- Bitcoin could surge towards $139,000 if it repeats its past performance during U.S. election cycles.

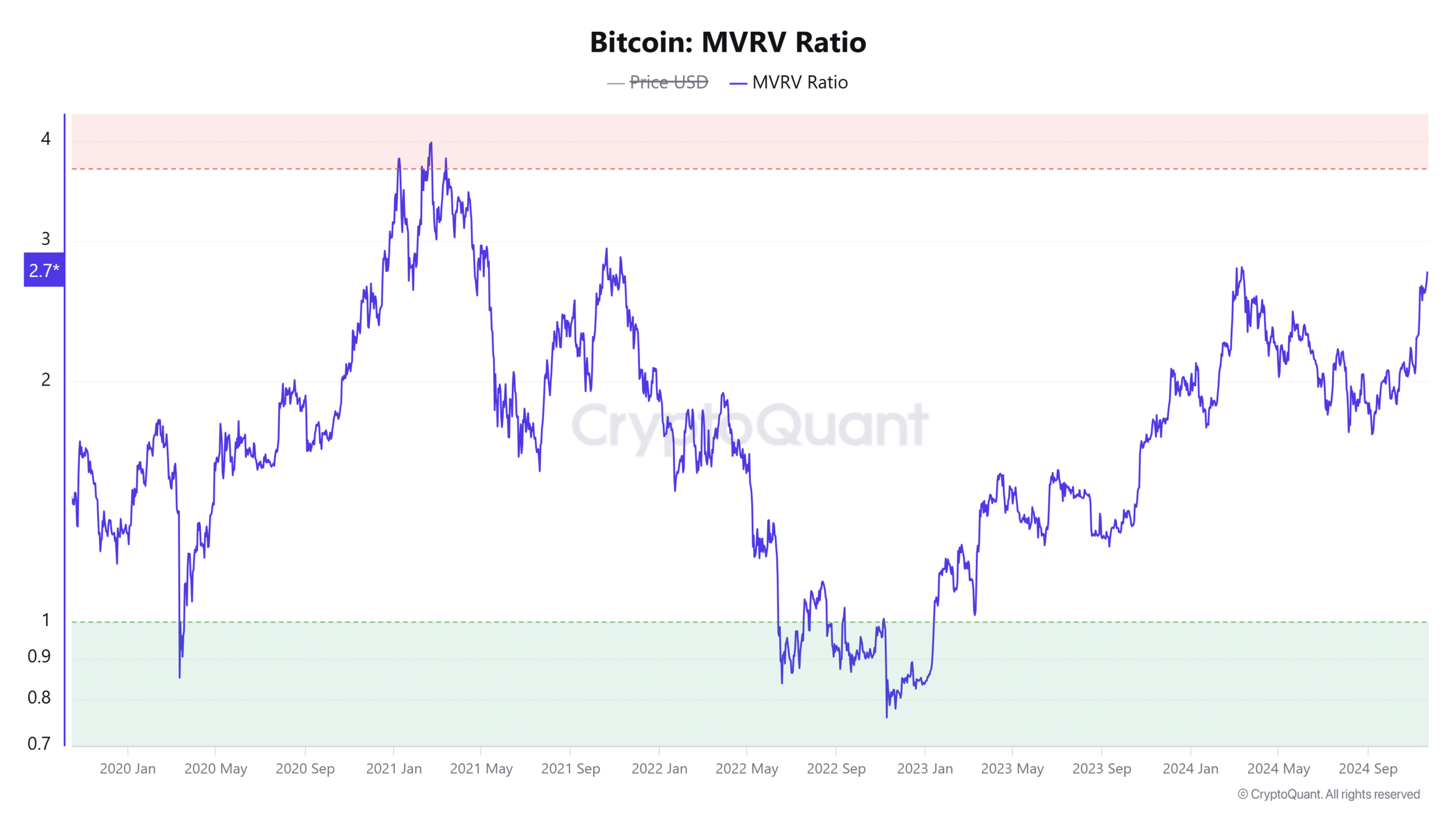

- The MVRV ratio also hinted at further upside, as it shows that Bitcoin is not yet overvalued.

As a seasoned analyst with over two decades of experience in the financial markets, I have seen my fair share of bull and bear cycles, and the current Bitcoin rally is reminiscent of the 2017 bull run that left me with a few too many late-night trades. The parallels between the U.S. election cycle and Bitcoin’s performance are striking, and if history repeats itself, we could be in for an exhilarating ride towards $139,000.

Bitcoin’s [BTC] remarkable surge since the U.S. Presidential election on November 5th appears to be echoing past price patterns. Typically, U.S. elections have resulted in substantial Bitcoin gains. If this trend repeats itself, we might see Bitcoin’s rally continue, potentially reaching $139,000.

According to TechDev’s analysis on X (previously known as Twitter), he pointed out that Bitcoin was priced at $69,400 on election day. Based on the increases seen during the elections in 2012, 2016, and 2020, there could potentially be a 4.51-fold increase to reach $139,180 by the year 2025.

Currently, Bitcoin is being exchanged for approximately $98,800, representing a 42% increase from the time of the election. Additionally, its market value is approaching the $2 trillion mark. With optimism around Bitcoin on the rise, one might wonder if it will adhere to previous patterns or deviate from them.

Is Bitcoin repeating past cycles?

Examining Bitcoin’s weekly graph implies that the ongoing upward trend, initiated during the election period, may persist further. Following the 2020 November elections, BTC began a climb that propelled it from approximately $13,700 to its all-time high (ATH) of $64,800 in under half a year.

A similar rally, that started during the 2024 election week is currently underway, and if the bullish momentum continues, the price could surge past $120,000 by April 2025.

The Relative Strength Index (RSI) backs up this perspective. At the moment, it’s showing a value of 77, which indicates that Bitcoin isn’t overheated just yet. This means that even with the recent spike, Bitcoin still has potential for further growth because it hasn’t reached its peak according to this indicator.

MVRV indicator shows THIS

As a crypto investor, I’m keeping an eye on the Market Value to Realized Value (MVRV) ratio of Bitcoin, which indicates potential future growth. Right now, this metric stands at 2.7, signaling that Bitcoin might not be overvalued just yet, suggesting there could still be room for more gains.

An MVRV ratio of 2.7 also shows that Bitcoin is still in the early stages of a bull run and despite the successive ATH records, it has yet to find a local top.

Traders should keep an eye on the MVRV (Market Value to Real Value) ratio surpassing 3.7, as it could signal that the cryptocurrency has grown too expensive. The last instance where the MVRV ratio indicated Bitcoin was overpriced occurred in early 2021, around the time following the 2020 elections.

Read Bitcoin’s [BTC] Price Prediction 2024-25

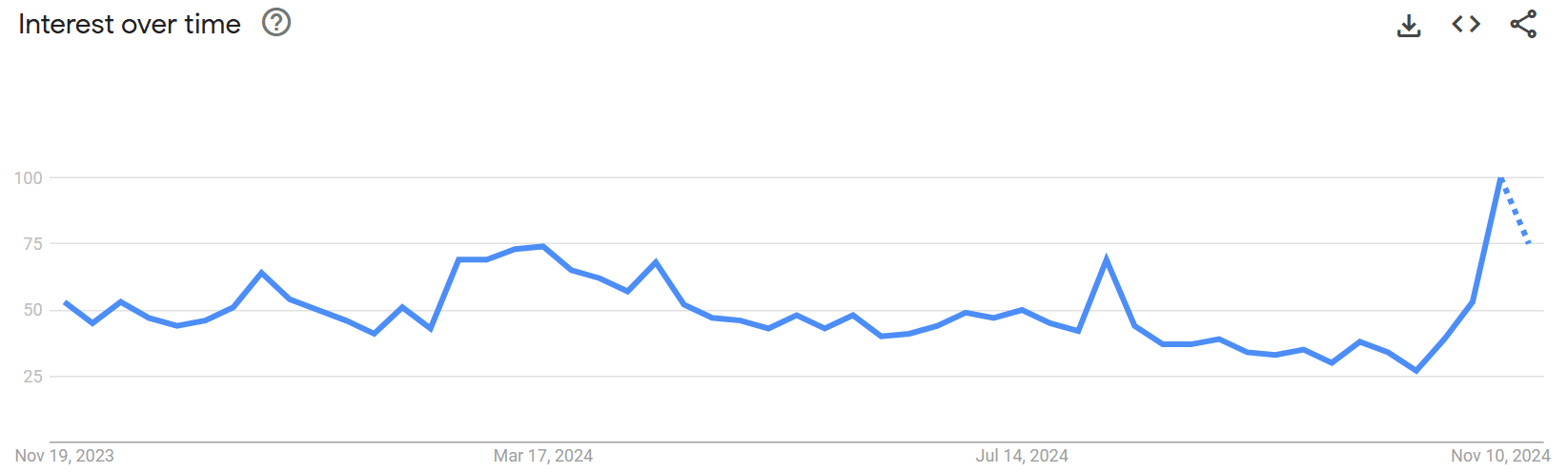

Google Trends suggests retail FOMO

With Bitcoin approaching a new all-time high over $100,000, it appears that the sense of fear of missing out (FOMO) among individual investors is running high. Interest in the keyword “Bitcoin” is currently at its peak in over a year.

Reaching a score of 100 on Google Trends signifies Bitcoin’s popularity is at an all-time high. This could also imply that the general public is experiencing a state of excitement or enthusiasm about the market.

Yet, if Bitcoin’s surge suggests the start of a bull market, such a rating might indicate growing popularity.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

2024-11-23 00:07