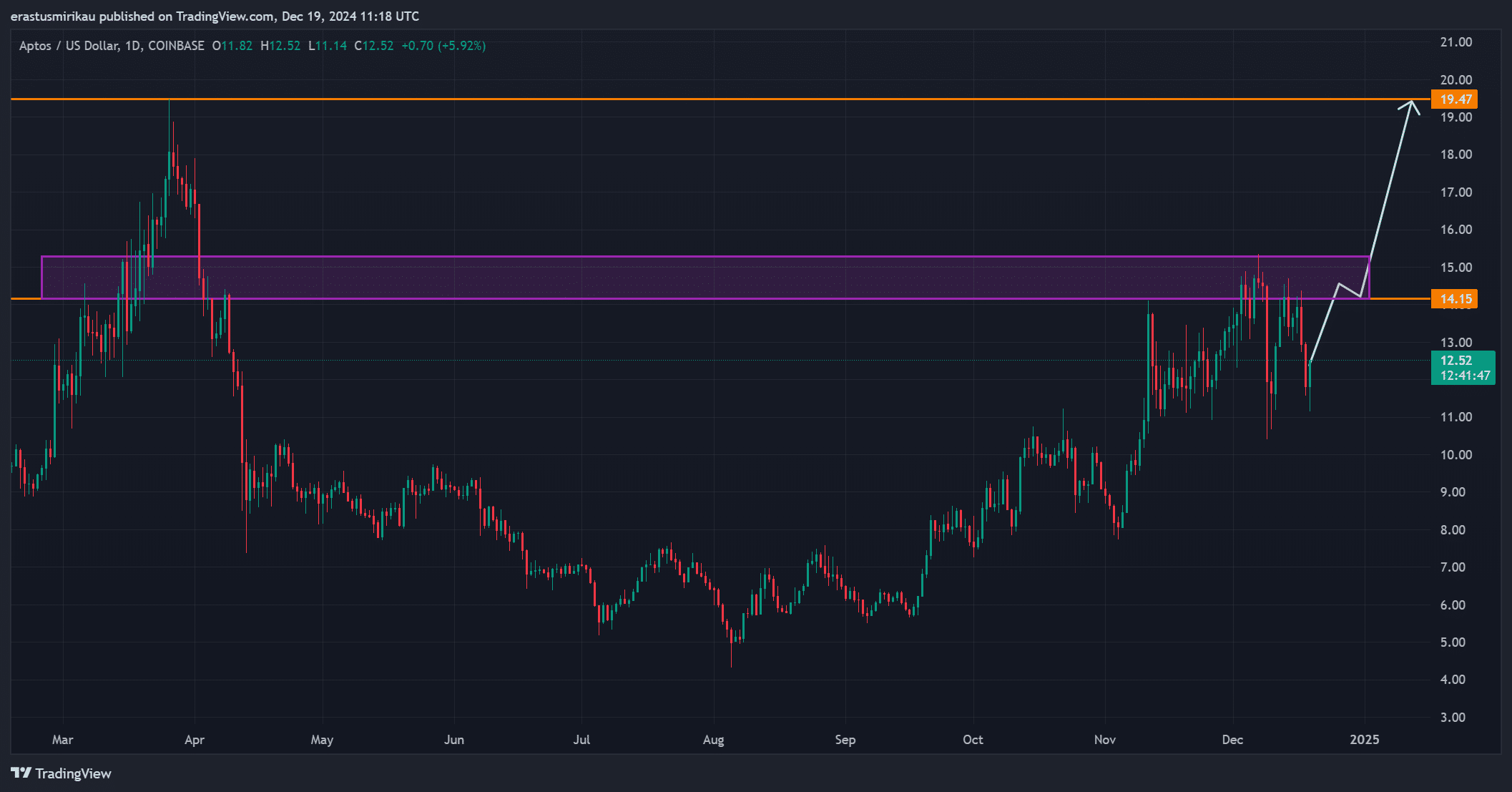

Aptos’ chart analysis

Currently, Aptos is being bought for $12.51 per unit, representing a decrease of 3.23% in the last day. It has just touched the support level of $11.14 and is moving towards the potential resistance point at $14.15.

Should APT surpass the $14.15 mark, it may aim for $19.47 – a noteworthy level based on its prior peak. On the flip side, if it struggles to exceed resistance, it might hold steady around $11.14 – an area where substantial buying activity has historically bolstered the price.

Fibonacci retracement and ADX trend strength

The significance of prices at $11.14 and $14.15 was underscored by Fibonacci retracement levels. Moreover, the ADX indicator currently reads 20.73, indicating a relatively feeble trend direction.

Consequently, Aptos needs stronger demand to push through the resistance level and solidify an upward trend as part of its bullish movement.

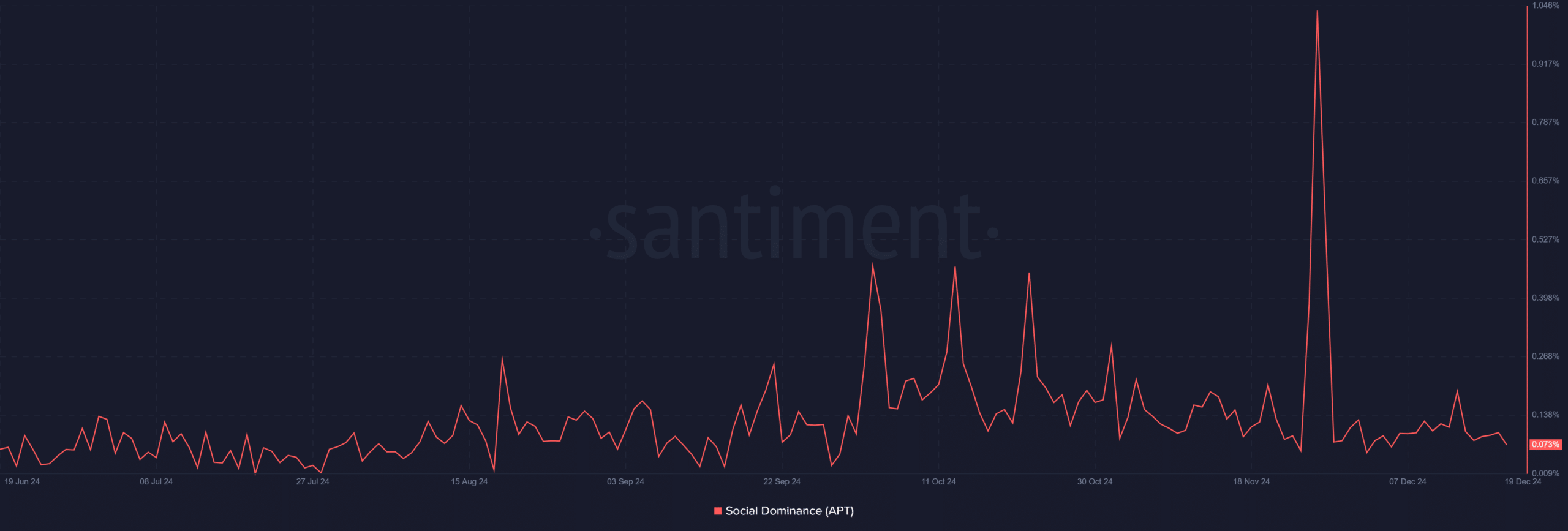

Social dominance signals declining retail interest

Yesterday, Aptos’ social dominance was at 0.1%, but it has significantly decreased to 0.073 as of now. This drop indicates less retail interest and engagement, which typically corresponds with a decrease in speculative actions.

On the other hand, this situation might offer a more tranquil build-up phase for long-term investors who continue to be hopeful about the project’s prospects.

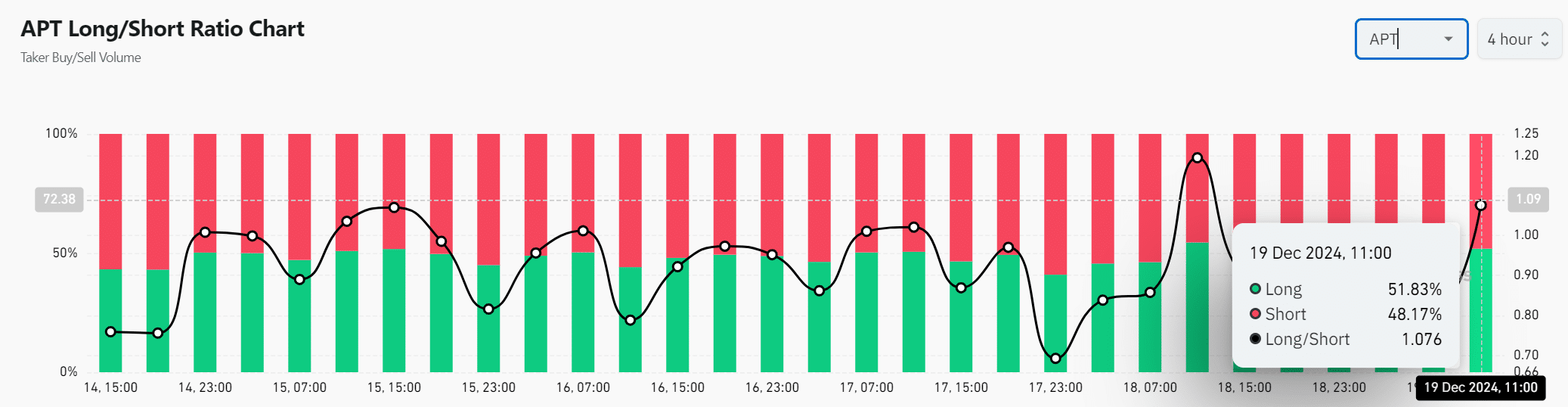

Long/Short Ratio and market sentiment reveal cautious optimism

Approximately 51.83% of traders have taken long positions, compared to 48.17% who are short selling. This indicates a somewhat positive outlook in the market, as it suggests a cautious optimism. Moreover, Open Interest decreased by 10.19%, reaching $267.45 million.

As a researcher, I’ve noticed a decline, indicating a potential lessening of speculative enthusiasm. This reduction might lead to a decrease in short-term market turbulence. Yet, it could also signal that the market is cautiously waiting for a clear, definitive move before investing additional capital.

Read Aptos’ [APT] Price Prediction 2024–2025

Conclusion: Can Aptos maintain its growth?

If Aptos manages to surpass its current resistance thresholds and effectively tackle scalability issues, it could continue to thrive in its growth trajectory. As more people embrace it and its ecosystem proves valuable, Aptos positions itself as a contender for leadership within the realm of blockchain technology.

Yet, its continued success hinges on sustaining public engagement and skillfully overcoming the obstacles that lie ahead.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Masters Toronto 2025: Everything You Need to Know

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

2024-12-20 10:15