- DOGE has seen a spike in dormant tokens that are back in circulation.

- The memecoin’s price has continued its consolidation attempts.

As a seasoned crypto investor with a knack for deciphering market trends and on-chain activity, I find myself intrigued by Dogecoin‘s current state of consolidation. The resurgence of dormant tokens and the increased transaction volumes are reminiscent of a well-timed game of chess, where the pieces are being moved with calculated precision.

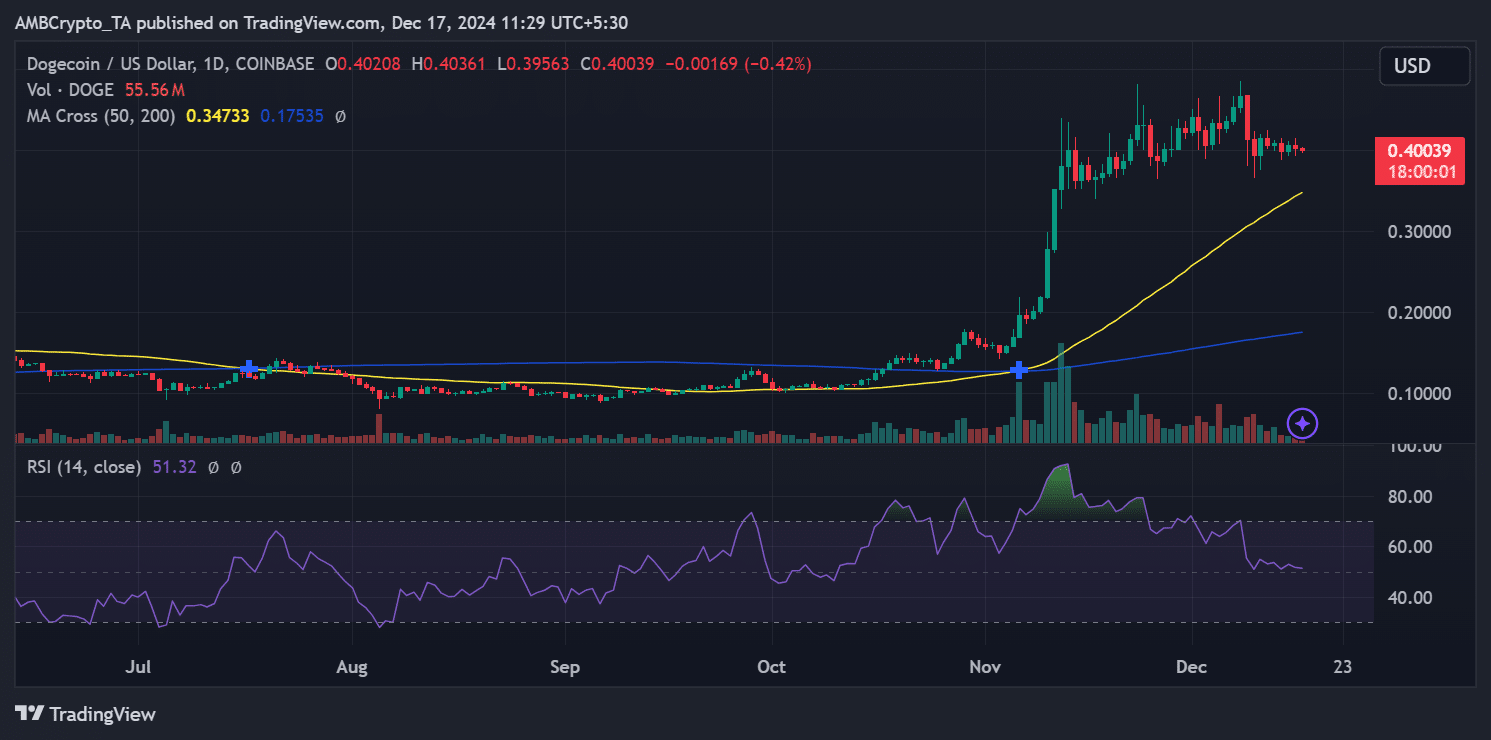

Dogecoin’s price seems to be stabilizing near the 0.40 USD level after a significant surge in early November. Lately, there’s been increased activity on the blockchain, as previously inactive coins are being used more frequently and transaction volume is rising.

As DOGE exhibits uncertain behavior, it’s crucial to keep a close eye on its interactions between overbought peaks and price fluctuations, particularly focusing on important levels of support and resistance.

Dogecoin dormant tokens resurface

One notable trend is the spike in Dogecoin’s Age Consumed metric, which tracks the movement of long-held, dormant tokens. As seen in the Santiment’s Age Consumed chart, major spikes occurred in late October, mid-November, and December.

On December 16th, the analysis revealed that the metric reached its peak of 1 trillion, which was the highest level since early October, surpassing the previous record of 1 trillion set in that month.

These actions frequently line up with significant shifts in prices, hinting at possible profit-taking by large investors (whales) or them adjusting their positions strategically. When inactive cryptocurrencies start moving again, it usually signifies long-term investors returning to the market or increasing selling pressure.

The biggest increase in data matches the early rise in Dogecoin’s price, supporting the idea that blockchain activity is linked to the coin’s increasing value trend.

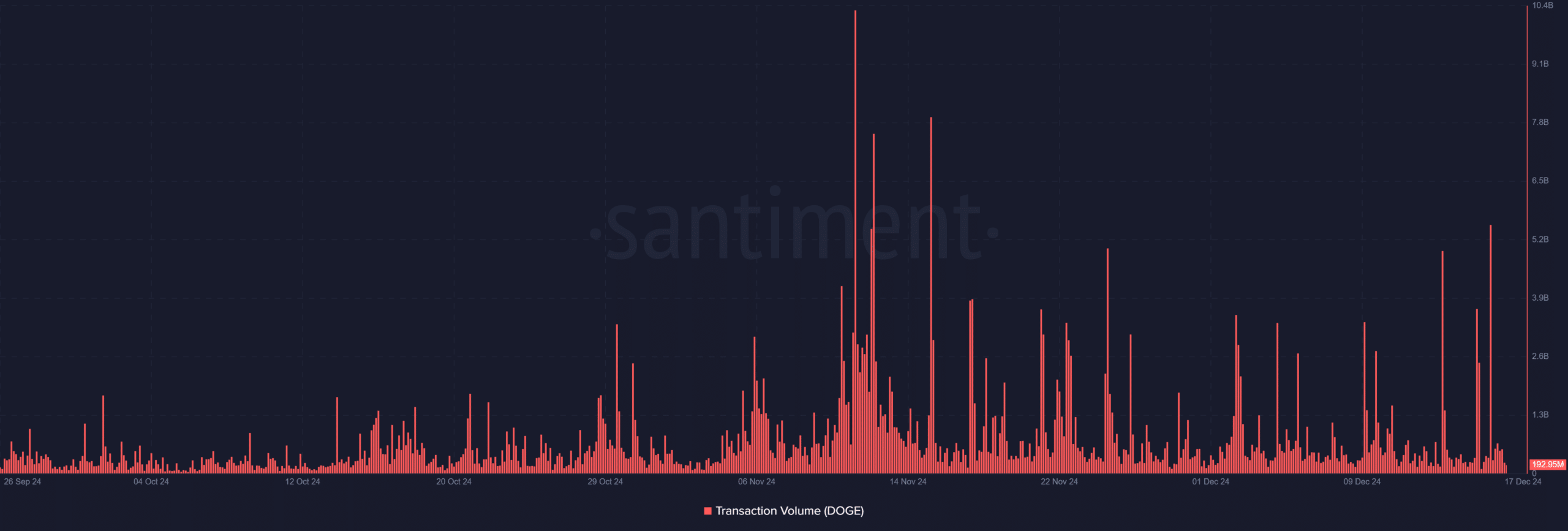

Transaction volume signals increased market activity

The Transaction Volume chart further validates this trend. Transaction volumes began rising sharply in late October, peaking in mid-November, coinciding with Dogecoin’s price rally.

Analysis showed a slight spike on the 16th of December when it grew to over 5.5 billion.

The increased level of trading suggests robust market enthusiasm and the influx of liquidity into Dogecoin (DOGE). Yet, it’s worth noting that the transaction volume dipped a bit in December, mirroring Dogecoin’s price stabilization near the $0.40 mark.

The cooling-off period implies a balanced market mood, as traders are anticipating a clear market breakout.

Dogecoin price holds support amid neutral RSI

Looking at the price and RSI graph, it appears that Dogecoin was holding steady above its 50-day Moving Average (MA) at approximately $0.34, signifying ongoing bullish sentiment. At the same time, the Relative Strength Index (RSI) stood at 51.32, indicating a neutral trend, as the coin doesn’t seem to be overbought or oversold at this moment.

Should DOGE maintain this crucial support point and trading activity resumes, it might propel the price towards approximately $0.45. But if it falls beneath the 50-day moving average, this could indicate a decrease in bullish momentum, potentially causing the price to dip back down toward around $0.30.

Dogecoin’s behavior suggests it is going through a crucial period of consolidation, as indicated by its on-chain activity and price fluctuations. A surge in Age Consumed and transaction volume implies increased whale involvement, yet the Relative Strength Index (RSI) at this time remains neutral, indicating a well-balanced market.

Traders should further monitor on-chain signals and price action to identify DOGE’s next move.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Masters Toronto 2025: Everything You Need to Know

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Gold Rate Forecast

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-12-17 20:07